Stock Market Today: S&P, Nasdaq Retreat After Sizzling Jobs Report

The U.S. economy has now recouped all of the jobs it lost at the onset of the pandemic, with the unemployment rate falling to its lowest level since early 2020.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A milestone jobs report sent stocks lower on Friday as it sparked concern the Fed will stay aggressive with its rate hikes.

Ahead of the opening bell, the Labor Department said the U.S. economy added 528,000 new jobs in July, more than double what economists were expecting. The U.S. has now recouped all 22 million positions lost in the early months of the pandemic. Also in the report: The unemployment rate fell to 3.5%, a level not seen since February 2020, while average hourly earnings were up 0.5% month-over-month and 5.2% year-over-year.

"Job gains were broad-based and especially prominent in sectors such as education, healthcare and government," says Jeffrey Roach, chief economist for independent broker-dealer LPL Financial. "Given the stability in the job market, especially considering rising borrowing costs and higher inflation, we do not expect the National Bureau of Economic Research (NBER) to call a recession at this point. The labor market is strong enough to offset the weaknesses in other parts of the economy such as real estate."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"This reading is positive for economic growth and households," says Tim Courtney, chief investment officer at investment firm Exencial Wealth Advisors. "It should support consumer spending moving forward. While that is good news, it likely means the Federal Reserve will continue with interest rate hikes."

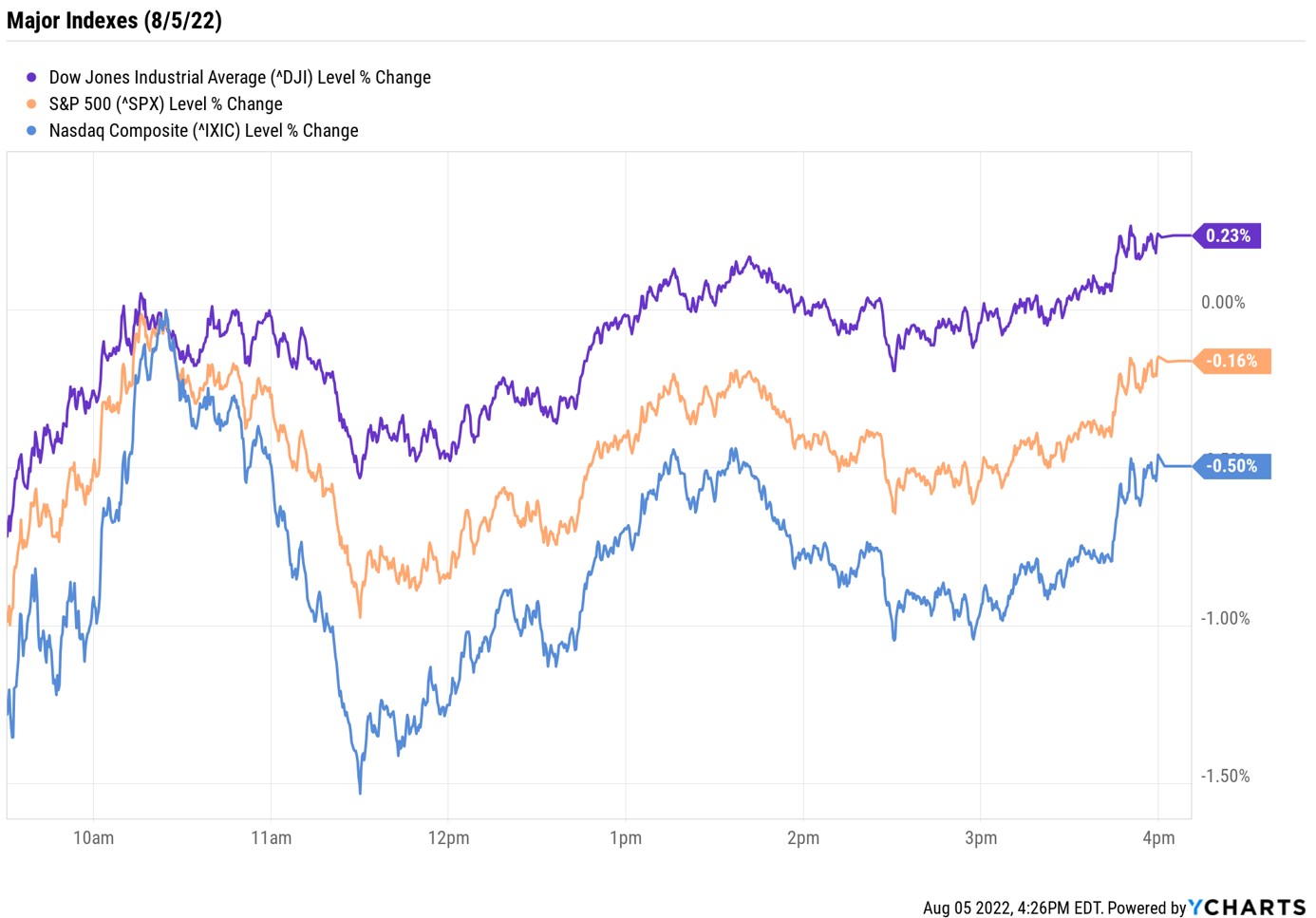

It's that last point that sent the 10-year Treasury yield spiking 15.4 basis points to 2.83% today. (A basis point is one-one hundredth of a percentage point.) This initially sent stocks deep into the red, though they came off their lows as the session wore on. At the close, the Dow Jones Industrial Average was up 0.2% at 32,803. The S&P 500 Index, meanwhile, was off 0.2% at 4,145, while the tech-heavy Nasdaq Composite – whose components are most sensitive to rising rates – shed 0.5% to 12,657.

Other news in the stock market today:

- The small-cap Russell 2000 gained 0.8% to 1,921.

- U.S. crude futures rose 0.5% to end at $89.01 per barrel.

- A strong dollar sent gold futures down 0.9% to $1,791.20 an ounce.

- Bitcoin rose 2.1% to $22,926.10. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Lyft (LYFT) spiked 16.6% after the ride-sharing company said it had 19.9 million riders in the second quarter, resulting in revenue per rider of $49.89 (more than the $49.30 analysts were expecting). LYFT also reported an adjusted profit of 13 cents per share compared to expectations for a per-share loss of 4 cents, while revenue jumped 29.5% year-over-year to $990.7 million. "While we are encouraged by the ride-share recovery, partially driven by higher airport volume and momentum in business bookings, we acknowledge concerns about peak travel demand," says CFRA Research analyst Angelo Zino (Buy). "That said, lagging West coast regions (e.g., San Francisco) are now recovering at a faster clip than other regions and should support revenue in the second half. In addition, we like LYFT's increasing emphasis on driving EBITDA growth by being more prudent on expenses."

- Carvana (CVNA) was another big post-earnings winner, with shares surging 40.1%. While the online auto dealer reported lower-than-expected revenue of $3.8 billion and a wider adjusted loss of $2.35 per share in its second quarter, CEO Ernie Garcia said in the company's earnings call that it is "shifting its focus to favor efficiency and cash flow" in response to a challenging economic environment. "As we consider carefully last night's quarterly announcement from CVNA and recent trends at the company, we overall view dynamics as 'better than feared' andsuggestive of underlying stabilizing and improving operational control at the company," says Oppenheimer analyst Brian Nagel (Outperform).

Stay Defensive!

Next up: Inflation data, with the July consumer price index (CPI) set to be released Wednesday morning. Douglas Porter, chief economist at BMO Capital Markets, points to the recent retreat in oil prices – U.S. crude futures fell 6.8% in July, and are down another 9.7% so far in August) as a reason for investors to be encouraged about this upcoming release.

"A moderation in energy and other commodity costs would go a long way to making the Fed's job of controlling inflation expectations much easier," Porter says. "In turn, it could lessen recession risks by removing some of the squeeze on consumers." Still, while the economist says that the headline inflation rate in Wednesday's CPI report could move back below 9% after topping this level in June, it's going to take many months to bring inflation substantially lower.

For investors, this means: Stay defensive. That could include focusing on stocks from the best inflation-proof sectors such as healthcare, consumer staples and utilities. Beverage stocks are also surprisingly good names to buy, not only for inflation protection, but also dividends. And for those that want to spread their risk around, consider these 10 defensive exchange-traded funds (ETFs) that could provide some ballast for choppy waters ahead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.