It's a Good Time to Invest in Europe

Europe is not exactly stable, but investors can feel better putting their money there.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

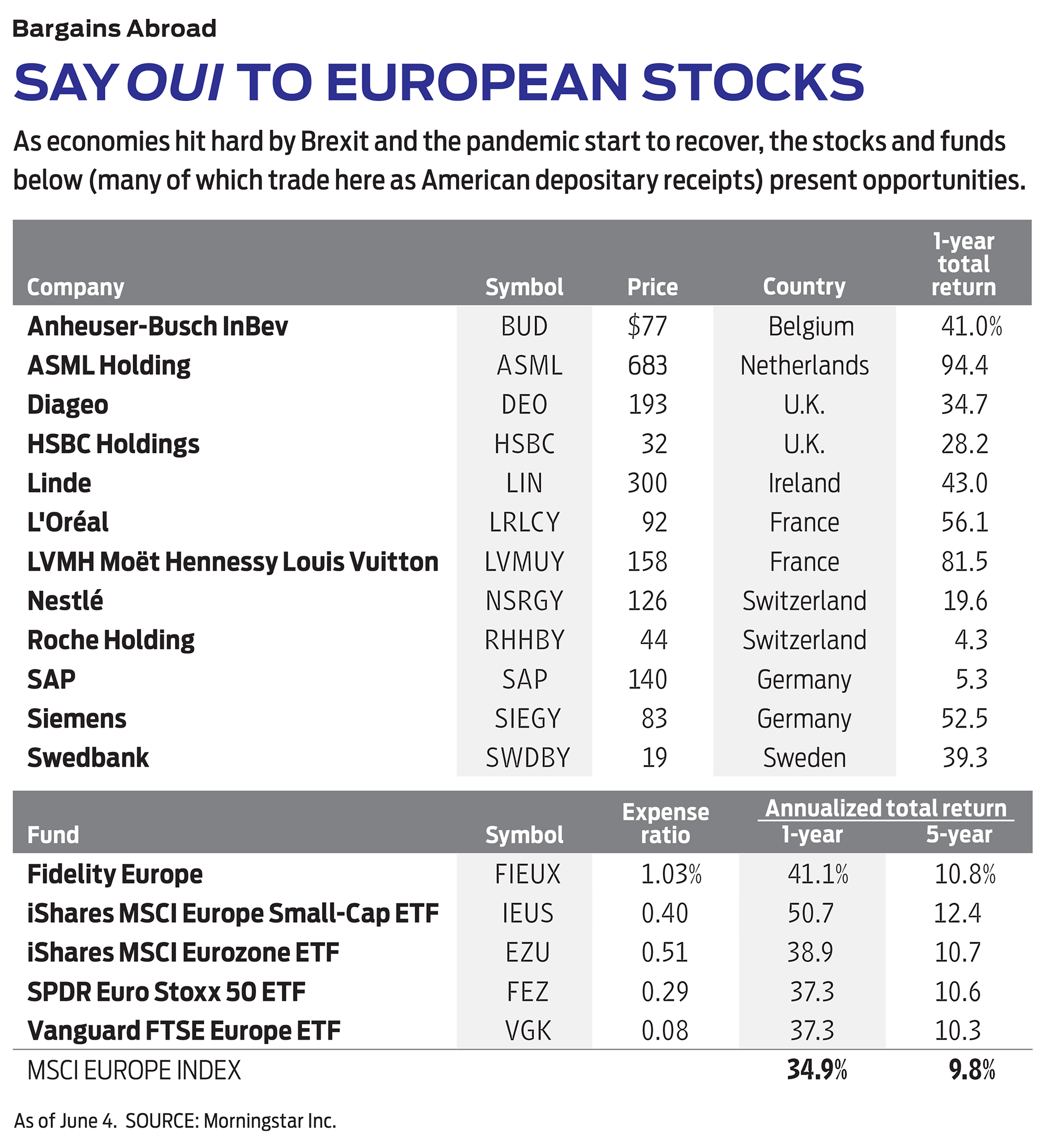

A good rule for investors is to look where others aren’t looking. Right now, that’s Europe, a continent whose stocks are ripe for growth after a truly lousy decade. Europe is settling down after the disruptions of “Brexit,” stocks are relatively cheap, and there are lots of good ones from which to choose.

Americans are often surprised to learn that Europe—defined as the 27 nations of the European Union plus the United Kingdom (which left the E.U. at the end of last year) and countries such as Switzerland and Norway, which were never members—has a larger population than the U.S. and roughly the same gross domestic product. Still, the 10 largest exchange-traded funds that concentrate on European stocks have a total market capitalization (shares outstanding times price) of only about $50 billion.

One reason U.S. investors shun European stocks is domestic bias; we prefer what’s in our own backyard. And until recently, Europe’s stocks have performed poorly. The largest European ETF, Vanguard FTSE Europe (VGK), has returned just 6% annualized over the past 10 years, compared with 15% for the largest U.S. stock ETF, SPDR S&P 500. The European fund fell in value in five of the past 10 years and trailed the S&P ETF in eight. (Stocks and funds I like are in bold.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

European stocks have lagged in part because of Europe’s economy. Annual U.S. growth was one-third higher, on average, than annual European growth between 2010 and 2019. The COVID-19 pandemic rendered 2020 an anomaly, but Europe’s GDP dropped 6.6% while the U.S. escaped with a decline of 3.5%.

In 2016, by a narrow margin, voters in the U.K. chose to leave the E.U., a process that dragged on for more than four years, and the uncertainty and dislocations that resulted harmed Europe as a whole. Now, however, the continent is learning to live with the new arrangement, and despite initial fears, no other country is itching to depart. Europe is not exactly stable, but it’s on a smoother path, and investors can feel better putting their money there.

A new look. This is not your father’s Europe. The largest companies aren’t British, they aren’t banks or industrial firms, and many depend on Asian customers. They are companies that recognize the value of brands, and they are not gigantic.

The largest among them would rank 13th in the U.S. by market cap, and it is quintessentially European: LVMH Moët Hennessy-Louis Vuitton (LVMUY), which I lauded in December 2019 when the stock was $89. It’s now $158 but still worth buying. LVMH, with a market cap just under $400 billion (roughly the same as Walmart), owns many of the world’s great luxury brands: champagne makers Dom Pérignon and Krug, fashion designers Christian Dior and Louis Vuitton, jewelers Bulgari and Chaumet, plus dozens more, with a total of 4,915 stores worldwide. Shares have quadrupled in a little over four years, and although the pandemic caused revenues to drop in 2020, they bounced back by 32% in the first quarter of 2021, led by watches and jewelry. The stock barely missed a beat.

Cut from the same cloth is cosmetics giant L’Oréal (LRLCY), with a market cap of $256 billion—a little bigger than Coca-Cola. L’Oréal sells perfume, shampoo and skin products under its own brand and about 40 others, including Kiehl’s, Ralph Lauren and Giorgio Armani. Like LVMH, L’Oréal has seen enormous growth in China, with sales rising 35% in the pre-pandemic year of 2019.

Europe is home to other companies that have acquired large portfolios of consumer products. Anheuser-Busch InBev (BUD), headquartered in Belgium, owns over 500 beer brands, including Budweiser, Stella Artois and Beck’s. Diageo (DEO), based in London, specializes in harder stuff, including Tanqueray gin, Johnnie Walker scotch and Ketel One vodka. Anheuser-Busch has rallied from its March 2020 low but is still far below its high of five years ago.

Among the five largest European companies is ASML (ASML), with a market cap of $282 billion. Based in Veldhoven, Netherlands, ASML makes machines that employ ultraviolet lithography to etch microscopic patterns on semiconductors. The stock has tripled in three years, but the demand for semiconductors, as evidenced by recent shortages, is not going to let up anytime soon. Even with a price-earnings ratio of 44, based on analysts’ earnings estimates for the year ahead, shares are, to my mind anyway, inexpensive.

Bargain prices. A major attraction of European shares is that they are cheaper than American shares. In a late-May analysis based on earnings estimates for the next 12 months, French stocks carried an average P/E of 18; German stocks, 15; U.K. and Italian stocks, 13; and U.S. stocks, 21. U.S. stocks have had higher P/Es than their European counterparts for at least the past quarter-century. What’s significant is that the gap has widened since the Brexit vote in 2016, creating an opportunity.

European funds come in many varieties. The Vanguard ETF I cited earlier tracks the FTSE (for Financial Times Stock Exchange) Europe All-Cap index. It holds U.K. stocks, including financial company HSBC (HSBC), and Swiss stocks, such as pharmaceutical company Roche (RHHBY) and Nestlé (NSRGY), with an extensive brand portfolio of its own, ranging from its eponymous chocolate to Perrier water, Häagen-Dazs ice cream and Purina Dog Chow. Vanguard FTSE Europe, with 1,302 holdings, has an expense ratio of 0.08%.

I also recommend iShares MSCI Eurozone ETF (EZU), linked to an index composed of 242 large- and mid-cap stocks of nations that use the euro as their currency (that is, not including the U.K., Switzerland, Sweden and few others). Its top holdings, in order, are ASML, LVMH and then two great German companies, SAP (SAP) (enterprise software) and Siemens (SIEGY) (industrial automation). The fund has expenses of 0.51%.

A managed large-cap fund that carries a higher expense ratio (1.03%) is Fidelity Europe (FIEUX), which has a preference these days for Scandinavian firms, such as Swedbank. For a concentrated ETF, a good choice is SPDR Euro Stoxx 50 (FEZ), whose top holdings include Linde, the British supplier of industrial gases such as nitrogen. Expenses are 0.29%.

Finally, if you can take more risk with the possibility of more reward, turn to iShares MSCI Europe Small-Cap ETF (IEUS), with a stellar performance in the first half of 2021. The portfolio is heavily weighted toward industrials and real estate. The fund holds more than 1,000 stocks, none representing more than 0.5% of total assets, and it charges expenses of 0.4%. What you are doing here is not so much buying individual companies as wagering on European growth. That sounds like a good bet right now.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.