15 Cheap Dividend Stocks Under $15

If you're looking for cheap dividend stocks and frustrated by the lack of options, check out the following list of 15 picks under $15.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Many investors look at expensive stocks like Amazon.com (AMZN) or Google parent Alphabet (GOOGL), and they wonder why they should bother with an investment so pricey they can only buy one or two shares. Instead, they target cheap stocks they can buy for just $20, $15, $10 … or even less.

However, it's important to remember that one share worth $1,000 is really the same as 1,000 shares at $1 – it's just sliced up differently.

Still, it's undeniable that many investors simply aren't interested in shares that trade for hundreds or even thousands of dollars. That's particularly true for income-oriented investors, who see plenty of high-priced stocks like Amazon that don't even pay a penny in dividends.

If you're looking for cheap dividend stocks and frustrated by the lack of options, check out the following list of 15 picks under $15. All are cheap dividend stocks that offer 3% yields or better at current prices, and have a decent amount of potential despite their relatively low profiles.

Data is as of Sept. 22 unless otherwise noted. Companies are listed by dividend yield, from lowest to highest. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

DRDGold

- Market value: $1.0 billion

- Dividend yield: 3.0%

Founded in 1895, South Africa-based DRDGold (DRD, $11.72) is a mining company that focuses on gold "tailings" businesses in the region. Tailings are minerals that exist in small amounts across other ores or even in otherwise useless rocks unearthed in the mining process, and require rather unconventional means of extraction. These include pulverizing the mining materials into powders and chemical processes that concentrate minerals and draw them out.

Clearly, this is a specialized business and not the normal old way of digging for gold. But it's a consistently profitable business for DRD nevertheless. That's particularly true in 2020, as gold prices are up 23% year-to-date, to $1,867 per ounce, and at one point reached $2,070 per ounce – driving DRDGold's shares 129% higher.

The yield, at 3%, is on the low end for these cheap dividend stocks, but still well above the 1.8% average on the S&P 500. Just note that the dividend is variable – it sometimes is paid only once a year, sometimes more, and the amount tends to change depending on profitability. But the stock, and the income potential, should continue to be good as long as gold prices remain elevated.

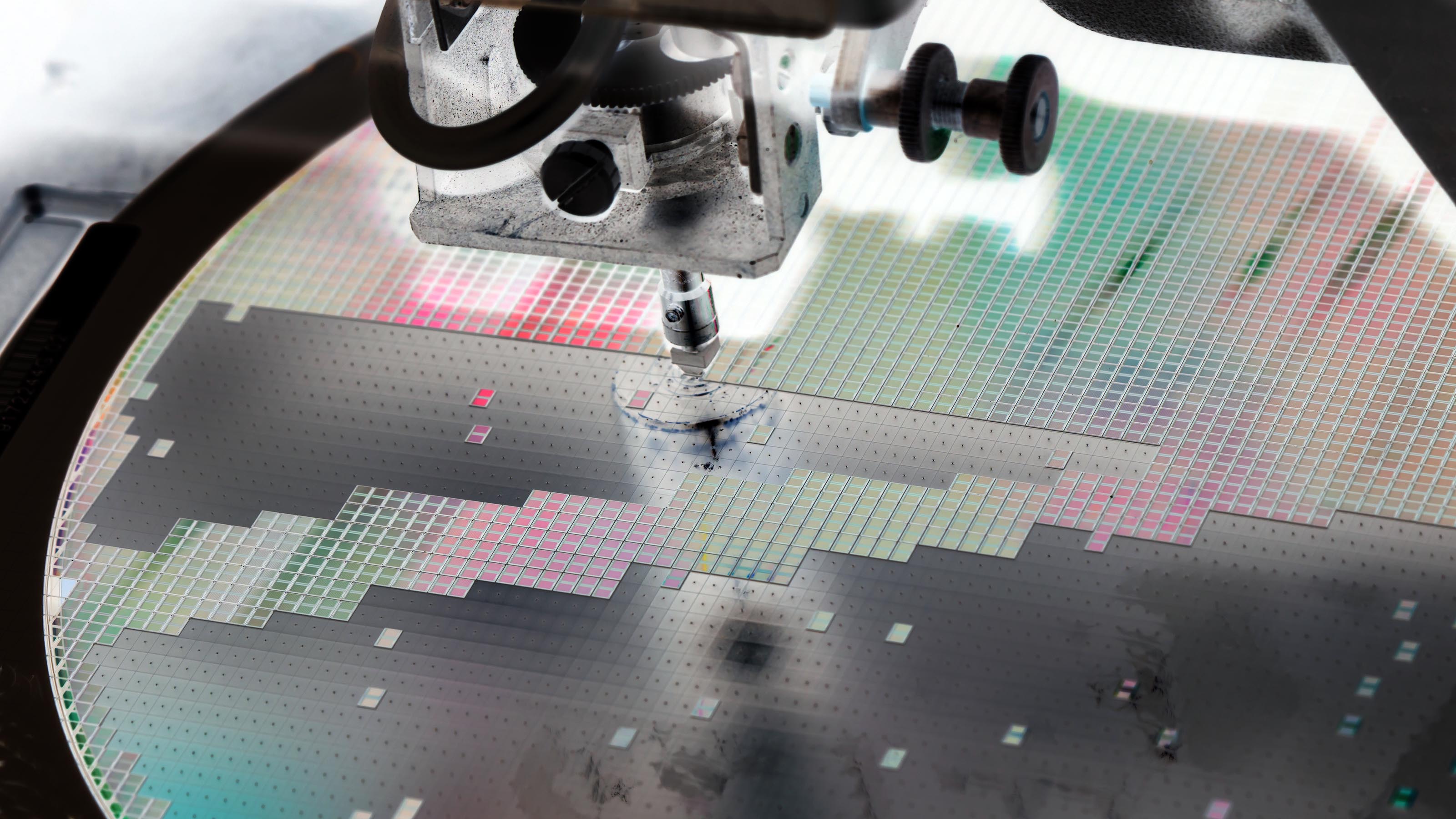

United Microelectronics

- Market value: $10.4 billion

- Dividend yield: 3.2%

United Microelectronics (UMC, $4.29) is a semiconductor wafer "foundry" that operates internationally but mainly in Asian markets including Taiwan, Singapore and China. Unlike many of the higher-profile companies that make their own branded chips, UMC is content to be the factory for semiconductors rather than research new cutting-edge designs and applications.

There are admittedly much lower margins in creating someone else's hardware. However, UMC makes up for these margins with a broad customer base that includes electronics companies but also fast-growing solar energy and LED industries. And back in July, when semiconductor giant Intel (INTC) hinted it might exit chip manufacturing altogether and just stick to designs, firms including United Microelectronics surged higher on the promise of winning more business in the future.

UMC is still one of the cheapest dividend stocks on this list, on a per-share basis, despite trading at roughly double its 52-week low. It also pays a generous dividend for the tech space. But like DRD, it's based on a variable dividend – one that's paid out only once a year, no less.

American Software

- Market value: $447.9 million

- Dividend yield: 3.2%

Rather than creating the hottest new social app or creativity suites, American Software (AMSWA, $13.79) is a lesser-known IT firm that creates supply chain management and enterprise software solutions. It operates via subsidiaries Logility, Demand Solutions, NGC Software and The Proven Method.

2020 has been an up-and-down year for AMSWA shares, which are off 7% year-to-date.

Still, William Blair sees hope in the company's recently reported fiscal first-quarter earnings, which saw subscription revenues gain 43% year-over-year to $200,000, and adjusted profits hit 9 cents per share to easily beat estimates.

"With regard to the pipeline, management stated that the total dollar value, number of transactions, and average size of transactions are trending positively and that in the last few weeks, sales activity has increased," note William Blair's analysts, which rate AMSWA at Outperform (equivalent of Buy). "In addition, there are more seven-figure deals in the pipeline than ever before."

AMSWA's dividend has remained level at 11 cents per share for years, but that currently translates into a 3%-plus yield that puts it on this list of cheap dividend stocks.

Adtran

- Market value: $491.1 million

- Dividend yield: 3.5%

Adtran (ADTN, $10.24) provides networking and communications equipment for telecom service providers, which primarily includes cable and internet companies. It offers fiber optic nodes, specialized software, transceivers and all manner of other gear that helps makes data networks work.

The Alabama-based company has seen particular strength lately thanks to a focus on broadband internet connectivity. You can thank a groundswell in students learning remotely and more employees working from home amid coronavirus disruptions.

Adtran was upgraded earlier this year by Goldman Sachs from Neutral to Buy with a $13 price target. And more recently, both Northland Securities and MKM Partners reiterated Buy-equivalent calls at $16 price targets.

Argus Research (Hold) is more cautious on the name, warning that it "could take some time to reach sustained profitability given its depleted revenue base." But it did raise its earnings estimates for 2020 and 2021 and notes that the company earns its second-highest rank for financial strength, thanks in part to a debt-free balance sheet.

And with a reliable dividend of 9 cents a quarter, ADTN offers a generous yield at current pricing.

Nomura

- Market value: $14.8 billion

- Dividend yield: 3.8%

One of the cheapest dividend stocks on this list is actually quite large: Nomura (NMR, $4.83) is a $15 billion Japanese financial player that provides services to individuals, corporations and institutions. That includes everything from roughly 130 retail branches serving people with checking accounts to asset management for pension funds.

Without moralizing too much over regulation, it's safe to say that Japanese banks are much more risk-averse than their global peers. There is no aggressive proprietary trading for profits, and there is more oversight. As a result, investors should see NMR as a more stable alternative to similarly sized banks elsewhere in the world.

However, as a financial stock, Nomura does provide the same generous stream of dividends that investors in the sector should be used to. Just be aware those semiannual payouts can fluctuate, as is typical of many non-U.S. dividend stocks.

Pitney Bowes

- Market value: $919.1 million

- Dividend yield: 3.8%

A decidedly old-school brand, Pitney Bowes (PBI, $5.31) has roots as a printing and mailing outfit. The company evolved to include e-commerce and digital marketing solutions in recent years. But that hasn't stopped the firm's share price from plummeting from almost $50 in 2007 to around $5 at present as many of its legacy business clients have pulled back on traditional paper assets or gone elsewhere for their digital needs.

Still, it's a testament to PBI management that the company hasn't faded away. And the company's 5-cent dividend, which was reduced from 18.75 cents at the beginning of 2019, is much more digestible. Investors who buy in at current levels can have a degree of confidence that payout is safe; Pitney Bowes is scheduled to record 49 cents in earnings per share in fiscal 2021, which puts its payout ratio at less than half of its corporate profits.

Lexington Realty Trust

- Market value: $2.9 billion

- Dividend yield: 4.0%

A real estate investment trust (REIT) that primarily owns "single-tenant" industrial properties, Lexington Realty Trust (LXP, $10.50) has been volatile in 2020.

After a plunge in March in the wake of the worst fears around the coronavirus pandemic, shares surged back quickly to set a new 52-week high in August. Shares have since reversed again, and shares are roughly breakeven for the year. It has been enough downward pressure to keep Lexington Realty Trust among the market's cheap dividend stocks.

Still, LXP's future looks secure. That's in part because Lexington's model is typically reliant on giants like Amazon.com, BMW, Caterpillar (CAT) and other mega-corporations who are renting one or more of its roughly 150 properties.

In theory, there's risk when you have a comparatively small number of sites that rely on just one tenant. But investors quickly realized these risks were relatively limited since the long-term leases from deep-pocketed clients weren't going to evaporate overnight. Furthermore, LXP has very reliable operations thanks to this focused business model – which leads to a steady stream of revenue to support consistent dividends.

Amcor

- Market value: $17.2 billion

- Dividend yield: 4.2%

Though Switzerland's Amcor (AMCR, $11.04) took it on the chin this spring, plunging to less than $6 a share, the stock has roughly doubled to set new 2020 highs as it has regained all of that ground and then some.

The packaging giant was initially in the crosshairs of investors as there were fears that coronavirus disruptions would upset supply chains and manufacturing processes at its customers, creating a natural reduction in demand. However, the reality is that any drawbacks were short-lived – and in fact, its food and beverage packaging has seen a natural increase in demand as consumers dine out less and buy more groceries.

It's not a particularly glamorous business, making blister packs of pills and cardboard milk cartons and plastic spray bottles for other businesses to fill up with actual products. But it's a crucial part of the global economy, and one that has proven to be quite reliable regardless of specific disruptions to certain sectors in the wake of the coronavirus.

Not only is AMCR among Wall Street's cheap dividend stocks right now – it's a rare Dividend Aristocrat that you can buy for under $15 per share (Amcor has raised its payout for 36 consecutive years). Better still: With dividends adding up to roughly 60% or so of projected fiscal 2021 earnings, income investors can be sure their quarterly checks from this cheap dividend stock should keep rolling in for the foreseeable future.

Donegal Group

- Market value: $411.3 million

- Dividend yield: 4.3%

Donegal Group (DGICA, $14.13) is an insurance holding company that provides personal and commercial policies spanning property and casualty insurance, automobile policies and a host of other related services. The company relies on a network of approximately 2,400 independent insurance agencies.

Thanks to a long history of figuring out a good price for premiums and managing risks accordingly, Donegal has built a very profitable operation that supports consistent dividends despite a relatively modest market value.

Specifically, DGICA is on track to post earnings of about $1.73 per share in 2020 over dividend payments of only about 60 cents in total. When you're paying only a third of your profits back to shareholders, that means your payments are stable -- and perhaps, due for an increase in the near future.

Analysts at Boenning & Scattergood, who rate the stock at Outperform, note that "at the current price, the shares also pay one of the highest dividends in the P&C insurance space."

DGICA might never be the hope of big-time growth like a tech stock, as share prices have been stuck in a fairly narrow range for the last year excluding a dip and snap-back in March, but if you're looking for a consistent investment with income potential, Donegal may be worth a look.

Monmouth Real Estate Investment Corporation

- Market value: $1.3 billion

- Dividend yield: 5.1%

Monmouth Real Estate Investment Corporation (MNR, $13.40) is one of the oldest publicly traded REITs on Wall Street, founded back in 1968, just a few years after the rules accommodating this structure were signed into law under President Eisenhower.

Monmouth specializes in single tenant "net-leased" industrial properties, meaning that the customers themselves have to pay for upkeep, insurance and taxes. That helps make Monmouth's earnings far more consistent and predictable.

Currently, MNR's portfolio is similar to LXP in that it spans about 120 industrial properties that add up to 23 million square feet across 31 states. With a footprint like this and a focus on long-term rental deals, Monmouth doesn't have to worry too much about a rash of tenants pulling out and impacting its operations.

Janney analysts (Buy) noted in August that "MNR has also collected 99.6% of rent in July, and expects to collect 99.6% for August," adding that same-store occupancy was 99.4% during the fiscal third quarter.

That means consistent revenue to fuel income for shareholders of this cheap dividend stock.

Star Group LP

- Market value: $423.0 million

- Distribution yield: 5.5%*

Unlike many oil and gas stocks lately, midstream energy stock Star Group LP (SGU, $9.67) has actually increased its distribution in 2020. Sure, it was a pretty modest bump from 12.5 cents quarterly to 13.3 cents, but something is better than nothing – and building on a history of similar small but steady increases over the last few years, that move paints a picture of a company that prioritizes paying its shareholders.

Part of the reason that Star can do this while other energy stocks can't is because it is much more of a service play than a bet on oil prices or how much fossil fuel is in the ground. SGU installs HVAC equipment and then supplies heating oil and propane to these customers, with a network of about 500,000 clients. It also delivers gasoline and diesel fuel to about 27,000 fleet customers. That helps Star smooth out some of the volatility you see in other stocks that are exposed directly to energy prices, since there is steady demand for heating fuels and fleet services regardless of the ups and downs in crude oil or the global economy.

* Distributions are similar to dividends but are treated as tax-deferred returns of capital and require different paperwork come tax time.

Kronos

- Market value: $1.5 billion

- Dividend yield: 5.7%

Kronos Worldwide (KRO, $12.62) is a specialized chemicals company that mainly provides titanium dioxide pigments internationally. If you're not familiar, titanium dioxide (or TiO2) is the additive that makes the bright "true white" you're used to seeing on everything from car finishes to appliances to to cosmetics. Chances are if you want something to be bright white and stay that way, it uses TiO2 vs. other whitening agents.

Clearly, KRO doesn't have a mammoth business model with this unique specialization. But a look around any home goods store will provide a plethora of items that prove the applications of TiO2 are widespread. This diversity in customers provides a relatively reliable business model.

"While Q3 will continue to be challenged by lower volumes and we forecast Q3 EBITDA to be down 12% YoY and 16% QoQ, we believe Kronos is well positioned to ride out of the downturn thanks to a large cash balance and a strong balance sheet," writes Deutsche Bank, which has KRO shares at Buy with a 12-month price target of $15 per share.

Kronos is among the cheap dividend stocks you can buy for under $15 per share, and in fact, the stock is still down about 6% year-to-date. That has helped plump up an already generous yield to 5.7% currently.

Global Medical REIT

- Market value: $621.2 million

- Dividend yield: 6.0%

Global Medical REIT (GMRE, 13.43) is a small-cap REIT that focusses on medical real estate. Specifically, it has about $1 billion in assets spread across 97 properties in more than 30 states – mostly medical office buildings, but also specialty hospitals, inpatient rehabilitation facilities and ambulatory surgery centers.

Like many medical REITs, GMRE didn't benefit from the COVID outbreak – quite the opposite, as its tenants suffered reduced elective procedures. But shares have fought their way back above breakeven, and there's reason to like GMRE and its stable 6% dividend going forward.

"We believe GMRE's Medical Office portfolio has performed well so far through the pandemic, and management continues to make accretive acquisitions with $132M announced YTD," write Stifel analysts, who rate the stock at Buy. "This combination is providing one of the strongest growth profiles in the healthcare REIT space."

Stifel adds that the 6% dividend "is very attractive in a low interest rate environment."

Uniti Group

- Market value: $1.9 billion

- Dividend yield: 6.1%

Uniti Group (UNIT, $9.80) is structured as a REIT, but is very much a telecommunications company at its core. UNIT is engaged in the construction and maintenance of wireless infrastructure solutions that include 6.5 million miles of fiber optic cables along with other related communications technology on its real estate properties throughout the U.S.

Needless to say, when social distancing in many communities has prompted Americans to do more working from home and attending school remotely, this kind of business became more important than ever. And as communications companies use Uniti's infrastructure to keep customers connected, they pay a small "toll" to use that equipment.

The result is a reasonably stable and business model, which supports a 15-cent quarterly dividend that adds up to a generous yield at current prices.

People's United Financial

- Market value: $4.2 billion

- Dividend yield: 7.2%

People's United Financial (PBCT, $10.03) is a regional bank in the Northeastern U.S. that manages more than $60 billion in assets and more than 400 branch locations.

But more importantly for dividend investors, it's:

- The highest-yielding of these cheap dividend stocks

- A member of the Dividend Aristocrats, delivering 27 consecutive years of dividend growth. That includes a small 1.5% uptick to the payout earlier this year.

Unless you happen to live in the area where they operate, regional banks are naturally not as well-known as the bigger banks with national presences. But dividend investors should consider these stocks because their local presence naturally means less sophisticated operations, with a focus on commercial lending and mortgage services instead of quirky investment banking services like those that got major firms in trouble during the financial crisis.

While financials have taken a beating in 2020, Piper Sandler analysts (Overweight, equivalent of Buy) write that "we are cautiously optimistic that in the days, weeks, and months ahead and along with 3Q20 earnings, the previously blurry credit picture will gradually begin to crystallize, and lend many opportunities to investors looking to build positions in high-quality names such as PBCT at attractive price entry points."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger. A veteran journalist with extensive capital markets experience, Jeff has written about Wall Street and investing since 2008. His work has appeared in numerous respected finance outlets, including CNBC, the Fox Business Network, the Wall Street Journal digital network, USA Today and CNN Money.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?

-

5 Top-Rated Housing Stocks With Long-Term Growth Potential

5 Top-Rated Housing Stocks With Long-Term Growth Potentialstocks Housing stocks have struggled as a red-hot market cools, but these Buy-rated picks could be worth a closer look.