Stock Market Today: Markets End Lower Again as Tech Stocks Drag

The effects of Fed Chair Powell's hawkish Jackson Hole speech lingered Monday, but stocks finished off their session lows.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

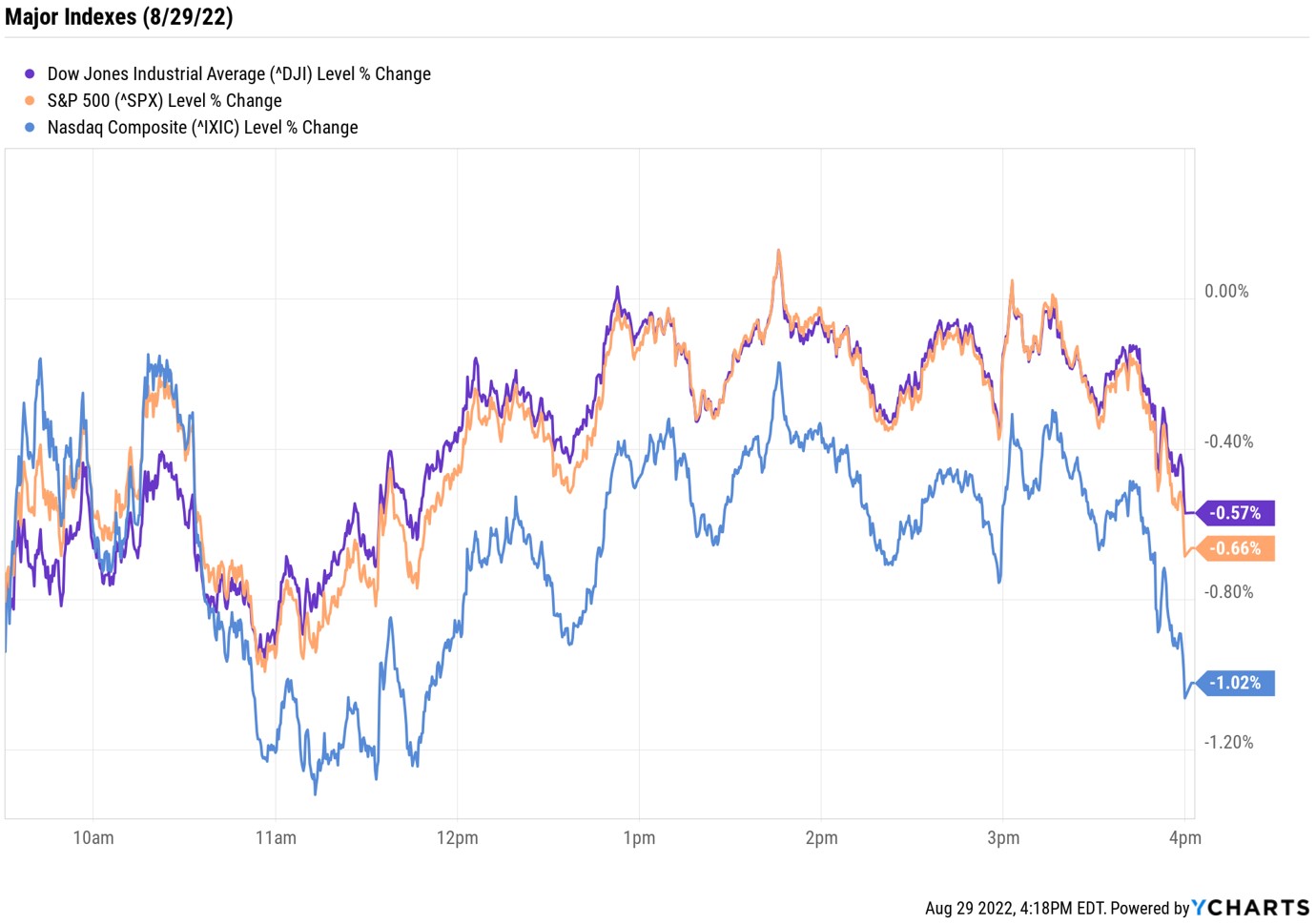

Investors braced for another stomach-churning session as stocks fell sharply in early trading Monday. However, unlike Friday, where losses accelerated as the day progressed, today's selling eased off.

Federal Reserve Chair Jerome Powell's gloomy speech last week in Jackson Hole, Wyoming, seemed to have a lingering effect on Wall Street. "Powell broke no new ground in his remarks, and instead reiterated his stance that the Fed is 1) attempting to moderate demand to allow supply to catch up and 2) monitoring inflation expectations to ensure they remain anchored," says Brent Schutte, chief investment officer at Northwestern Mutual Wealth Management Company. He adds that the head of the Fed was "more direct" in the central bank's commitment to fight inflation, "saying it is prepared to continue its aggressive rate hike posture for as long as needed, even if it causes pain for the economy and households."

Technology (-1.3%) was Monday's worst-performing sector, pressured lower by semiconductor stocks Advanced Micro Devices (AMD, -3.0%) and Nvidia (NVDA, -2.8%). Meanwhile, energy stocks (+1.5%) outperformed as U.S. crude futures spiked 4.2% to $97.01 per barrel.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Looking at the major indexes, the tech-heavy Nasdaq Composite, which was off 1.3% at its session low, ended the day down 1.0% at 12,017. The S&P 500 Index fell 0.7% to 4,030 and the Dow Jones Industrial Average gave back 0.6% to 32,098.

Other news in the stock market today:

- The small-cap Russell 2000 fell 0.9% to 1,882.

- Gold futures posted a marginal loss to end at $1,757.90 an ounce.

- Bitcoin shed 2.6% to $20,101.84. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Netflix (NFLX) rose 0.6% after a Bloomberg report indicated the streaming giant is getting ready to launch an ad-supported tier. The new plan will be priced at $7 to $9 per month, and will aim to initially include about four minutes of ads for every one hour of content, according to Bloomberg.

- Honda Motor Co. (HMC) gained 1.8% after the car company said it has teamed up with Korea's LG Energy Solution to build a battery production plant for electric vehicles in the U.S. Construction on the $4.4 billion project is expected to get underway early next year, with production of batteries anticipated by the end of 2025.

Hedge Funds' Favorite Blue-Chip Stocks

"What's the smart money doing?" This is a question we attempt to answer each quarter via regulatory filings. The point isn't to copy exactly the moves of hedge funds, institutional investors and high-net-worth individuals. Rather, it's done as a learning exercise – to see what those with access to research and insights typically not available to the average retail investor are doing with their money, particularly during periods of market turbulence.

Warren Buffett, for instance, took advantage of the second-quarter stock market selloff to go bargain-hunting on existing positions in the Berkshire Hathaway equity portfolio.

As for hedge funds, they "cut leverage, shifted back towards growth stocks, and increased portfolio concentrations in their favorite stocks [in Q2]," notes the portfolio strategy team at Goldman Sachs Global Investment Research. In particular, hedge funds honed in on blue-chip stocks. Here, we take a look at the 21 stocks that were most widely held among hedge funds with deep pockets and vast resources in Q2. Take a look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.