Stock Market Today: Nasdaq, S&P Snap Weekly Win Streaks as Tech Slumps

The 10-year Treasury yield hit its highest level since late July after Fed officials chimed in on rate hikes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

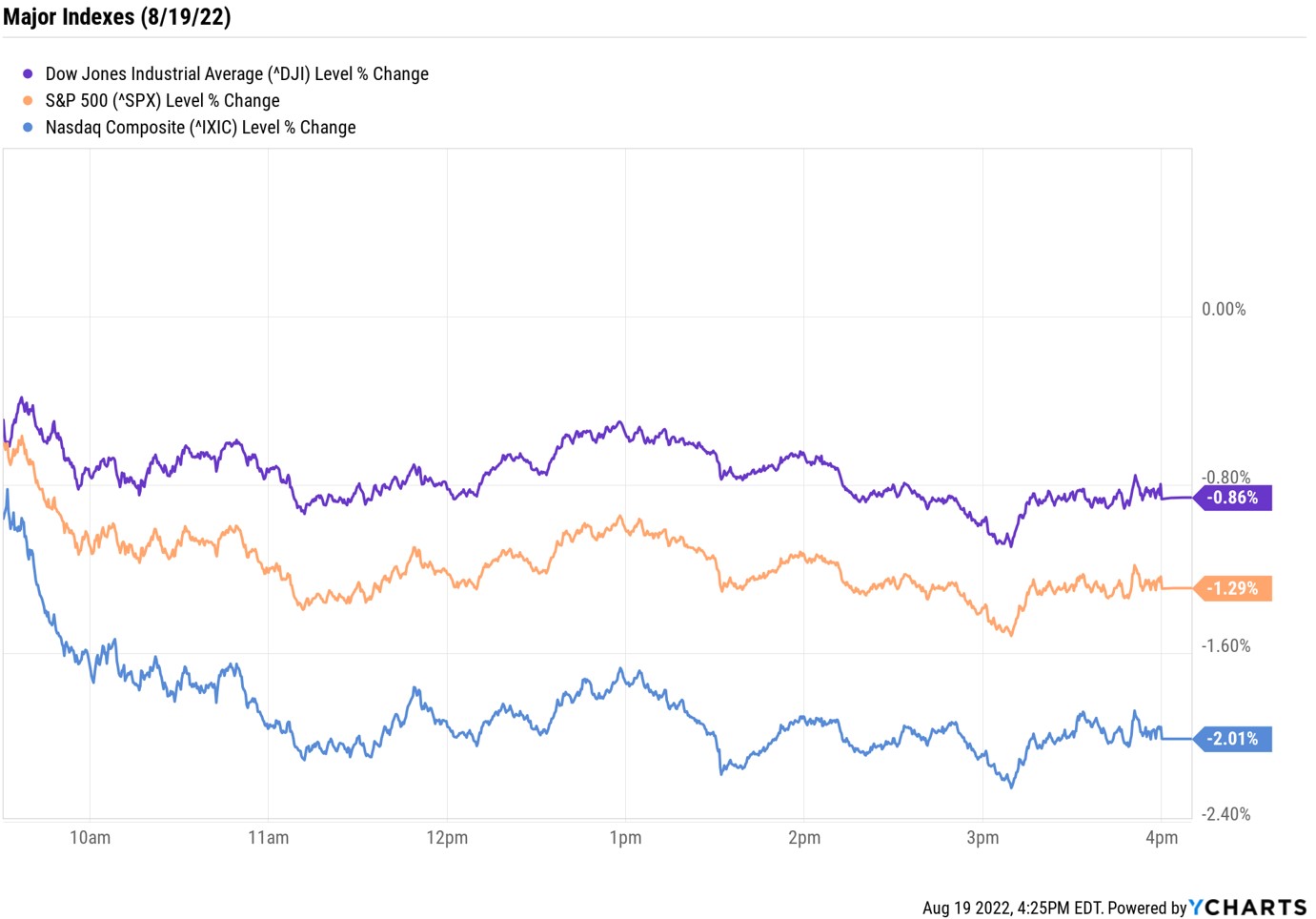

Tech stocks led the broader market lower Friday, as government-bond yields spiked after a pair of Federal Reserve officials weighed in on rate hikes.

The 10-year Treasury yield jumped as high as 2.998% – its loftiest level since late July – before ending up 9.4 basis points at 2.974%. (A basis point is one-one hundredth of a percentage point.)

This came after St. Louis Fed President James Bullard – a current voting member of the Federal Open Market Committee (FOMC) – said in an interview with The Wall Street Journal Thursday that he "would lean toward [raising rates] the 75 basis points" at the central bank's September meeting. "I think we've got relatively good reads on the economy, and we've got very high inflation, so I think it would make sense to continue to get the policy rate higher and into restrictive territory," Bullard added.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

And this morning, Richmond Fed President Thomas Barkin said at an event in Maryland that the central bank "will do what it takes" to get inflation back down to its 2% target. Barkin is not a voting member of the FOMC this year.

Monthly options also played a part in today's volatile price action. Options expiration activity can increase liquidity in the market, says Souhow Yao, analyst at Susquehanna Financial Group, and can exacerbate price moves in the underlying stocks or indexes. Today, over $2 trillion worth of options contracts expired.

Technology (-1.8%) was one of the weaker sectors in today's selloff, dragging the Nasdaq Composite down 2.0% to 12,705. The S&P 500 Index finished 1.3% lower at 4,228, and the Dow Jones Industrial Average gave back 0.9% to 33,706. All three indexes closed lower on the week, with the Nasdaq and S&P 500 snapping their weekly win streaks.

Other news in the stock market today:

- The small-cap Russell 2000 plunged 2.2% to 1,957.

- U.S. crude futures rose 0.3% to settle at $90.77 per barrel, but still finished the week down 1.4%.

- Gold futures gave back 0.5% on the day to end at $1,762.90 an ounce. For the week, gold prices fell 2.9%.

- Bitcoin plunged 8.6% to $21,349.47. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) "Weakness has seeped into the crypto sphere as speculators retreated from highly risky assets amid expectation that higher interest rates were set to linger for much longer," says Susannah Streeter, senior investment and markets analyst at U.K.-based financial firm Hargreaves Lansdown.

- Thursday's confirmation that Ryan Cohen, GameStop (GME) board chair and Chewy (CHWY) founder, sold his entire stake in Bed Bath & Beyond (BBBY) sent the shares into another tailspin today. A regulatory filing showed Cohen unloaded his entire 8.1-million stake at prices ranging from $18.68 per share to $29.22 per share, and sold all of his call options. BBBY shares plunged 40.5% in reaction.

- Foot Locker (FL) surged 20.0% after the athletic apparel retailer reported earnings. The company brought in a per-share profit of $1.10 per share in the second quarter, beating the consensus estimate by 30 cents. Revenue of $2.1 billion was in line with expectations. The company also announced a C-suite shocker that caused BofA Securities analyst Lorraine Hutchinson to upgrade the stock to Neutral from Underperform (the equiavalents of Hold and Sell, respectively. "In a surprise move, FL announced that current President, Chairman and CEO Richard Johnson will retire from the company and will be replaced by former Ulta (ULTA) CEO Mary Dillon," the analyst says. "This is a thesis-changing move in our view given Dillon's reputation in the industry. She is a highly respected consumer executive who most recently was CEO of Ulta Beauty for 8 years through June 2021. While at the helm at Ulta, Dillon engineered a best-in-class loyalty program, revenue increased at a 16% CAGR, and the stock tripled."

Stay Prepared With Your Portfolio Picks

Wall Street could get more color on the Fed's monetary policy outlook next week, with the central bank hosting its annual Jackson Hole symposium. "A major source of friction between the market and central bank communications has been around the issue of how long rates will need to stay relatively high to corral inflation," says Douglas Porter, chief economist at BMO Capital Markets. "Next week's headline event may focus on this very issue," he adds. "This year's theme for the symposium is 'Reassessing Constraints on the Economy and Policy.' Sustained strength in underlying inflation would be a meaningful constraint on both the economy and the room to maneuver for policy."

So what does this mean for investors? Well, it might be a good time to do a portfolio check, making sure it's positioned for continued inflation, additional rate hikes and more volatility in the market. Does it include dividend stocks? Is there exposure to companies with pricing power or healthcare stocks, both of which are considered inflation hedges? Investors looking for broader protection might want to consider these defensive ETFs. The funds featured here use a variety of strategies but share the same goal: providing stability against the macro-headwinds still impacting markets.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.