5 Top Dividend Aristocrats to Beef Up Your Portfolio

The 65-member Dividend Aristocrats are among the market's best sources of reliable, predictable income. But these five stand out as truly elite.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The past year-plus has been easy going for investors looking to generate profits from equity returns, with the S&P 500 up by almost double from the March 2020 lows. Income, however, is another story altogether. Already-low interest rates started retreating this spring; the yield on the 10-year Treasury note is back down to a paltry 1.3%.

Fortunately, investors have a better way to collect reliable, predictable income.

Dividend Aristocrats – companies with a track record of increasing shareholder payouts for at least 25 consecutive years – offer the best of many worlds. Most Aristocrats are large-cap blue chips with typically stable earnings, healthy balance sheets and long histories of profitability and growth. That allows them to:

- Pay secure, typically well-covered dividends.

- Raise their payouts regularly without interruption.

- Offer the potential for much more significant price gains than bonds typically deliver.

Investors have plenty of Dividend Aristocrats to choose from – 65 at present, in fact. But it's unlikely that anyone is looking to buy up individual shares of each and every one. So if you had to buy just a few, which ones should they be?

To help answer that question, we looked at the full list of Dividend Aristocrats through the lens of the Stock News POWR Ratings System. We then narrowed our focus down to only those Aristocrats receiving a Strong Buy rating from the pros based on the company's current financial situation and future prospects.

Based on those criteria, here are the five best Dividend Aristocrats for investors looking to beef up their income portfolios.

Data is as of Sept. 13. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price. Stocks are listed in reverse order of dividend yields.

Abbott Laboratories

- Market value: $224.5 billion

- Dividend yield: 1.4%

- POWR Ratings overall rating: A (Strong Buy)

- POWR Ratings average broker rating: 1.40

Abbott Laboratories (ABT, $126.62) manufactures and markets a diversified line of healthcare products, including medical devices, adult and pediatric nutritional products, diagnostic equipment and testing kits and branded generic drugs.

Its Established Pharmaceuticals division includes branded generics, while its Medical Devices unit provides care for diabetes, as well as vascular, heart and nerve issues. ABT's Diagnostics segment manufactures and markets diagnostic systems and tests in four business lines: Core Laboratory, Molecular, Point of Care and Rapid Diagnostics.

ABT had a strong second quarter, generating sales growth across each operating segment. In Adult Nutrition, the firm saw robust global demand for its Ensure and Glucerna products. This is being driven by new customers and an increase in usage from existing customers. The Pediatric Nutrition unit also gained ground, driven by sales of Pedialyte and PediaSure.

Diagnostics sales are strong, too, thanks to improving demand for routine diagnostic and COVID-19 testing. In particular, organic sales jumped 57.2% from the year prior. ABT is also seeing increased adoption of its glucose monitoring technology, FreeStyle Libre, which helped spur 45.1% organic sales growth in its Medical Devices unit.

Last December, Abbott's board of directors approved a 25% dividend hike to 45 cents per share. This marked the 49th straight year the Dividend Aristocrat raised its payout. Additionally, the company has declared 390 consecutive quarterly dividends since 1924.

The POWR Ratings system gives Abbott Laboratories an overall grade of A (Strong Buy), due in part to its Growth Grade of A. In the most recent quarter, adjusted earnings per share surged 105.3% year-over-year, while global revenue rose 39.5%. For the full year, earnings are expected to improve 21.4%.

The company also has a Sentiment Grade of B, which means it has shown consistent growth and price performance. For instance, the stock has a beta of 0.63, which indicates it is not very volatile. See the complete POWR Ratings analysis for Abbott Laboratories (ABT) here.

Target

- Market value: $118.6 billion

- Dividend yield: 1.5%

- POWR Ratings overall rating: A (Strong Buy)

- POWR Ratings average broker rating: 1.45

Target (TGT, $243.10) is a leading U.S. general merchandise retailer, offering various products across several categories, including beauty and household essentials, food and beverage, home furnishings and decor, and apparel and accessories. It has a significant e-commerce presence and owns Shipt, an online same-day delivery platform.

TGT has undertaken numerous initiatives to boost its performance, and so far, things are going well.

In the most recent reported quarter, both sales and earnings rose year-over-year. Total revenues were $25.2 billion in the second quarter, which represented a 9.5% increase from the year prior. This was led by momentum across all five of Target's core merchandise categories: Apparel, Food & Beverage, Essentials & Beauty, Home and Hardlines.

The company is investing $4 billion annually to increase store openings, scale up fulfillment services and enhance its supply chain capabilities. In particular, it has made investments to strengthen its omnichannel capabilities, such as same-day delivery of in-store purchases. Its loyalty program, Target Circle, has also been gaining traction.

In June, the company raised its quarterly dividend by 32.4% to 90 cents a share. This hike continues Target's membership in the Dividend Aristocrats, and puts it on track for a 50th successive year of annual dividend increases.

The POWR Ratings system gives Target an overall grade of A, which translates into a Strong Buy. Among reasons to like the stock is its low valuation – a Value Grade of B is supported by TGT's trailing price-to-earnings (P/E) ratio of 19.4, which is well below the industry average of 31.8. Plus, its price-to-tangible book ratio comes in at 8.1.

Target also has a Quality Grade of B due to its solid balance sheet. As of the most recent quarter, the company's cash balance was $7.4 billion, compared to only $1.4 billion in short-term debt.

The firm is also highly efficient, with a return on equity of 42.5%. Get Target's (TGT) complete POWR ratings analysis here.

Sysco

- Market value: $39.4 billion

- Dividend yield: 2.5%

- POWR Ratings overall rating: A (Strong Buy)

- POWR Ratings average broker rating: 1.73

Sysco (SYY, $76.87) is the largest U.S. foodservice distributor, boasting a 16% market share. The company delivers food and non-food products to over 625,000 customer locations, including restaurants, healthcare facilities, travel and leisure, retail, education and government buildings.

At its 2021 Investor Day, the company unveiled a quarterly dividend hike of 2 cents per share to 47 cents a share. This was the company's 52nd straight annual dividend hike, securing its spot as one of the best Dividend Aristocrats.

SYY has been benefiting from improved trends in its industry as many markets are reopening. The impact of this was notable in the most recent quarter, where both Sysco's top and bottom lines soared year-over-year. The former, specifically, surged 82% in SYY's fiscal fourth quarter to $16.1 billion.

The company also unveiled its "Recipe for Growth" plan on its Investor Day, which aims to transform Sysco into a more growth-oriented, customer-focused and innovative business. The goal involves five strategic priorities that will enable SYY to grow 1.5 times faster than the market by the end of the fiscal 2024.

SYY is also looking to grow its distribution network and customer base through acquisitions. On May 20, Sysco said it is buying independent Italian specialty distributor Greco and Sons. The company operates 10 distribution centers across the U.S.

Sysco's overall grade of A (Strong Buy) from the POWR Ratings system includes a Growth Grade of A – partly driven by the growth in the most recent quarter. In addition to surging sales, SYY brought in adjusted earnings of 71 cents per share in its fiscal fourth quarter, compared to a loss of 29 cents per share in the year prior. Analysts forecast earnings to grow another 158.8% year-over-year in the current quarter.

SYY also has a Quality Grade of B, with a current ratio of 1.5. This indicates the company has more than enough liquidity to handle short-term needs. Like Target, Sysco has a high return on equity, coming in at 33.8%. Check out Sysco's (SYY) full POWR Ratings breakdown.

Johnson & Johnson

- Market value: $436.5 billion

- Dividend yield: 2.6%

- POWR Ratings overall rating: A (Strong Buy)

- POWR Ratings average broker rating: 1.50

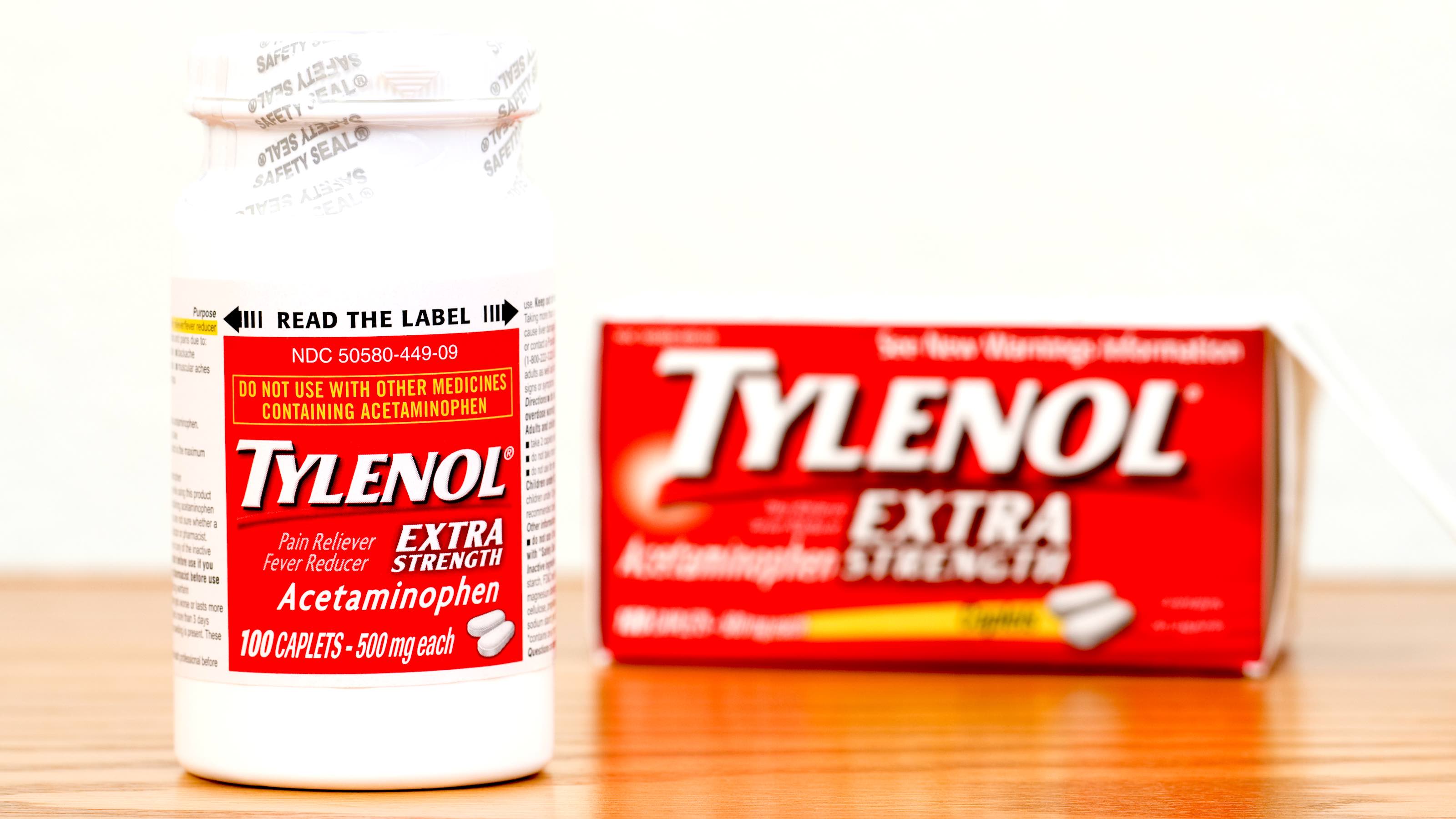

Johnson & Johnson (JNJ, $165.80) is one of the world's largest healthcare firms. It operates through three divisions: Pharmaceutical, Medical Devices and Consumer Health. The drug and device segments represent close to 84% of sales and drive the majority of cash flows for the firm. Its consumer offerings include baby care, beauty, oral care, over-the-counter drugs and women's health.

It's easy to see why the healthcare stock is on a list of the best Dividend Aristocrats. It has raised its payout to shareholders for 59 consecutive years, including a 5% hike to $1.06 per share in April.

Drilling down on some fundamentals, JNJ's Pharmaceutical segment is performing well. In the second quarter, sales surged 17.2% to $12.6 billion, driven by increased penetration and new indications of its blockbuster drugs, including Imbruvica, Darzalex and Stelara. Johnson & Johnson's plaque psoriasis drug Tremfya and prostate cancer treatment Erleada also contributed to growth.

Additionally, JNJ has a deep pipeline with key candidates such as ciltacabtagene autoleucel/BCMA CAR-T therapy for relapsed multiple myeloma.

JNJ's Medical Devices segment is also seeing a solid recovery after sales were down in the early part of the pandemic, with Q2 revenues up 27.1% year-over-year to $7.0 billion. Sales in the Consumer Health segment also improved, rising 13.3% to $3.7 billion.

Johnson & Johnson has an overall grade of A, translating into a Strong Buy. The company has a Growth Grade of A, as total sales rose 27.1% year-over-year and adjusted earnings per share surged 48.5% in the second quarter.

Wall Street pros think JNJ is one of the best Dividend Aristocrats, too. The stock has a Sentiment Grade of B, with 14 out of 20 analysts rating the stock a Buy or Strong Buy. Get the complete POWR Ratings analysis for Johnson & Johnson (JNJ) here.

AbbVie

- Market value: $189.9 billion

- Dividend yield: 4.9%

- POWR Ratings overall rating: A (Strong Buy)

- POWR Ratings average broker rating: 1.50

AbbVie (ABBV, $107.48) is a drug company with strong exposure to immunology and oncology. The firm was spun off from Abbott Laboratories in early 2013. Nearly half of ABBV's current profits come from its top drug, Humira.

Another big growth driver is Botox maker Allergan, which AbbVie acquired for $63 billion in May 2020. The deal lowered ABBV's dependence on Humira, which has already lost patent protection in Europe and is due to face competition in the U.S. beginning in 2023.

Still, Humira continues to drive strong revenues, and it is currently approved for 11 indications in the U.S. ABBV has also been successful in expanding the labels of its cancer drugs, Imbruvica and Venclexta. The firm's two new immunology drugs, Skyrizi and Rinvoq, are also performing beyond expectations.

While the acquisition of Allergan significantly expanded AbbVie's revenue base with new therapeutic areas, Botox was the crown jewel. It is approved for therapeutic and aesthetic use and is now a key sales driver for ABBV.

AbbVie is included among the elite Dividend Aristocrats because it has raised dividends – including its time as part of Abbott – for the past 49 years. Most recently, its board of directors approved a 10.2% quarterly dividend hike last October to $1.30 per share. Since the spinoff, it has increased its dividend by 225%.

ABBV has an overall grade of A , which is a Strong Buy, in the POWR Ratings system. The company has a Value Grade of B, which makes sense with its forward P/E ratio of 9.62.

Lastly, AbbVie has a Quality Grade of B due to solid fundamentals. For instance, its return on equity is very high at 52.5%, and its operating margin of 29.9% is well above the industry average. Get AbbVie's (ABBV) complete POWR Ratings analysis here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Cohne has 20 years of experience as an investment analyst and writer. Prior to StockNews, David spent 11 years as a consultant providing outsourced investment research and content to financial services companies, hedge funds and online publications. David enjoys researching and writing about stocks and the markets. He takes a fundamental quantitative approach in evaluating stocks for readers.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.