Amazon Stock Might Be the Best Amazon Prime Day Deal of All

Amazon Prime Day offered loads of good deals to subscribers, but the best bargain of all is still available to investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Amazon.com Prime Day offers a frenzy of deals and discounts, but the best bargain of all might be Amazon stock, analysts say.

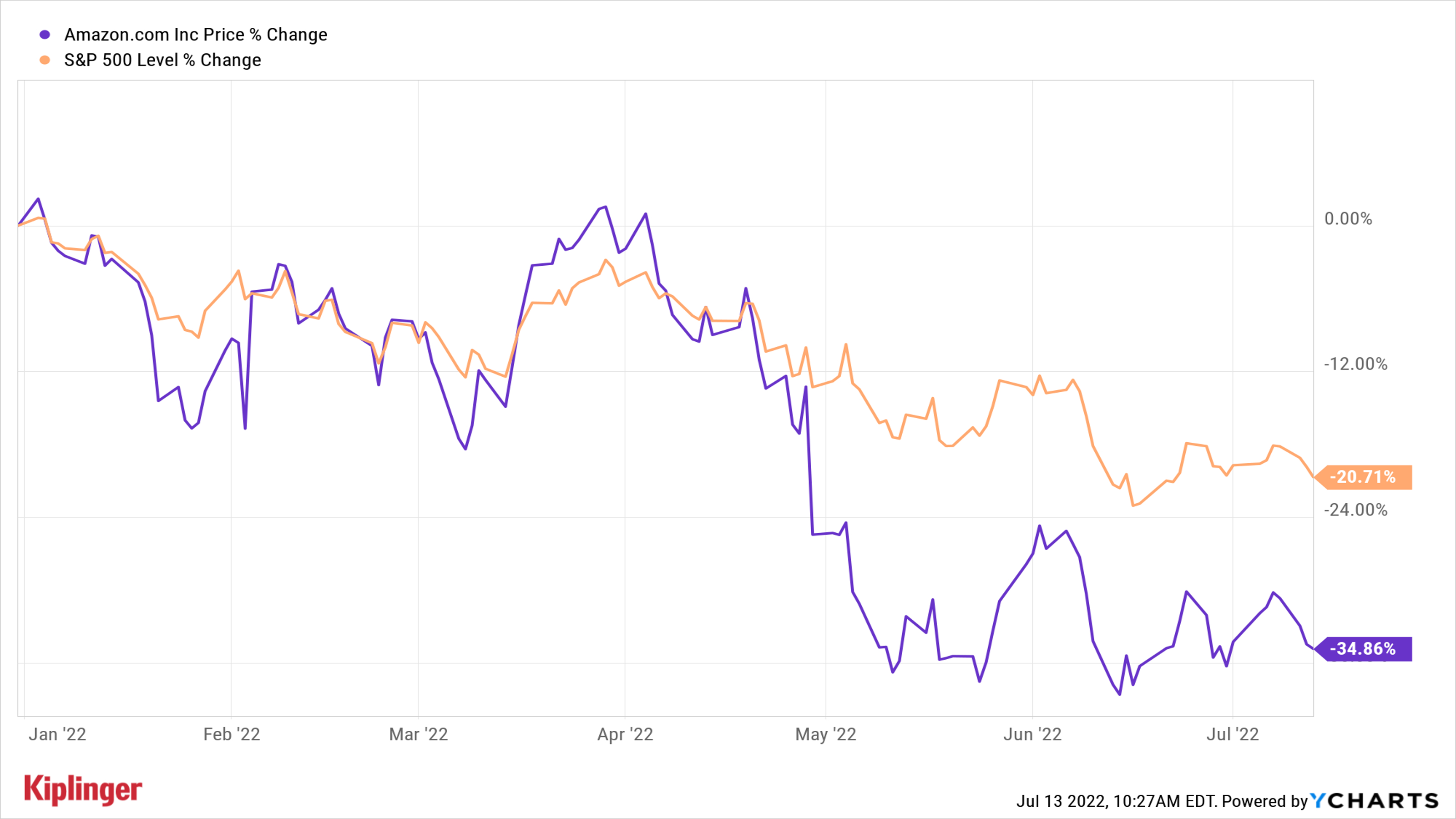

Shares are off by 32% for the year-to-date, lagging the broader market by about 13 percentage points. Rising fears of recession and its potential impact on retail spending are partly responsible for the selloff. The market's rotation out of pricey growth stocks and into more value-oriented names is likewise doing AMZN no favors. See the chart below:

True, Amazon is hardly alone when it comes to mega-cap names getting slaughtered in 2022. Where the stock does distinguish itself is in its deeply discounted valuation, and the mass of Wall Street analysts banging the table for it as a screaming bargain buy.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

AMZN's Elite Consensus Recommendation

It's well known that Sell calls are rare on the Street. For different reasons entirely, it's almost equally unusual for analysts (as a group, anyway) to bestow uninhibited praise on a name. Indeed, only 25 stocks in the S&P 500 carry a consensus recommendation of Strong Buy.

AMZN happens to be one of them. Of the 53 analysts issuing opinions on the stock tracked by S&P Global Market Intelligence, 37 rate it at Strong Buy, 13 say Buy, one has it at Hold, one says Sell and one says Strong Sell.

If there is a single point of agreement among the many, many AMZN bulls, it's that shares have been beaten down past the point of reason.

Here's perhaps the best example of that disconnect: At current levels, Amazon's cloud-computing business alone is worth more than the value the market is assigning to the entire company.

Just look at Amazon's enterprise value, or its theoretical takeout price that accounts for both cash and debt. It stands at $1.09 trillion. Meanwhile, Amazon Web Services – the company's fast-growing cloud-computing business – has an estimated enterprise value by itself of $1.2 trillion to $2 trillion, analysts say.

In other words, if you buy AMZN stock at current levels, you're getting the retail business essentially for free. True, AWS and Amazon's advertising services business are the company's shining stars, generating outsized growth rates. But retail still accounts for more than half of the company's total sales.

More traditional valuation metrics tell much the same story with AMZN stock. Shares change hands at 42 times analysts' 2023 earnings per share estimate, according to data from YCharts. And yet AMZN has traded at an average forward P/E of 147 over the past five years.

Paying 42-times expected earnings might not sound like a bargain on the face of it. But then few companies are forecast to generate average annual EPS growth of more than 40% over the next three to five years. Amazon is. Combine those two estimates, and AMZN offers far better value than the S&P 500.

Analysts Say AMZN Is Primed for Outperformance

Be forewarned that as compellingly priced as AMZN stock might be, valuation is pretty unhelpful as a timing tool. Investors committing fresh capital to the stock should be prepared to be patient.

That said, the Street's collective bullishness suggests AMZN investors won't have to wait too long to enjoy some truly outsized returns. With an average target price of $175.12, analysts give AMZN stock implied upside of a whopping 55% in the next 12 months or so.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.