Stock Market Today: Stocks Extend Losing Streak as Fed Fears Persist

Lingering concerns over the Fed's rate-hike timeline dragged the major indexes lower for a fourth straight day.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks once again erased early gains to end lower for a fourth straight session as investors continued to fret about an extended rate-hike campaign from the Federal Reserve.

Wednesday's decline came after Cleveland Fed President Loretta Mester said during this morning's speech in Dayton, Ohio, that "it is far too soon to say that inflation has peaked." Mester, a voting member of the Federal Open Market Committee (FOMC), added that she does not anticipate any rate cuts this year or next.

Wall Street also got another read on the labor market, with this morning's ADP employment report estimating the U.S. added a lower-than-expected 132,000 private-sector jobs in August, down from July's reading of 270,000. This comes ahead of Friday's nonfarm payrolls report – the last major check on employment ahead of the Fed's September meeting.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"So it begins," says Edward Moya, senior market strategist at currency data provider OANDA. "The labor market is cooling as private payrolls clearly showed a more conservative pace of hiring. ADP's new methodology was in place and showed job growth slowed for a second consecutive month as companies added the fewest jobs since early 2021."

The Friday jobs report is likely to continue this narrative. The consensus estimate is for 300,000 jobs, compared to the 528,000 new positions added in July. "A slower pace of hiring still gives the Fed the greenlight for more aggressive rate hikes over the next couple of FOMC meetings," Moya adds.

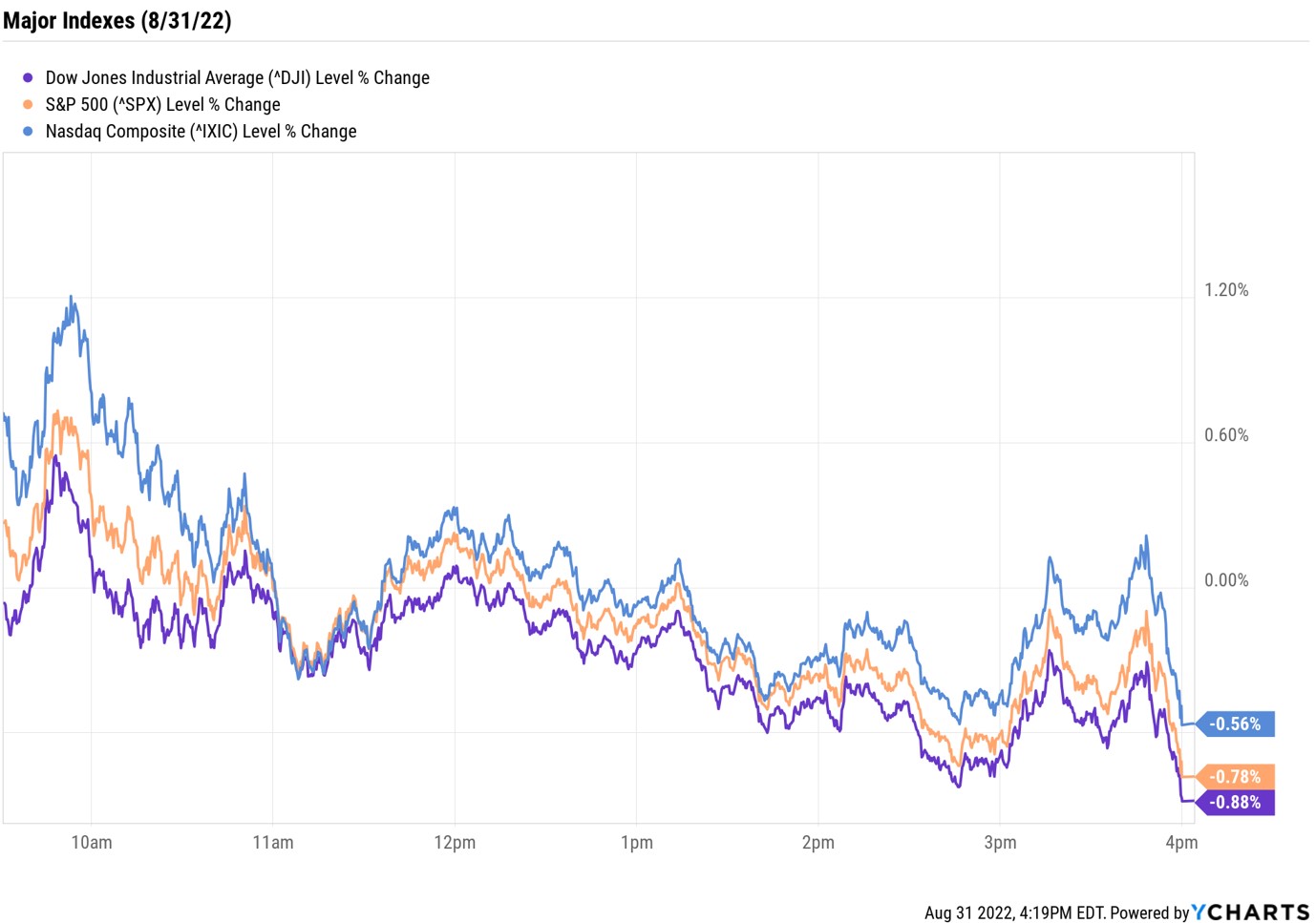

At today's close, the Nasdaq Composite was down 0.6% at 11,816, with the S&P 500 Index (-0.8% at 3,955) and the Dow Jones Industrial Average (-0.9% at 31,510) also ending lower. All three indexes finished August with monthly losses of more than 4%.

Other news in the stock market today:

- The small-cap Russell 2000 shed 0.5% to 1,846.

- U.S. crude futures fell 2.3% to finish at $89.55 per barrel, bringing their monthly decline to 9.2%. This marked the third straight monthly decline for oil prices, the longest such streak since early 2020.

- Gold futures ended the day down 0.6% at $1,726.20 an ounce, and ended the month off 3.1%. It was the fifth consecutive monthly drop for gold prices, the lengthiest losing streak since 2018.

- Bitcoin rose 1.3% to $20,212.29. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Bed Bath & Beyond (BBBY) plunged 21.3% after the homegoods retailer unveiled a strategic update, which includes plans for a 12 million common stock offering, the closing of roughly 150 underperforming stores and a round of layoffs. BBBY also said it is pausing store remodels and updates for the remainder of its fiscal year as it looks to lower capital expenditures to around $250 million from $400 million. Even with today's decline, the meme stock ended the month up 90%.

- Cost-cutting plans sent social media stock Snap (SNAP, +9.7%) higher today. The Snapchat parent last night unveiled a restructuring plan that includes cutting roughly 20% of its workforce and ending several projects including its Snap Originals premium show lineup. "We are restructuring our business to increase focus on our three strategic priorities: community growth, revenue growth, and augmented reality," CEO Evan Spiegal said in a memo. The announcement comes just weeks after Snap posted its weakest quarter of revenue growth ever.

Check Out These Cheap Stocks Under $10

Investors would be wise to stay on their toes for just a bit longer. "September and October are traditionally dangerous months for the market," says Anthony Denier, CEO of trading platform Webull. "So, people should expect choppy waters. Obviously, investors need to watch the economic indicators. Is inflation rising or falling? Will GDP growth be negative in the third quarter, confirming that we are in a recession? Will the job market start to cool off?"

We've used this space before to mention ways investors can shore up their portfolio against volatility risk. This includes focusing on traditional safety plays like utilities and consumer staples stocks, or honing in on low-volatility stocks.

However, some investors prefer the thrill of a roller-coaster ride – and what better way to experience the excitement than with cheap stocks. Many people avoid low-priced stocks because they are extremely risky and volatile, but others appreciate their affordability factor and ability to return big gains in short order. Here, we've compiled a list of 10 cheap stocks under $10, each with something to offer investors. But buyer beware: as quickly as these low-priced stocks can go up, they can go down. Don't invest more than you can afford to lose.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.