Stock Market Today: Nasdaq, S&P 500 Fall Again as Treasury Yields Rise

Newly upgraded Amgen (AMGN) kept the Dow's head above water.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

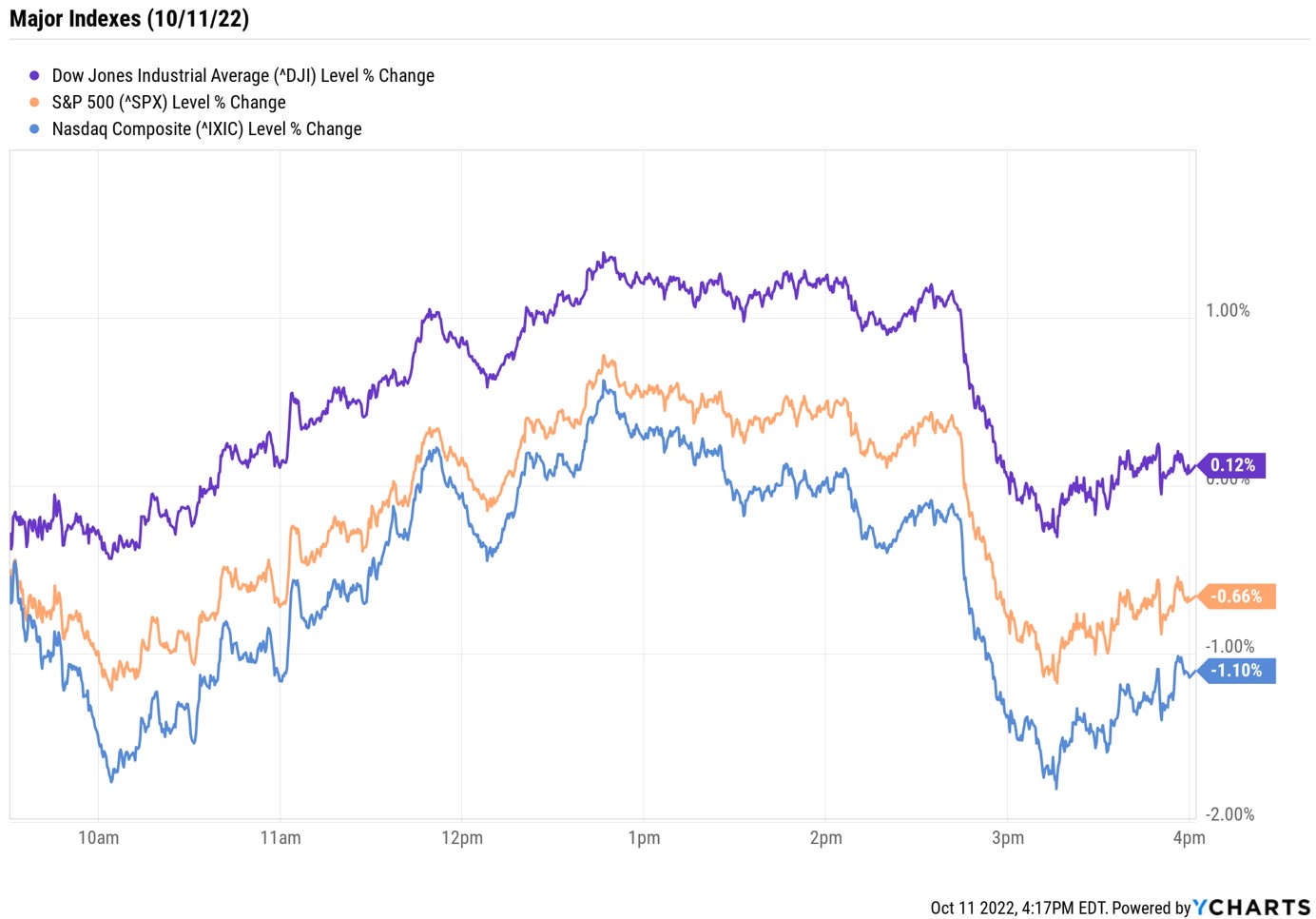

Most stocks closed lower for a fifth straight day Tuesday, as rising government bond yields turned up the heat once again.

The Nasdaq Composite (-1.1% at 10,426) and the S&P 500 Index (-0.7% at 3,588) finished in the red as the 10-year Treasury yield climbed 5.2 basis points to 3.937%. (A basis point = 0.01%.) Remember, rising bond yields can have an outsized effect on tech stocks that are valued based on longer-term earnings. And as bond yields and borrowing costs rise, these longer-term earnings can be negatively impacted.

Not helping matters was an early afternoon speech from Cleveland Fed President Loretta Mester. "Given the current level of inflation, its broad-based nature, and its persistence, I believe monetary policy will need to become more restrictive in order to put inflation on a sustainable downward path to 2 percent," Mester said. Investors will hear the latest inflation updates this week, with the producer price index (PPI) set for release tomorrow and the consumer price index (CPI) due out Thursday.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, the Dow Jones Industrial Average (+0.1% at 29,239) eked out a win thanks to a big rally in Amgen (AMGN). The biotech stock jumped 5.7% after Morgan Stanley analyst Matthew Harrison upgraded it to Overweight (the equivalent of a Buy), saying AMGN has upside potential thanks to its experimental weight-loss drug, AMG133.

Other news in the stock market today:

- The small-cap Russell 2000 edged up 0.06% to 1,692.

- U.S. crude futures fell 2% to settle at $83.95 per barrel.

- Gold futures gained 0.6% to finish at $1,686 an ounce.

- Bitcoin shed 1.1% to $18,996.66. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Walgreens Boots Alliance (WBA) rose 2.4% after the drugstore chain said it will buy the remaining 45% of at-home healthcare company CareCentrix it doesn't own for $392 million. WBA expects the full acquisition to be complete in March 2023.

- Ride-sharing stocks Uber Technologies (UBER, -10.4%) and Lyft (LYFT, -12.0%) slid after the Labor Department said it will revisit how some gig workers are classified. "While independent contractors have an important role in our economy, we have seen in many cases that employers misclassify their employees as independent contractors, particularly among our nation's most vulnerable workers," said Marty Walsh, secretary of Labor, in a prepared statement. "Misclassification deprives workers of their federal labor protections, including their right to be paid their full, legally earned wages.

Q3 Earnings Season: What the Experts Are Saying

In addition to this week's PPI and CPI releases, inflation will be a major point of focus as the third-quarter earnings season kicks off. Beverage giant PepsiCo (PEP) headlines tomorrow's results, while big banks like JPMorgan Chase (JPM) and Wells Fargo (WFC) appear on Friday's earnings calendar.

Expectations are low for earnings growth this time around thanks to a quarter full of macro headwinds, including inflation, a stronger dollar and rising interest rates. "As of today, the S&P 500 is expected to report (year over-year) earnings growth of 2.4% for the third quarter, which would be the lowest earnings growth reported by the index since Q3 2020," says John Butters, senior earnings analyst at FactSet. And this is down from the 2.8% third-quarter earnings growth that was estimated on June 30.

Here, we rounded up what some of Wall Street's top minds are saying about a potentially brutal Q3 earnings. Take a look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.