Stock Market Today: Stocks Resume Rally on Strong Earnings, Economic Data

The ISM services index and the latest reading on factory orders both came in higher than expected.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

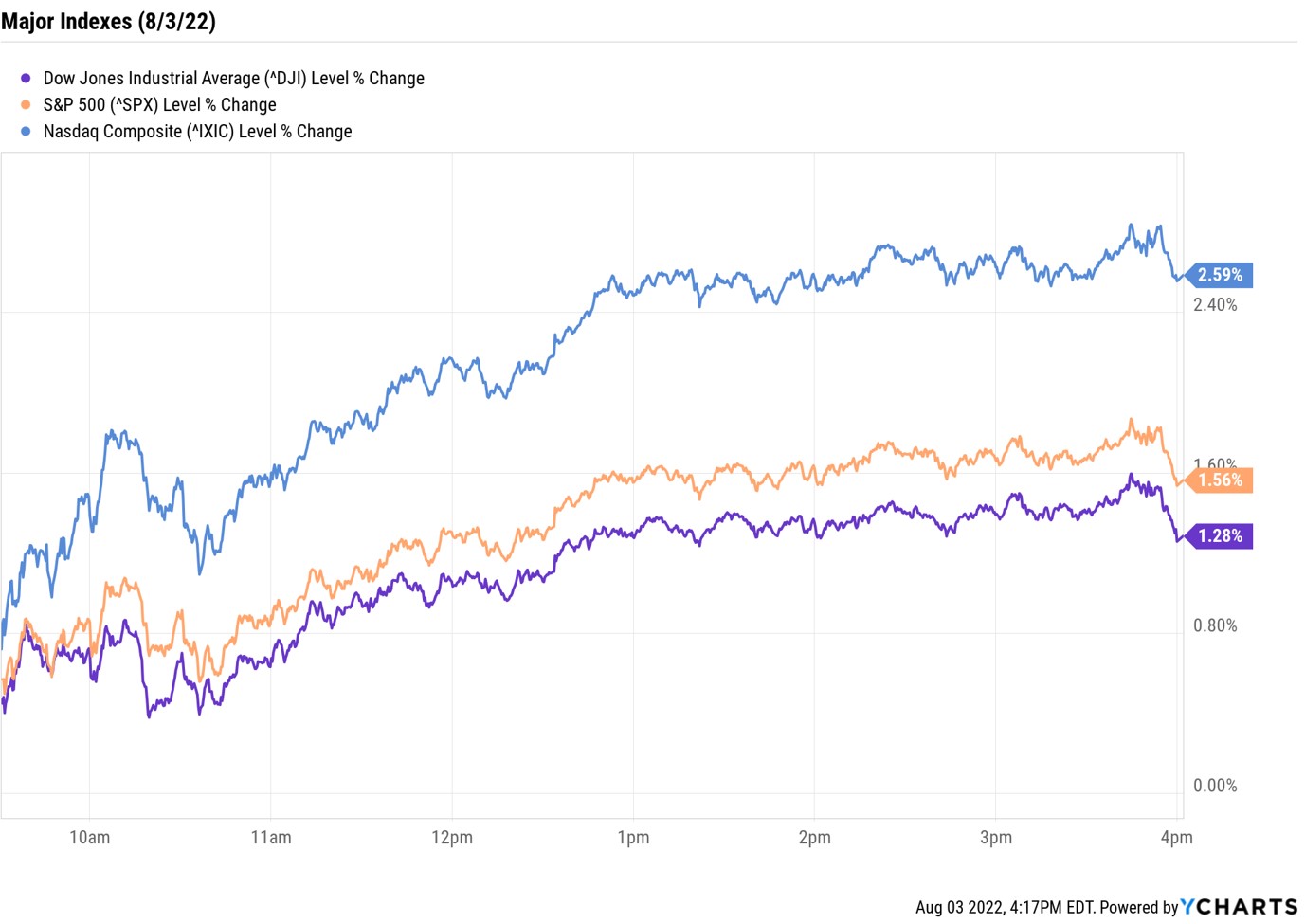

The major market indexes ran higher right from the start on Wednesday – and never looked back.

Helping boost investor sentiment were a pair of economic reports that indicated the U.S. economy is still growing. Data from the Institute for Supply Management this morning showed business activity in the services sector hit a three-month high of 56.7% in July.

"The ISM services index not only defied the consensus expectation for a decline, but rose by the most in five months in July," says Wells Fargo senior economist Tim Quinlan. "A jump in new orders bodes well for coming demand, and an array of measures suggests supply chain pressures continue to ease."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A separate report showed factory orders were up 2% month-over-month in June, more than economists were expecting.

A heavy dose of well-received corporate earnings reports added to the bullish buzz. Among the day's big post-earnings winners were drugmaker Moderna (MRNA, +16.0%) and fintechs PayPal Holdings (PYPL, +9.3%) and SoFi Technologies (SOFI, +28.4%).

Technology was the best-performing sector today, surging 2.7%. As such, the tech-heavy Nasdaq Composite outpaced its peers, rising 2.6% to 12,668. Still, the S&P 500 Index (+1.6% at 4,155) and Dow Jones Industrial Average (+1.3% at 32,812) posted solid gains. It was the first win this week for all three indexes.

Other news in the stock market today:

- The small-cap Russell 2000 spiked 1.4% to 1,908.

- U.S. crude futures plummeted 4% to finish at $90.66 per barrel after the Energy Information Administration posted a surprise rise in U.S. crude and gasoline inventories.

- Gold futures snapped their five-day winning streak, shedding 0.7% to end at $1,776.40 an ounce.

- Bitcoin rose 2.2% to $23,462.92. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Robinhood Markets (HOOD) jumped 11.7% today after the financial services platform said it was slashing its global workforce by roughly 23%, with most of the layoffs occurring in the operations, marketing and program management divisions. CEO Vlad Tenev said the cuts come amid a "deterioration of the macro environment, with inflation at 40-year highs accompanied by a broad crypto market crash." The company also reported a slimmer-than-expected per-share loss of 34 cents in its second quarter, while revenue of $318 million came in above the consensus estimate. While the layoffs are the headline of the report, says Mizuho Securities analyst Dan Dolev (Buy), the fundamentals show more positives than negatives – including higher quarter-over-quarter sales and average revenue per user. "We believe that once the market digests the 'shock' from the layoff's sheer size, investors will shift focus to fundamentals and path to profitability, which may even result in the stock trading higher tomorrow," Dolev adds.

- Not all of today's earnings reactions were positive. Match Group (MTCH) tumbled 17.6% after the online dating app provider reported lower-than-anticipated revenue of $795 million for its second quarter. The company also gave weak current-quarter revenue guidance and said Tinder CEO Renate Nyborg is leaving. Still, Jefferies analyst Brent Thill maintained a Buy rating on MTCH stock. "In our view, third-quarter revenue guidance is likely conservative to account for potential disruptions," Thill says. "We believe the new [Match Group] CEO Bernard Kim's heightened focused on faster product innovation, an expedited Hinge international rollout and improving monetization at Tinder will be key catalysts for driving accelerating revenue growth in fiscal 2023."

Don't Give Up on Bonds Just Yet

Long live the 60-40 portfolio! So says Douglas Beath, global investment strategist for Wells Fargo Investment Institute.

Many pundits have declared the traditional portfolio structure – which dictates you allocate 60% to stocks and 40% to bonds – as obsolete following a more than 16% decline in both the S&P 500 and the Bloomberg U.S. Aggregate Bond Index in the first half of 2022.

But Beath says that while "this year in capital markets is unusual," such calls are "greatly exaggerated," and in fact the 60-40 portfolio "will continue to be an effective strategy for investors." The strategist points to historical returns of bonds, which have provided a "significant hedge" during periods of market volatility, as well as attractive valuations following the recent downturn. And this is why the model is alive and well and continues "to serve as a solid foundation for long-term investors."

While investing in individual bonds is impractical for most retail investors, bond funds and bond ETFs allow them to gain exposure to fixed-income assets. Here, we've compiled a list of the 10 bond funds to buy now that cover a wide variety of categories and create diversification for income investors.

Karee Venema was long HOOD as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.