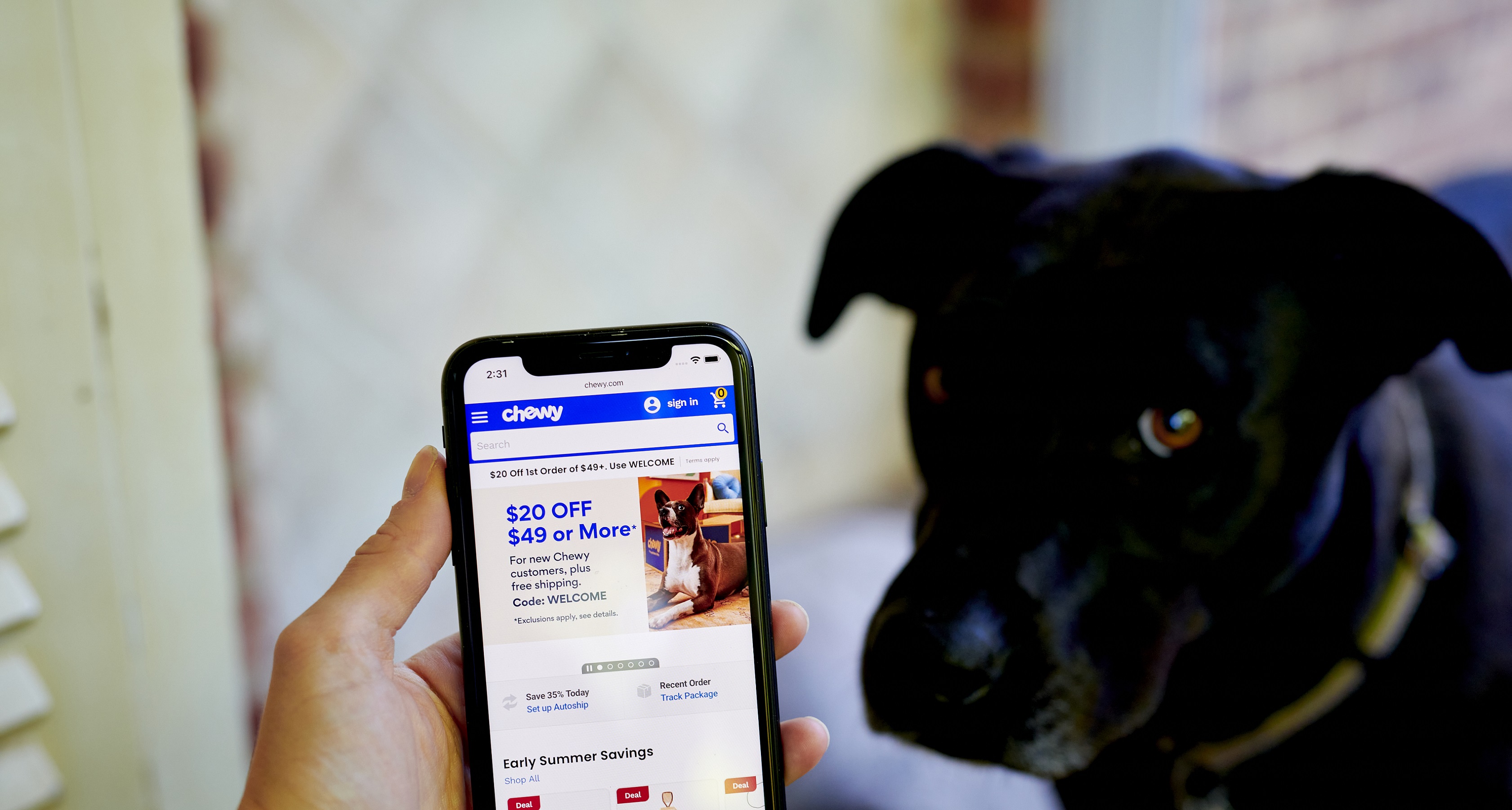

Chewy Says People Are Now More Discerning on Where They Shop

Chewy beat Q2 sales and earnings expectations and said that high inflation is changing customer buying habits.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Chewy (CHWY) beat second-quarter sales and earnings expectations and said it believes high inflation is causing pet store customers to become more discerning on where they shop.

For the quarter ended July 30, Chewy reported earnings with net sales growth of $2.78 billion, up 14.3%, and adjusted net income of $63.3 million, up 1.9%, compared to the same year-ago period.

The pet supply retailer’s active customer count decreased 0.6% from the prior year to 20.4 million, according to its report, and its net sales per active customer increased 14.7% to $530 per customer. Autoship sales, which consists of orders shipped through its autoship subscription program, represented 75.5% of total sales, a 240 basis points increase from the prior year, Chewy said.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“Coming out of the summer months, we are sensing a shift in consumer mindset towards being more discerning, and at the same time, with a higher willingness to consolidate their share of wallet to their trusted retailer of choice,” Chewy said in its Q2 Shareholder Letter. “This behavior is driven by a more fluid macro environment including high levels of inflation, which have been passed through the industry over the past 18 months,” Chewy said, adding that its suppliers confirmed that these trends permeate the pet industry.

That is in line with a recent Kiplinger retail sales report saying that, while strong consumer spending is keeping the economy out of recession, a slowdown is expected soon along with a drop in goods buying later this year.

Current environment is challenging

Chewy said it believes it is insulated from certain pressures due to the high quality of its customer base, its mix of Consumables and Healthcare businesses, its “powerful” autoship subscription service, and its overall value proposition to pet parents.

The company acknowledged, however, that it is not exempt from pressures the pet industry is now facing. “Pet household formation remains relatively muted and the consumer mindset continues to be pressured. These factors, taken together, make the current environment a challenging period to forecast consumer behavior.”

The company added that its upcoming expansion into the Canadian market remains on track for the third quarter and that the expansion of its Sponsored Ads program remains on track to ramp through the second half of the year and into 2024.

Last week, rival pet supply retailer Petco announced earnings results and cut its outlook. The company cited a shift in consumer spending and pressures on its discretionary business, as Kiplinger reported.

RELATED LINKS

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joey Solitro is a freelance financial journalist at Kiplinger with more than a decade of experience. A longtime equity analyst, Joey has covered a range of industries for media outlets including The Motley Fool, Seeking Alpha, Market Realist, and TipRanks. Joey holds a bachelor's degree in business administration.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.