Stock Market Today: Downgraded Apple Drags on Stocks

The iPhone maker was handed a rare downgrade on concerns over weakening consumer demand.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Yesterday's market rise proved just a blip as stocks on Thursday returned to the script for most of September by finishing solidly in negative territory.

The decline came as yields on government bonds resumed their climb. After the 10-year Treasury yield notched its biggest one-day decline since 2009 yesterday, it rose 6.2 basis points today to 3.769% (a basis point is 0.01%).

A pair of economic reports did little to lift sentiment. The final reading on Q2 gross domestic product (GDP) confirmed the U.S. economy contracted for a second straight quarter, meeting the technical definition of a recession. Additionally, weekly jobless claims fell more than economists were expecting (193,000 actual vs. 215,000 estimate), hitting their lowest level since April. While this jobs data "would ordinarily be celebrated, on this occasion that resilience could translate to stubborn inflation and more rate hikes," says Craig Erlam, senior market analyst at currency provider OANDA.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In terms of single-stock movers, Apple (AAPL, -4.9%) took a notable slide after BofA Securities analyst Wamsi Mohan downgraded the tech giant to Neutral (the equivalent of Hold) from Buy, citing weaker consumer demand for its new iPhone 14.

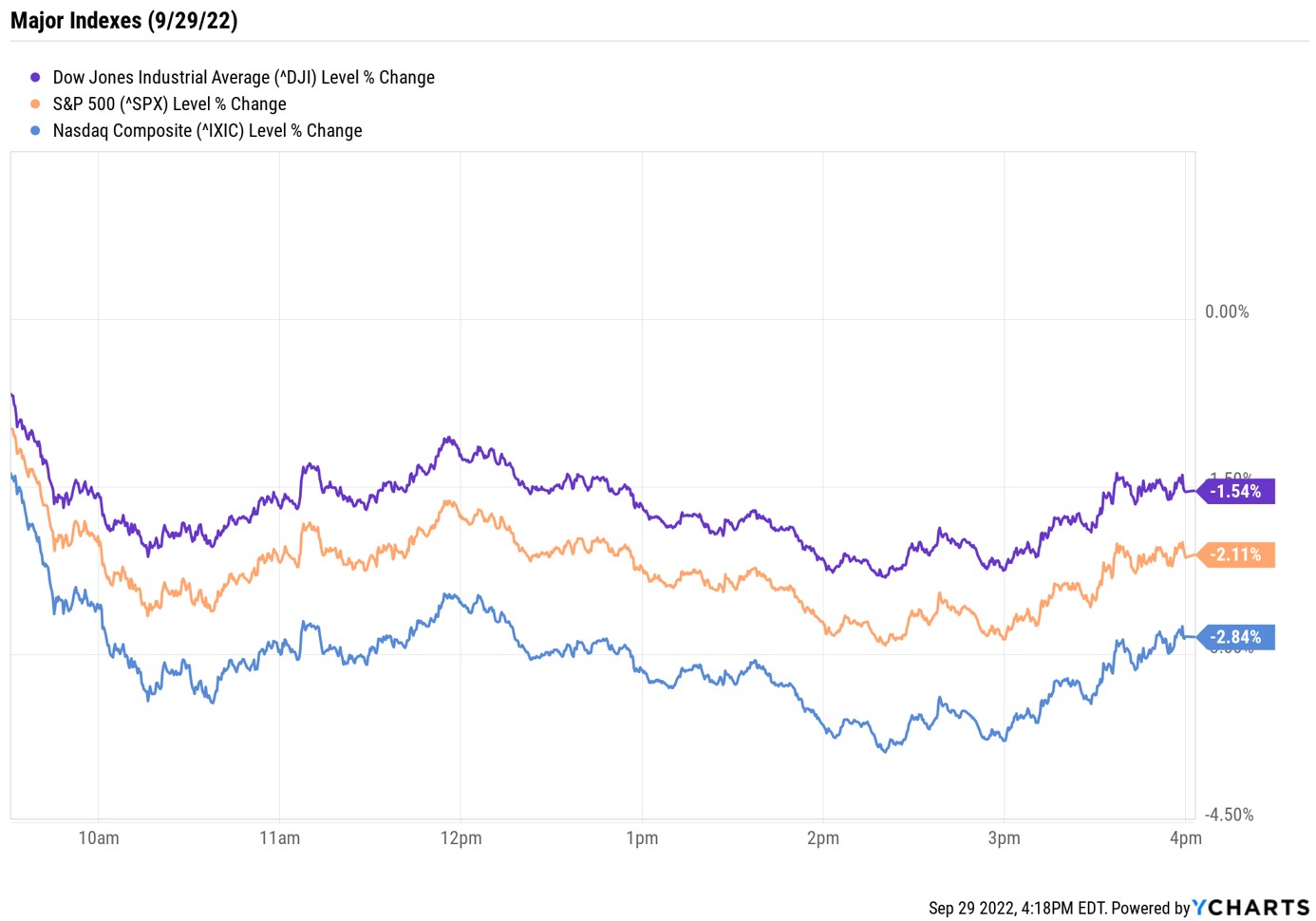

AAPL's decline put more pressure on the major indexes, with the Dow Jones Industrial Average shedding 1.5% to 29,225, the S&P 500 Index giving back 2.1% to 3,640, and the Nasdaq Composite sliding 2.8% to 10,737.

Other news in the stock market today:

- The small-cap Russell 2000 spiraled 2.4% to 1,674.

- U.S. crude futures fell 1.1% to finish at $81.23 per barrel.

- Gold futures ending marginally lower at $1,668.60 an ounce.

- Bitcoin slipped 0.6% to $19,420.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- CarMax (KMX) plummeted 24.6% after the used car dealer reported earnings. In its fiscal second quarter, KMX recorded a 54% year-over-year drop in earnings to 79 cents per share, while revenue ticked up 2% to $8.1 billion. Analysts were expecting earnings of $1.72 per share on $8.5 billion in sales. "On their conference call the company's CEO highlighted broad weakness in the used car market," says Michael Reinking, senior market strategist at the New York Stock Exchange. "This news has hit the auto makers, OEMs and semiconductor stocks hard. One slight positive takeaway from this report is that car prices are moving lower. This has been a big source of inflationary pressure over the last year so we should expect to see this flow through the data in the coming months."

- Bed Bath & Beyond (BBBY) tumbled 4.2% after the home goods retailer said fiscal second-quarter sales fell 28% to $1.4 billion, while its net loss widened to $4.59 per share from 72 cents per share in the year-ago period. Consensus estimates were for revenue of $1.5 billion and a per-share loss of $1.85. Additionally, same-store sales plummeted 26% over the three-month period.

Q4 Stock Opportunities

We're rounding third and heading for home. More specifically, tomorrow marks the end of the third quarter, meaning there's just one more to go in what has been a tough year for stocks.

We're certain to see more volatility through the end of the year, with the third-quarter earnings season set to kick off in two weeks, midterm elections happening in early November and two more Fed meetings on the docket. But we are also entering a historically positive stretch for stocks. Since 1928, the S&P 500 has averaged gains of 0.5% in October, 0.8% in November and 1.4% in December, according to Yardeni Research.

This year's slump creates "incredible opportunity," says Sonia Joao, chief operating officer of Robertson Wealth Management. "Some of our favorite growth names, particularly in technology, are trading at prices we never expected to see again." With that in mind, take a look at the best stocks to buy for the rest of 2022 and beyond. Some of these are familiar names and others are not so well known, but they all present potential opportunities heading into the final quarter of the year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.