Stock Market Today: Stocks Snap Weekly Losing Streak

Energy was one of the best-performing sectors today as oil prices rebounded.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

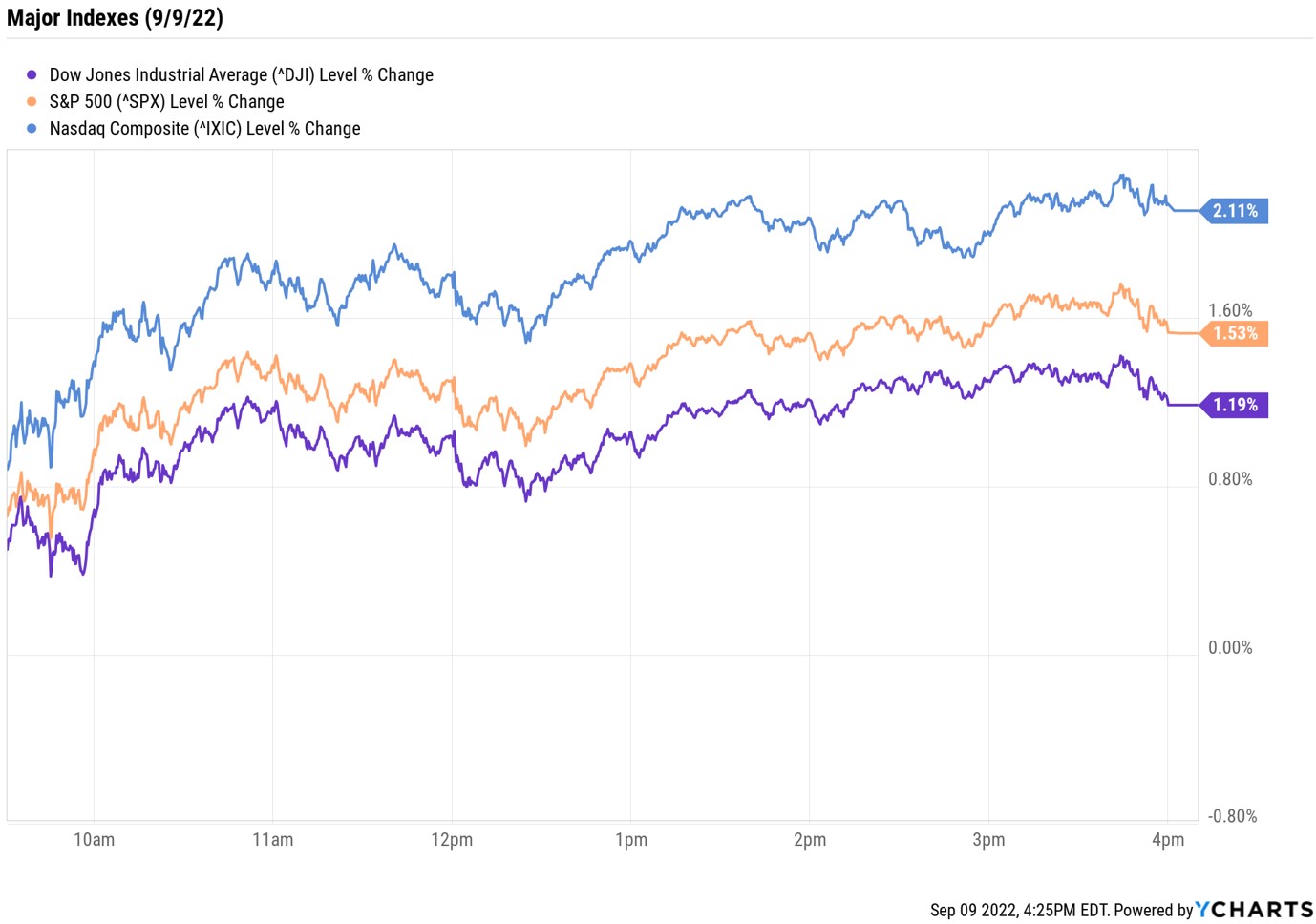

Stocks continued their push higher Friday, with today's gains helping the major market indexes snap a three-week losing streak.

There was nothing particularly new today to boost investor sentiment. Both the economic and earnings calendars were thin. And early afternoon speeches from Kansas City Fed President Esther George and Fed Governor Christopher Waller echoed the hawkish tone struck by central bank officials in recent weeks. It could just be that Wall Street has come to terms with the fact that the Fed will almost certainly issue a third-straight 75 basis point rate increase at its policy meeting later this month. Or perhaps investors are simply taking advantage of bargains from the late-August selloff.

Whatever the reason, today's rally was broad-based, with all 11 sectors finishing higher. Leading the pack was communication services, which jumped 2.8% on strong gains for components Meta Platforms (META, +4.4%) and Netflix (NFLX, +2.7%). Energy (+2.5%) also outperformed as U.S. crude futures bounced 3.9% to $86.79 per barrel.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As for the major indexes, the Nasdaq Composite's 2.1% rally to 12,112 outpaced its peers. Still, the S&P 500 Index (+1.5% to 4,067) and the Dow Jones Industrial Average (+1.2% at 32,151) ended with solid gains as well.

Other news in the stock market today:

- The small-cap Russell 2000 spiked 2% to 1,882.

- Gold futures rose 0.5% to finish at $1,728.60 an ounce.

- Bitcoin surged 9.9% to $21,278.60. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Kroger (KR) gained 7.4% after the grocery store chain reported earnings. In its second quarter, KR recorded higher-than-expected earnings of 90 cents per share and revenue of $34.6 billion. Same-store sales jumped 5.8%, beating the consensus estimate. Still, CFRA Research analyst Arun Sundaram kept a Sell rating on KR stock, saying its recent outperformance is unsustainable. "Fuel margins will likely normalize over time, while KR's major top-line benefit over the last several quarters (i.e., higher food prices) will likely fade as comps get tougher and promotional activity increases," Sundaram says. "We see wage pressures continuing in fiscal 2023, which, along with weaker identical sales growth, will likely lead to weaker operating margins next year."

- DocuSign (DOCU) was another post-earnings winner, jumping 10.5% after its results. The e-signature company reported second-quarter earnings of 44 cents per share on $622.2 million, more than analysts were expecting. DOCU also said billings were up 9% in the three-month period to $647.7 million. But it wasn't enough to convince UBS Global Research analyst Karl Keirstead, who kept a Neutral (Hold) recommendation on DOCU. "In our view, DocuSign's valuation multiples don't look compelling yet given the single-digit growth outlook and high total addressable market penetration," Keirstead says.

4 Ways to Spend $1,000

How would you spend $1,000? We took this question to the editors of Kiplinger's Personal Finance Magazine to see what advice they would give on how to spend, save and invest a thousand bucks. For those wanting to level up their philanthropy game, there are plenty of ways to use that money, including donating to Kiva, an impact investing platform that facilitates crowdfunded loans to entrepreneurs.

Opportunities for investors are also abundant. Those just getting started on their investment journeys might consider opening roboadviser accounts. These services, which are offered by most banks and brokerage firms, offer low-cost, computer-driven investment management. For those looking to put $1,000 straight into to their portfolios, we've got you covered, too. One option is to take advantage of stock slice programs that let folks buy fractional shares of expensive companies. Investors might also want to consider small-cap stocks. It's been a rough year for this corner of the market, but history shows that stocks with smaller market values can still outperform for patient investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.