Stock Market Today: Stocks Resume Slide as Treasury Yields Rise

Signs of strength in the U.S. economy did little to lift investor sentiment on Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Thursday marked another day of choppy trading for stocks as investors considered a round of data that showed the U.S. economy remained resilient even in the face of the Federal Reserve's aggressive rate-hike campaign.

Ahead of this morning's open, data from the Labor Department showed weekly jobless claims fell for a fifth straight week, underscoring strength in the labor market. Additionally, the Commerce Department said retail sales rose 0.3% month-over-month in August, beating economists' expectations for a slight decline in consumer spending.

"This [retail sales] report is not good for the Fed's goals of slower inflation," says José Torres, senior economist at Interactive Brokers. "The Fed would like to see consumers slow down their spending and debt accumulation to slow down inflation. Higher rates provide an incentive to save, not to spend, and that's part of the reason why tighter monetary policy brings down demand and inflation." As such, Torres says the market is not only expecting a 75 basis-point rate hike at next week's Fed meeting, but one at the November meeting too. (A basis point is one-one hundredth of a percentage point.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

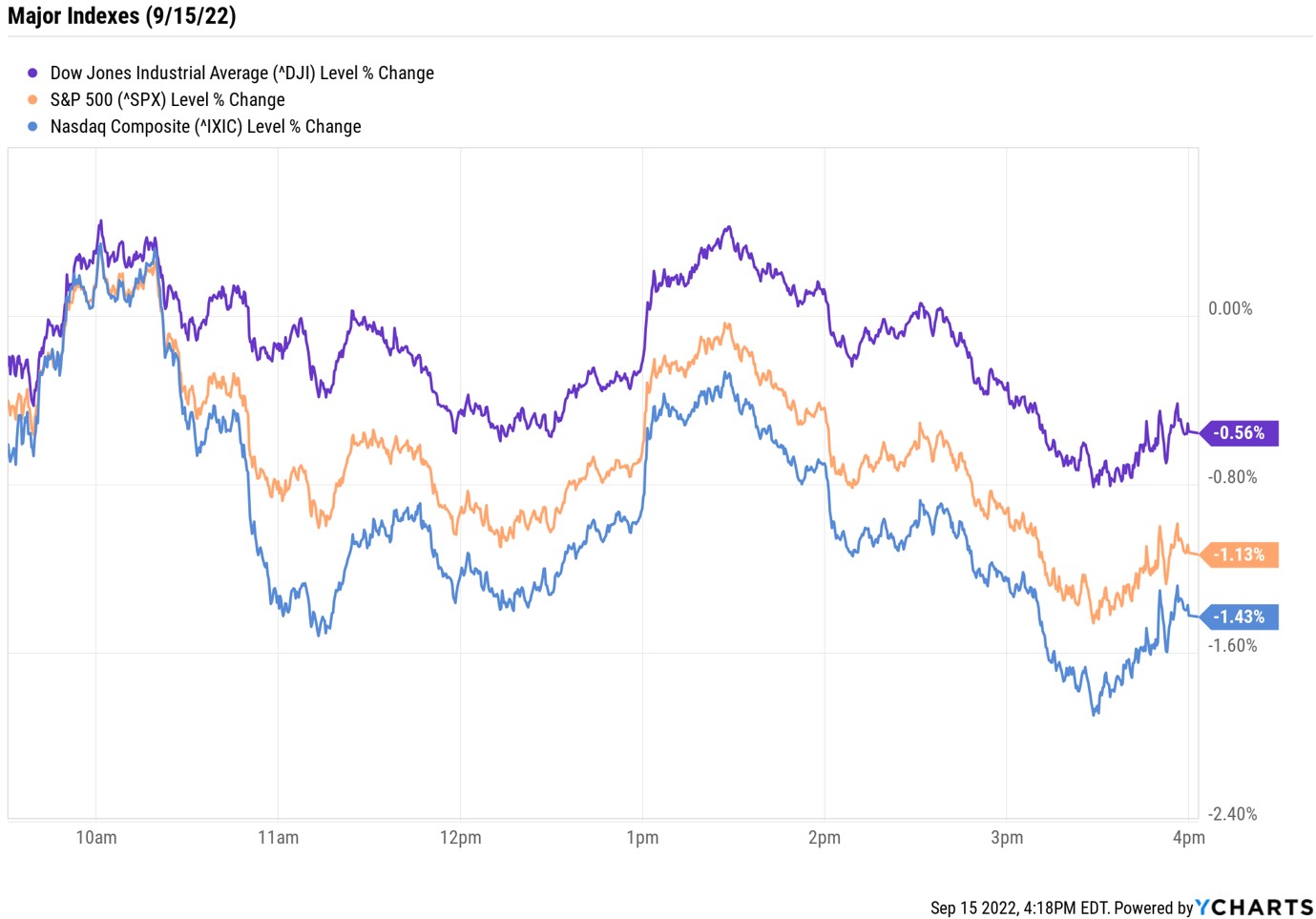

By the close, the market had taken a decisive turn lower as the 10-year Treasury yield jumped 3.5 basis points to 3.447%. The tech-heavy Nasdaq Composite suffered the worst of it, slumping 1.4% to 11,552. However, the S&P 500 Index (-1.1% to 3,901) and the Dow Jones Industrial Average (-0.6% at 30,961) also ended solidly in the red.

Other news in the stock market today:

- The small-cap Russell 2000 shed 0.7% to 1,825.

- U.S. crude futures fell 3.8% to settle at $85.10 per barrel.

- Gold futures plummeted 1.9% to $1,677.30 an ounce, their lowest settlement price since April 3, 2020, according to Dow Jones Market Data.

- Bitcoin slipped 0.8% to $19,800.53. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.) Elsewhere, Ethereum spiraled 6.3% to $1,499.28 after the Ethereum Merge. "The merge paves the way for the world's second-largest cryptocurrency to become more energy-efficient and to operate on a 'proof-of-stake' network," says Edward Moya, senior market strategist at currency data provider OANDA. "Crypto traders are often used to 'sell the event' reactions in the cryptoverse and this Merge proved to be another example of just that."

- Adobe (ADBE) plunged 16.8% after the Creative Cloud parent said it is buying design software firm Figma in a cash-and-stock deal valued at roughly $20 billion. "This would be by far Adobe's largest-ever acquisition," says Scott Kessler, global sector lead for Technology Media and Telecommunications at Third Bridge. "About four years ago it bought Marketo for around $5 billion. Meanwhile, its closest peer and competitor in some ways, Salesforce.com (CRM), has been far more aggressive with M&A, most recently buying Slack last year in a deal valued at nearly $30 billion." ADBE also reported higher-than-expected fiscal third-quarter earnings of $3.40 per share on inline revenue of $4.4 billion.

- Netflix (NFLX) jumped 5.0% after Evercore ISI analyst Mark Mahaney upgraded the streaming stock to Outperform from Inline, the equivalents of Buy and Hold, respectively. The analyst believes NFLX's ad-supported offering and its clampdown on password sharing create "catalysts that can drive a material reacceleration of revenue growth." Mahaney adds that these catalysts are currently not priced into the stock.

Stocks Making the Most of Supply-Chain Woes

Supply-chain disruptions have been front and center for most of the pandemic and the possibility for another disturbance came back to the forefront this week as a potential railroad strike loomed. While the latest headlines suggest that the strike will be averted as both sides reach a tentative deal, the fragility of the system remains a concern for investors.

"Supply chains were built for efficiency in the past," says Tony DeSpirito, chief investment officer at BlackRock's U.S. Fundamental Active Equities. "And that meant the lowest cost, wherever it was." But COVID "underscored the need for resilience of supply chains," he adds. "And that's what we're starting to see – the trend away from globalization to onshoring or reshoring operations. It's essentially a shift from efficiency to resiliency." This shift is creating a tough short-term environment for investors, DeSpirito adds, but he reminds us that it helps to take a long-term perspective.

And over the long term, companies should benefit from a move to more reliable processes. With that in mind, we've come up with five stocks that stand to win as supply chains falter. Most of the list is made up of industrial stocks, but the tech sector makes an appearance too.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.