Stock Market Today: Dow Officially Enters a Bear Market After Monday's Slide

Casino stocks were a pocket of strength after Macau said it will ease COVID-related travel restrictions in November.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

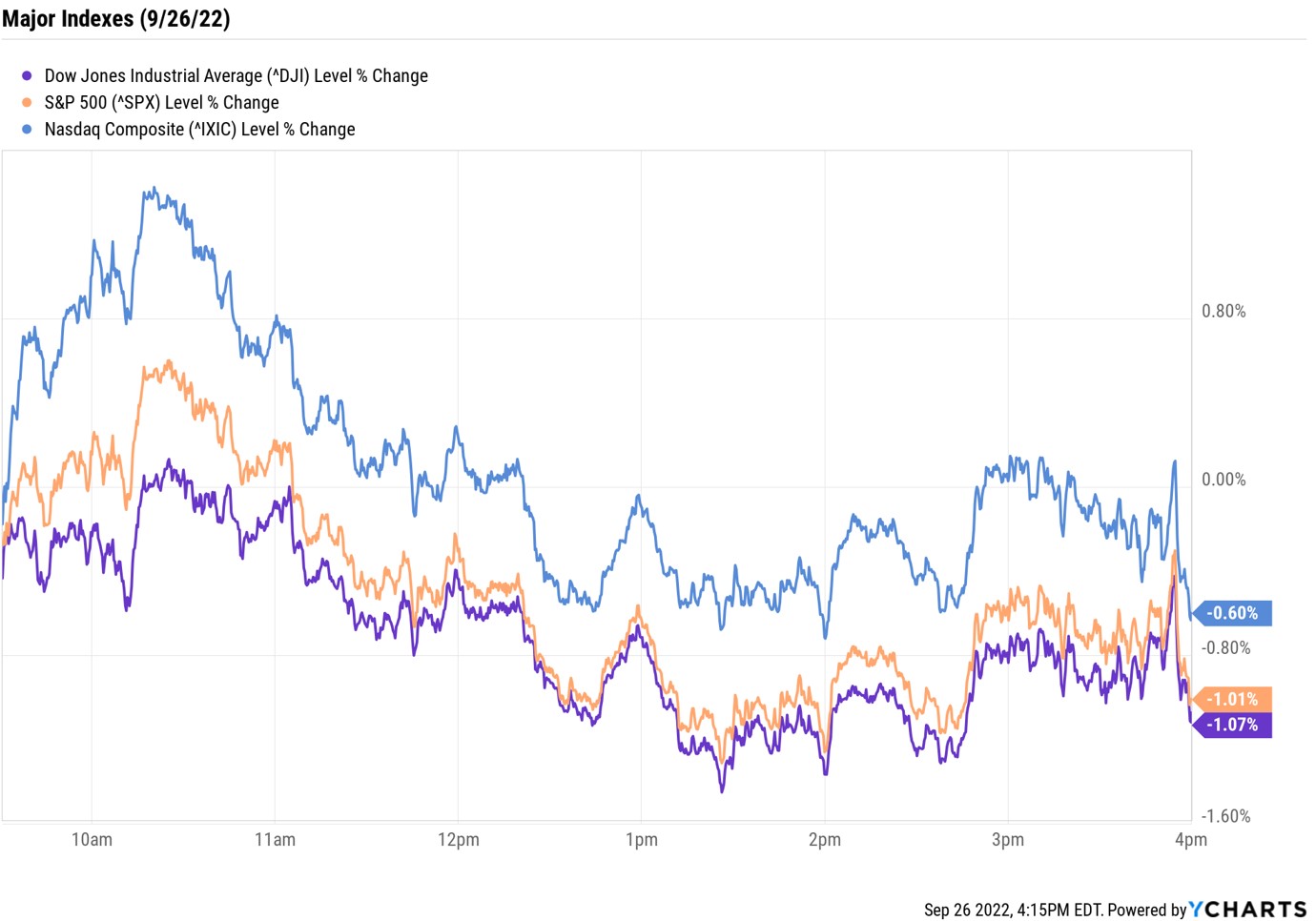

Selling in the stock market picked right back up Monday, and despite a brief mid-morning push into positive territory, the major indexes still ended lower.

"Despite a quiet global economic data front, this weekend and Monday morning have been anything but quiet as global yields are surging to record highs," said Stefanos Bazinas, execution strategist at the New York Stock Exchange. Indeed, both the 2-year Treasury yield (+10.5 basis points to 4.319%) and the 10-year Treasury yield (+20.3 basis points to 3.90%) continued to climb, hitting levels not seen in over a decade.

And this, Bazinas says, comes after the U.K. last week announced the biggest tax cuts in more than 50 years and indicated more were to come. This sent the British pound to an all-time low against the U.S. dollar earlier today. The dollar, for its part, hit its highest level since early 2002.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Most sectors finished lower, led by sharp losses for real estate (-2.7%) and utility (-2.4%) stocks. And while consumer discretionary (-0.2%) also ended in the red, its loss wasn't nearly as deep thanks to strength in Las Vegas Sands (LVS, +11.8%) and Wynn Resorts (WYNN, +12.0%). The casino stocks rallied after Macau, a huge destination for Asian gambling, said it is planning on relaxing COVID-related travel restrictions as soon as November.

As for the major indexes, the Dow Jones Industrial Average ended the day down 1.1% at 29,260, falling into its first bear market since 2020. The S&P 500 Index (-1.0% at 3,655) and the Nasdaq Composite (-0.6% at 10,802) also finished the day notably lower.

Other news in the stock market today:

- The small-cap Russell 2000 fell 1.4% to 1,655.

- U.S. crude futures slumped 2.6% to end at $76.71 per barrel.

- Gold futures shed 1.3% to settle at $1,633.40 an ounce.

- Bitcoin gained 1.9% to $19,186.36. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- News that Beijing will extend a tax break on electric vehicles (EVs) through the end of 2023 boosted several U.S.-listed Chinese EV stocks. Li Auto (LI, +5.6%) and Xpeng (XPEV, +4.8) were among the biggest gainers.

- Planet Fitness (PLNT) rose 1.2% after Raymond James analyst Joseph Altobello upgraded the fitness chain to Strong Buy from Market Perform (Neutral). "Our bullish stance on the shares of Planet Fitness reflects the company's highly resilient business model and value gym positioning, ample store growth opportunity (just over halfway toward its current 4,000 stores target in the U.S.), and what we believe is an attractive valuation," Altobello says. The analyst points to PLNT's "recession-resistant business model" and healthy growth opportunity in 2023. "Further, PLNT has no interest rate risk and very little near-term debt maturities, while current valuation is well below its recent historical average," he adds.

The Pros' Favorite Retail Stocks Right Now

There's a lot that to look forward to in October, including an early start to the holiday shopping season. Amazon.com (AMZN) will kick things off by hosting a second Prime Day mid-month, called Amazon Prime Early Access.

It's been a rough year for the retail sector amid several headwinds, including stubbornly high inflation, slowing demand and excess inventory. However, in spite of these hurdles, consumer spending has stayed steady, as evidenced by an unexpected rise in retail sales last month. "August retail sales show consumers' resiliency to spend on household priorities despite persistent inflation and rising interest rates," says Matthew Shay, president and CEO of the National Retail Federation. "As we gear up for the holiday season, consumers are seeking value to make their dollars stretch." In other words, consumers are willing to spend, but will seek out the best deals to get the most bang for their buck.

As for investors, they can find plenty of deals in both the consumer discretionary and consumer staples sectors at the moment. For a short list of the best retail stocks around, consider these five picks, each of which sports top ratings from Wall Street analysts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.