Stock Market Today: Nasdaq Leads Again as Tesla Stock Pops

Tesla (TSLA) reported a bottom-line beat in Q2, and said it sold Bitcoin to boost its cash reserves.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors sifted through a busy news cycle on Thursday and decided they liked what they saw, with stocks ending higher for a third straight day.

Things got started early this morning on word that the European Central Bank (ECB) lifted interest rates by a higher-than-expected 50 basis points (a basis point is one-one hundredth of a percentage point). The rate hike marks the first for the ECB in 11 years, and comes as the central bank attempts to battle sizzling inflation and slowing economic growth across the eurozone.

Back at home, the earnings calendar remained in focus, with the latest quarterly results from Tesla (TSLA) garnering notable attention. The maker of electric vehicles reported second-quarter earnings that beat analysts' consensus estimate, though they fell short on revenue.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The company was clearly profitable this quarter," says Wes Gottesman, market advisor at Web3 trading platform TradeZing. "However relative to other quarters, the automotive revenue was down to $14.6 billion, as compared to the previous quarter's $16.9 billion. The culprit clearly being the shutdowns in Shanghai, and cutbacks in production/deliveries. That was the issue for this quarter, at no fault of their own. Their gross margins are at 25%, which means they have significant pricing power, while increasing production. Tesla also has a strong solar energy component which will continue to prosper as the world transitions to solar energy."

In addition, TSLA sold roughly three-quarters of its Bitcoin purchases in Q2. The move was made to "maximize" the company's cash position, CEO Elon Musk said in the earnings call. He added that Tesla is "open to increasing" its Bitcoin holdings in the future, and that "this should not be taken as some verdict" on the cryptocurrency. TSLA did not sell any of its Dogecoin, according to Musk.

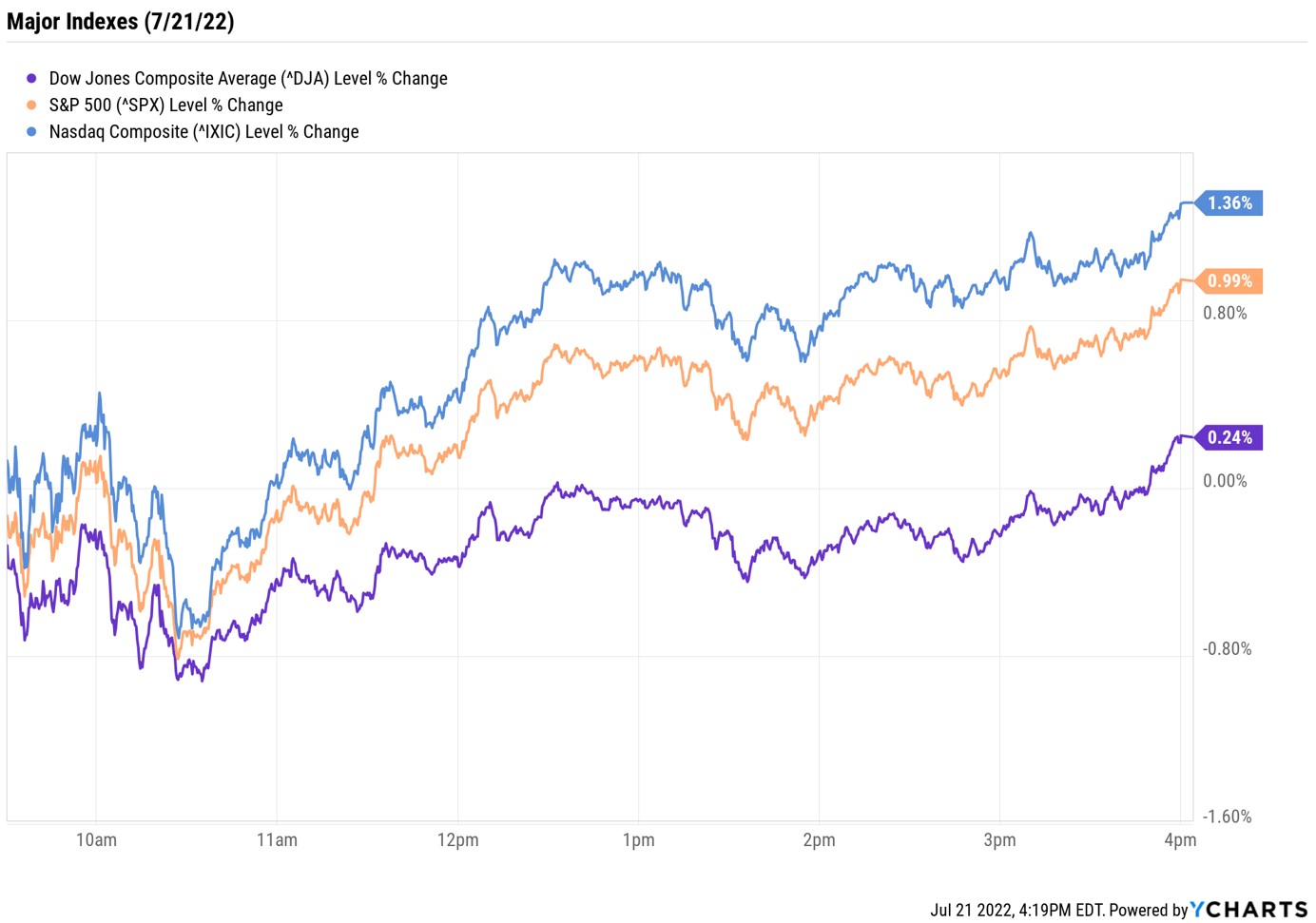

Still, Bitcoin fell 2.0% to 23,197 on that news (Bitcoin markets don't close; price taken at 4 p.m. ET.), while TSLA shares soared 9.8%. Tesla's rally helped the broader stock market brush off news that President Joe Biden tested positive for COVID-19, with the Nasdaq Composite gaining 1.4% to 12,059. The S&P 500 Index rose 1.0% to 3,998, while the Dow ended up 0.5% at 32,036.

Other news in the stock market today:

- The small-cap Russell 2000 added 0.5% to 1,836.

- U.S. crude futures shed 3.5% to settle at $96.35 per barrel.

- Gold futures rose 0.8% to end at $1,713.40 an ounce.

- AT&T (T) plunged 7.6% after the telecom firm lowered its full-year free cash flow guidance to $14 billion from $16 billion, "to reflect heavy investment in growth and working capital impacts related to timing of collections," the company said in its press release. This overshadowed T's higher-than-expected adjusted earnings of 65 cents per share and revenue of $29.6 billion in the second quarter.

- Travel stocks struggled today following negative earnings reactions for American Airlines (AAL, -7.4%) and United Airlines (UAL, -10.2%). While AAL posted its in-line earnings per share of 76 cents on higher-than-expected revenue of $13.42 billion, it cut third-quarter capacity, now expecting to fly 8%-10% below what it did in Q3 2019. And UAL recorded a slimmer-than-anticipated second-quarter loss of $1.43 per share, but revenue of $12.11 billion fell short of the cosensus estimate.

- Data from the Labor Department showed jobless claims rose 7,000 on a weekly basis to 251,000 – the most since last November. Still, this did little to move markets today. "With earnings season in full swing and the ECB announcing its first-rate hike in more than a decade, the slight tick up in jobless claims may take a backseat in investors' minds," says Mike Loewengart, managing director of investment strategy at E*Trade. "But with jobless claims on an upward trend over the last month, some may question if the labor market will start to factor in more to the Fed's plan as it works aggressively to tame inflation."

A "Best-of-Both-Worlds" Scenario for Investors

Mid-cap stocks were another area of the market where investors found green ink today. This group of equities (typically firms with market capitalizations that fall between $2 billion and $10 billion) have been quietly holding their own in recent weeks, up 0.8% today and 6.7% so far this quarter.

Often, mid caps are overlooked by those seeking out larger-cap names for stability or small-cap stocks for growth. Yet, this area of the market can provide investors a "best-of-both-worlds" scenario: higher growth potential than large caps and less volatility than smaller cap names.

And in the current backdrop of "a fast-moving business cycle and global central bank tightening," investors should consider mid-cap stocks, say Wells Fargo Investment Institute strategists; specifically, those with "the potential to post stable, high-quality earnings." Here, we've put together a list of the best mid-cap stocks to buy for these very qualities. What's more, each enjoys top ratings from Wall Street's pros.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.