Stock Market Today: Tech Earnings, Fed Hike Light Fire Under Stocks

Despite posting lower-than-expected quarterly results, Alphabet (GOOGL) and Microsoft (MSFT) stocks soared.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wednesday was a busy, but successful, day for stocks, with today's upside fueled by a well-received round of earnings and the latest Fed policy update.

There was no shortage of corporate updates for investors to sift through, but last night's results from Big Tech titans Alphabet (GOOGL, +7.6%) and Microsoft (MSFT, +6.7%) drew the most attention.

While Alphabet missed on both the top and bottom lines, the company did see strong growth in Google Search revenue thanks to travel and retail searches. Microsoft's fiscal fourth-quarter results also came up short, but it expects double-digit revenue and operating income growth in fiscal 2023 (on a currency adjusted basis). Both firms reported their slowest revenue growth since 2020, and pointed to a stronger dollar as a significant headwind.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also in focus today was the Federal Reserve, which, as expected, raised interest rates by 75 basis points (a basis point is one-one hundredth of a percentage point).

"With some softening of recent economic data, Fed officials likely didn't feel the pressure to go beyond market consensus with regards to the level of rate change in the policy rate," says Charlie Ripley, senior investment strategist at Allianz Investment Management. He adds that there is plenty of time between now and the Fed's September meeting for the central bank to see if policy changes that have already been made are working. Overall, there were no surprises in today's meeting, and what happened this afternoon ultimately leaves the central bank's options open this fall, he says.

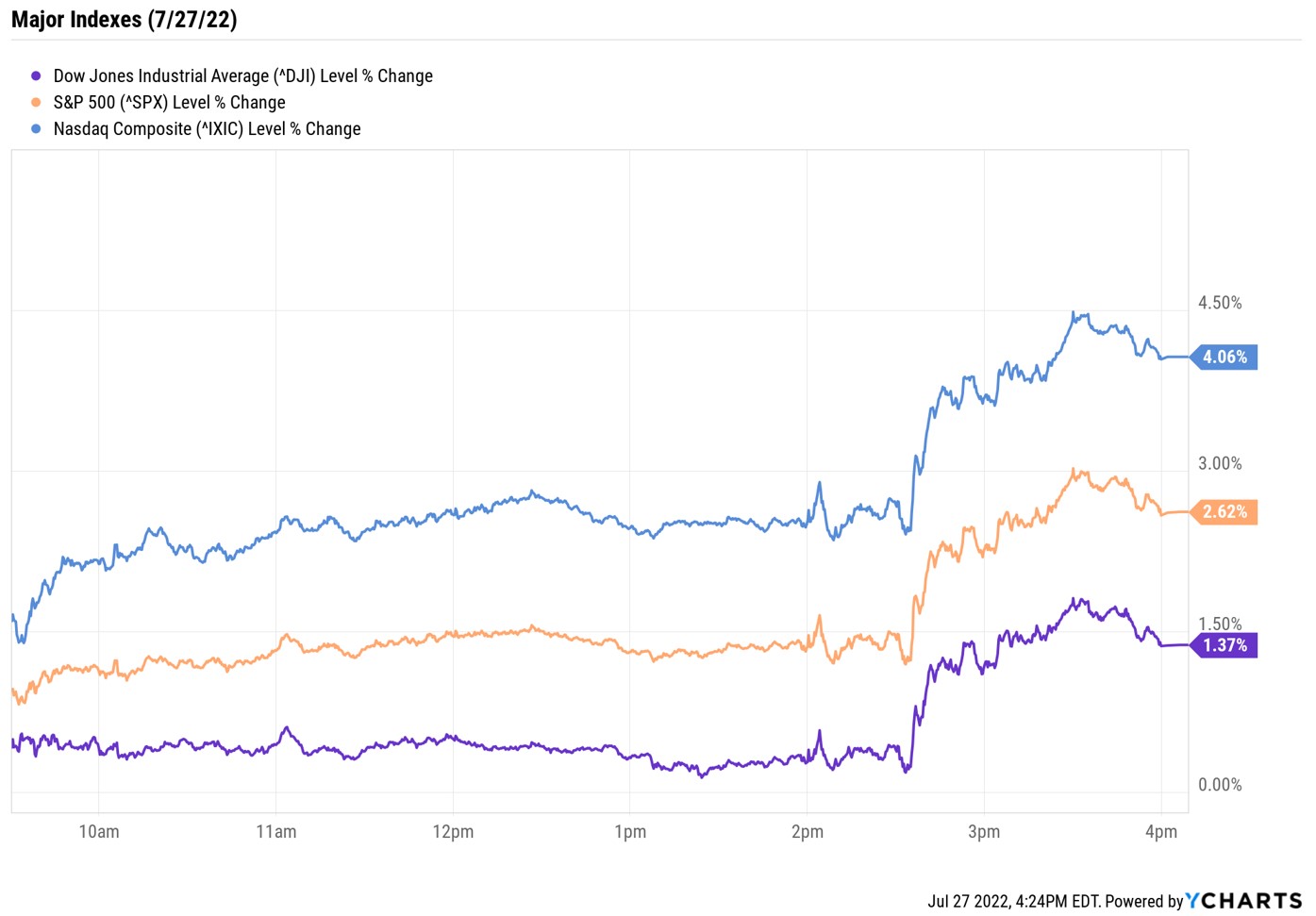

Stocks were solidly higher heading into the mid-afternoon central bank announcement, but skyrocketed following it. The Dow Jones Industrial Average jumped 1.4% to 32,197 and the S&P 500 Index soared 2.6% to 4,023. The Nasdaq Composite, meanwhile, spiked 4.1% to 12,032, its best day since April 2020.

Other news in the stock market today:

- The small-cap Russell 2000 rose 2.4% to 1,848.

- U.S. crude futures advanced 2.4% to settle at $97.26 per barrel.

- Gold futures eked out a marginal gain to end at $1,719.10 an ounce.

- Bitcoin enjoyed an 8.9% boost to $22,769.69. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Chipotle Mexican Grill (CMG) rallied 14.7% after the burrito chain reported second-quarter earnings of $9.30 per share, more than analysts were expecting. And while revenue was up 17% year-over-year for the three-month period, it came in just below the consensus estimate. CMG also said it will raise prices again in August ot counter inflation. "We believe that Chipotle has a healthy balance sheet along with robust mobile ordering and delivery platforms that will help it to recover as the economy reopens," says Argus Research analyst John Staszak (Buy). "While some consumers may be put off by Chipotle's relatively high prices, we expect its strong brand to continue to attract customers."

- Enphase Energy (ENPH, +17.9%) was another post-earnings winner. The maker of solar energy microinverters reported higher-than-expected Q2 revenue of $530 million, boosted by a 69% quarter-over-quarter spike in European sales. "Beyond energy security concerns in the European Union, we believe the electrification of both the heat and transportation markets are going to drive demand for distributed power assets as existing infrastructure struggles to keep pace," says Oppenheimer analyst Colin Rusch (Outperform). "We are also beginning to see the impact of inflation on delivered electricity prices, which is helping solar + storage unit economics while grid reliability has become increasingly challenged."

It's Been a Rocky Road for Airline Stocks

Red-hot inflation is not only a thorn in the Fed's side, but it – as we have witnessed time and time again – is also weighing on consumer-facing companies. Take for instance the airline industry, which is seeing higher fuel costs weigh on financial results. "Inflation is a major headache for all industries and the airline business is not immune to rising costs," says Peter McNally, global sector lead for industrials, materials and energy at research firm Third Bridge Group.

And these rising costs are creating a less profitable business environment than before the pandemic, even as "the underlying demand for air travel is strong." But, he adds, business and international travel have yet to recover at the same pace that leisure has, and these two areas could create a key source of future profits for airlines.

While there is certainly a reason to hold out hope for the industry, not all airline stocks are created equal. Here, we take a closer look at seven airline companies to see which ones are best positioned to ride out this rocky recovery.

Karee Venema was long GOOGL as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.