Stock Market Today: Stock Rally Continues; Twitter Soars on Musk U-Turn

The Tesla CEO said he now wants to buy Twitter at his original offer price.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

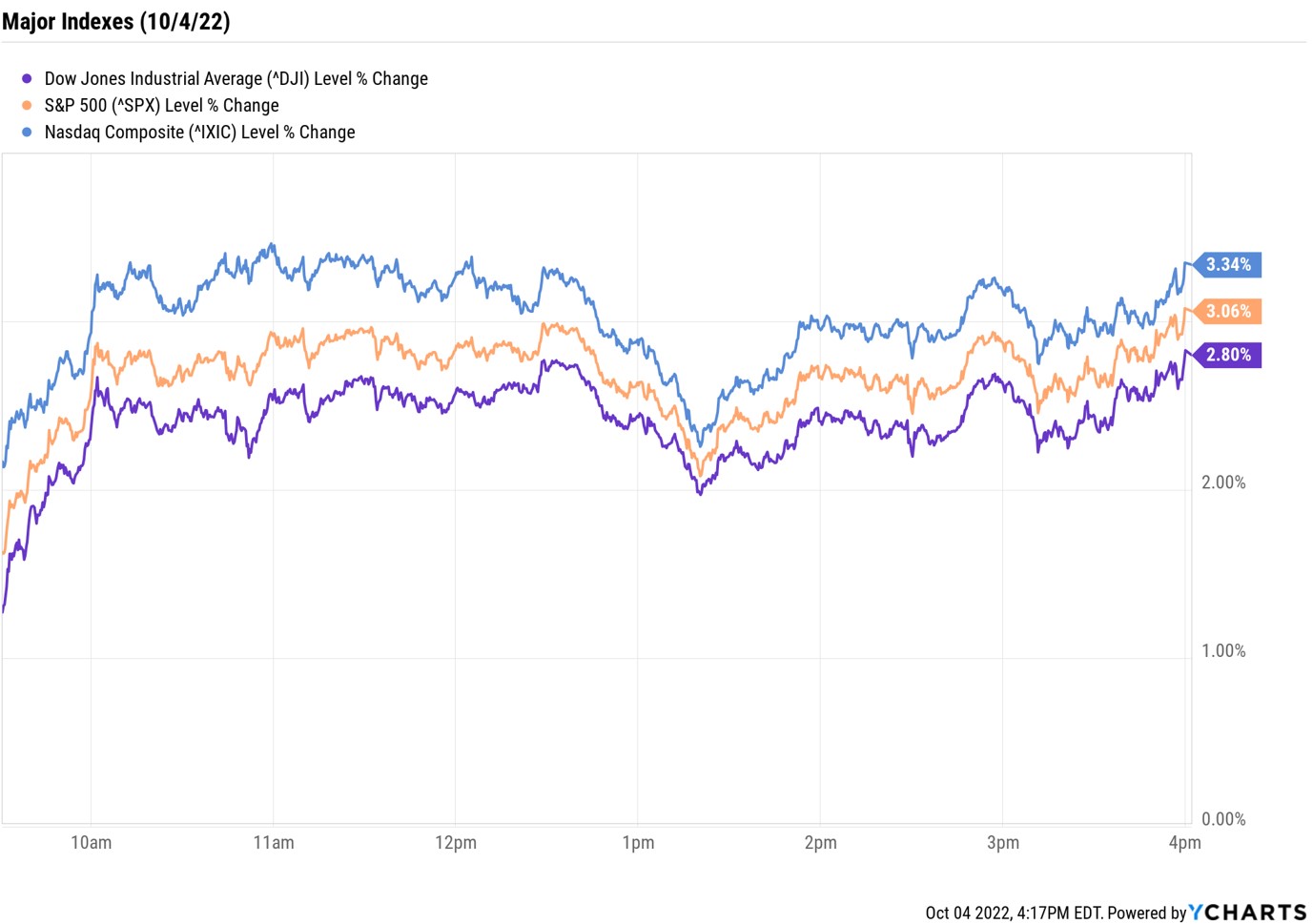

Stocks ran higher for a second straight day, building on Monday's gains which saw the three major indexes each rally more than 2%.

There were two different catalysts behind Tuesday's surge. Both raised hopes that the streak of aggressive Fed rate hikes could end sooner rather than later. One came from the Reserve Bank of Australia, which overnight issued a lower-than-expected rate hike. The other was this morning's Job Openings and Labor Turnover Survey (JOLTS) that showed job openings in the U.S. declined by 10% in August while layoffs edged higher.

"A hot labor market continues to be a challenge to the Fed's goal," says Matt Dyer, investment analyst at institutional asset management firm Penn Mutual Asset Management. But while "this morning's JOLTS data release shows some signs of cooling, the labor market is still running extremely hot with job openings outweighing the number of job seekers," Dyer adds.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The day's headlines weren't all about global central banks and economic data, though. In single-stock news, Twitter (TWTR, +22.2%) rallied after Bloomberg reported that Tesla (TSLA, +2.9%) CEO Elon Musk will reverse course and go through with his original $44 billion bid to buy the social media company. The two parties were scheduled to go to court later this month after Musk in August accused Twitter of fraud and said he wanted to walk away from the deal.

"It's the latest twist in the dramatic takeover saga, and comes just two days before he was set to be deposed by Twitter's lawyers, raising speculation that 'Team Musk' believe the chances of the court ruling in his favor were slim," says Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown. "If Elon Musk loses, it could mean he'd be forced to complete the deal or be made to pay billions or more for breach of contract."

At the close, the Dow Jones Industrial Average was up 2.8% at 30,316. The S&P 500 Index (+3.1% at 3,790) and the Nasdaq Composite (+3.3% at 11,176) also finished with solid gains.

Other news in the stock market today:

- The small-cap Russell 2000 rocketed 3.9% to 1,775.

- U.S. crude futures jumped 3.5% to finish at $86.52 per barrel ahead of tomorrow's highly anticipated OPEC+ meeting.

- Gold futures gained 1.7% to end at $1,730.50 per ounce.

- Bitcoin rose 3.4% to $20,220.13. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Poshmark (POSH) popped 13.1% after the online second-hand apparel marketplace said it will be acquired by South Korean internet firm Naver for $1.2 billion, or $17.90 per POSH share. Today, the stock closed just below here at $17.61. "E-commerce has been one of the toughest sub-groups in our coverage over the past 12-18 months, with the average of our six e-commerce names trading ~80% below their 52-week highs," says Wedbush analyst Tom Nikic (Neutral). "This deal, however, may have created a 'floor' for this beaten-down group. Admittedly, POSH does have some key advantages that make them relatively more attractive to potential acquirers (healthy cash balance, asset-light business model, large user base, 'social network' characteristics, etc.), but some of the other e-commerce names in our coverage look particularly cheap in light of the proposed takeout."

- Rivian Automotive (RIVN) soared 13.9% after the electric vehicle (EV) maker said production in the third quarter was up 67% from Q2. The company also confirmed that it is on pace to reach its 2022 goal of building 25,000 vehicles.

Midterm Elections and Stocks

Another potentially positive driver for the stock market is right around the corner: the midterms. Congressional midterm elections will occur on Tuesday, Nov. 8, and determine which political party controls the House of Representatives and the Senate for the next two years.

A lot can happen between now and the midterm election races, but odds seem increasingly likely for a split Congress – which tends to be the most bullish outcome for the stock market. "Historically, split governments have been the best for equities," says Savita Subramanian, head of equity and quantitative strategy at BofA Securities. "Q4 has seasonally been the strongest quarter (+4.5% on average and positive 81% of the time), particularly in midterm years (+7.7% on average and 86% positive hit rate)."

But returns aren't the only impact elections can have on the stock market. Here, we explore what else the midterms could mean for investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.