Stock Market Today: S&P, Nasdaq Extend Losing Streaks on Micron Demand Woes

Micron Technology (MU) became the latest chipmaker to warn of a challenging market environment.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The latest batch of corporate earnings updates sparked a selloff in stocks on Tuesday, with the tech-heavy Nasdaq leading the path lower.

Travel stocks were hit particularly hard after Norwegian Cruise Lines (NCLH) reported its second-quarter results. For the three-month period, the cruise operator brought in revenue of $1.2 billion and recorded a per-share loss of $1.14, missing analysts' consensus estimates. And in the company's earnings call, CEO Frank Del Rio said that bookings in the second half remain below the "extraordinarily strong" levels they were at in 2019. This sparked a 10.6% drop in NCLH stock to a point not much above its pandemic lows. Other travel-related names like Royal Caribbean Cruises (RCL, -5.6%) and American Airlines (AAL, -2.7%) fell as well.

Meanwhile, Micron Technology (MU, -3.7%) followed in the footsteps of fellow chipmaker Nvidia (NVDA, -4.0%), whose revenue warning on Monday put pressure on tech stocks. This morning, MU said it anticipates challenging market conditions to last through its next fiscal year, sparked by lower demand for its memory chips.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"[The] memory industry, including Micron, is in the midst of a meaningful inventory correction by customers," says Susquehanna Financial Group analyst Mehdi Hosseini – who adds that the issue will likely not be resolved until at least mid-2023. Other semiconductor stocks closed lower on the news, including Advanced Micro Devices (AMD, -4.5%) and Applied Materials (AMAT, -7.6%).

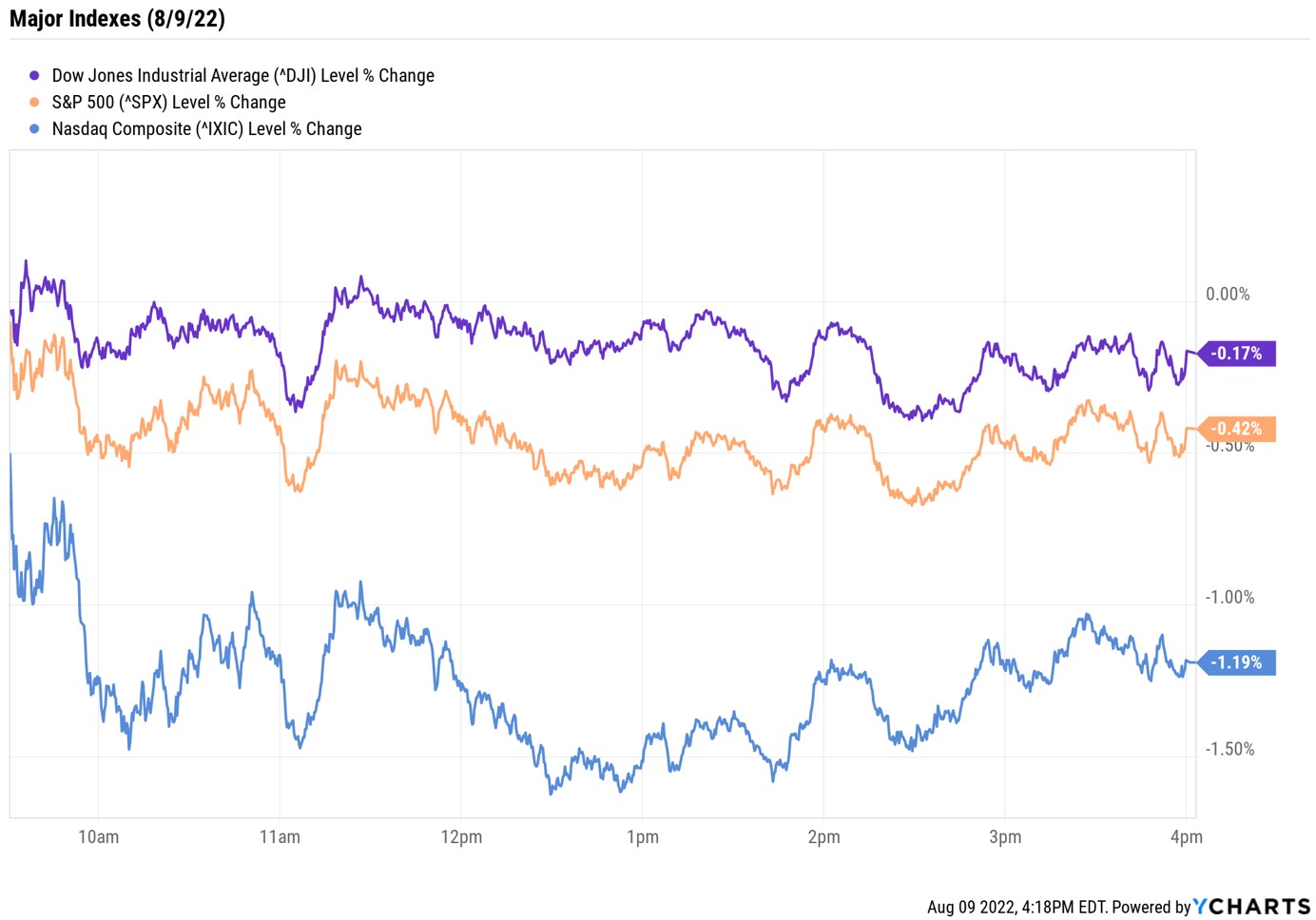

Against this backdrop, the tech-heavy Nasdaq Composite slid 1.2% to 12,493 – marking its third straight loss – while the S&P 500 Index shed 0.4% to 4,122, its fourth consecutive decline. The Dow Jones Industrial Average gave back 0.2% to 32,774.

Other news in the stock market today:

- The small-cap Russell 2000 shed 1.5% to 1,912.

- U.S. crude futures slipped 0.3% to $90.50 per barrel.

- Gold futures gained 0.4% to finish at $1,812.30 an ounce.

- Bitcoin fell 3.6% to $23,064.60. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Novavax (NVAX) plunged 29.6% after the vaccine maker reported a per-share loss of $6.53 in its second quarter on revenue of $185.9 million. Analysts, on average, were expecting earnings of $5.54 per share on $1.0 billion in revenue. The company also slashed its full-year revenue forecast to a range of $2 billion to $3 billion (down from previous guidance for revenue of $4 billion to $5 billion), "to account for several evolving market dynamics," NVAX executives said.

- Signet Jewelers (SIG) plunged 11.7% after the jewelry retailer cut its second-quarter and full-year financial forecasts, citing a slowdown in consumer spending in July. SIG also said it is acquiring online jewelry retailer Blue Nile for $360 million in cash.

America's Most Expensive Cities

Tomorrow we'll get the latest update on inflation, with the consumer price index (CPI) slated for release at 8:30 a.m. Eastern time. "Investors are laser-focused on Wednesday's CPI data, as they hunt for signs of U.S. inflation levels, whether those levels have peaked and, ultimately, how the latest figures will impact the Fed's immediate and medium-term rate policy decisions," says Greg Bassuk, CEO at asset management firm AXS Investments.

June's CPI report showed inflation had not yet peaked, with significant price increases seen in food (+10.4% year-over year), energy (+41.6% YoY) and shelter (+ 5.6% YoY). And while it's possible that July's data could show moderation in cost increases – particularly given the recent drop in oil – higher prices remain a hot topic.

With that in mind, we decided to take a closer look at the most expensive U.S. cities. Whether it be gas prices, housing costs or groceries, this list is made up of the priciest American cities to call home.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.