Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The economic banishment of all things Russian. Tariffs on Chinese imports. Pandemic-caused shortages of computer chips, bicycles, garage door parts and other imports. Brexit.

Just about everywhere you turn, you can see that the tectonic plates of the global economy have stopped converging and are starting to pull apart in ways that will determine new winners and losers, says Ethan Harris, head of global economics for Bank of America Securities. "Deglobalization is a gradual process, and in the long run, very important" to investors, he says, because it will have profound impacts on corporate profitability.

Globalization refers to the increase of commerce across borders. U.S. companies prospered for decades as new markets opened for their goods and labor costs plummeted thanks to overseas production. Strategists at BofA have estimated that over the past 20 years, globalization has contributed more than half of what has been a robust expansion in profit margins. Globalization has also helped to deliver low-cost goods to American consumers.

But now, says market strategist Ed Yardeni, the pandemic and spreading political and military conflicts have stretched supply chains past the breaking point, prompting companies to bring many operations closer to home. "Deglobalization was almost inevitable," Yardeni says. U.S. companies are starting to "reshore" production back to the U.S., "near-shore" it to neighbors such as Mexico, or "friend-shore" it to allies such as Vietnam.

Investment firm Piper Sandler counted more than 900 announcements of companies either building or expanding manufacturing facilities in the U.S. in the 12 months ending in May of 2022. In 2012, there were only about 100 such announcements. Over the long term, companies should benefit from more-reliable processes. Yardeni predicts that among the biggest winners will be companies with economic bases in the U.S. that leverage cost-saving automation to offset higher wages and energy expenses.

"Globalization 2.0 is more of a rightsizing than the end of globalization," says Jake Oubina, senior U.S. economist at Piper Sandler. Rising interest rates and a threatened recession may slow or pause some reshoring projects. But longer term, he sees a wide-open field for investors willing to bet on a new productivity boom. "Companies are going to find ways to lower their cost structures. We are just at the infancy stages of a productivity revolution."

We found five companies that should benefit from the long-term trend toward deglobalization.

Prices and other data are as of Aug. 5. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Ametek

- Sector: Industrials

- Market value: $29.0 billion

- Dividend yield: 0.7%

Osterweis Capital Management is bullish on deglobalization – and on Ametek (AME, $126), a Berwyn, Pennsylvania-based manufacturer of precision instruments and electromechanical devices that should benefit from investments in productivity, says portfolio manager Larry Cordisco. Ametek has been buying up robotics and automation companies. The company is "a well-known consolidator with a really great history of growing earnings," Cordisco says.

Ametek's automation offerings accounted for about 10% of the company's 2021 revenues of $5.5 billion. Ametek's products range from remotely controlled motors for factories to data systems that help hospitals manage patient needs to robots used in applications as varied as embroidery, woodworking, spray painting and disinfecting.

Joshua Aguilar, a senior analyst at investment research firm Morningstar, says the company's move into the health industry is especially promising because so many hospitals have struggled with staffing shortages. "Health care automation solutions will be a boon" for the company, he says. He notes that Ametek's overall leadership position in many markets has allowed it to raise prices ahead of inflation and increase profitability.

The company notched a record profit of nearly $1 billion last year, up 14% from 2020. Analysts see another double-digit gain this year. Ametek is not immune from a recession, but it is in a strong position to ride out an economic storm, says ValueLine Investment Survey analyst Jeremy Butler. "Its cash flow generating ability is consistently formidable," Butler says.

The industrial stock is well loved on Wall Street. Goldman Sachs recently noted Ametek's potential for high risk-adjusted returns, and 14 of 17 analysts who cover the stock recently recommended it, according to S&P Global Market Intelligence.

Applied Materials

- Sector: Technology

- Market value: $95.4 billion

- Dividend yield: 1.0%

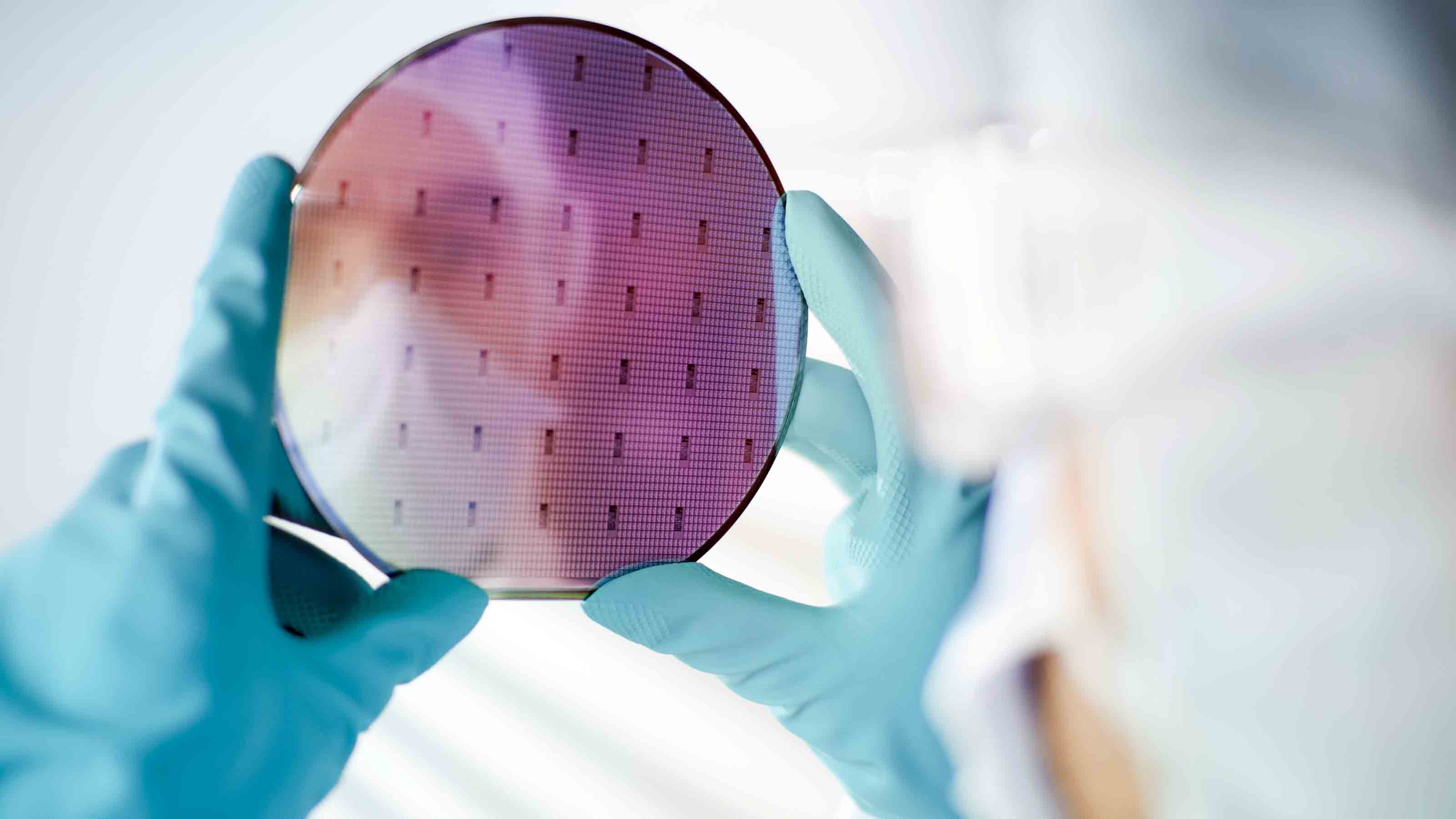

Americans invented the computer chip. But many of the pioneering manufacturing plants in the U.S. couldn't compete with lower-cost Asian fabrication facilities. By the start of the pandemic, the U.S. produced only about 12% of the world's chips. That was nowhere near enough to serve the many appliance, automobile and other factories in North America that had to sit idle during the pandemic because of chip shortages.

Now chip manufacturers are scrambling to produce more chips in the U.S. And, in a rare example of bipartisanship, Congress recently passed a bill to provide financial incentives to chip manufacturers. A good way to take advantage of this coming boom in chip production is to look at suppliers to chip manufacturers, says Todd Ahlsten, chief investment officer for Parnassus Investments. He has bought up shares of Applied Materials (AMAT, $110), which, among other things, makes the equipment needed to etch circuits onto the silicon wafers used as the base for chips. Ahlsten worries that a surge in manufacturing could create a short-term glut of chips. "But if you have a three-year time horizon, Applied Materials is going to be fantastic," he says.

The stock lost about half its value in the first half of 2022, in part because of its own supply-chain problems. But a consensus of analyst estimates forecasts earnings to go up nearly 10% in the fiscal year ending Oct. 31 and another 11% in fiscal 2023.

Morningstar sector strategist Abhinav Davuluri estimates a fair value for the stock of $142, up 29% from its recent close. Applied Materials is "the chip equipment industry's standard bearer. The firm has the broadest product portfolio and offers customers the closest thing to a one-stop shop," he says.

Deere

- Sector: Industrials

- Market value: $104.9 billion

- Dividend yield: 1.3%

Deglobalization is one of a handful of big economic trends that strategists currently consider when picking investments for the Strategas Macro Thematic Opportunities ETF, says Ryan Grabinski, a managing director on the strategy team for Strategas. Deere (DE, $343), the farm and construction equipment giant and a fund holding, fits the theme as a likely beneficiary of reshoring activity. "Reshoring is already evident in private, nonresidential construction activity, with manufacturing representing the third-largest category," Grabinski says.

More than two-thirds of Deere's revenue comes from the Americas. There have been some bumps so far in 2022, due partly to supply-chain snarls and chip shortages for Deere's high-tech equipment. And a recession could slow sales of expensive farm and construction machinery. But Grabinski says that historically, Deere stock "tends to be one of the first to come back" as the business cycle rebounds.

Parnassus's Ahlsten is also a fan. "Deere isn’t just a tractor company; it's a technology company. Deere is using computing power to enable precision agriculture," which conserves resources such as water and fertilizer. That high-tech bent makes Deere a holding with staying power for patient investors. "It's a great long-term stock," says Ahlsten. "The next 10 years will be better than the last 10."

Research firm CFRA gives the stock a 12-month price target of $393, implying a gain of 15%, citing benefits from improving demand, investments in high-tech equipment and U.S. infrastructure spending.

Lincoln Electric Holdings

- Sector: Industrials

- Market value: $8.3 billion

- Dividend yield: 1.6%

Another pick from Osterweis Capital Management is Lincoln Electric (LECU, $143), a leader in robotic welding that is benefitting from the reshoring trend. Lincoln gets about 60% of its revenue from U.S. customers and another 20% from Europe. The company has been landing contracts from manufacturers of home and industrial goods, says Osterweis's Cordisco.

Lincoln, founded in 1895 and headquartered in Cleveland, has been beefing up its welding automation business, notes Baird senior research analyst Mircea Dobre, who recommends the stock. Automation accounted for about 15% of the company's sales in 2021 but was rising at twice the rate of its more-traditional manual welding equipment and was on track to nearly double sales to $1 billion by 2025, he says. And the company's product mix and market dominance allow it to keep raising prices, and thus expand profit margins, even during rising inflation.

Lincoln Electric has fared well in a tough market, up 3.1% for the year so far, compared with a loss of 12% for the S&P 500 Index. The shares trade at a price-to-earnings ratio of 17, a premium to the industry average of 15, according to Zacks Investment Research. The stock yields 1.6%.

Union Pacific

- Sector: Industrials

- Market value: $142.8 billion

- Dividend yield: 2.3%

Companies may be pulling back from China and Russia, but that doesn't mean they will return only to the U.S. Instead, Adam Posen, president of the Peterson Institute for International Economics, expects a "corrosion of globalization" to boost commerce among allied or friendly countries, with many manufacturers moving production to low-wage countries either geographically or politically closer to large consumer markets. Mexico could be one of the biggest beneficiaries of such near-shoring and friend-shoring, Posen says.

Parnassus's Ahlsten says that's why he likes Union Pacific (UNP, $229) stock. "We see deglobalization as a big trend, which has led us to invest in railroads that connect the U.S. with Canada and Mexico, such as Union Pacific," he says.

The storied railroad company, founded in 1862, has a 26% ownership stake in Ferromex, Mexico's largest railroad. Union Pacific also controls the major railroad ports of entry on the U.S.-Mexico border and moves 70% of all freight rail traffic to and from Mexico. Mexico accounted for $2.4 billion, or 11%, of Union Pacific's 2021 revenues.

The stock has had a rough 2022, plunging from a high of $275 in March to $206 in June, in part due to labor shortages that gummed up deliveries. Morningstar senior analyst Matthew Young considers the stock fairly valued now. He is hopeful about the railroad's long-term prospects because train transport typically has lower costs than trucking. Union Pacific will benefit if gas prices remain high.

Many investors treasure Union Pacific for its high and rising dividend. The stock currently yields 2.3%. And Union Pacific has raised its dividend at least once a year – and sometimes twice – for more than a decade. That's a ticket income-seeking investors might want to punch.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kim Clark is a veteran financial journalist who has worked at Fortune, U.S News & World Report and Money magazines. She was part of a team that won a Gerald Loeb award for coverage of elder finances, and she won the Education Writers Association's top magazine investigative prize for exposing insurance agents who used false claims about college financial aid to sell policies. As a Kiplinger Fellow at Ohio State University, she studied delivery of digital news and information. Most recently, she worked as a deputy director of the Education Writers Association, leading the training of higher education journalists around the country. She is also a prize-winning gardener, and in her spare time, picks up litter.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

Dow Adds 314 Points to Thanksgiving Rally: Stock Market Today

Dow Adds 314 Points to Thanksgiving Rally: Stock Market TodayInvestors, traders and speculators enjoy the best Thanksgiving Week gains for the major stock market indexes in more than a decade.

-

Nasdaq Rises 2.7% as Musk Tweets TSLA Higher: Stock Market Today

Nasdaq Rises 2.7% as Musk Tweets TSLA Higher: Stock Market TodayMarkets follow through on Friday's reversal rally with even bigger moves on Monday.