Stock Market Today: Stocks End Mixed After Bleak Bank Earnings, Inflation Data

Both JPMorgan Chase and Morgan Stanley saw sharp declines in profit in Q2.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks' volatility continued Thursday, sparked by a weak start to second-quarter earnings season and another sizzling inflation update.

On the earnings front, JPMorgan Chase (JPM, -3.5%) this morning said profit in the second quarter was down 28% from the year-ago period, while revenue rose a modest 1%. The financial firm also said it is suspending stock buybacks in order to boost its capital reserves. Fellow big bank Morgan Stanley (MS, -0.4%) also saw its profit sink – down 29% year-over-year – while revenue plunged 11%.

Also in focus today was the latest reading of the producer price index (PPI), which confirmed what Wednesday's scorching consumer price index (CPI) report already told us: Peak inflation was not reached last month. Data from the Labor Department showed that the PPI, which measures how much suppliers are charging businesses and their customers for their goods, surged 11.3% year-over-year in June, its seventh straight month of double-digit annual percentage gains. On a sequential basis, wholesale prices were 1.1% higher.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

One positive from the report was that the core PPI, which excludes the volatile energy and food sectors, was up 0.3% over the prior month – or down slightly from May's 0.4% increase.

"It’s clear that food and energy are driving PPI higher, as was the case in yesterday's inflation print," says Peter Essele, head of portfolio management for Commonwealth Financial Management. "When removing these volatile components, PPI appears to have peaked and is starting to roll over, a tell-tale sign that the economy is shifting into late-cycle territory. The probability of a 100-basis-point hike from the Fed in late July has greatly increased after the two price index releases."

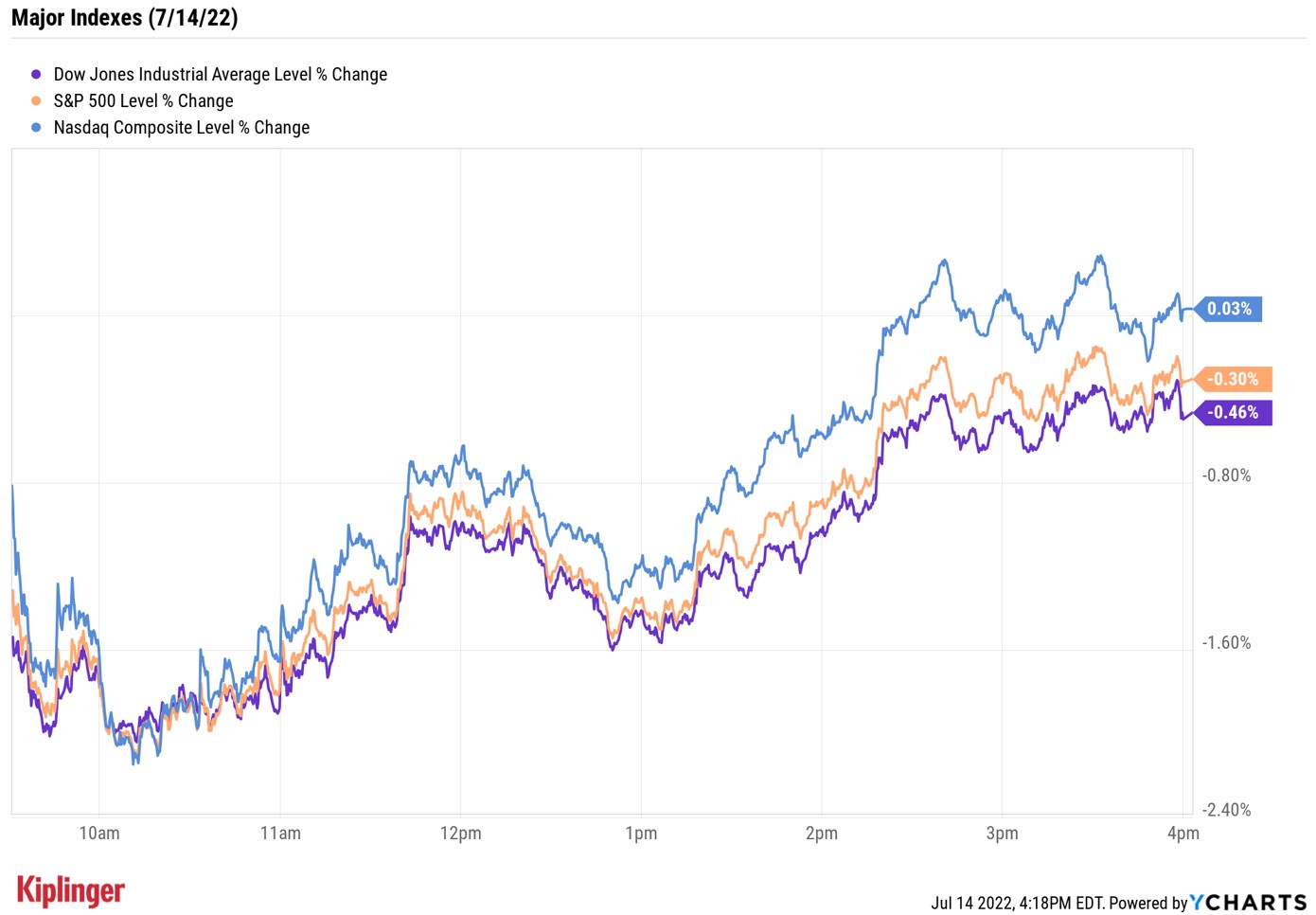

The one-two punch had stocks wallowing deep in negative territory for most of the morning, but the major benchmarks climbed well off their session lows by the close. The S&P 500 Index (-0.3% at 3,790) and Dow Jones Industrial Average (-0.5% at 30,630) still suffered their fifth straight loss, however, while the Nasdaq Composite ended marginally higher at 11,251.

Other news in the stock market today:

- The small-cap Russell 2000 slumped 1.1% to 1,707.

- U.S. crude futures shed 0.5% to finish at $95.78 per barrel.

- Gold futures slumped 1.7% to $1,705.80 an ounce, their lowest settlement since March 30, 2021.

- Bitcoin climbed 4.9% to $20,603.56. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Conagra Brands (CAG) fell 7.3% after the packaged food maker reported fiscal fourth-quarter revenue of $2.91 billion, below analysts' consensus estimate for revenue of $2.93 billion. However, CAG's adjusted earnings of 65 cents per share beat the average estimate by 2 cents. The company also said it plans to raise prices in the second quarter of fiscal 2023 in order to offset higher costs related to inflation. CFRA Research analyst Arun Sundaram maintained a Buy rating on the consumer staples stock after earnings. "We expect margins to improve in FY 23 with more pricing flowing through and cost inflation likely approaching its peak," the analyst says. "Also, cost savings should be easier to realize in FY 23 as the overall supply chain stabilizes. Together, we see more upside than downside to CAG's FY 23 bottom-line targets as the fiscal year progresses."

- Energy stocks suffered notable losses as crude futures continued to slide. APA (APA, -4.0%), Diamondback Energy (FANG, -3.5%) and EOG Resources (EOG, -3.6%) were just a few of the day's biggest decliners.

Play Green Energy Stocks for Long-Term Growth Trends

Market volatility is likely to continue for the time being, which creates an especially uncertain environment for investors. "Inflation has taken a bite out of stock and bond markets – and the bite may not be over quite yet," says Liz Young, head of investment strategy at SoFi. "Before the end of the month, we could get negative earnings guidance, a 75-100 basis point hike from the Fed, and a negative Q2 GDP print. This scenario could prove to be bad news for markets, but good news for buyers."

Although Young suggests investors "don't swing for the fences," she does believe that "we have to start swinging the bat before summer is over." And there's certainly plenty good of pitches to hit for investors of all stripes.

Those wanting to boost the income-producing parts of their portfolios may want to consider these discounted Dividend Aristocrats. The best Dow dividend stocks are another great place to find reliable and rising payouts.

Other investors might be keen on long-term growth trends. If that's the case, green energy stocks look like a fountain of opportunity. Indeed, the renewable energy market is forecast to grow to almost $2 trillion by the end of the decade. These top-rated picks are well-positioned to take a piece of that pie.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.