Stock Market Today: S&P, Nasdaq Rack Up Longest Weekly Win Streak of 2022

Preliminary data from the University of Michigan indicated consumer sentiment is improving in August.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks closed out the week with a bang Friday, boosted by an encouraging reading on consumer sentiment.

Ahead of today's opening bell, the University of Michigan said its preliminary consumer sentiment index rose to 55.1 in August from July's final reading of 51.5. However, the data also showed that 48% of survey respondents believe inflation is negatively impacting their living standards.

"Consumers are nervous about spending on big ticket items and are increasingly convinced that now is a bad time to buy a vehicle or a major household item," says Jeffrey Roach, chief economist at independent broker-dealer LPL Financial. "Consumer spending will likely slow in the near term."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Investors will get a closer look at consumer data next week with July's retail sales figures due out Thursday morning, and a heavy dose of retailers on the earnings calendar. While their quarterly results will reveal details on consumer spending during the second quarter, post-report earnings calls with analysts could shed more light on current conditions.

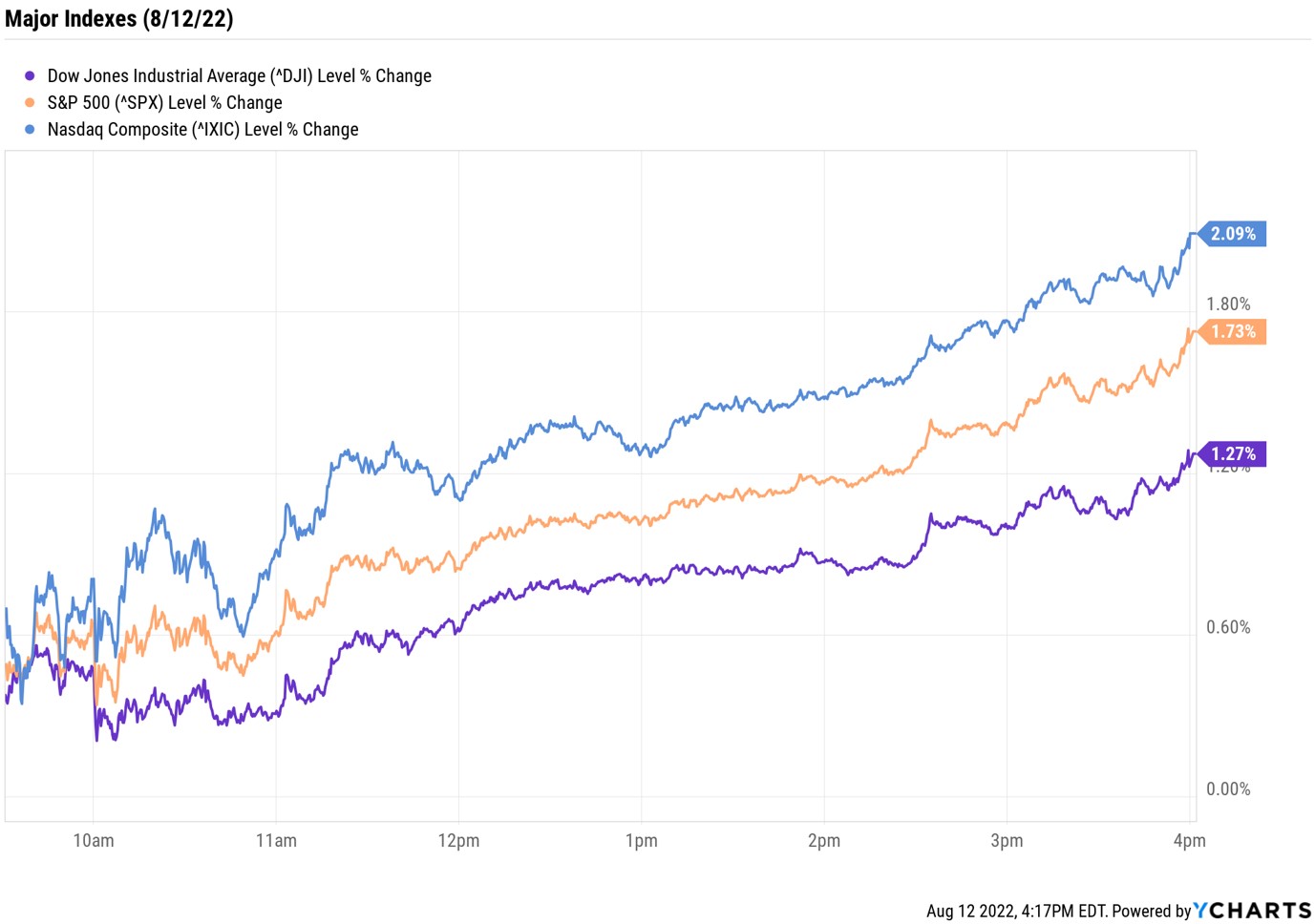

Today's broad-based rally was led by strong performances in the technology (+2.0%) and communication services (+1.8%) sectors. As such, the tech-heavy Nasdaq Composite outpaced its peers, jumping 2.1% to 13,047. The S&P 500 Index gained 1.7% to 4,280 and the Dow Jones Industrial Average added 1.3% to 33,761. The Nasdaq and S&P closed higher for a fourth straight week, the longest such streak since November.

Other news in the stock market today:

- The small-cap Russell 2000 surged 2.1% to 2,016.

- U.S. crude futures fell 2.4% to finish at $92.09 per barrel.

- Gold futures rose 0.5% to end at $1,815.50 an ounce.

- Bitcoin slipped 0.1% to $24,175.21. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Peloton Interactive (PTON) jumped 13.6% after the treadmill maker said it is cutting almost 800 jobs and closing stores across North America in order to cut costs. "These are hard choices because we are impacting people's lives," Peloton CEO Barry McCarthy wrote in a memo that was released to several media outlets, include CBS News. "We simply must become self-sustaining on a cash flow basis." McCarthy, who took over the top spot in February, also said PTON is raising prices on both its Bike+ and Peloton Tread.

- It was a volatile session for Rivian (RIVN) which was up more than 4% at one point and down more than 4% at another, before shares settled with a modest 0.1% loss. This was in reaction to the electric vehicle (EV) maker's second-quarter earnings report which showed a narrower-than-expected loss of $1.62 per share on higher-than-anticipated revenue of $364 million. The company also said it will likely post a wider loss than initially anticipated in its full fiscal year, as well as capital expenditures totaling $2 billion versus the $2.6 billion it previousy guided for. "RIVN and other EV names have gotten a boost from the expected passage of the Inflation Reduction Act, but it is unclear how many customers would be able to claim the proposed $7,500 federal tax credit given RIVN's recent price hikes and a requirement that electric trucks/SUVs have MSRPs under $80K," says CFRA Research analyst Garrett Nelson. "We remain at a Hold, seeing risks to its 2022 production guidance and have concerns about its cash burn."

The Best Value in REITs Right Now

Although the real estate sector struggled in the first half of 2022, it – like the rest of the stock market – is attempting to recover some of its steep year-to-date losses. Since July 1, the sector is up more than 9%, which is great news for those invested in real estate investment trusts (REITs).

Investors should also be encouraged by the attractive yields on offer by the sector. At the end of July, REITs sported an average dividend yield of 3.2% – more than double that of the S&P 500 – according to Nareit, a leading global producer of REIT investment research.

And thanks to a selloff early in the year, there are plenty of bargains to be found among these high-yielding real estate stocks. Investors stand to benefit in two ways by scooping up value REITs. For starters, discounted shares have the potential to generate outsized price appreciation on a rebound. At the same time, dividend-paying stocks can further juice total returns. With that in mind, we took a look at 10 REITs that have experienced significant share price declines in 2022, yet still offer sturdy fundamentals and healthy dividends. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.