Stock Market Today: Stocks Wave Off Recession Worries

The latest gross domestic product data showed the U.S. economy contracted for a second straight quarter in Q2.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks posted solid gains for a second straight day on Thursday, even as preliminary data showed the U.S. economy contracted 0.9% in the second quarter.

The latest report from the Commerce Department marks back-to-back quarterly declines in gross domestic product (GDP), and sparked a whirlwind of recession chatter on Wall Street.

"Two consecutive quarters of negative GDP meets our humble definition of a recession," says Dan Eye, chief investment officer at financial advisory firm Fort Pitt Capital Group. "But we agree with the view that labor market strength and a well-positioned consumer limits the severity of the economic contraction." Eye adds that the market sees lower odds of a third 75 basis-point rate hike (a basis point is one-one hundredth of a percentage point) at the Federal Reserve's September meeting and is beginning "to price in interest rate cuts as early as February 2023."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Earnings were also in focus today. Meta Platforms (META) plummeted 5.2% after the Facebook parent said revenue declined 1% year-over-year in the second quarter to $28.8 billion – below what Wall Street was expecting. The company's earnings also came up short, as did its current-quarter revenue forecast.

"This is the first quarter ever that META is reporting declining revenue growth from a year ago," says David Wagner, portfolio manager at financial advisory firm Aptus Capital Advisors. "You couple this with the fact that guidance is substantially lighter than expected is why the stock is lower." Wagner adds that "given the market's focus on profitability, we like the fact the company has slowed down egregious spending in products that appear to be black holes."

Ford Motor (F), on the other hand, jumped 6.1% after the automaker said Q2 operating income nearly tripled on a year-over-year basis to $3.7 billion. F also hiked its quarterly dividend by 50% to 15 cents per share.

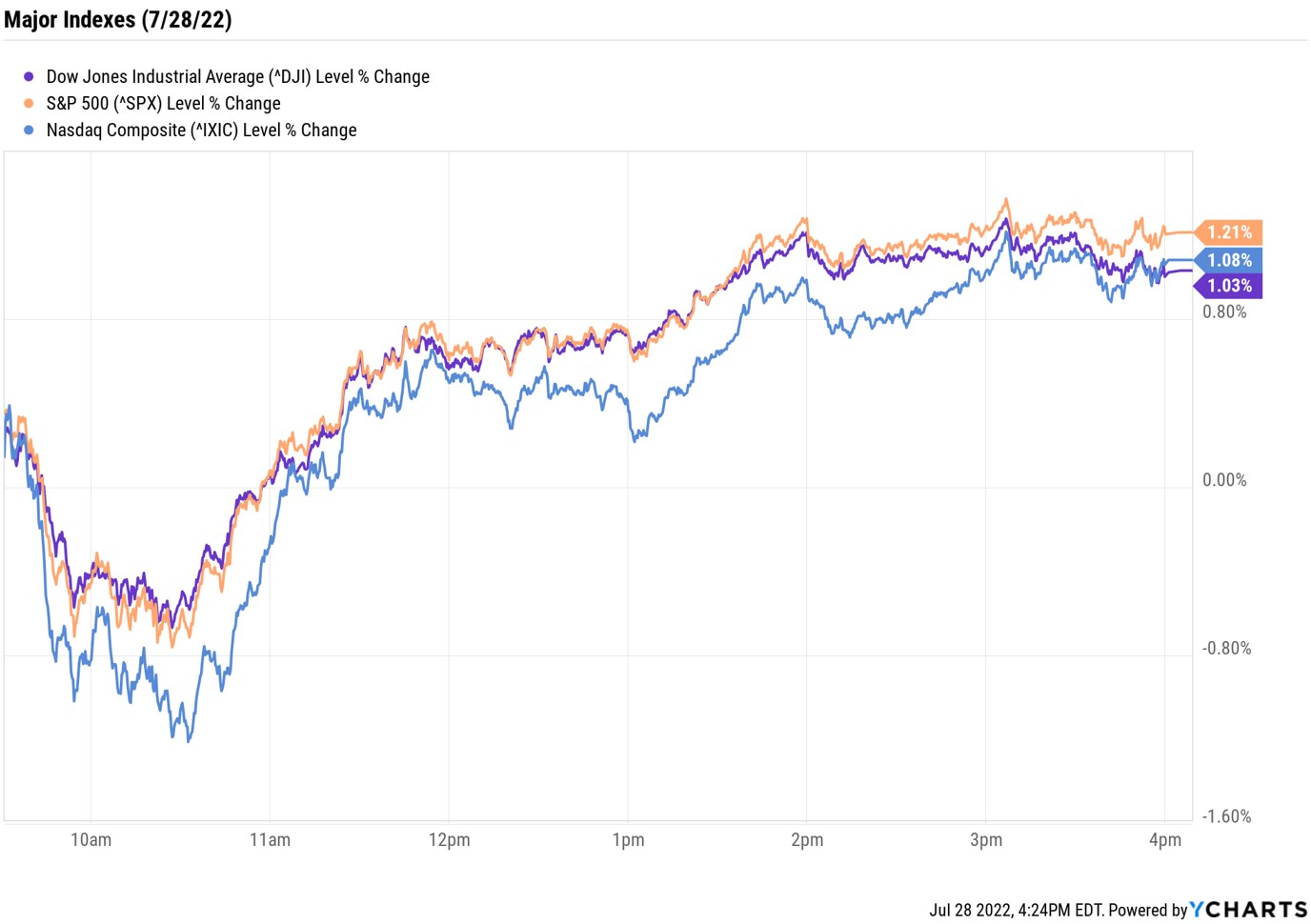

The major indexes managed to shake off some early morning weakness to finish near their session highs. The Dow Jones Industrial Average gained 1% to 32,529, the S&P 500 Index rose 1.2% to 4,072 and the Nasdaq Composite climbed 1.1% to 12,162.

Other news in the stock market today:

- The small-cap Russell 2000 gained 1.3% to 1,873.

- U.S. crude futures fell 0.9% to settle at $96.42 per barrel.

- Gold futures jumped 1.8% to $1,750.30 an ounce.

- Bitcoin soared 4.5% to $23,798.25. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Spirit Airlines (SAVE) rose 5.6% after the discount airline said it ended merger talks with Frontier Group Holdings (ULCC, +20.5%), instead accepting the $3.8 billion buyout offer from JetBlue Airways (JBLU, -0.4%). "The companies will have an uphill battle convincing regulators that this deal should be approved," says Chris Pultz, portfolio manager for alternative investment firm Kellner Capital. "The Biden administration has been vocal about competitiveness in the airline industry, and this will not be looked upon favorably."

- Qualcomm (QCOM) sank 4.5% after the wireless technology company gave current-quarter guidance that fell short of the consensus estimate, citing a "challenging macroeconomic environment." This overshadowed QCOM's higher-than-expected earnings of $2.96 per share and revenue of $10.9+ billion for its fiscal third quarter. Still, Argus Research analyst Jim Kelleher maintained a Buy rating on the tech stock. "QCOM has slightly outperformed peers during the tech sector selloff, reflecting the enduring strength of its silicon products and IP portfolio, and in our view continues to offer exceptional value," he says.

The Best Cheap ETFs We Can Find

Stock market gains from the past two days have brought some relief to investors, but worries over a potential recession will likely keep the roller-coaster ride going for the time being. Still, "investors should stay invested through the volatility and try to navigate into areas of the market that are more likely to provide downside protection in the volatile months ahead," says Gargi Chaudhuri, head of iShares investment strategy.

To weather the storm of a turbulent market, economic slowdown risks and high inflation, she says investors should gain exposure to "companies with strong balance sheets and the ability to pass on higher costs to consumers," which could help cushion a portfolio.

For that, there are plenty of single-stock plays for investors to choose from, like these companies with pricing power or these steady dividend growers. For those who want broad diversification, consider exchange-traded funds (ETFs) – which allow investors to build a core portfolio or make tactical moves across a basket of assets. But with thousands of ETFs to choose one, it can get overwhelming. Here, we've narrowed the list down to 20 of our favorite funds, which we call the Kip ETF 20. The exchange-traded funds featured here offer a variety of strategies for investors, at low costs to boot.

Karee Venema was long F as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.