Stock Market Today: Dow Plummets 486 Points, Nears Bear Market

The selling wasn't confined to the equities market, with crude oil, gold and Bitcoin all suffering steep losses.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

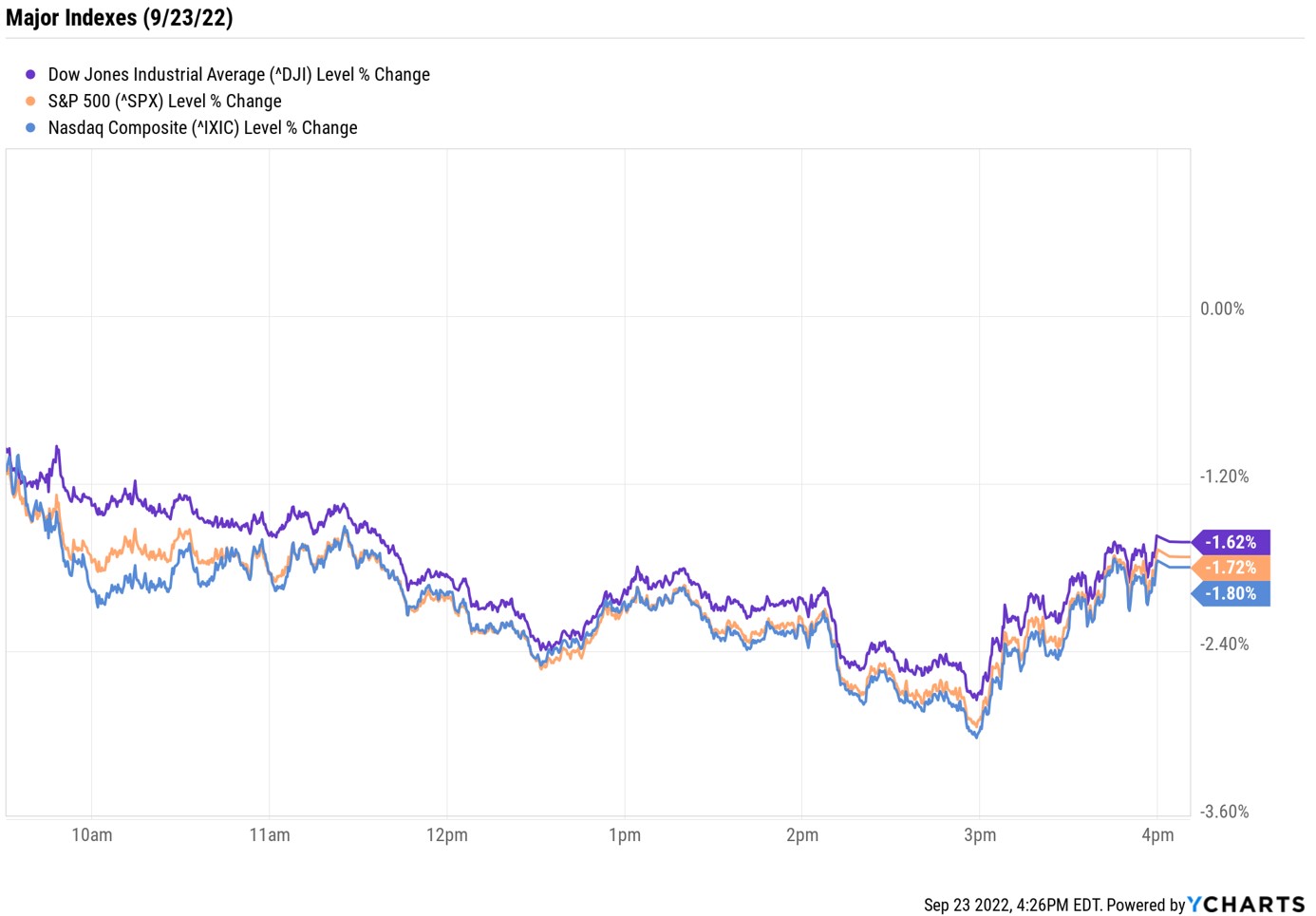

The stock market took another step lower Friday, as Treasury yields continued to rise to levels not seen in over a decade.

Today's drop brought the Dow below the important 30,000 mark and this close to bear-market territory, which is defined as a 20% drop from the most recent high (or its Jan. 3 peak at 36,585.06, in this case). The blue-chip index is the only one of its major market peers to have not crossed that threshold (the Nasdaq, remember, entered a bear market on March 7, and the S&P 500 on June 13).

"Financial markets are now fully absorbing the Fed's harsh message that there will be no retreat from the inflation fight," says Douglas Porter, chief economist at BMO Capital Markets. "The steep back-up in global rates further bludgeoned stocks, resource prices, and commodity currencies this week, given mounting recession odds," he added.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While yields on government bonds came off their earlier highs, they are still hovering at levels not seen in over 10 years (2011 for the 10-year note and 2007 for the two-year). Specifically, the 10-year Treasury yield hit a session peak of 3.829% before settling at 3.695%, while the 2-year Treasury yield climbed as high as 4.27% before ending at 4.201%.

As for the equities market, the Dow Jones Industrial Average closed down 1.6% at 29,590 – ending less than 1% above the 29,278.05 it needs to fall below in order to enter a new bear market. The S&P 500 Index finished 1.7% lower at 3,693 and the Nasdaq Composite spiraled 1.8% to 10,867. The S&P and Nasdaq finished at their lowest levels since June, while the Dow notched a new year-to-date low.

Other news in the stock market today:

- The small-cap Russell 2000 plummeted 2.5% to 1,679.

- U.S. crude futures spiraled 5.7% to $78.74 per barrel, its lowest close since Jan. 10.

- Gold futures shed 1.5% to finish at $1,655.60 per ounce, their lowest settlement since April 2020.

- Bitcoin slumped 2.6% to $18,823.30. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Costco Wholesale (COST) got knocked down 4.3% after earnings. In its fiscal fourth quarter, the wholesale retailer reported earnings of $4.20 per share on $72.1 billion in revenue, more than analysts were expecting. Same-store sales were up 13.7% year-over-year, matching the consensus estimate. "COST is seeing some signs of inflation relief as steel prices have eased and container shortages and port delays have improved," says BofA Securities analyst Robert Ohmes (Buy). "In addition, the stronger U.S. dollar should help mitigate some of the import pricing pressures. However, there is expected to be continued 'stickiness' in recent CPG company price increases (still apparently supported by the rising wage environment). In addition, there are no specific examples of easing inflation in COST's Food & Sundries category."

- FedEx (FDX) gave back 3.4% after the shipping giant announced a round of rate hikes for its Express, Ground and Home Delivery services, and said it is targeting fiscal 2023 cost savings of $2.2 billion to $2.27 billion. This comes on the heels of FedEx's earnings warning last week, which sent shares tumbling. "FDX is now (belatedly) parking freight planes and trimming staff and facilities, which should improve operating margin from August quarter's dismal 5.3% (vs. 6.8% year-over-year)," says CFRA Research analyst Colin Scarola (Hold). "But with highly volatile macroeconomic conditions and new FDX management seeming slow to react, we recommend a neutral stance on shares despite historically low valuation."

Are These the Best Stocks to Buy Now?

Is now the time to buy stocks? It's a question that has divided Wall Street – and one that can only be answered with time. But no matter what, "significant declines are a regular and recurring feature of the stock market," says Brad McMillan, chief investment officer for Commonwealth Financial Network. "In that context, this one is no different. And since it is no different, then like every other decline, we can reasonably expect the markets to bounce back at some point."

And while a bear market gives investors plenty of reasons to worry and creates short-term pain, it also "gives a chance to buy stocks on sale, potentially leading to better future returns when it recovers," McMillan adds. "And, as always, a bear market gives investors a chance to take a good hard look at their portfolios and find out if they are really comfortable with the risk they are taking. The pain is real, but there are some positive side effects."

Many investors will choose to go to cash amid this volatility. But for those looking to find big bargains in the stock market, there are certainly plenty of names trading much lower than where they started the year. But finding the best stocks to buy when the market is selling off can be daunting, so we turned to the pros to find a list of their top high-conviction picks – each expected to rally at least 20% in the next 12 months or so. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.