Stock Market Today: Stocks Close Lower After Roller-Coaster Session

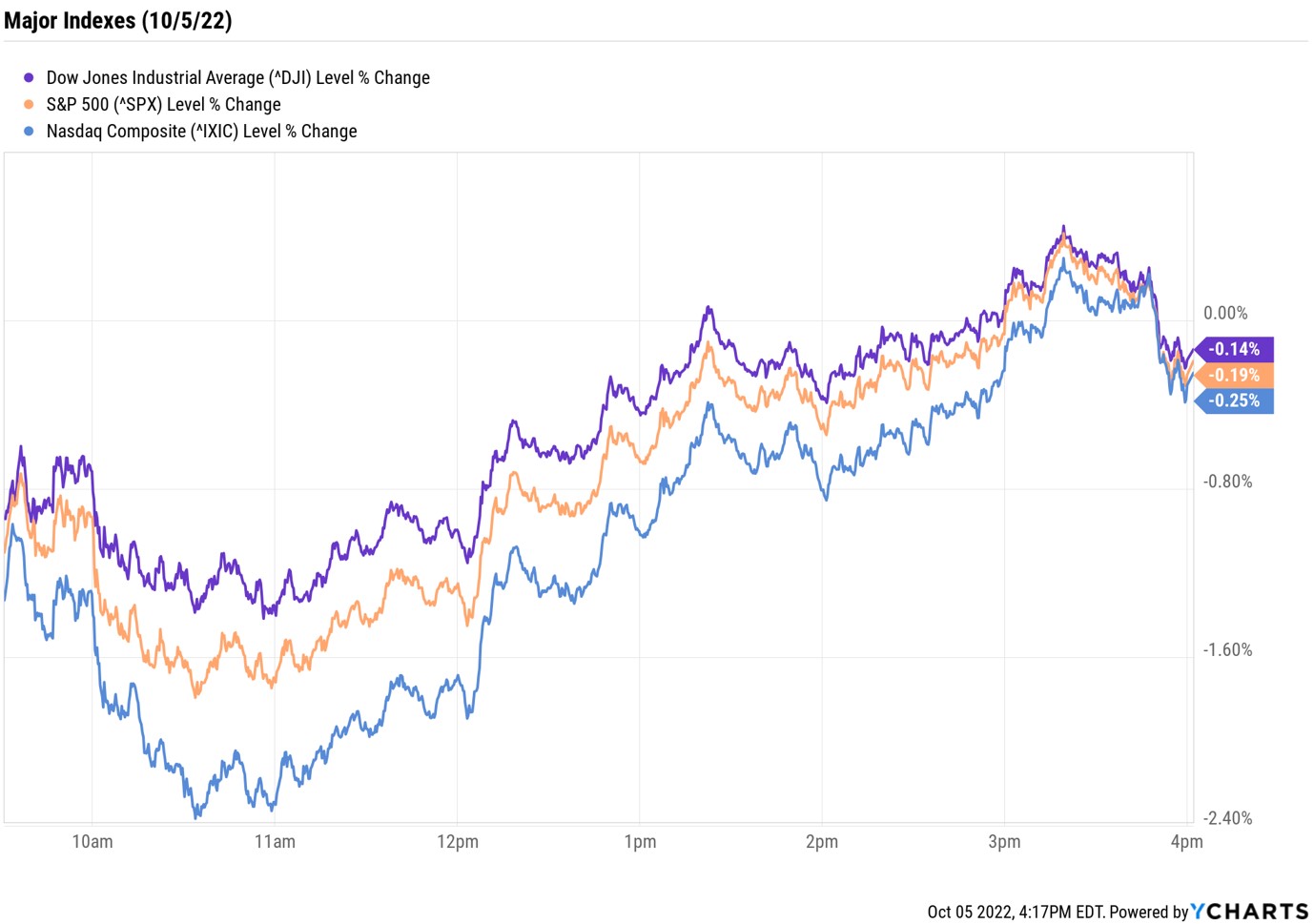

The major market indexes were all trading sharply lower after this morning's economic data, but came off their session lows by the close.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks opened sharply lower Wednesday following two straight days of red-hot gains as yields on government bonds resumed their recent climb.

The 10-year Treasury yield jumped 13.6 basis points to 3.753% after today's round of data pointed to a resilient U.S. economy. (A basis point is equivalent to 0.01%.)

The economic reports released this morning included the ADP employment report that showed the U.S. added a higher-than-expected 208,000 private-sector jobs in September. Additionally, the Institute for Supply Management's (ISM) services purchasing managers' index slipped to 56.7% in September from the August reading of 56.9%. So while activity in areas such as restaurants and hotels slowed last month, it still remained exceptionally strong.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The equity market's big moves higher on Monday and Tuesday "came on the back of multiple economic data points, all helping markets point towards a sooner-rather-than-later Fed pivot," says Stefanos Bazinas, execution strategist at the New York Stock Exchange. "Today's round of economic data, however, has reversed some of this Fed pivot optimism."

Still, despite that early selloff that saw major market indexes down between 1%-2%, all three finished well off their session lows. At the close, the Dow Jones Industrial Average was down 0.1% at 30,273, while the S&P 500 Index (-0.2% at 3,783) and the Nasdaq Composite (-0.3% at 11,148) ended with modest losses.

Other news in the stock market today:

- The small-cap Russell 2000 fell 0.7% to 1,762.

- Gold futures slipped 0.6% to settle at $1,720.80 an ounce.

- Bitcoin edged down 0.5% to $20,127.02. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Helen of Troy (HELE) jumped 3.3% after the consumer products maker, whose brands include Braun and Vicks, reported earnings. In its fiscal second quarter, HELE reported earnings of $2.27 per share on revenue of $521.4 million, beating analysts' consensus estimates.

The Pros' Favorite Oil Stocks

Energy stocks got a big boost today after OPEC+ issued its biggest supply cut since the early days of the pandemic. Specifically, the Organization of the Petroleum Exporting Countries and its allies said they will decrease production by 2 million barrels per day in an effort to buoy oil prices, which have been spiraling in recent months amid fears of slowing demand.

In reaction to the news, U.S. crude futures spiked 1.4% to $87.76 per barrel and the energy sector handily outperformed, jumping 2.1%. Today's move by OPEC marks a win for oil bulls – including Warren Buffett, whose Berkshire Hathaway (BRK.B) holding company has been steadily increasing its shares of Occidental Petroleum (OXY) in recent quarters – sparking rumors of potential buyout.

While Buffett is upbeat on Occidental, analysts are not, giving the stock a consensus Hold recommendation. But while OXY may not be one of the best oil stocks to buy now, according to Wall Street pros, these three names certainly are. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.