Stock Market Today: Stocks Gain Ground After ECB's Aggressive Rate Hike

The European Central Bank (ECB) went "ultra-big" this morning in its fight against inflation, and indicated more rate hikes are on the way.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

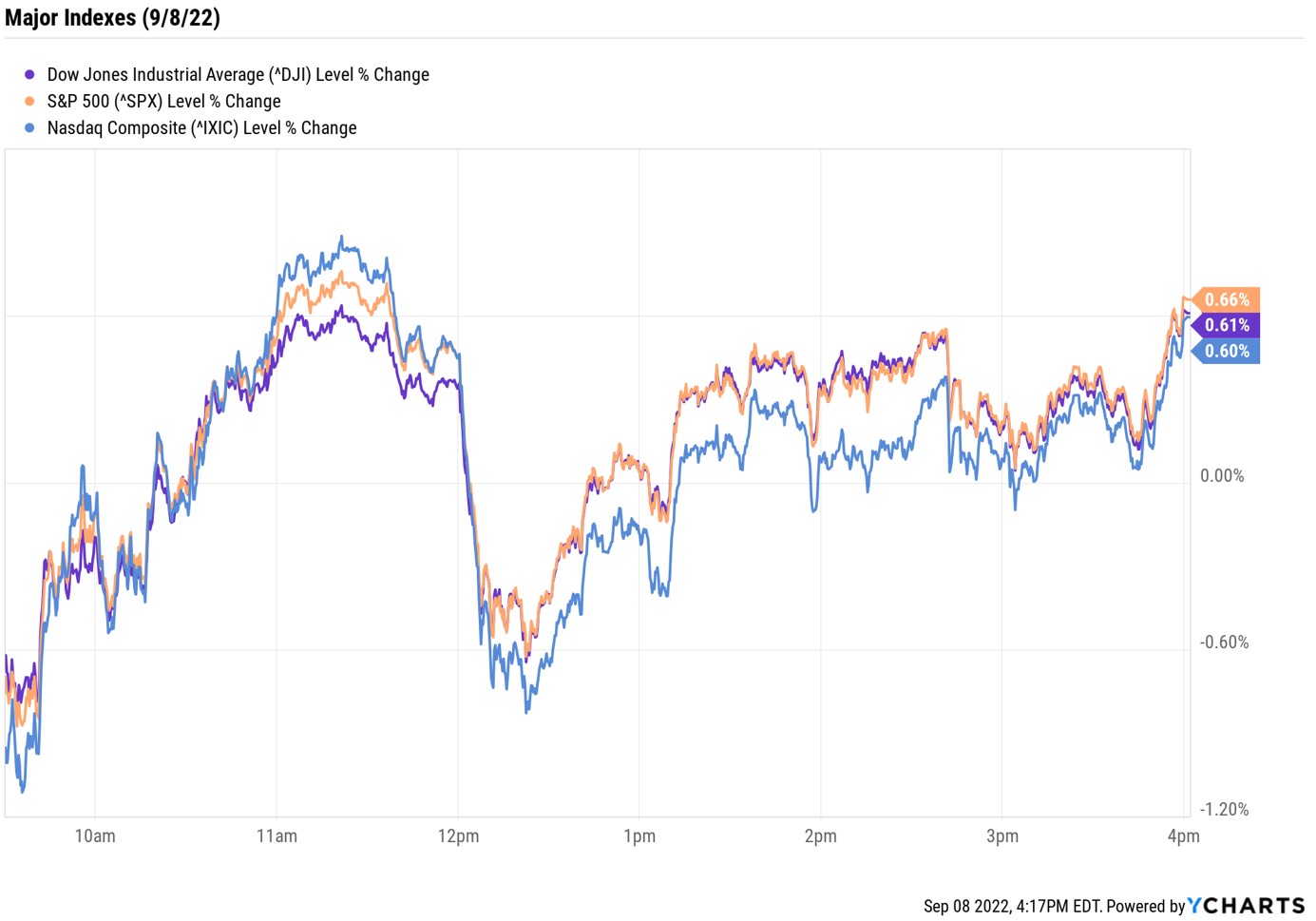

Stocks kept investors on edge for most of Thursday, swinging between positive and negative territory throughout the session as investors sized up global central bank headlines.

Kicking things off was an early morning decision from the European Central Bank (ECB) to hike its key interest rate by an unprecedented 75 basis points. A basis point is one one-hundredth of a percentage point.

"Stuck between a rock and a hard place, ECB policymakers felt they had little option but to go ultra-big with the rate rise to try and cut the rope on inflation and spark a fall from its ascent," says Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown. She adds that it couldn't have come at a worse time. "With energy prices so elevated, bringing an end to the price spiral is going to be far from easy, and the ECB is warning that fresh hikes will be on the way."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Back at home, Federal Reserve Chair Jerome Powell this morning doubled down on the hawkish tone he struck in a late-August speech in Jackson Hole, Wyoming. Speaking during a virtual conference hosted by the Cato Institute, Powell indicated that the Fed is firmly committed to fighting inflation and will be as aggressive as it needs to be in order to do that. "It is very much our view, and my view, that we need to act now forthrightly, strongly, as we have been doing, and we need to keep at it until the job is done," he said.

These two events sparked a wild ride for investors, but at the close, the major market indexes were in the green. The Dow Jones Industrial Average ended up 0.6% at 31,774, the S&P 500 Index rose 0.7% to 4,006, and the Nasdaq Composite gained 0.6% to 11,862.

Other news in the stock market today:

- The small-cap Russell 2000 tacked on 0.7% to 1,844.

- U.S. crude futures gained nearly 2% to end at $83.54 per barrel.

- Gold futures fell 0.4% to finish at $1,720.20 an ounce.

- Bitcoin rose 1.8% to $19,355.05. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Snap (SNAP) stock jumped 9.4%, building on Wednesday's 6.4% gain, after a report in The Verge detailed a leaked memo from the social media company's CEO Evan Spiegel. According to the article, the internal memo to employees detailed SNAP's plans to grow Snapchat's user base by 30% to 450 million and increase revenue to $6 billion by the end of 2023. UBS Global Research analyst Lloyd Walmsley (Buy) said he is "encouraged" by the targets. "We recognize this could be an internal stretch goal and the company is in a show-me mode given macro uncertainty," Walmsley writes in a note to clients. "Nonetheless, we think the company has done a good job executing, showing daily active user growth of 85% since 2018 to date and growing revenue 3x from 2018 through 2022 estimates. As such, we give management the benefit of the doubt here."

- GameStop (GME) rose 7.5% after the video game retailer reported earnings. While GME reported lower year-over-year sales and a wider per-share loss in its second quarter, it unveiled a partnership with crypto exchange FTX. "At a high level, the partnership will introduce more GameStop customers to FTX's community and its marketplaces for digital assets," says Wedbush analyst Michael Pachter, who has an Underperform (Sell) rating on GME. "The two companies will collaborate on new ecommerce and online marketing initiatives, with GameStop beginning to carry FTX gift cards in select stores as its preferred retail partner in the U.S. Financial terms were not disclosed, though we are skeptical that the partnership will drive meaningful revenue or profit contribution."

REIT Dividends to Help Fight Inflation

Next week, Wall Street will get the latest reading on inflation data, with the consumer price index (CPI) for August set for release ahead of the Sept. 13 open. Prices eased back slightly in July, but it's likely that inflation is not done yet.

"There is some evidence that food prices may be moderating after a year's worth of large monthly increases," says Kiplinger economist David Payne. "But continuing large wage increases at many businesses are likely to keep upward pressure on most prices for some time to come." And even if inflation continues to trend lower, it will take awhile to bring prices back down to a sustainable level.

Given that backdrop, investors should know that dividend stocks offer a powerful way to mitigate the effects of red-hot inflation. And one of the best places to find healthy yields is in real estate investment trusts (REITs). Remember, REITs are an especially attractive option for income-seeking investors because they are legally required to distribute at least 90% of their taxable earnings back to shareholders. It's even better when these generous REITs boast exceptional dividend growth. Here, we take a look at 12 real estate stocks that have consistently raised their payouts in recent years, and delivered impressive growth to boot.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.