Stock Market Today: Stocks Soar as Treasury Yields Retreat

The stock market rallied after the Bank of England took action to stabilize its financial markets.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market bounced sharply on Wednesday after the Bank of England (BoE) took emergency action to shore up its bond market.

Similar to the U.S. Treasury market, yields on U.K. government bonds have been spiking lately. The most recent surge came after the government put into effect the largest set of tax cuts in decades – a move that sent the British pound spiraling. Overnight, though, the BofE said it will begin buying longer-term U.K. bonds and delay selling bonds it purchased during the pandemic "to restore orderly market conditions."

This led to a rally in U.K. and U.S. bonds, which sent yields lower (remember, bond prices and yields move in opposite directions). Most notably, the 10-year Treasury yield, which earlier topped the 4.0% level for the first time since 2008, finished down 23.8 basis points at 3.725%. A basis point is one-one hundredth of a percentage point.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

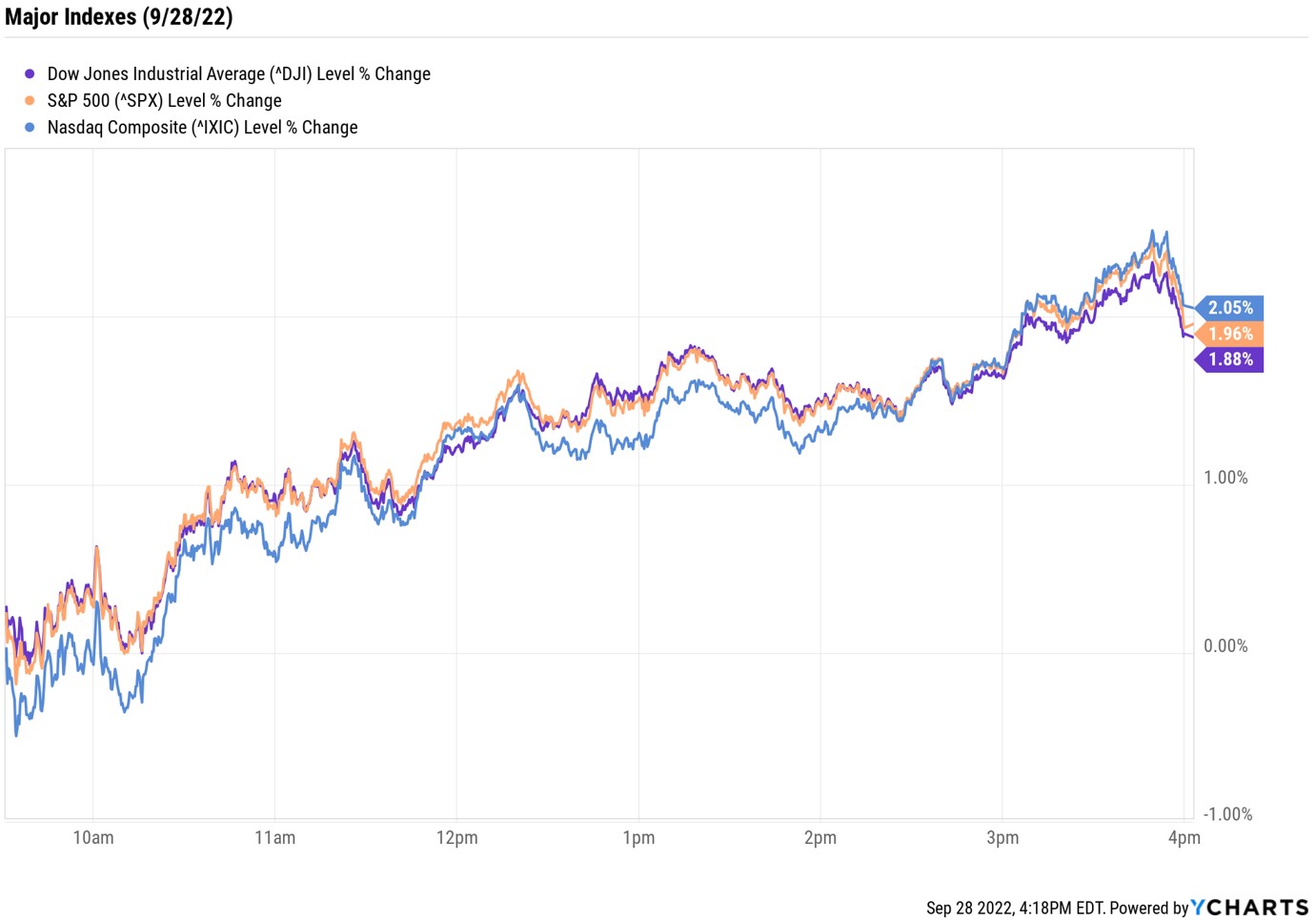

As for the equities market, the Dow Jones Industrial Average jumped 1.9% to 29,683, the S&P 500 Index rallied 2.0% to 3,719, and the Nasdaq Composite gained 2.1% to 11,051.

Other news in the stock market today:

- The small-cap Russell 2000 jumped 3.2% to 1,715.

- U.S. crude futures spiked 4.7% to settle at $82.15 per barrel as Hurricane Ian gained strength in the Gulf of Mexico.

- Gold futures rose 2.1% to finish at $1,670 an ounce.

- Bitcoin gained 2.5% to 19,535. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Apple (AAPL) was the only Dow Jones stock to finish in negative territory today, shedding 1.3%. The move lower comes after a Bloomberg report suggested the tech giant has asked suppliers not to increase production of its new iPhone 14s as it anticipates a decline in demand. "We still believe that AAPL will meet/exceed September quarter expectations and see more favorable mix supporting average selling prices for the iPhone 14 cycle," says CFRA Research analyst Angelo Zino (Buy). "However, we see downside risk as we progress through the cycle, specifically in the March quarter, given extremely tough comparisons and our belief that not even AAPL is immune to macro headwinds. In addition, the virtually parabolic move/strength of the U.S. dollar is adding significant risk to all large-cap tech companies ahead of September quarter earnings season, including AAPL, where we see growth expectations likely be tempered within both hardware and services."

- Biogen (BIIB) soared 39.9% after the drugmaker reported positive late-stage study results for lecanemab, an Alzheimer's disease drug being co-developed with Japan's Eisai. The data showed the treatment slowed cognitive decline by 27% after 18 months. UBS Global Research analyst Colin Bristow (Buy) was one of many to chime in on BIIB stock today, calling the results "clinically meaningful" and "the positive Alzheimer's data point we were waiting for."

What's Next for Stocks?

So, what's next for the stock market? It's a question that will only be answered with time, but also one that has sparked a lot of chatter around Wall Street.

"We know the stock market doesn't just go up in a straight line," says Scott Wren, senior global market strategist at Wells Fargo Investment Institute. For investors, Wren says "it is helpful to look at history and realize that at some point inflation will ease, financial markets will stabilize, and the Federal Reserve will be finished hiking interest rates. While those things won't likely happen tomorrow or next week, we believe the markets are pricing in much of the bad news we expect to hear in coming months."

Wren is just a single voice of many, and here, we've rounded up what some other top minds are expecting next for stocks – including one strategist who makes a compelling case for owning both value and growth stocks in the current environment. See what they have to say.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.