Stock Market Today: Dow Plunges 643 Points as Treasury Yields Climb

Growth stocks were some of the biggest losers today as government-bond yields spiked.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks sold off sharply Monday as the 10-year Treasury yield continued to climb. The yield on this closely watched government bond jumped 4 basis points to 3.029% – marking its first trip above the 3% threshold since late July. (A basis point is one-one hundredth of a percentage point.)

Uncertainty over the Federal Reserve's rate-hike timeline – specifically, the "how long?" and "by how much?" narratives – is spooking investors, with commentary last week from central bank officials hinting at the potential for a third straight 75 basis-point increase at the September meeting.

"Naturally, all eyes are on Jackson Hole later in the week and in particular, the appearance of Fed Chair Jerome Powell," says Craig Erlam, senior market strategist at currency data provider OANDA. Powell is scheduled to deliver a speech at the central bank's annual symposium in Wyoming on Friday morning. "This platform has in the past been used to make significant announcements and so every year, traders are left on the edge of their seats in case of another this time around."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Today's selling was broad-based, with the consumer discretionary sector (-2.7%) suffering a massive drop amid weakness in Amazon.com (AMZN, -3.6%) and Tesla (TSLA, -2.3%). Growth stocks in the technology (-2.8%) and communication services (-2.9%) sectors were also hit hard.

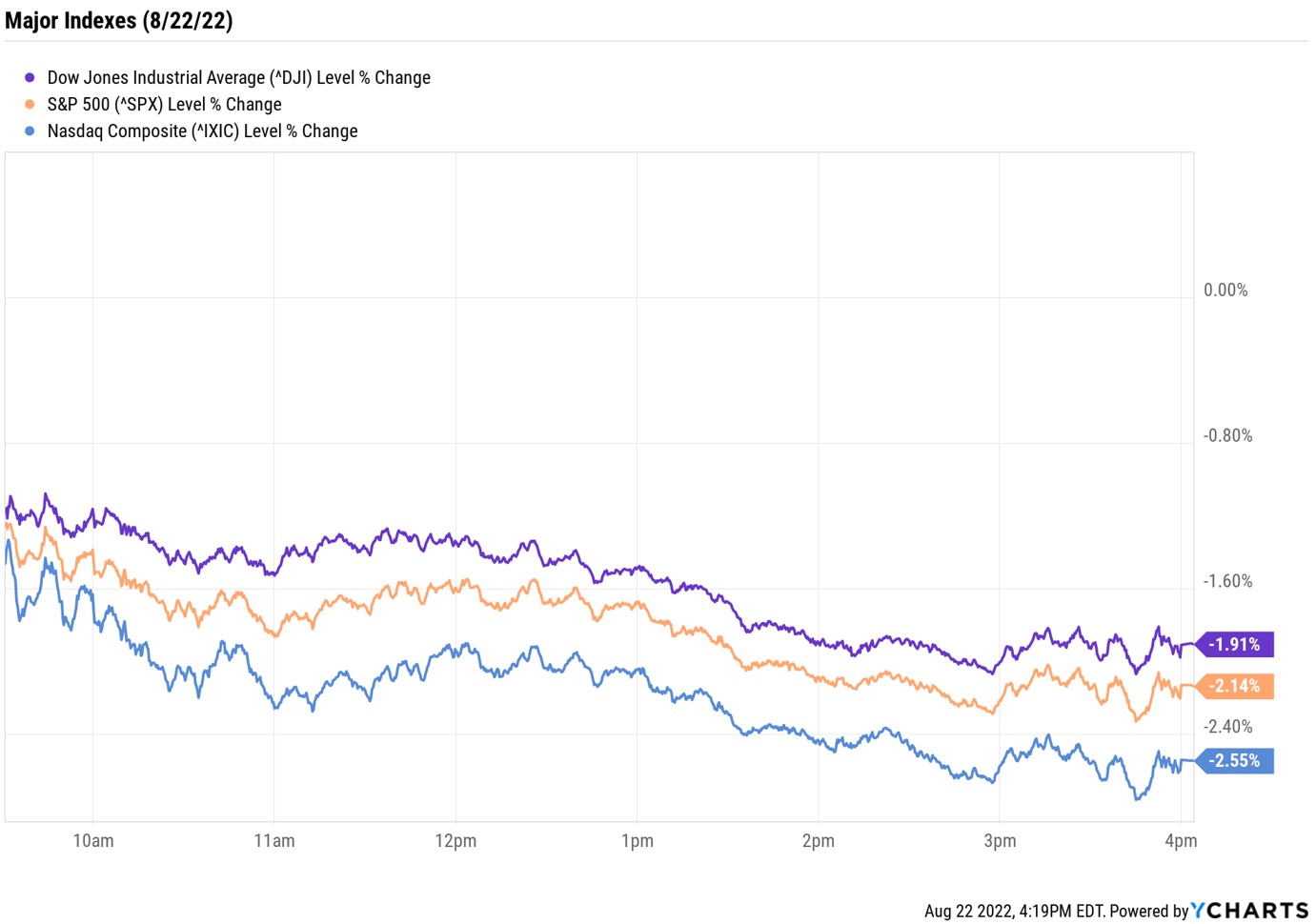

As for the major indexes, the Nasdaq Composite slid 2.6% to 12,381, the S&P 500 Index plunged 2.1% to 4,137, and the Dow Jones Industrial Average shed 1.9% to 33,063.

Other news in the stock market today:

- The small-cap Russell 2000 spiraled 2.1% to 1,915.

- U.S. crude futures slipped 0.6% to $90.23 per barrel.

- Gold futures shed 0.8% to $1,748.40 an ounce, their sixth straight drop.

- Bitcoin fell 1.4% to $21,049.05. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- AMC Entertainment Holdings (AMC) plummeted 42% after fellow movie theater chain Cinemark said it could file for bankruptcy. The drop in AMC coincides with the recent selloff in fellow meme stock Bed Bath & Beyond (BBBY, -16.2%), which also ended sharply lower today.

- Signify Health (SGFY) was a rare splash of green in Monday's trading, gaining 32.1%. Over the weekend, a report in The Wall Street Journal pointed to several potential bidders for the home healthcare provider, including CVS Health (CVS, -1.6%) and Amazon.com (AMZN).

Another Big Week Awaits Investors

Today's price action shows that the dog days of summer have yet to hit the equities market, and there's plenty on tap this week that could stoke further volatility in stocks. In addition to news from the Fed's Jackson Hole retreat, investors will also hear the latest updates on manufacturing, housing, second-quarter GDP and inflation.

We'll also get another batch of companies releasing their quarterly financial reports. So far this earnings season, "the equity markets have cheered overall results that were 'better than feared,'" says Chris Haverland, global equity strategist at Wells Fargo Investment Institute. "S&P 500 Index revenue grew by more than 13%, while earnings per share (EPS) grew by nearly 8%," Haverland says, adding that "63% of [S&P 500 components] beat sales expectations and 76% beat earnings expectations."

This week, we're previewing at-home exercise equipment maker Peloton (PTON), software-as-a-service (SaaS) firm Salesforce (CRM) and cloud-based data platform Snowflake (SNOW) ahead of their respective turns on the earnings calendar. Read on as we take a look at what Wall Street pros are expecting from this trio of names.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.