Dividend Increases: 14 Stocks That Have Doubled Their Payouts

Looking for companies executing substantial dividend increases? These 14 stocks have upped the payout ante by a minimum of 100% this year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

2021 has turned out to be a banner year for dividend growth investors, marked by unusually large dividend increases.

Dividends began rising steeply during this year's June quarter when many companies that had suspended dividends during the pandemic resumed payments. There were even more firms that reduced payments during 2020 or left their dividend unchanged but signaled their improving business prospects in 2021 by issuing dividend increases.

The result was a median increase in the S&P 500 dividend during the June quarter to 8.3%, up from 7.7% in the March quarter and 4.8% in the December quarter. And during the September quarter, the median dividend increase for S&P 500 stocks was 9.7%, up from 8.3% one year earlier and 4.2% two years ago.

"Dividends are back as record earnings, sales and margins have permitted companies to return to the business of returning shareholder wealth," says Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices. December-quarter dividends are expected to exceed the new record set in September, he adds, and data points to a new annual record for dividend growth during 2021.

Increases in S&P 500 dividends have been impressive this year. However, they pale in comparison to the actions by a handful of extraordinary companies in 2021 that doubled, tripled and in some cases quadrupled their dividends.

Today, we're looking at 14 stocks that have recently announced much-larger-than-usual dividend increases. Each raised its dividend at least once in 2021, with increases of at least 100%. Most are classic dividend growers, too, with solid balance sheets, formidable cash flow and meager payout ratios paving the way for more dividend growth going forward.

Data is as of Nov. 25. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

GeoPark

- Market value: $755.6 million

- Dividend yield: 1.3%

- Dividend hike: 100%

GeoPark (GPRK, $12.44) is an oil and gas firm that has benefited from this year's rebound in energy prices. This company develops oil and gas reserves in Chile, Columbia, Brazil, Argentina, Peru and Ecuador. GeoPark holds economic interests in 31 drilling blocks, as well as offshore concessions in Brazil that contain 124 million barrels of net proved reserves.

Despite output declines caused by a shutdown at its Platanillo field where production has since been restored, GeoPark is generating significantly improved profits and EBITDA (earnings before interest, taxes, depreciation and amortization) in 2021. During the first nine months of the year, the company's revenues rose 69% year-over-year to $486.2 million and adjusted EBITDA improved 32% to $213.7 million, or roughly 44% of sales.

GPRK has an aggressive 2022 drilling plan that aims for 40-48 wells and opening up 15-20 targets in new fields. Thanks to rising free cash flows – the cash leftover after capital expenditures, dividend payments and financial obligations have been met – the company anticipates self-funding its $30.6 million the drilling program. GeoPark told investors that every $1 spent on drilling in 2022 is expected to add $2.80 to adjusted EBITDA.

GeoPark has $77 million of cash and leverage of only 2.2 times adjusted EBITDA. The company used its cash in August to double its quarterly dividend, and in November, it commenced a 6 million share repurchase program. Even with the higher dividend, payout from cash flow is less than 5%, making the new dividend very safe.

As far as Wall Street analysts go, four say GPRK is a Strong Buy, two call it a Buy and two believe it's a Hold, according to S&P Global Market Intelligence. The $21 consensus price target for GPRK stocks is 68.5% higher than the current share price.

Lear

- Market value: $10.7 billion

- Dividend yield: 1.1%

- Dividend hike: 100%

Lear (LEA, $179.22) manufactures seating systems and electronic distribution and connection systems for automobiles, as well as embedded vehicle control software. The company sells to original equipment manufacturers (OEMs) worldwide and operates 257 manufacturing facilities across 38 countries.

Although component shortages in 2021 have hurt OEMs and affected Lear's sales, both of the company's businesses grew faster than the market and Lear is positioning for a 2022 rebound fueled by acquisitions and significant new joint ventures.

During the September quarter, Lear acquired a business from Kongsberg Automotive that is a market leader in luxury seating and is expected to contribute $300 million of revenues this fiscal year. In addition, Lear signed joint ventures with a manufacturer of automotive connector devices and a builder of on-board chargers for electric vehicles (EVs). Lear also launched products with General Motors (GM), Land Rover, Mercedes, Volvo and Jaguar.

The company signaled its expectation of a 2022 rebound by doubling its dividend and using some of its $1.1 billion of balance-sheet cash for share repurchases. Lear's low 13.7% payout makes frequent dividend increases manageable.

Wall Street analysts have six Strong Buy, four Buy, eight Hold and two Sell ratings on LEA. Evercore ISI is one of those that are bullish on the stock and recently upgraded LEA to Outperform (Buy). The research firm sees more than 30% upside for the shares over the next year.

Marathon Oil

- Market value: $13.1 billion

- Dividend yield: 1.6%

- Dividend hike: 100%

Marathon Oil (MRO, $16.83) is an independent energy company focused on production from four major U.S. oil plays – Eagle Ford in Texas, the Bakken formation in North Dakota, the Stack and Scoop properties in Oklahoma and the Permian Basin in New Mexico. Production is a 50-50 mix of natural gas and natural gas liquids (NGL) and averaged 284,000 barrels per day last quarter, with sales of 281,000 barrels per day.

MRO is reaping the benefits of natural gas and NGL prices that have roughly doubled in 2021 and the fact that the company has few near-term hedges in place limiting its upside from rising prices.

Marathon's free cash flow soared to $1.3 billion in the first nine months of 2021, which, combined with existing cash, enabled $1.4 billion of debt repayment, $200 million of share repurchases, and dividend increases three quarters in a row for a cumulative 100% dividend hike since the end of 2020.

The company plans to return 50% of December quarter cash flow to investors via share repurchases and dividends and recently authorized a new $2.5 billion share repurchase program. With $3.6 billion of liquidity and improving free cash flow, Wall Street analysts think the company could buy itself back within five years.

MRO is a top energy pick of Truist Securities analyst Neal Dingmann, who has a Buy rating on the stock. This outlook is shared by several Wall Street pros. Of the 31 covering Marathon Oil tracked by S&P Global Market Intelligence, 14 say it's a Strong Buy, six call it a Buy, 10 believe it's a Hold and just one deems it a Sell.

Morgan Stanley

- Market value: $181.45 billion

- Dividend yield: 2.8%

- Dividend hike: 100%

Morgan Stanley (MS, $101.12) is a leading global financial services firm with operations across 41 countries. The company provides investment banking, stock and bond trading, wealth management and institutional investment management services.

Last year, Morgan Stanley closed two major acquisitions – E*Trade and Eaton Vance – which helped support growth of $400 billion of net new client assets and increased total client assets under management to a staggering $6.2 trillion.

E*Trade gives MS 5.2 million new client accounts, a major presence in online brokerage and a more durable, diversified revenue stream. In addition, E*Trade's strong deposit base averaging around $56 billion per year provides a source of funding for Morgan Stanley's loans to wealthy clients, an area where the company has struggled. The financial firm also expects to realize $400 million of operating synergies from the deal.

The impact of these acquisitions is apparent in 2021 results. Morgan Stanley's revenues grew 28% during the first nine months of this year and adjusted earnings per share (EPS) rose 30%. September quarter results showed revenues 24% higher from the year prior and 19% EPS gains.

Morgan Stanley signaled its positive outlook with a 100% dividend hike during 2021. A conservative 26% payout has helped the company deliver eight consecutive years of dividend increases and 24 years in a row of paying dividends.

Wall Street analysts look for Morgan Stanley to outperform banking peers in 2022 and deliver exceptional dividend growth. The consensus rating among the eight analysts following the stock being tracked by S&P Global Market Intelligence is Buy.

Suncor Energy

- Market value: $38.8 billion

- Dividend yield: 5.1%

- Dividend hike: 109%

Canadian oil driller Suncor Energy (SU, $26.64) develops reserves in Canada's Athabasca oil sands formation, which is one of the world's largest petroleum resource basins. The company's oil sands operations recover a substance called bitumen that is either upgraded on-site or sent to market as a refinery feedstock, diesel fuel or other byproduct. Oil sands make up 7.4 billion of Suncor's 7.8 billion barrels of reserves.

In addition to oil production, Suncor owns four refineries with a combined refined product capacity of 460,000 barrels per day, Canada's largest ethanol plant and 1,800 Petro-Canada gas stations across the Great White North.

Rising oil prices created a tailwind for the company in 2021. Suncor hits breakeven at oil prices of approximately $35 a barrel, and West Texas Intermediate (WTI) oil prices are currently around $80 per barrel. SU also has initiatives underway that will further lower breakeven costs by another $4.50 per barrel by 2023 and $8.00 per barrel by 2025.

Suncor used its greatly increased 2021 free cash flow to double its dividend, make the largest share buyback in its history, cut $3 billion from debt and invest $2.6 billion-$3.1 billion in its operations. Going forward, Suncor is targeting 25% annual dividend increases over the next five years.

This would add to Suncor's 29-year history of paying dividends and with a cash flow payout ratio of 15%, there's plenty of room for dividend growth.

As far as analyst ratings go, there are six Strong Buys, 10 Buys and six Holds on SU. Analysts like the company's low breakeven, high margin of safety, commitment to a rising dividend and modest valuation.

SU shares look cheap, too, trading at 11.3 times forward earnings – a 35.8% discount to the company's five-year average forward price-to-earnings (P/E) ratio.

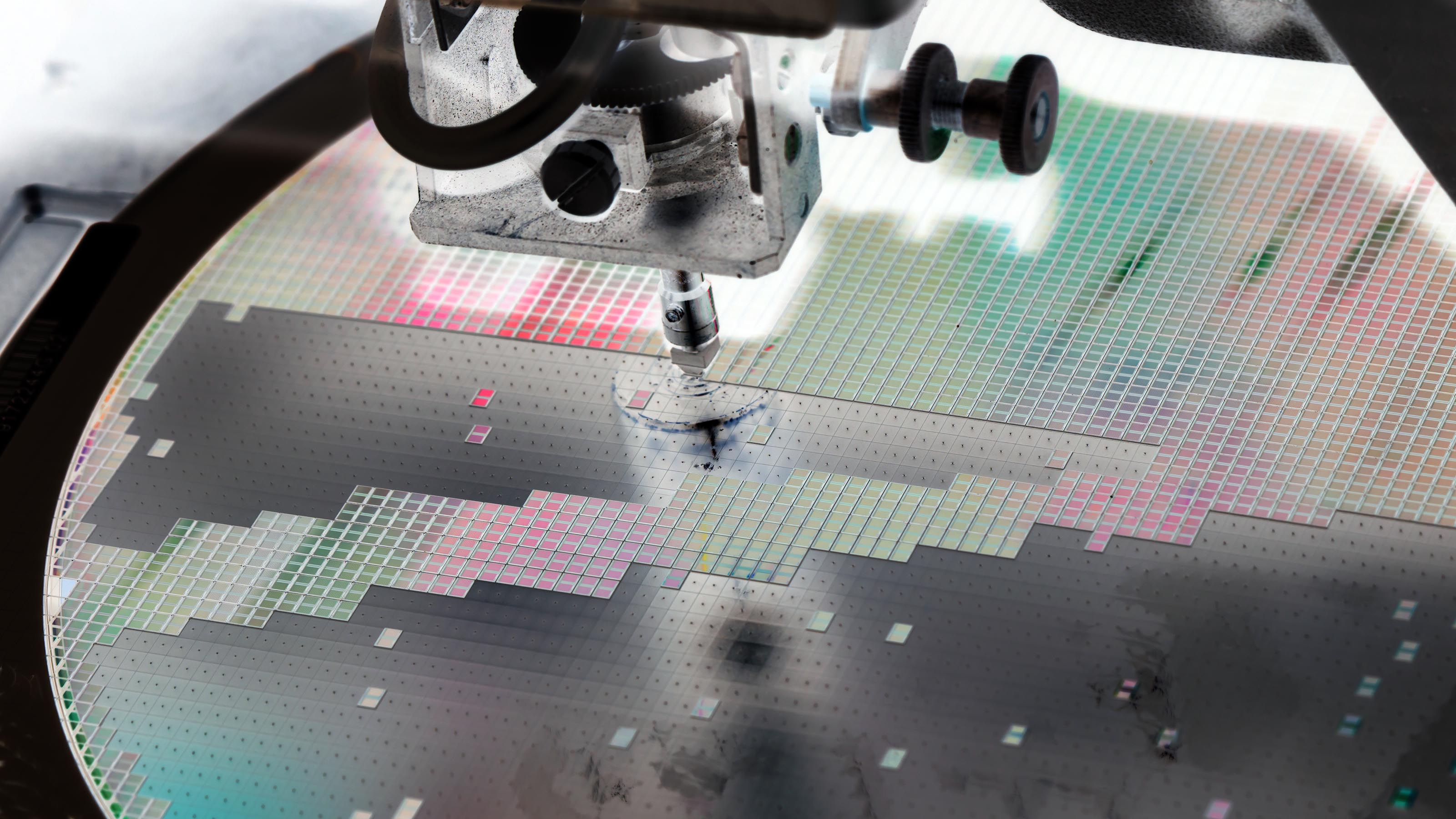

United Microelectronics

- Market value: $28.3 billion

- Dividend yield: 2.5%

- Dividend hike: 110%

United Microelectronics (UMC, $11.41) operates 12 semiconductor wafer foundries across Taiwan, Singapore, China, Hong Kong, Europe and the U.S. The company is one of the world's largest chipmakers, counting among its customers telecom giants such as Broadcom (AVGO), MediaTek, Texas Instruments (TXN) and Qualcomm (QCOM).

Chip shortages coming out of the pandemic recovery, fueled by newer chip applications in 5G and auto, have semiconductor prices surging in 2021 and industry players like UMC working at 100% capacity. Wafer shipments have risen five quarters in a row.

UMC's revenues rose 25% year-over-year in the September quarter, and EPS rose 91%. The company is guiding for wafer shipments and average selling prices to each rise 1%-2% during the December quarter, with 100% capacity utilization expected.

Technology market research firm IDC sees the semiconductor market reaching $600 billion by 2025, which equates to an annual growth rate of 5.3%. Increased revenues will come from new chip applications in 5G, smartphones, game consoles and automotive.

UMC signaled its confidence by raising its dividend 110% in July. The company boasts an 11-year track record of paying dividends and 26% annual dividend increases over the past five years. Payout has remained conservative at 37% of total earnings.

UMC shares are well-liked by Wall Street analysts. Of the four following the stock tracked by S&P Global Market Intelligence, two have a Strong Buy rating, one says Buy and one calls it a Hold.

Alico

- Market value: $265.3 million

- Dividend yield: 5.6%

- Dividend hike: 178%

Alico (ALCO, $35.25) is an American agribusiness that owns 84,000 acres of citrus groves and other farmland. The company is one of the largest citrus growers in North America, holds a roughly 12% share of the Florida citrus market and has Tropicana as its largest customer. Alico was named Tropicana's top grower four years in a row.

Citrus prices have increased significantly in 2021 as a result of a tightened citrus supply and rising fresh orange juice consumption. The company is well-positioned to capitalize on strong pricing trends due to 1.5 million new citrus trees planted since 2018 from which Alico can begin harvesting fruit in 2022.

The company estimates production at 6.4 million boxes of citrus this year. Harvesting fruit from the newer trees could boost annual production by 56% next year to 10.0 million boxes.

In addition to citrus groves, Alico owns 35,000 acres of grazing land for cattle and 90,000 acres of oil, gas and mineral rights in Florida. The value of Alico's land holdings, less the company's debt, is estimated at $415 million-$548 million, nearly twice the company's market value.

Alico's adjusted EBITDA grew 42% in the first nine months of 2021 and adjusted EPS jumped to $4.77 from 86 cents the year prior.

This company has rewarded investors with multiple dividend increases since 2019, including a 178% dividend bump in 2021. Dividend payout over the past 12 months was a relatively modest 19%.

ALCO is covered by just one Wall Street analyst, but they maintain a Buy rating on the stock. Meanwhile, their price target of $44 represents implied upside of 22% to current levels.

Methanex

- Market value: $3.3 billion

- Dividend yield: 1.1%

- Dividend hike: 233%

Methanex (MEOH, $43.87) is the world's largest producer of methanol, a clean-burning chemical that is used to produce foams, resins, plastics, paints and medical products. Methanol is also used as an alternative energy fuel to power vehicles and heat homes. The company supplies methanol to a worldwide customer base and maintains a global network of terminals, storage facilities and the industry's largest tanker fleet.

Methanol demand rebounded in 2021 as a result of higher industrial production. MEOH is also benefiting from renewed interest in methanol as a marine and vehicle fuel. Methanol is being blended into gasoline and used in existing vehicles. Taxis in China are already running on methanol-blended fuel and several other countries are assessing or in the commercial stage of adding methanol to vehicle fuels.

The company's methanol sales volume grew 6.5% and prices rose 60% in the first nine months of 2021. Methanex's revenues improved 72%, adjusted EBITDA grew 266% and adjusted EPS swung to $3.60 from a $1.77 per-share loss a year ago.

To capitalize on methanol demand predicted to rise by 20% or 16 million tons, over the next five years, Methanex is building a new 1.8 million-ton methanol plant in Louisiana expected to begin operations in late 2023.

Concurrent with the announcement of this construction project in July, Methanex raised its dividend 233% to an annualized rate of 50 cents per share.

The company has paid shareholders 18 years in a row and issued dividend increases every year between 2017 and 2019. Payments were reduced sharply at the onset of the pandemic and the new 2021 dividend amount is roughly one-third of what it was in 2019. With payout at only 6%, Methanex has plenty of flexibility when it comes to dividend growth.

Wall Street analysts predict free cash flow will surge in 2022 and the dividend rate will climb quickly again once Methanex hits its goal of having $1.1 billion of cash on the balance sheet. The company ended the September quarter holding $932 million of cash.

SLM

- Market value: $5.4 billion

- Dividend yield: 2.4%

- Dividend hike: 267%

SLM (SLM, $18.50), also known as Sallie Mae, is the largest originator of private student loans in the U.S. In addition to lending, the company markets deposit accounts, high-yield savings accounts and other banking products to its customers.

A return of students to college campuses in 2021, assisted by federal stimulus funds and direct payments to schools from the Higher Education Emergency Relief Fund, created tailwinds for Sallie Mae that fueled 10% year-over-year loan origination growth during the September quarter. The company's loan originations have risen steadily since 2016 with the exception of 2020.

Lower-than-expected charge-offs and delinquent loans as well as a greatly reduced share count due to repurchases create a strong outlook for future EPS.

Sallie Mae rewarded investors with a 267% dividend hike this year. The company's ultra-low 3%-6% payout from adjusted earnings creates optimal flexibility for more dividend growth.

SLM stock has six Strong Buy and four Buy ratings (compared to two Holds and zero Sells) from Wall Street analysts. In addition, insiders have recently stepped-up share purchases, which is often seen as a positive sign. SLM shares are modestly priced, too, trading at just 6.7 times forward earnings.

Advance Auto Parts

- Market value: $14.6 billion

- Dividend yield: 1.7%

- Dividend hike: 300%

Advance Auto Parts (AAP, $233.37) supplies replacement auto parts through a network of more than 4,700 stores across North America. The company mainly sells to automotive repair professionals, which account for roughly 60% of sales. In 2021, AAP launched Carquest – a new store concept that targets the automotive do-it-yourself (DIY) channel and provides customers with additional operations and merchandising support.

AAP benefits from the aging of the U.S .vehicle fleet. The average age of cars and light trucks in the U.S. is a record 12.1 years, according to research firm IHS Markit. Aged vehicles account for most replacement parts demand since these vehicles are typically past warranty and serviced by independent garages. Demand for replacement parts surged in 2021 due to rising car prices and scarcity of new vehicles, which caused owners to repair rather than replace vehicles.

Even before COVID-19, the company was posting impressive financial results, with comparable store sales experiencing a 1.9% compound annual growth rate (CAGR) and adjusted EPS expanding at 16.6% CAGR since 2018.

In the first nine months of 2021, sales rose 11.7% year-over-year and adjusted EPS soared 49.5%. Advance Auto Parts is targeting 80-120 net new store openings and 6%-8% same-store sales growth in 2021, which analysts expect to drive 39.4% EPS gains.

The company has a 15-year record of paying dividends and rewarded investors with a 300% dividend hike in 2021. Payout is targeted at around 30% of future earnings.

Analysts are mostly bullish on AAP stock, with 10 calling it a Strong Buy and two saying Buy, compared to 11 rating it at Hold and one at Sell. Plus, Credit Suisse included AAP among its nine "top of the crop" picks in November and UBS calls AAP one of its high-conviction, strong[ pricing power stocks.

Trinseo

- Market value: $2.0 billion

- Dividend yield: 2.5%

- Dividend hike: 300%

Trinseo (TSE, $51.81) is a global manufacturer of plastics and latex binders used in automotive, consumer electronics, medical devices, packaging and other end-markets. The company generates $3 billion of annual sales and operates 26 manufacturing sites worldwide.

Despite higher material costs and supply-chain challenges in 2021, Trinseo delivered 87% year-over-year sales gains and 81% adjusted EPS growth during the September quarter. The company is guiding for record 2021 financial results.

Trinseo plans to boost profits by shifting its business mix away from commodity chemicals and toward highly specialized, value-added products. The shift began in late 2020 with the $1.36 billion acquisition of PMMA operations from Arkema (ARKAY). PMMA is a rigid, transparent plastic used in automotive, medical and consumer electronics applications. In connection with the acquisition, Trinseo cut its dividend to focus more resources on reducing acquisition-related debt.

Having successfully reduced leverage to roughly two times EBITDA, Triseo recently acquired PMMA manufacturer Aristech, announced the sale of its synthetic rubber business and rewarded shareholders with a 300% dividend hike. The new dividend is 20% below the 2020 rate, which could make another dividend hike likely in early 2022.

In addition, with the consensus analyst estimate for $10.80 in EPS this year, Trinseo could easily afford to hike its $1.28 per share annualized dividend.

Despite the company successfully expanding into higher-margin businesses, TSE shares are cheap, trading at just 5.5 times forward earnings.

Star Bulk Carriers

- Market value: $2.1 billion

- Dividend yield: 5.2%

- Dividend hike: 317%

With a fleet of 128 vessels and 14.1 million tons of freight capacity, Star Bulk Carriers (SBLK, $20.99) is one the world's largest shipping companies, transporting bulk cargo like iron ore, coal, grain and fertilizer for businesses on a global scale.

Bulk shipping rates have surged to a decade-plus high in 2021 as a result of a post-pandemic surge in demand and tight supply worsened by a dearth of new vessels joining the fleet. What originally looked like a short-term shipping rate spike earlier in the year now appears structural and long-term, according to shipping industry insiders.

Strong fleet utilization and rising shipping rates contributed to Star Bulk Carriers' stellar September quarter performance, which showed sales rising 108% year-over-year, adjusted EBITDA increasing 248% and adjusted EPS surging to $2.20 from 29 cents per share one year ago. The company utilized its rising cash flow to trim adjusted net debt by 35% and interest expense by roughly $5 million this year.

Star Bulk Carriers hiked its dividend to $1.25 per share in November – up 317% from the 30 cents per share it paid in May.

Stifel analyst Benjamin Nolan has a Buy rating on the shipping stock, saying the company's strong Q3 were reflective of a solid dry bulk market."With plenty of upside in valuation, as long as dry bulk rates stay at these healthy levels, cash flows and dividends should continue to accrue to SBLK shareholders," he adds.

Devon Energy

- Market value: $30.5 billion

- Dividend yield: 1.0%

- Dividend hike: 345%

Devon Energy (DVN, $45.09) is an independent oil and gas producer who owns drilling properties in prolific U.S. plays that include Eagle Ford and the Anadarko, Delaware, Powder River and Williston Basins. The company's production is a diversified mix of oil, natural gas and natural gas liquids. At Devon's current pace of drilling, its existing, undeveloped properties represent 10 years of low-risk development inventory.

Production volume rose to 608,000 barrels per day during the September quarter and exceeded guidance by 5%. Devon's operating cash flow rose 46% year-over-year to $1.6 billion. After investing 30% in development activities, the company was left with $1.1 billion of free cash flow, up eightfold from last year and the highest quarterly amount in Devon's 50-year history.

With breakeven costs of only $30 per barrel, Devon anticipates free cash flow yields ranging from 15%-18%, assuming WTI oil prices of $70 per barrel to $80 per barrel.

The good news for current investors is that Devon is prioritizing free cash flow generation and returning cash to shareholders over volume growth. During the September quarter, the company raised its fixed-plus-variable rate dividend by 71%, initiated a $1.0 billion share repurchase program and increased balance sheet cash to $2.3 billion.

Devon has a 29-year track record of paying dividends, grew the fixed component of its quarterly dividend 345% this year to 49 cents per share and is guiding for better than 90% dividend growth in 2022.

DVN stock is well-liked by Wall Street analysts. Of the 33 following the stock tracked by S&P Global Market Intelligence, 21 say it's a Strong Buy, seven believe it's a Buy and just five have it at Hold. Investors like the company's rich resource base, modest valuation and upside surprise potential tied to both dividend hikes and share repurchases.

Genco Shipping & Trading

- Market value: $617.1 million

- Dividend yield: 2.2%

- Dividend hike: 650%

Genco Shipping & Trading (GNK, $14.72) is an ocean freight carrier that transports iron ore, coal, grain and other bulk commodities worldwide. The company owns a fleet of 44 vessels of various sizes and configurations with an aggregate capacity of approximately 4.4 million deadweight tons.

Shipping rates have hit decade-plus highs in 2021 and Genco's president recently told Bloomberg that he expects rates to move even higher because of clogged supply chains and expanded trade that is straining fleet capacity. According to Genco, every $1,000 increase in daily rental rates for its 44-vessel fleet equates to $16 million of incremental annualized EBITDA.

The company's September quarter EPS was the highest in 13 years and quarterly EBITDA of $79.8 million exceeded full-year 2020 EBITDA.

Genco took advantage of robust pricing in September by locking in high daily rates for several vessels over multi-year periods. The company also took delivery of four new vessels that will immediately begin contributing to cash flow.

Genco has used its expanded 2021 cash flow to trim one-third from its debt and issue dividend increases three times for a cumulative 2021 increase of 650%. The company began paying quarterly dividends in 2020 and maintains payout at a modest 13%-14% of cash flow.

GNK shares have six Strong Buy ratings, one Buy and one Hold from Wall Street analysts, who expect shipping rates to remain at elevated levels next year, which will help expand the company's cash flows and share price.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa currently serves as an equity research analyst for Singular Research covering small-cap healthcare, medical device and broadcast media stocks.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.