BofA: 13 Stocks to Buy for a Tax-Loss Harvesting Haul

A BofA Securities note identifies 13 stock picks that might be temporarily hampered by tax-loss harvesting but are fundamentally sound and could outperform in the coming months.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Tax-loss harvesting season is upon us once again – that depressing time of year when investors must face the worst of their stock-picking blunders.

Although kicking losing positions out of a portfolio to salvage a tax break is no one's idea of fun, it doesn't have to be all doom and gloom. Indeed, BofA Securities has actually found a way to turn tax-loss harvesting season into an opportunity for tactical stock picking glory.

It just so happens that tax-loss harvesting season can be a great time to pick up year-to-date losers on the cheap – then reap outsized rewards in the months ahead, says the U.S. Equity & Quant Strategy team at BofA.

The strategists found that since 1986, S&P 500 stocks that were down more than 10% in the first 10 months of the year – also known as Tax-Loss Harvesting Candidates (TLCs) – went on to rise by an average of 5.6% from Nov. 1 through Jan. 31.

"That's 1.7 percentage points higher than the S&P 500's average return of 3.9% over the same period, with a hit rate of 69%," write strategists Savita Subramanian, Jill Carey Hall and Shuwen Wang. In other words, TLCs have outperformed the broader market essentially 70% of the time over the three months following Halloween.

With that data in hand, the Equity & Quant Strategy team screened the S&P 500 for TLCs that are Buy-rated by BofA Securities equity analysts. The process served up 13 year-to-date losers that the team believes are poised to beat the market in the months ahead. We then dove into what the rest of Wall Street says about BofA's 13 picks, checking analysts' consensus recommendations, price targets, individual research and other data.

Read on for a comprehensive look at BofA Securities' 13 stocks to buy for a potential tax-loss harvesting windfall.

Share prices and other data are as of Oct. 26, courtesy of S&P Global Market Intelligence and YCharts, unless otherwise noted. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Global Payments

- Market value: $45.8 billion

- Dividend yield: 0.6%

- Analysts' consensus recommendation: 1.57 (Buy)

Shares in Global Payments (GPN, $155.97) have lost more than a quarter of their value so far in 2021. However, BofA Securities likes the stock's potential for outperformance, and so does the rest of the Street.

As one of the world's largest providers of transaction services for businesses, GPN was hit hard by the global slowdown in payments for everything from travel and leisure to entertainment and retail. But with the worst of the downturn in global transactions behind it, analysts say it's time for GPN to catch up.

"After significant relative underperformance, GPN has likely found its bottom," says Oppenheimer analyst Dominick Gabriele, who rates the stock at Outperform (the equivalent of Buy).

At BofA Securities, analyst Jason Kupferberg (Buy) says the steep pullback "illustrates how much the market has devalued core GPN, which in our view significantly misjudges the quality of the GPN franchise."

Of the 30 analysts issuing opinions on GPN tracked by S&P Global Market Intelligence, 17 rate it at Strong Buy, nine call it a Buy and four say Hold. Their average target price of $223.26 gives GPN implied upside of more than 40% in the next 12 months or so, making it one of BofA's highest-potential tax-loss harvesting stocks to buy.

Viatris

- Market value: $16.3 billion

- Dividend yield: 3.3%

- Analysts' consensus recommendation: 2.47 (Buy)

Hopes ran high when Pfizer's (PFE) Upjohn business merged with Mylan in November 2020 to form Viatris (VTRS, $13.48), but the good feelings didn't last long. Indeed, shares in the off-patent branded and generic drugmaker are trailing the S&P 500 by about 50 percentage points this year.

BofA Securities rates VTRS at Buy, citing an "undemanding valuation, new management with an execution focus and an attractive dividend." The rest of the Street tilts toward a consensus Buy call on the name, too, albeit with lower conviction. Two analysts rate shares at Strong Buy, four say Buy and nine have them at Hold, per S&P Global Market Intelligence.

Although Viatris' portfolio includes some of the best-known and best-selling drugs of all time – including Lipitor for high cholesterol, Celebrex for pain, and ED medication Viagra – mature, off-patent medications aren't known for having spectacular margin and growth profiles.

That's partly why Argus Research analyst Jasper Hellweg rates VTRS at Hold. The pandemic, which has "weighed on earnings growth," and a profit outlook that's "still a bit murky" also give Hellweg pause.

Be that as it may, the Street's average price target of $19.29 gives VTRS implied upside of more than 40% in the next 12 months or so.

Lamb Weston

- Market value: $8.5 billion

- Dividend yield: 1.6%

- Analysts' consensus recommendation: 1.75 (Buy)

As a packaged food company specializing in frozen french fries and other potato-based foods, Lamb Weston (LW, $58.34) was in a particularly vulnerable position during the worst of the COVID-19 pandemic. The closure of restaurants, sporting events and other food service venues was the last thing LW needed.

And as if that weren't enough, input-cost inflation and a weak potato harvest are continuing to sour the market's stomach for shares. Indeed, Lamb Weston has lost more than a quarter of its value year-to-date.

Happily for shareholders, BofA Securities – and much of the rest of the Street – views LW as a perfect tax-loss harvesting candidate. Indeed, the pros largely say the time has come to get a good stock at an attractive price.

"Sales growth recovery has remained above expectations while profit recovery has been delayed beyond fiscal 2022, as the company contends with higher input costs and a poor potato crop," says Stifel analyst Christopher Growe (Buy). "We believe the company maintains some of the strongest pricing power in the industry to accommodate this inflation."

BofA Securities, for its part, cites "improving demand trends and margin potential" in making its Buy call on LW.

As for the consensus, the majority of pros covering LW have it among their stocks to buy. Four analysts rate the stock at Strong Buy, two say Buy and two call it a Hold. Meanwhile, their average 12-month target price of $71.88 gives LW implied upside of 23%.

Incyte

- Market value: $14.7 billion

- Dividend yield: N/A

- Analysts' consensus recommendation: 1.84 (Buy)

Incyte (INCY, $66.55) is another stock that's sitting on a 20%-plus decline for the year-to-date, but that BofA Securities and the rest of the Street nonetheless believes is set for big returns.

Indeed, analysts' average price target of $98.94 gives the biopharmaceutical stock implied upside of nearly 50% in the next year or so.

"We believe INCY's lead marketed product, Jakafi, has significant potential in myelofibrosis (MF) and polycythemia vera (PV) and potentially other indications," says Oppenheimer analyst Jay Olson (Outperform). "INCY has a deep and promising pipeline, which should drive accelerating revenue growth, which is currently undervalued."

At Argus Research, analyst Jasper Hellweg rates the stock at Buy, but notes Incyte doesn't consistently hit earnings targets and shares are volatile. "As such, we view INCY as appropriate for risk-tolerant investors as part of a diversified portfolio," Hellweg says.

With such caveats in mind, know that 10 analysts rate INCY at Strong Buy, two say Buy and seven have it a Hold. Moreover, they forecast Incyte to generate average annual earnings per share (EPS) growth of more than 32% over the next three to five years. With INCY trading at just 15.3 times analysts' 2022 EPS estimate, the stock does appear to be a bargain relative to its growth prospects.

Vertex Pharmaceuticals

- Market value: $47.8 billion

- Dividend yield: N/A

- Analysts' consensus recommendation: 1.88 (Buy)

Biotech Vertex Pharmaceuticals (VRTX, $184.07) is the leader in treatments for cystic fibrosis (CF), a genetic lung disorder. But its decision to end investigational treatments for an inherited condition that can lead to lung and liver disease has clobbered the stock.

And now, after falling 23% so far this year, BofA Securities has Vertex among its tax-loss harvesting stocks to buy. For what it's worth, other bulls say VRTX is too compelling to pass up, as well.

"We view this decline as an overreaction – and a buying opportunity – as the company continues to expand margins, grow earnings and outperform market expectations," says Argus Research's Hellweg (Buy). "We also like Vertex's product line-up and deep pipeline."

Indeed, the biotech's strong pipeline should serve as a source of catalysts going forward, notes Baird Equity Research analyst Brian Skorney (Outperform).

"While investors' main focus of CF provides a floor to valuation, the clinical stage pipeline has been taking shape," Skorney says. "We think upside to shares could occur following updates from these programs."

Besides, the expansion of Vertex’s CF franchise "makes Vertex one of the few true large-cap growth companies," Skorney adds.

Thirteen analysts rate the stock at Strong Buy, five say Buy, five have it at Hold, one says Sell and one calls VRTX a Strong Sell. Their average 12-month price target of $257.81 gives shares implied upside of about 40%.

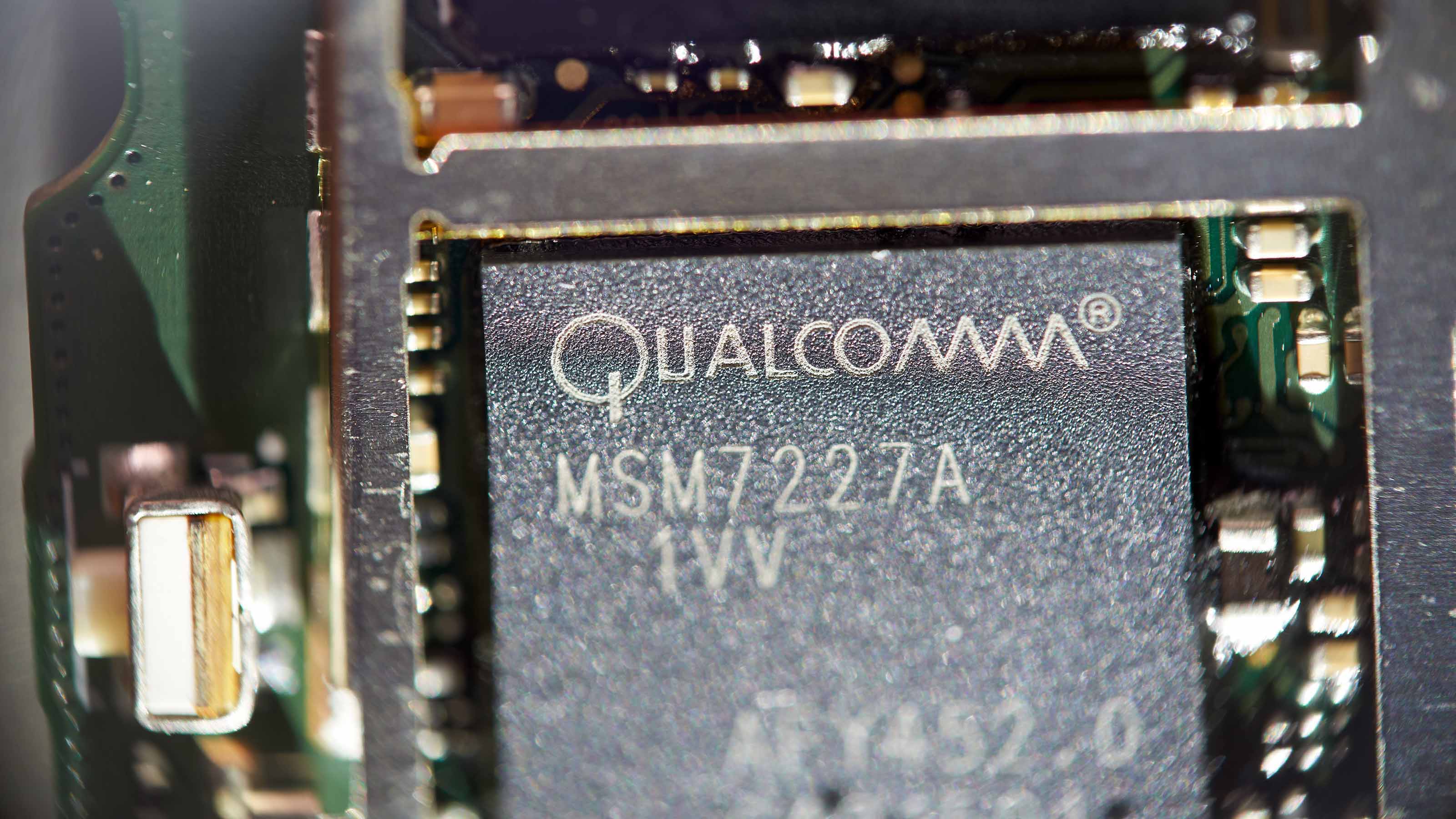

Qualcomm

- Market value: $148.8 billion

- Dividend yield: 2.1%

- Analysts' consensus recommendation: 1.77 (Buy)

Shares in tax-loss harvesting pick Qualcomm (QCOM, $131.94) are lagging the broader market by roughly 35 percentage points year-to-date, but analysts say the chipmaker's stock is bound to bounce back amid the rollout of 5G wireless gadgets and services.

"Qualcomm remains the undisputed leader in 3G/4G/5G cellular connectivity with a strong intellectual property portfolio across application and connectivity solutions for handsets, autos and the Internet of Things (IoT)," says Jefferies analyst Kyle McNealy, who initiated coverage of QCOM at Hold in early October.

Although McNealy remains on the sidelines over concerns about the maturing smartphone market, his peers tend to be far more bullish. Sixteen analysts rate QCOM at Strong Buy, five say Buy and nine have it at Hold. And their average target price of $174.70 gives the stock implied upside of more than 30% in the next 12 months or so.

Raymond James analyst Christopher Caso (Strong Buy) counts himself among QCOM's biggest backers, noting that competitors' replacement of banned Huawei phones represents a $4 billion annual opportunity in chip sales for QCOM – and that's just for Huawei's high-end handsets.

The Street forecasts Qualcomm to generate average annual EPS growth of more than 29% over the next three to five years. And with shares changing hands at just 14.2 times analysts' 2022 EPS estimate, QCOM does indeed look like a bargain stock to buy.

Penn National Gaming

- Market value: $12.5 billion

- Dividend yield: N/A

- Analysts' consensus recommendation: 2.28 (Buy)

Casino operator Penn National Gaming (PENN, $74.19) made a splash over the summer when it acquired Score Media and Gaming – owner of the "theScore Bet" betting platform – for $2 billion in cash and stock.

The market, however, wasn't all that impressed by PENN's roll of the dice. Shares, which are off 14% year-to-date, are lagging the broader market since the Aug. 5 deal was announced.

But analysts, for the most part, like the tie-up, especially in light of PENN's acquisition of Barstool Sports earlier this year.

"We think this deal makes strategic sense as it complements Barstool Sports and helps PENN build a more complete sports media ecosystem, integrating sports, media, gaming and technology to create multiple avenues for growth," says CFRA Research analyst Arun Sundaram (Buy).

BofA Securities clearly sees Penn National as a tax-loss harvesting stock to buy, too. Analyst Shaun Kelley (Buy) echoes Sundaram's view, applauding PENN's "increasingly strong core business with upside optionality through its unique and profitable approach to online."

Six analysts rate the stock at Strong Buy, five rate it at Buy, five call it a Hold, and two say it's a Strong Sell. Their average target price of $97.88 gives PENN implied upside of about 32% over the next 12 months or so.

T-Mobile US

- Market value: $145.2 billion

- Dividend yield: N/A

- Analysts' consensus recommendation: 1.65 (Buy)

T-Mobile US (TMUS, $116.36) shares are down about 14% so far this year to make BofA's tax-loss harvesting list, but analysts say market-share gains and savings from the 2020 acquisition of Sprint have them springloaded for outperformance.

"T-Mobile is the third-largest wireless carrier in the U.S., capturing 100% of the industry growth since 2013," says Oppenheimer analyst Timothy Horan (Outperform). "The market share gains have come from a greatly improved network and innovative marketing to underserved niches, primarily in urban areas but increasingly rural."

Where the Street is especially bullish is on TMUS' prospects for returning cash to shareholders as synergies from the Sprint deal really start to kick in.

"We believe the free cash flow ramp as T-Mobile finishes the integration should be dramatic," says Raymond James analyst Ric Prentiss (Outperform). "Given the potential for up to $60 billion in stock buybacks from 2023 to 2025 (vs. current market cap of approximately $160 billion), we see upside."

The Street expects TMUS to generate average annual EPS growth of roughly 45% over the next three to five years, and an average price target of $168.22 gives the stock implied upside of 45% over the next year. The Street overwhelmingly lists T-Mobile among its stocks to buy, too. Seventeen analysts rate the stock at Strong Buy and 10 say Buy, but only three have it at Hold and just one says Strong Sell.

Fidelity National Information

- Market value: $75.6 billion

- Dividend yield: 1.3%

- Analysts' consensus recommendation: 1.67 (Buy)

Fidelity National Information (FIS, $122.40) is another financial technology firm specializing in payments and other services that's delivering disappointing share-price performance. The stock is off about 14% so far this year … but that has analysts saying it's ripe for the picking.

Of the 30 analysts issuing opinions on FIS, 17 call it a Strong Buy, six say Buy and seven rate it at Hold. They forecast the company to generate average annual EPS growth of nearly 14% over the next three to five years, yet shares trade at just 16.2 times 2022 earnings.

Thanks in part to that bargain valuation, analysts' average target price of $165.41 gives FIS implied upside of roughly 35% in the next 12 months or so.

Among their arguments in favor of the stock, bulls believe the market isn't properly valuing the totality of Fidelity's franchise.

"In our view, performance in the Banking segment (where we expect continued acceleration in the third and fourth quarters) remains underappreciated," says BofA Securities analyst Jason Kupferberg (Buy).

At Susquehanna Financial Group, analyst James Friedman says the fintech's "trends sound good to us, especially in the Bank IT segment." Channel checks indicate the company's Modern Banking Platform continues to "make waves and capture market share."

The analyst expects FIS to continue to add new banking customers thanks to its differentiated suite of cloud-based services, which in turn supports his Positive (Buy) rating on the stock.

AT&T

- Market value: $181.1 billion

- Dividend yield: 8.2%

- Analysts' consensus recommendation: 2.71 (Hold)

There's no question that AT&T (T, $25.37) is a dividend stalwart. But anyone thinking about deploying fresh funds with the sole intent of capturing T's current sky-high yield might want to slow down.

AT&T is slimming down, divesting itself of DirecTV and WarnerMedia. That, in turn, means less cash available to return to shareholders.

"AT&T's dividend looks unsustainable following its media divestitures," says Argus Research analyst Joseph Bonner (Hold). "We expect a dividend cut when the company completes the WarnerMedia spinoff in mid-2022."

Although AT&T says it will maintain a dividend in the 95th percentile of companies, "the math just doesn't work after taking the DirecTV and WarnerMedia spinoffs into account," Bonner adds.

Although the impending cut has most analysts sitting on the sidelines, a few bulls believe T's 12% year-to-date slide makes the valuation compelling. Indeed, AT&T's stock trades at just 7.9 times 2022 EPS estimates. For context, T has traded at an average of 10.3 times expected EPS over the past five years, per Refinitiv Stock Reports Plus.

BofA seems to believe in AT&T, however. AT&T is "fundamentally sound, with a stable subscription-based business model," says BofA Securities analyst David Barden (Buy). "Historically, the stock has outperformed during periods of market uncertainty."

The bottom line? Six analysts rate T at Strong Buy, two say Buy, 17 have it at Hold and three call it a Strong Sell. That consensus Hold call comes despite a 12-month average price target of $31.68 gives T implied upside of about 25%.

Western Union

- Market value: $7.8 billion

- Dividend yield: 4.9%

- Analysts' consensus recommendation: 2.89 (Hold)

Western Union (WU, $19.31) shares are off about 15% year-to-date, making them good candidates for tax-loss harvesting.

Whether they're good for potential upside, however, is a heated debate.

The Street is pretty evenly split on the payments company's stock. Three analysts call it a Strong Buy and one says Buy. Three rate WU at Sell and one says Strong Sell. The remaining 11 pros have Western Union's stock at Hold.

A proliferation of competition in the fintech sector is just one reason for analysts' caution. After all, between entrenched players and startups, the digital payments landscape is littered with well-funded rivals, they say.

"We find the current share price and embedded expectations to be highly dependent on the assumption of WU being able to maintain its competitive position over the next decade or longer," says CFRA Research analyst Chris Kuiper (Hold). "While we think this is possible, it will require WU to catch up and defend against nimbler fintech rivals."

More bullishly, shares do appear attractively valued. WU changes hands at 8.5 analysts' 2022 earnings estimate. At the same time, analysts forecast the company to deliver average annual EPS growth of more than 10%.

The Street's average price target looks pretty good too. At $25.33, analysts as a group give WU stock implied upside of 31% over the next 12 months or so.

FedEx

- Market value: $63.2 billion

- Dividend yield: 1.3%

- Analysts' consensus recommendation: 1.73 (Buy)

Supply-chain issues are hurting logistics and shipping companies, and FedEx (FDX, $237.83) has not been immune. Shares are off about 9% so far this year. The Street, however, sees better times ahead, with FDX offering an attractive entry point to boot.

"We believe FedEx is in a strong position to capitalize on secular macroeconomic tailwinds, including a significant pull-forward of global e-commerce trends," says Stifel analyst J. Bruce Chan (Buy). "Furthermore, we believe that relative valuation is attractive in light of growth opportunities."

As for that valuation, FDX trades at 12.1 times the Street's 2002 EPS estimate. That offers a significant discount to its own five-year average of 14.2 times expected earnings, per Refinitiv Stock Reports Plus. The valuation is also attractive in light of analysts' expectations for average annual EPS growth of 14% over the next three to five years.

At BofA Securities, analyst Ken Hoexter (Buy) adds that he likes FDX's chances vs. peers when it comes to navigating its way through our current inflationary environment.

"If FedEx is able to demonstrate sustained pricing gains and offset labor costs, it could lead to multiple expansion," Hoexter says.

Seventeen analysts rate FDX at Strong Buy, four say Buy and nine have it at Hold, according to S&P Global Market Intelligence. Their average price target of $299.85 gives the stock implied upside of about 26% in the next year or so.

Ross Stores

- Market value: $40.5 billion

- Dividend yield: 1.0%

- Analysts' consensus recommendation: 1.83 (Buy)

Ross Stores (ROST, $113.86) stock has lost about 7% in 2021, so investors are welcome to view it as a candidate for tax-loss harvesting. But there's no shortage of analysts who would probably advise clients to tap the brakes on such a move.

After all, too many of them see too much potential upside in the off-price retailer's stock. With an average target price of $137.56, the Street gives ROST implied upside of roughly 21% in the year ahead.

Meanwhile, the valuation is deeply attractive in light of the company's long-term growth prospects. Shares in Ross Stores trade at 25.3 times the Street's 2022 EPS estimate. That might sound rich, but not when analysts expect the retailer to generate average annual EPS growth of 67% over the next three to five years.

BofA Securities analyst Lorraine Hutchinson (Buy) bases her bullishness, in part, on ROST's competitive advantage in an economic recovery marked by inflationary pressures.

"We expect Ross to gain market share this year and next," Hutchinson writes in a note to clients. "The company has a long history of being able to grow in good and bad macroeconomic environments. Ross has the potential to nearly double its footprint and we expect square footage to grow at a mid-single-digit rate longer term."

Hutchinson's bullishness is in the majority on the Street, where 11 analysts call ROST a Strong Buy, six say Buy and seven rate shares at Hold.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

US-China Trade Hopes Send Stocks to New Highs: Stock Market Today

US-China Trade Hopes Send Stocks to New Highs: Stock Market TodayApple and Microsoft are on track to join Nvidia in the $4 trillion market cap club.

-

What Tariffs Mean for Your Sector Exposure

What Tariffs Mean for Your Sector ExposureNew, higher and changing tariffs will ripple through the economy and into share prices for many quarters to come.

-

Stock Market Today: Stocks Struggle to Sustain Gains

Stock Market Today: Stocks Struggle to Sustain GainsMixed messages from multiple sources continue to make for a messy market for investors, traders and speculators.

-

Stock Market Today: Stocks Swing Higher After Early Slump

Stock Market Today: Stocks Swing Higher After Early SlumpNegative earnings reactions for Nike, FedEx and Micron kept pressure on the main indexes, though.

-

Qualcomm Stock Drops After Its Earnings Beat. Here's Why

Qualcomm Stock Drops After Its Earnings Beat. Here's WhyQualcomm stock is lower Thursday even after the chipmaker reported strong earnings and gave an encouraging outlook. This is what investors need to know.

-

The Best Communication Services Stocks to Buy

The Best Communication Services Stocks to BuyCommunication services stocks represent a diverse segment of the market that includes media companies, internet giants and telecoms. Here's how to find the best ones.

-

T-Mobile Earnings Send Stock to the Top of the S&P 500

T-Mobile Earnings Send Stock to the Top of the S&P 500T-Mobile stock is notably higher Wednesday after the wireless provider's earnings beat and strong full-year outlook. Here's what you need to know.