Stock Market Today: Stocks End Lower Ahead of Major Inflation Update

Energy was the worst-performing sector as U.S. crude futures sold off on worries over slowing oil demand.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Broader markets bounced around Tuesday as investors waited for guidance from a pair of impending market catalysts: the latest inflation data and the start of second-quarter earnings season.

As for tomorrow morning's release of the June consumer price index (CPI), "it does seem that the market is pretty well prepared for a hot number at least from a headline perspective," says Michael Reinking, senior market strategist for the New York Stock Exchange. "Street estimates are calling for headline CPI to be up more than 1% on a monthly basis, with some calls that the year-over-year increase could be as high as 9%."

Reinking adds that a big driver of inflation will likely be oil prices, which peaked in the middle of the month and have moved sharply lower since. Indeed, U.S. crude futures plummeted 7.9% today to settle at $95.84 per barrel as China's latest round of COVID-related restrictions sparked concerns over slowing oil demand, and are now down more than 21% from their June peak above the $122 per-barrel mark.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Not surprisingly, energy (-2.0%) was the worst performing sector today, with APA (APA, -5.2%) and Occidental Petroleum (OXY, -3.6%) among the biggest decliners.

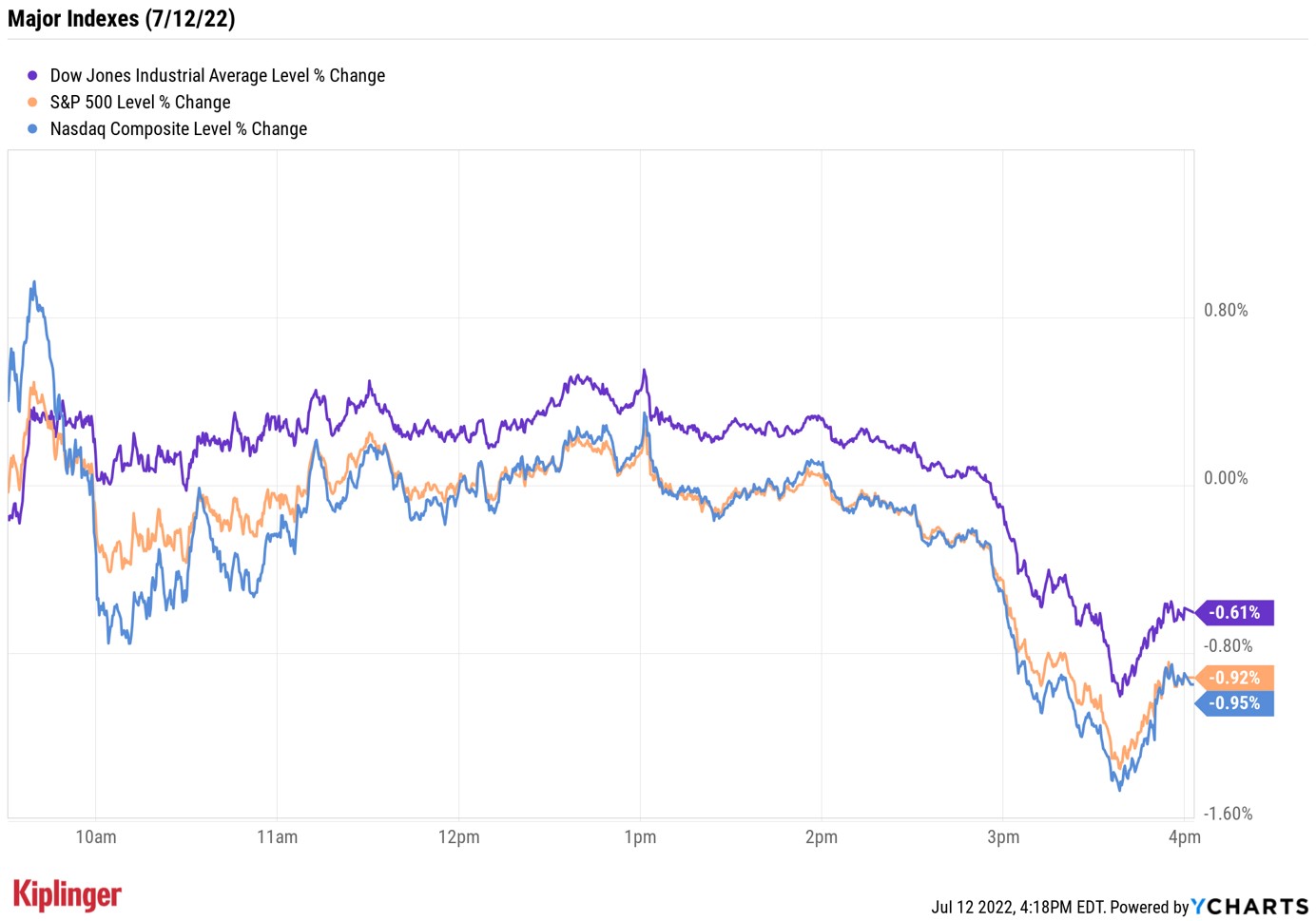

The weakness in energy stocks weighed on the broader S&P 500 Index (-0.9% at 3,818), while the Nasdaq Composite also finished lower (-1.0% at 11,264). The Dow Jones Industrial Average, meanwhile, spent most of the day higher as blue chip Boeing (BA) jumped 7.4% on solid Q2 delivery data, but ended the day down 0.6% at 30,981.

Other news in the stock market today:

- The small-cap Russell 2000 gave back 0.2% to end at 1,728.

- Gold futures shed 0.4% to settle at $1,724.80 an ounce.

- The rout in Bitcoin continued, with the cryptocurrency falling 5.3% to $19,397.89. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Gap (GPS) fell 5.0% today after the retailer said CEO Sonjia Syngal is stepping down, effective immediately. The company also expects its adjusted operating margin percentage to be zero to slightly negative in the second quarter due to higher promotional activity. "While the macro is far from good today, the majority of these issues appear to be self-inflected and centered on Old Navy," says Wells Fargo analyst Ike Boruchow, who downgraded GPS stock to Equalweight from Overweight (the equivalents of Hold and Buy, respectively. "As such, as we remain cautious on our space. We simply cannot continue to recommend a name that is juggling company specific challenges on top of growing macro pressure."

- American Airlines Group (AAL) soared 10% after the air carrier said it is guiding for a pretax profit of $585 million in its second quarter. The news created a halo effect for other travel stocks, with Delta Air Lines (DAL, +6.2%) and United Airlines Holdings (UAL, +8.1%) among those gaining ground.

Don't Give Up on Consumer Discretionary Stocks

Higher inflation will likely continue to weigh on how consumers are feeling about the economy – as well as their willingness to open their wallets. While the latest credit and debit card spending data from BofA Data Analytics shows that total retail spending, excluding auto, was up 25% in June over the same period in 2019, it also revealed that most of this rise was due to higher prices. In fact, all categories they track outside of jewelry were down on a month-to-month basis.

This, of course, is creating headwinds for many consumer-facing companies, which are only being compounded by dwindling COVID-related stimulus, rising input costs and worker shortages, says Wells Fargo Advisors analyst Brian Postol.

But not all hope is lost, and Postol believes "blue skies are faintly appearing in the distance, and brighter days will return." The analyst sees demand building across many pockets of the consumer discretionary sector, including automotive retail and e-commerce.

And with the sector down more than 30% so far in 2022, investors have plenty of opportunity to find some solid consumer discretionary plays at a bargain. Read on as we explore the best consumer discretionary stocks to buy for the rest of 2022.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.