How to Find the Best Gold Stocks

Buying gold stocks is an easier way for investors to gain exposure to the precious metal, but not all are created equal. Here's how you find the best ones.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Believe it or not, if you'd like to invest in gold, your best play might not be gold itself, but something a little more indirect: Gold stocks.

While owning the physical metal is the purest way of investing in gold, it's also the most cumbersome. You have to find somewhere to buy it (though, hey, you can get it at Costco), get it shipped, determine a secure way to actually store the gold, insure it, and then, when you're ready to sell, find a buyer and figure out how to deliver it.

If you're averse to butt pains, you've got a much easier method at your disposal: gold stocks. Because they're publicly traded companies, they don't give you perfect exposure to the price of gold – indeed, they often trade much more aggressively (in both directions) than the metal. But they're much more affordable on a nominal dollar basis, and you can buy them with a click of a button in your brokerage account.

So read on as we talk about what a gold stock is, why you'd want one, and what to consider when seeking out the best gold stocks.

What are gold stocks?

The term "gold stocks" simply refers to companies involved in the gold mining process. And, generally speaking, there are three types of gold stocks:

Miners: Gold miners are companies that are actually involved in extracting gold out of the earth. Miners typically develop a mining facility, mine the gold – which involves extracting ore and then processing it into gold – then sell the metal to buyers, who will use the gold to make anything from coins and bars to jewelry to electronic components.

Junior miners: Despite the term "miners," junior gold miners don't actually mine for anything. They're exploration companies that search out potential gold deposits and determine feasibility of the mines. Gold miners then buy these assets from the juniors – and from time to time, they'll buy the junior firms outright.

Royalty companies: Royalty companies never get anywhere close to physical gold. Instead, these firms provide financing to miners, who in turn agree to pay the royalty company either a percentage of revenues or gold production.

In all cases, the price of gold has a lot of sway on how these stocks perform. High gold prices mean higher selling prices for miners, higher deposit sales prices for junior miners, and higher royalties for royalty companies.

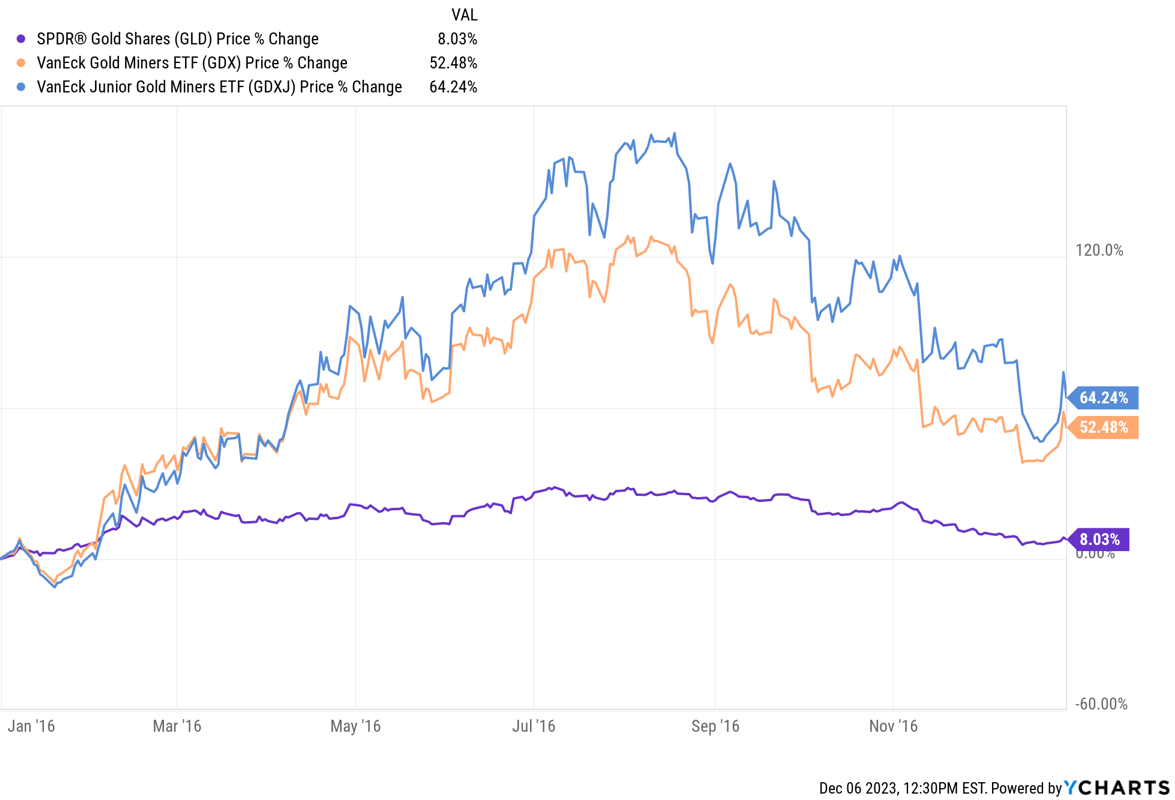

In fact, the metal's price impacts gold stocks' financial situations so much that miners' share prices tend to trade much more drastically than the metal itself. And given that juniors are typically a much more high-risk, high-reward proposition than actual mining companies (which also tend to be larger), juniors typically trade in an even more exaggerated fashion.

One of the clearest illustrations of this: 2016, when gold prices rose for a half a year before pulling back.

This dynamic exists for better or worse. Consider this Goldman Sachs observation about gold miners from late 2023:

"Across the gold space, the gold miners in our coverage have underperformed the commodity by 14% year-to-date, driven by idiosyncratic factors (i.e. capex increases, M&A, operational execution challenges)."

How to find the best gold stocks

While gold prices are arguably the most important factor behind the price movement in gold stocks, it's not the only one. Asset quality, company quality, management ability, and more, set one gold stock apart from the next.

If you're looking for the best gold stocks, here are a few things to consider:

All-in sustaining costs: All-in sustaining costs (or just all-in costs) are the total costs of producing an ounce of gold. These include materials, labor, taxes, royalties and more. In general, the lower the all-in costs, the better. Think of it as protection against lower gold prices. For example, let's say Gold Miner A has all-in costs of $1,200 per ounce, and Gold Miner B has all-in costs of $1,400 per ounce. Even if gold dropped from current prices around $2,100 per ounce to $1,300 per ounce, Gold Miner A's profit margin will be much smaller, but it will still be profitable – whereas Gold Miner B will actually be producing gold at a loss.

Exposure to other metals besides gold: Exposure to other metals isn't inherently a good or bad thing – it's merely a consideration as you're selecting an individual gold stock to buy. If you want a company that can best help you leverage the price of gold, you probably want a pure-play gold miner. However, if you want a diversified company that can perform well if gold prices rise, but won't necessarily crash if gold prices do, you might want to consider a miner that deals in multiple metals – say silver, platinum, iron, nickel, etc.

Individual stocks vs ETFs: It can be exceedingly difficult for beginner investors to tell one gold stock from another. Also, even though gold stocks hinge greatly on gold prices, it's possible to pick a poor individual producer. So, rather than single out one or two mining stocks, you might consider owning dozens through an exchange-traded fund. Two of the most popular gold ETFs are the VanEck Gold Miners Equity ETF (GDX), which holds large, established gold miners, and the VanEck Junior Gold Miners ETF (GDXJ), which, as the name suggests, owns juniors.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.