UBS: 7 Best Stocks to Buy Now for Pricing Power

Some of the best stocks to buy now include those that are able to navigate higher inflation, say the pros. These seven top-rated picks fit the bill.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Consumers have felt the sting of higher prices for months. Since May, annual inflation has been running at 5%, with October's consumer price index rising 6.2% from the year prior – the biggest such jump since 1990.

That's one reason why analysts, when picking their best stocks to buy now, are focusing on pricing power.

When companies face cost pressures – through higher prices for shipping and raw materials, for example – they have to choose whether to raise prices on their goods or services, or absorb the hit and let margins suffer. The best-positioned firms are those that can pass most of those prices along without consumers balking and taking their business elsewhere.

In a recent report, UBS identified several high-conviction picks that it views as "strong pricing power stocks" – those able to raise prices on products and that have solid margin momentum. The investment bank found that shares of companies with strong pricing power outperformed those without by around 20%, on average, over the following 12 months once inflation rises above 3% on an annualized basis, which is currently the case.

With that in mind, here are seven of the best stocks to buy now for a pricing power advantage, according to UBS. In addition to enjoying a high-conviction Buy rating from UBS, each pick ranks in the top third of its sector for pricing power, margin momentum and input cost exposure.

Data is as of Nov. 17. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Salesforce.com

- Sector: Technology

- Market value: $300.6 billion

- Dividend yield: N/A

- UBS' 12-month price target: $330 (7.5% implied upside)

Salesforce.com (CRM, $307.09) changed the way salespeople find and track leads by providing access to the service over the internet from a web browser, which was revolutionary in its day. The company also introduced the Software-as-a-Service (Saas) concept – or a pay-as-you-use model – helping clients avoid upfront installation costs and software upgrade maintenance.

The company remains the "clear leader" in salesforce automation and its software is considered "mission-critical" to sales teams in helping them generate revenue, according to Morningstar. Salesforce went from no product to 33% market share in 20 years.

UBS analyst Karl Keirstead says this about the company: "Salesforce is the market share leader within its two core markets (Sales and Service), which competes against legacy offerings from Oracle (ORCL) and SAP (SAP)."

Keirstead notes that demand for applications such as CRM "remains strong," raising his confidence about the company's ability to keep posting robust financial results. Healthy topline growth gives credence to the company's outlook of 20% for its operating margin in fiscal 2023, which was higher than what Wall Street expected.

This improved margin forecast is "sustainable" driven by three things: revenue outperformance, permanent shift to work from home, Zoom customer interactions and renewed internal cost controls, Keirstead says.

Wall Street analysts seem to agree that this is one of the best stocks to buy now. The consensus rating for CRM is a Buy with an average price target of $325.73, according to S&P Global Market Intelligence.

Nike

- Sector: Consumer cyclical

- Market value: $272.0 billion

- Dividend yield: 0.6%

- UBS' 12-month price target: $185 (7.7% implied upside)

If there's a company whose pricing power could be expected to remain strong under any economic environment, it is Nike (NKE, $171.83). For the seventh year in a row, Nike was named the world's most valuable apparel brand by global brand valuation consultancy firm Brand Finance in its 2021 report.

As the world's largest athletic apparel, shoes and equipment company, Nike has a history of signing endorsement deals with key athletes including Michael Jordan, LeBron James, Cristiano Ronaldo, Kevin Durant and Tiger Woods. This partnership with the best athletes gives sales a lift: A whopping 77% of NBA basketball players in the 2020-21 season wore Nikes or its Converse or Jordan shoes, according to shoe database Baller Shoes DB.

The company's revenue track record speaks to this brand dominance: Since 2010, sales have risen year-over-year with the exception of last year's pandemic. The longer-term trend is expected to resume this year, with analysts projecting a 5.8% rise in annual revenue to $47.1 billion.

NKE is also known for its innovation, from introducing pressurized air in the soles of running shoes more than 40 years ago to today's Nike Air Zoom Viperfly designed specifically for the 100-meter dash, and many others.

UBS analyst Jay Sole believes Nike's sales momentum can continue. He cites three sales growth drivers: industry trends, market share gains and channel mix shift. In recent years, NKE has been focusing more on its direct-to-consumer distribution channel as a growth engine.

Despite Nike's longevity and iconic brand status, Sole says the market "doesn't fully appreciate how the company's investments in product innovation, supply chain and e-commerce are working in concert to drive unit growth and ASP [average selling price] increases."

He sees NKE as a "long-term outperformer" that is expected to generate 18% earnings per share growth annually in each of the next four years.

The pros on Wall Street tend to agree. They have a consensus Buy rating on the stock with a $180.37 average price target.

SBA Communications

- Sector: Real estate

- Market value: $37.8 billion

- Dividend yield: 0.7%

- UBS' 12-month price target: $380 (9.4% implied upside)

Thank SBA Communications (SBAC, $347.38) for the ability to access the internet, text or make calls on mobile phones and other wireless devices. The company owns and operates wireless infrastructure – cell towers, antenna placements on buildings and rooftops, distributed antenna systems and small cells (low-powered radio access nodes). Organized as a real estate investment trust (REIT), SBA has operations in the U.S., Canada, Latin America and South Africa.

Mobile data usage has been exploding and it is set to expand even more as 5G becomes ubiquitous. UBS analyst Batya Levi points out another catalyst: For the first time in years, all U.S. mobile carriers will be active in network deployments in the next 12 months. These include T-Mobile's (TMUS) 2.5 GHz rollout, Dish Network's (DISH) network buildout, 5G efforts and more.

Another reason SBAC is on this list of the best stocks to buy now is that network deployment internationally is about five years behind the U.S., meaning more business will be in the pipeline for the company. Internationally located towers make up about 20% of SBA's business, the analyst notes.

"Tower growth is strong, defensible and we believe SBAC is well positioned to capitalize on industry trends of rising data usage and increase carrier activity alongside the multi-year 5G investment cycle," Levi writes.

The analyst expects U.S. wireless capital expenditures to increase by around 10% to a record $35 billion this year and ramp up another 10% next year to nearly $40 billion. In contrast, spending has topped $30 billion a year in the past decade, Levi says.

As for analysts' consensus view toward SBAC: the average rating is Buy and price target is $370.11.

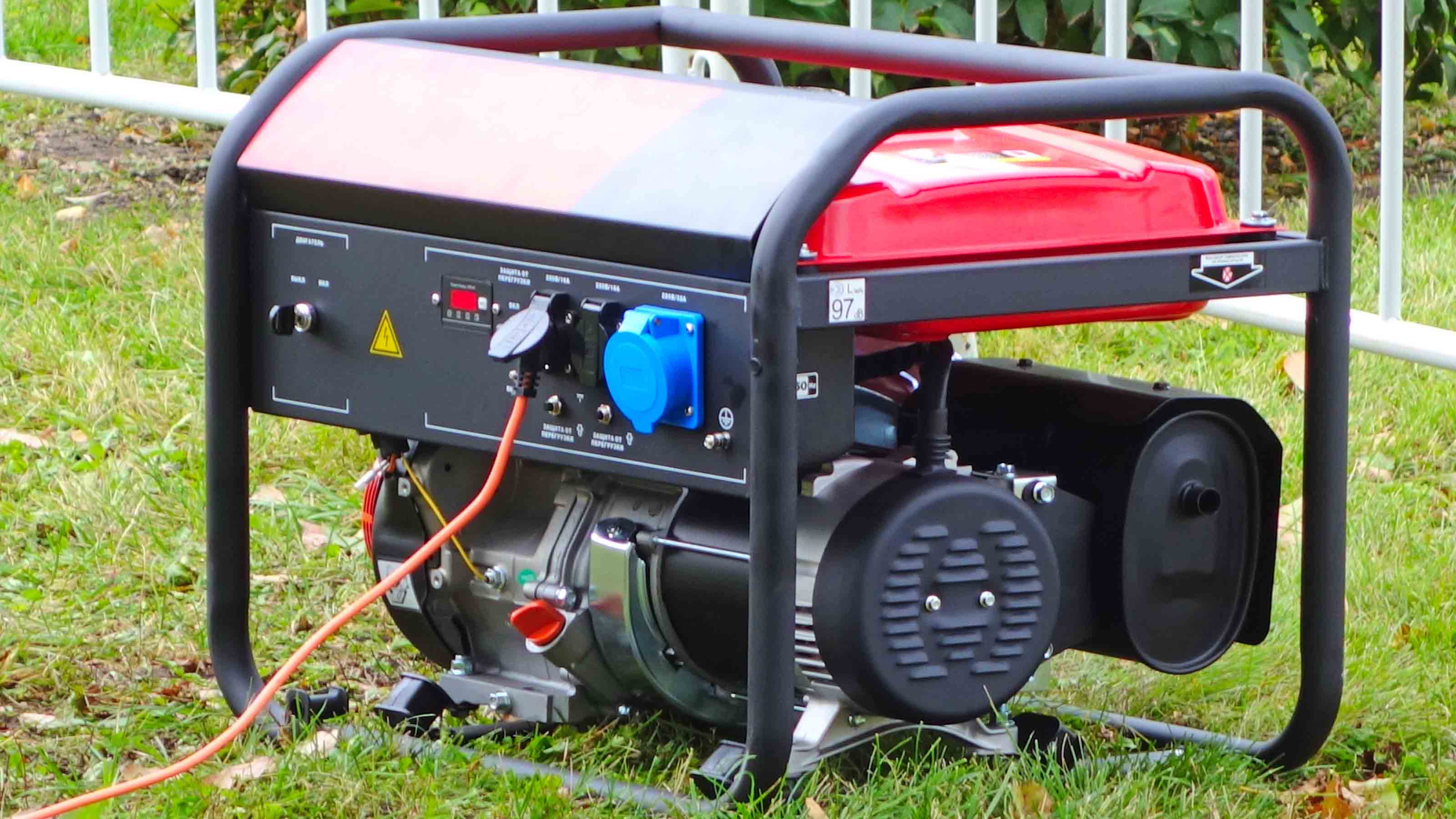

Generac Holdings

- Sector: Industrials

- Market value: $27.7 billion

- Dividend yield: N/A

- UBS' 12-month price target: $500 (14% implied upside)

Generac Holdings (GNRC, $438.68), a name synonymous with home backup generators, has been positioning itself for a clean energy future. Since 2019, the company has been expanding its home solar and energy storage businesses while maintaining market dominance in its core fossil-fuel generator business.

UBS analyst Jon Windham believes Generac can make inroads into the residential solar market due to its customer acquisition platform that will let it take market share from incumbents such as SolarEdge (SEDG) and Enphase (ENPH).

Also, its recent acquisition of microinverter firm Chilicon Power will transform GNRC into a "one-stop shop for residential clean energy solutions, unique within the solar supply chain, and providing Generac's installer network with a compelling value proposition," he says.

Generac also can use its market prowess – it has a 75% market share in North American home backup generators – to expand in the solar and energy storage market. The company's competitive advantages include its brand, experience converting marketing leads to sales, its existing customer service infrastructure, installer support and others, according to UBS.

"GNRC provides a relatively uniquely diversified opportunity to which investors can gain exposure to the rapidly growing solar and storage market with underlying earnings stability from Generac's core business of recession-resilient home standby power," the analyst says.

Another reason this is one of the best stocks to buy now: GNRC is cheap relative to its solar inverter peers. Specifically, shares are trading around 39 times 2021 estimated price-to-earnings (P/E) compared to 70 times for the latter.

Most of Wall Street is in agreement with UBS. The consensus analyst rating is a Buy, with an average price target of $505.53.

Apple

- Sector: Technology

- Market value: $2.5 trillion

- Dividend yield: 0.6%

- UBS' 12-month price target: $175 (15.9% implied upside)

When it comes to pricing power, it will come as no surprise to most consumers that Apple (AAPL, $151.00) – which revolutionized the smartphone market in 2007 with the iPhone – has loads of it. If Nike is the world's most valuable apparel brand, AAPL is the world's most valuable brand overall, according to Brand Finance.

Apple's slew of products and services are familiar to most people: iPhone, iPad, Apple Watch, Apple TV, Apple TV+, Apple Music, CarPlay and more. But with the iPhone – the biggest source of the company's revenue by product – at 14 years old and looking long in the tooth, investors are looking to AAPL's future bets to drive higher growth.

One of those bets is in the battery electric vehicle (BEV) market. Over the years, AAPL has invested in self-driving car licenses and remote-sensing LiDAR patents, according to UBS. Analyst David Vogt says he sees the company introducing a branded battery electric vehicle at some point and potentially snagging at least a 5% share in the global BEV market.

Apple's self-driving vehicle ambitions have been talked about for years. In January, Korean media reported that Apple was in talks with Hyundai to develop a self-driving electric car – though the automaker has since said the two were not involved in any such projects.

This comes after a December 2020 Reuters report that suggested Apple is not only aiming to produce a car, but also to introduce a new battery design that will drastically reduce battery costs and increase range, according to a person with knowledge on the matter. Now in June, Reuters reported, per those familiar with the effort, that Apple was in early stage talks with Chinese battery manufacturers to develop this battery.

"We believe Apple's significant cash flow should enable it to enter the battery electric vehicle market," Vogt says. "Although Apple is not a first-mover, its significant resources should enable the company to be a 'fast follower' in time" for the coming explosion in demand for electric vehicles. He sees the global auto market to become nearly 100% electric over the next 10 years.

The bulk of analysts are bullish on AAPL, too. The consensus rating among those tracked by S&P Global Market Intelligence is Buy and the average price target is $167.11.

Danaher

- Sector: Healthcare

- Market value: $218.4 billion

- Dividend yield: 0.3%

- UBS' 12-month price target: $365 (19.4% implied upside)

Danaher (DHR, $305.59), a medical, industrial and commercial instruments company, adheres to the Japanese "kaizen" philosophy of continuous improvement, which became the basis for its Danaher Business System (DBS) way of operating.

This way of doing business is an "important" factor to consider when finding the best stocks to buy, according to UBS analyst John Sourbeer. DBS is a "lean operating model" encompassing all facets of planning, hiring, decision-making and benchmarking across the whole company. "DBS is Danaher," he says. "As such, it's critical for current or prospective shareholders to understand what DBS entails, what benefits it affords Danaher, and how to assess its future impact."

DBS posits that "exceptional people develop outstanding plans and execute them using world-class tools to construct sustainable processes, resulting in superior performance." Superior performance and high expectations then attract exceptional people, which propagates the cycle. Four priorities guide these efforts: Quality, Delivery, Cost and Innovation.

Historically, the company has grown through acquisitions. There is room for future merger and acquisition (M&A) activity to drive returns and share price appreciation, Sourbeer says. He is projecting a compound annual growth rate of around 7% for DHR's revenue over the next three years, which is higher than Street consensus of 6%.

Still, Sourbeer thinks he might be conservative in his forecast "given (Danaher's) increasing exposure to high-growth areas (pharma, bioproduction, diagnostics) and M&A upside. Further, DBS is driving operational excellence."

The consensus rating on Wall Street is Overweight (Buy), while the average stock price target is $339.17, according to S&P Global Market Intelligence.

EOG Resources

- Sector: Energy

- Market value: $53.8 billion

- Dividend yield: 3.2%

- UBS' 12-month price target: $119 (29.5% implied upside)

The fracking revolution made America a net oil exporter instead of importer, a milestone that occurred in 2018 for oil and refined fuels for the first time in decades. EOG Resources (EOG, $91.90) is one of the largest independent oil producers in this market, with nearly all its production coming from U.S. shale fields. A former division of now-bankrupt oil giant Enron, EOG split off in 1999 and has not looked back.

The company differentiates itself by identifying prospective areas for exploration before competitors, enabling it to get attractive leasehold rates, according to Morningstar. EOG also has more experience in shale wells than most peers, resulting in above-industry average productions in new wells. Today's higher energy prices also boost revenue.

UBS analyst Lloyd Byrne believes EOG will be able to keep increasing shareholder returns. He points out that the company raised its base dividend by 10% this year to $960 million and paid a special dividend of $600 million as well. For 2022 to 2023, EOG is expected to generate $9 billion of cumulative free cash flow after base dividends, he says.

"With significant amount of free cash flow, we believe EOG will continue returning capital back to shareholders in the form of increasing base dividends, special dividends and share buybacks," the analyst writes.

As for handling inflationary pressures, EOG is "well positioned" to mitigate higher prices expected in 2022, Byrne says. He notes that the company expects to see flat to lower costs for drilling, including rigs, and completion services – accounting for around half of well costs. It can do this by reducing the number of drilling days, negotiating contracts at lower rates, and others.

The general view on Wall Street is that EOG is one of the best stocks to buy now. The consensus rating as a Buy and the average price target arrives at $108.30.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Deborah Yao is an award-winning journalist, editor, and personal finance columnist who has held editorial roles at Kiplinger, The Wharton School, Amazon, The Associated Press, S&P Global (SNL Kagan) and MarketWatch. She specializes in writing and editing articles on finance and technology, with particular expertise in the areas of stock analysis, monetary policy, fintech, blockchain, macroeconomics, financial planning, taxes, among others. She has been published in The New York Times, USA Today, CBS News, ABC News, Wharton Magazine, and many other news outlets.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

These Unloved Energy Stocks Are a Bargain

These Unloved Energy Stocks Are a BargainCleaned-up balance sheets and generous dividends make these dirt-cheap energy shares worth a look.