Stock Market Today: Energy Dampens Dow, FAANGs Elevate Nasdaq

Recessionary fears weighed on oil and economically sensitive sectors Tuesday, while declining Treasury yields lifted tech-esque stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

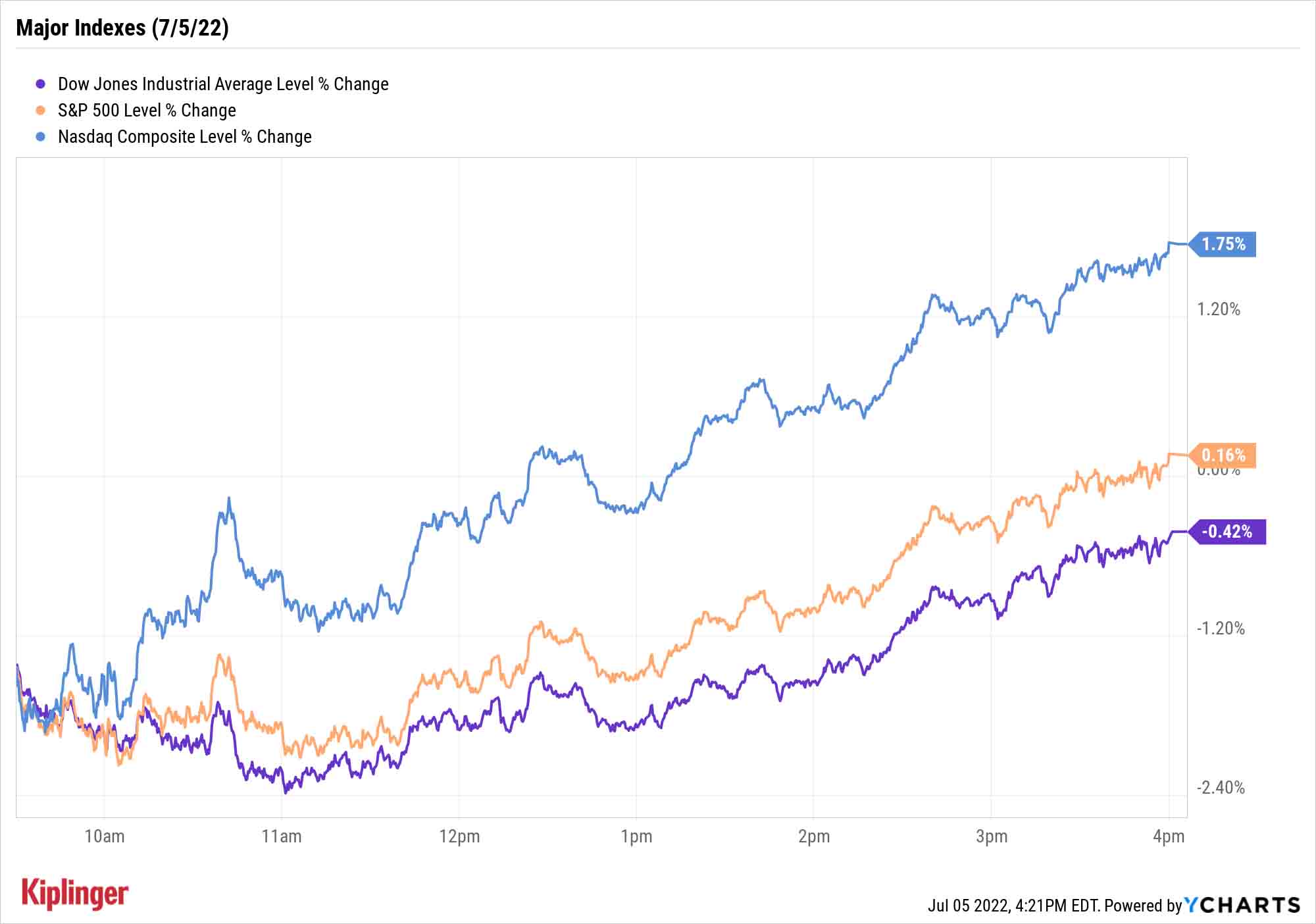

The first session of the holiday-shortened week was a wild one, as a deep Tuesday morning dip evolved into a severely split market featuring pockets of red and green alike.

On one side, you had big dips in economically sensitive sectors. Energy (-4.0%) fared the worst thanks to a drastic decline in U.S. crude oil futures, which plunged 8.2% to $99.50 – the commodity's lowest finish in more than two months.

"This move came on the back of an ever-increasing number of economic indicators (Goldman Sachs US Financial Conditions Index, Citi US Economic Surprise Index, ISM orders) now pointing to sustained weakening of financial conditions as well as Street expectations," says Michael Reinking, senior market strategist for the New York Stock Exchange.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also weighing on oil was a strengthening U.S. dollar, which closed the session at a 19-year high. (Remember: Oil is priced in U.S. dollars, so a strong dollar will weigh on oil prices, and vice versa.) The aforementioned worries of weakness hampered other sectors, too, including materials (-2.0%) and industrials (-1.5%).

"Shifting to a more near-term view, with commodity prices coming a bit back down to reality, some investors may view this as a welcome sign that inflation is beginning to cool – the main driver of recent volatility," adds Chris Larkin, managing director of trading for E*Trade.

However, other parts of the market – namely, those pinned to the ground by rising interest rates – came off the mat as recent weakness in Treasury yields continued.

The 10-year T-note yield fell as low as 2.78% on Tuesday, sending communication services (+2.4%) and consumer discretionary (+2.2%) stocks higher. Facebook parent Meta Platforms (META, +5.1%), Google parent Alphabet (GOOGL, +4.2%) and Amazon.com (AMZN, +3.6%) – all members of the "FAANGs" – were among the session's noteworthy winners.

That resulted in markedly divergent results among the major indexes, which all finished well off their morning lows. The Dow Jones Industrial Average, led lower by Chevron (CVX, -2.6%), dipped 0.4% to 30,967, while the S&P 500 finished with a tame 0.2% uptick to 3,831. The Nasdaq Composite, however, popped 1.8% to 11,322.

Other news in the stock market today:

- The small-cap Russell 2000 gained 0.8% to 1,741.

- Gold futures, also weighed down by a strong dollar, closed off 2.1% to $1,763.90 per ounce, marking their lowest settlement of 2022.

- Bitcoin strengthened as the day went on, recovering by 5.4% to $20,397.00. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

Buy the Dip in Emerging Markets?

Inflationary pressures (and related stock-market pain) are hardly exclusive to investors in U.S. equities. For instance, the iShares MSCI Emerging Markets ETF (EEM) – one of the most popular funds holding emerging markets stocks – entered bear-market territory this year and is currently off 19% year-to-date.

Like with anything that's down, investors might put EMs on their buy-the-dip list. BofA Securities does warn that a comeback isn't necessarily imminent – but emerging markets won't be down forever.

"We stay bearish into the summer but see emerging long-term value. Don't turn bullish before central banks panic about recession more than inflation," say BofA's David Hauner and Claudio Irigoyen. But they add that "2023 is starting to come into focus: it might get better for EM. The EM-US growth differential is one of the more reliable top-down indicators. For 2023, our mid-year forecast update implies the best such number in a decade."

Thus, investors would do well to at least start building their EM wish lists.

But if you find individual names to be a bit too risky, emerging markets mutual funds allow you to enjoy some of this category's explosive upside while decreasing the chances that a single-stock blow-up will torpedo your portfolio. We look at five top emerging market funds.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.