If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

Apple stock is back at record highs, but then it's been a buy-and-hold beast for the ages.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Apple (AAPL) stock took investors on quite a ride in 2025. Shares that were off as much as 30% for the year to date in early spring are now trading at record levels.

AAPL's 60% rally off its April nadir added about $1.6 trillion to the company's market cap in eight months. That's remarkable. Anyone who timed the bottom is probably feeling pretty good about their trading skills.

But truly long-term buy-and-hold Apple investors should be even more pleased. They've lived through this sort of volatility before – and have enjoyed incomparable returns over the past few decades – just by sitting on their hands.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

From January 1990 through December 2020, AAPL stock created $2.67 trillion in shareholder wealth, or an annualized dollar-weighted return of 23.5%, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Indeed, per Bessembinder's findings, which account for a stock's increase in market cap adjusted for cash flows in and out of the business and other adjustments, Apple was the best stock in the world over those 30 years.

True, AAPL stock traded sideways for the first few years of the 21st century, but an explosion of innovation soon put an end to that.

Under the visionary leadership of the late Steve Jobs, Apple essentially reinvented itself for the mobile age, launching revolutionary gadgets such as the iPod, MacBook and iPad.

But what really set Apple on its course to becoming the world's third-largest publicly traded company – and one of hedge funds' favorite blue chip stocks – was the 2007 debut of the iPhone.

Today, Apple isn't just a purveyor of gadgets; it sells an entire ecosystem of personal consumer electronics and related services. And it's a sticky ecosystem at that.

No less an eminence than Warren Buffett has called the iPhone maker Berkshire Hathaway's (BRK.B) "third business," noting Apple fans' fantastic brand loyalty as one reason for being all-in on the stock. (Apple accounts for roughly 23% of the value of the Berkshire Hathaway equity portfolio.)

True, Berkshire Hathaway cut its Apple stake sharply over the past year, but that was because the holding company believes that corporate taxes are likely to rise at some point in the future. Bulls needn't worry about Berkshire losing its taste for the stock. Warren Buffett adores Apple as much as ever.

Little wonder the iconic tech firm was tapped to become one of the elite 30 Dow Jones stocks. In 2015, Apple replaced AT&T (T) in the Dow Jones Industrial Average.

The bottom line on Apple stock?

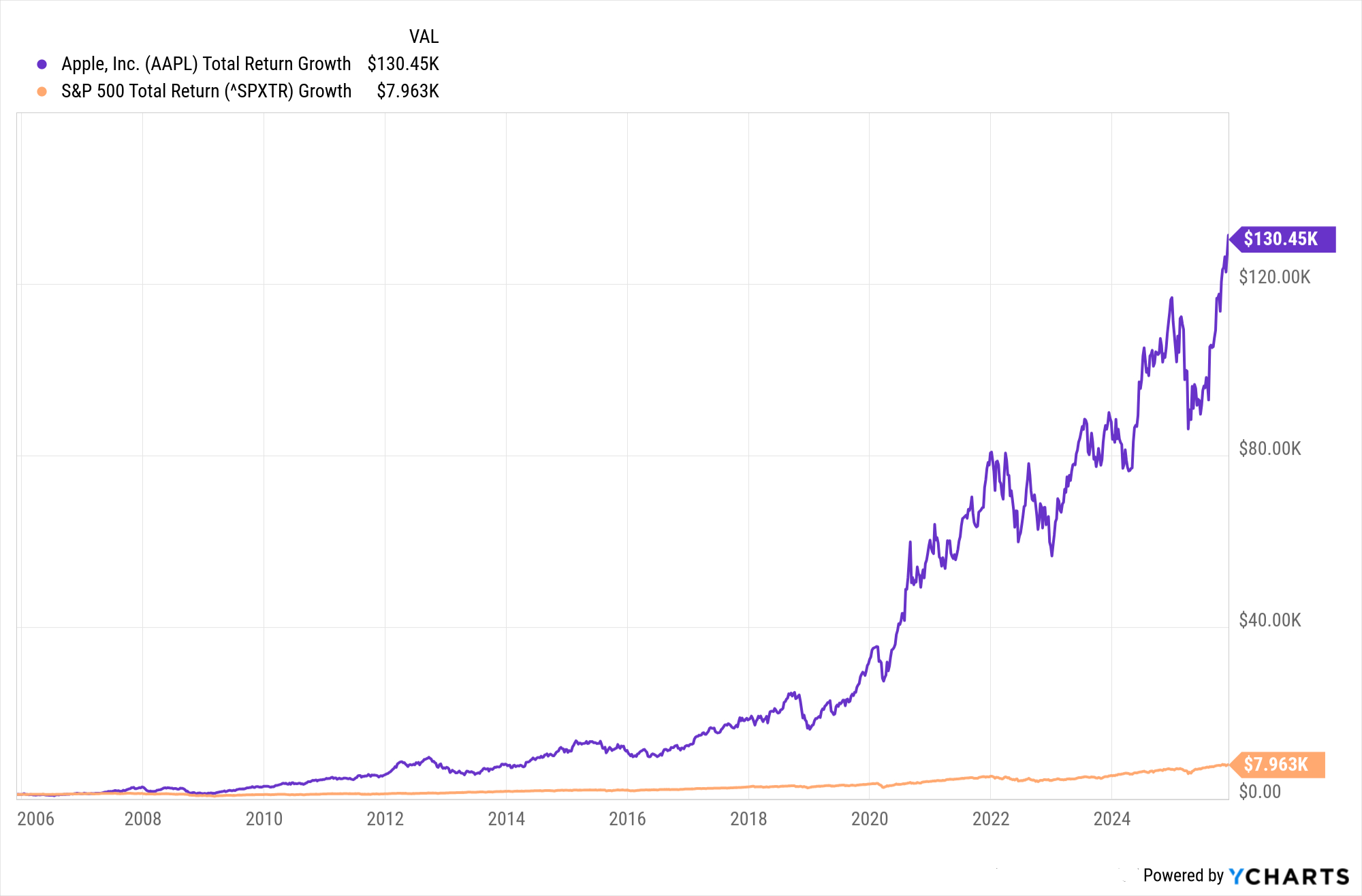

Over the past 20 years Apple stock generated an annualized total return (price change plus dividends) of 27.6%. By comparison, the S&P 500 delivered an annualized total return of 10.9% over the same span.

What does that look like on a brokerage statement? Check out the chart below and you'll see that if you invested $1,000 in Apple stock 20 years ago, it would today be worth about $130,000.

The same $1,000 invested in the S&P 500 would theoretically have turned into about $8,000 over the same period.

For those wondering if Apple stock is a buy at current levels, Wall Street mostly thinks so.

Of the 48 analysts covering AAPL surveyed by S&P Global Market Intelligence, 24 rate it at Strong Buy, five say Buy, 15 have it at Hold, three say it's a Sell and one has it at Strong Sell.

That works out to a consensus recommendation of Buy, albeit it with mixed conviction.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Amazon Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Netflix Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.