Stock Market Today: Nvidia Revenue Warning Weighs on Stocks

Chipmaker Nvidia (NVDA) said second-quarter revenue will fall short of its previous guidance, due to weakness in its gaming segment.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

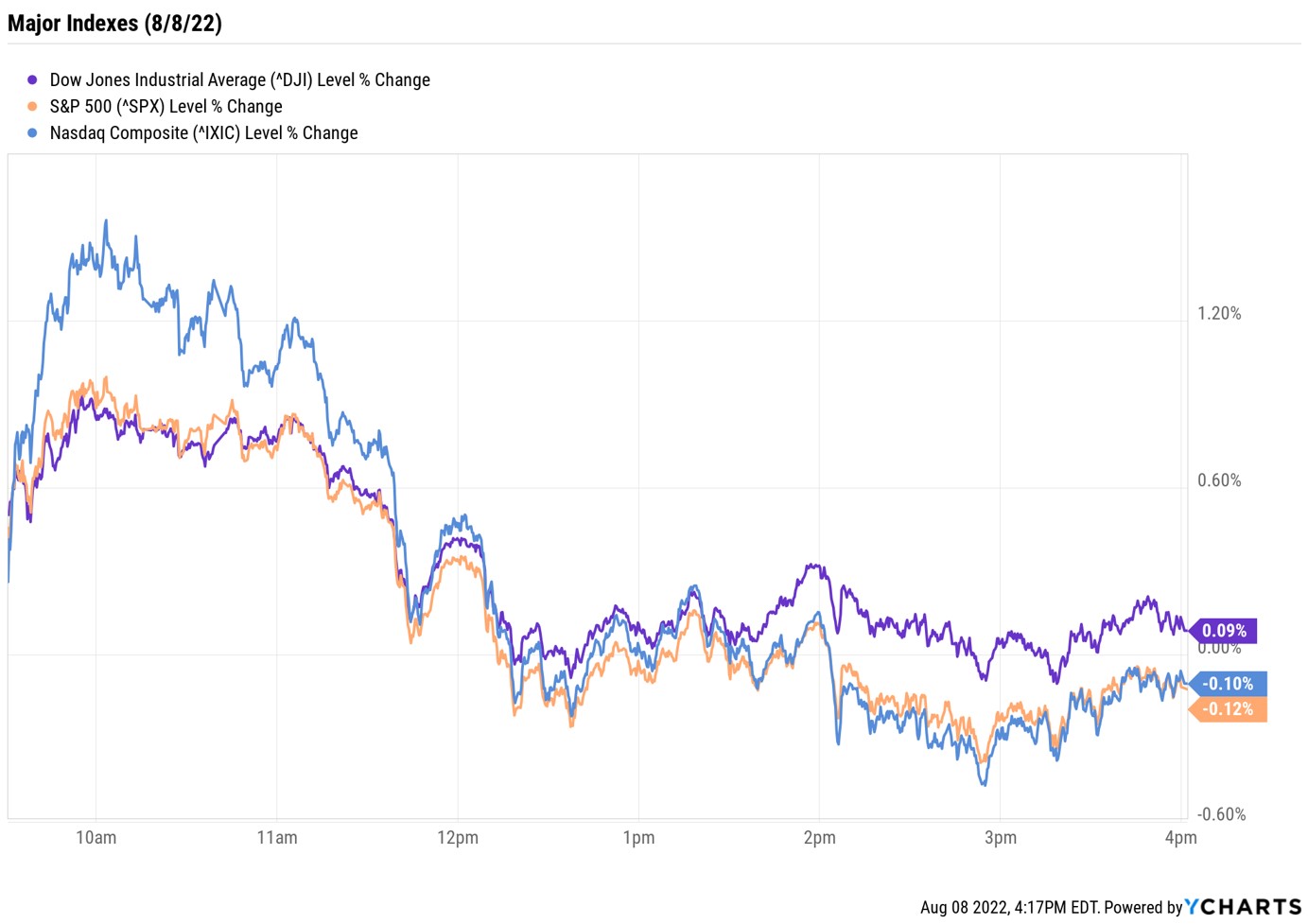

Stocks ended Monday with a whimper as a solidly higher open lost momentum throughout the trading day.

Disappointing earnings announcements from a pair of tech names created selling pressure for the broader market. Most notably, Nvidia (NVDA) shed 6.3% after the chipmaker said its second-quarter revenue will likely come in at $6.7 billion – lower than the $8.1 billion it previously guided for – amid a 33% year-over-year decline in gaming revenue. The company also expects "challenging market conditions" to persist in Q3. NVDA will release its full earnings report on Aug. 24.

Earnings from Palantir Technologies (PLTR) were also on Wall Street's radar. Shares plunged 14.2% after the data analytics firm reported a per-share loss of 1 cent in its second quarter, compared to the consensus estimate for earnings of 3 cents per share. PLTR also gave lower-than-anticipated full-year revenue guidance.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Not surprisingly, technology was the worst-performing sector today, giving back 0.9%. Meanwhile, the biggest gains were found in the materials (+0.6%) and real estate (+0.7%) sectors.

As for the major indexes, the Nasdaq Composite (-0.1% at 12,644) and S&P 500 Index (-0.1% at 4,140) finished in negative territory, while the Dow Jones Industrial Average eked out a 0.1% gain to end at 32,832.

Other news in the stock market today:

- The small-cap Russell 2000 jumped 1.0% to 1,941.

- U.S. crude futures gained 2.0% to settle at $90.76 per barrel.

- Gold futures rose 0.8% to $1,805.20 an ounce.

- Bitcoin soared 4.4% to $23,932.38. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Bed Bath & Beyond (BBBY) and AMC Entertainment Holdings (AMC) were notable gainers, with many suggesting retail traders on Reddit's WallStreetBets were driving the action in the two meme stocks. BBBY was up 63.5% at its intraday peak, before closing with a 39.8% gain. AMC shares popped 8.0% today.

- Signify Health (SGFY) jumped 11.0% after a report in The Wall Street Journal over the weekend said CVS Health (CVS, -0.3%) is looking to buy the healthcare platform. CVS plans to submit an offer for SGFY in the coming week, the article indicates, citing people familiar with the matter. "Since the CVS investor day in December of last year, investors have been waiting for details on how the company plans to deploy capital in order to improve its care delivery model," says BofA Global Research analyst Michael Cherny, who has a Buy rating on CVS. "SGFY used an over-arching tech platform that both allows for optimal efficiency for its clinicians but also to ensure the most appropriate types of evaluations in the home. While CVS does not participate in this market directly, building any additional services into the home in our view would be a positive step, even if it feels like there is more urgency on the primary care side."

What the Inflation Reduction Act Means for Investors

Electric vehicle (EV) stocks were a pocket of strength today after the Senate over the weekend passed the Inflation Reduction Act. The industry is poised to benefit from the spending bill, which aims to commit $369 billion toward green energy investments – including extending a tax credit for purchases of electric vehicles – and reduce carbon emissions by 40% by the end of this decade.

The efforts to fight climate change are a major part of the roughly $430 billion bill. But as with all things in life, nothing is free. In order to pay for the measures, the plan proposes a 1% tax on stock buybacks and a 15% minimum tax on companies reporting more than $1 billion in revenue.

"We find the potential tax on share buybacks to be particularly interesting," says Sonia Joao, chief operating officer of Houston-based RIA Robertson Wealth Management. "Share buybacks have been a popular way for American companies, and particularly tech firms, to reward their shareholders. This may incentivize them to spend less on payouts and more on dividends or debt reduction. It's early, but we could see this having far-ranging implications for the U.S. market."

While the bill still has to make it through the House before being signed into law by President Joe Biden, investors will want to keep an eye out for its potential impact to their portfolios. Here, we've put together a short guide detailing some of the best (and worst) stocks from the Inflation Reduction Act. Check them out.

Karee Venema was long PLTR as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.