Homebuilder Stocks Get a Pandemic Boost

As COVID shifts to an endemic, housing stocks could get a lift should Americans move to homes with more space and amenities.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

COVID-19 is transitioning from pandemic to endemic – that is, like other infectious diseases, including influenza, COVID will be with us for as far as the eye can see. With vaccines and therapies, we will render it less devastating, but we will have to learn to live with it safely.

The SARS-CoV-2 virus that causes the disease is transmitted almost exclusively in tiny aerosols that linger indoors but are immediately dissipated outdoors.

Also, of course, catching the disease is less likely when you are among fewer people, especially if they are people you know, such as family members. So the biggest long-term changes that COVID will make in our lives are to shift activities, whenever possible, away from interior spaces and to make us more homebound.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

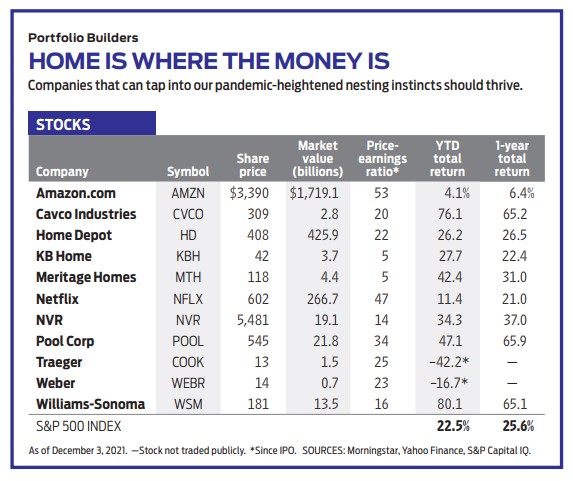

These alterations are already evident and reflected in the stock prices of many companies, but I don't think that investors have recognized that the changes are likely to be permanent and profound. For example, in August, Weber (WEBR), maker of outdoor grills that will surely benefit from both the trends I've identified, held an initial public offering (IPO) but raised only $250 million, or half the amount it had intended. Since the IPO, the stock has fallen despite soaring revenues.

Traeger (COOK), a Weber competitor that uses wood pellets for fuel, has fared even worse. Suffering from supply-chain problems, the company's stock price dropped from $22 at its July IPO to just under $13 in early December. Neither company is profitable, so shares of both are risky, but they appear to be good long-term investments. (Stocks I like are in bold; prices and other data are through Dec. 3.)

There was early speculation that Americans would be moving from cities to suburbs and from the Northeast and Midwest, where they have to stay indoors much of the year, to more temperate states including South Carolina or California. But the evidence so far is mixed.

On April 26, Bloomberg ran an article that said, "There is no urban exodus; perhaps it's more of an urban shuffle. Despite talk of mass moves to Florida and Texas, data show most people who did move stayed close to where they came from." But the next day, a Wall Street Journal piece carried the headline, "The Pandemic Changed Where Americans Live."

The data are mixed, but my guess is that endemic COVID will indeed encourage Americans to move to homes with more space and amenities in parts of the country where they can be outside – but the exodus isn't going to happen overnight.

The big winners of the COVID shift, then, will be homebuilders. The shares of most of them have already risen since the pandemic began but, in my view, by not nearly enough to make them unattractive to long-term investors. Consider KB Home (KBH), the 64-year-old Los Angeles company that builds mainly in Sun Belt states, such as Texas, North Carolina and Arizona. Its shares traded at $38 in January 2020 before COVID hit and are now at $42. The stock looks like a value investor's dream, trading at a price-to-earnings (P/E) ratio of just 5 based on a consensus of analysts' earnings projections for 2022.

Housing Stocks: Best in Class

My favorite homebuilder, NVR (NVR), has fared better than many of its rivals, and I think it's best in class. Shares have risen by 37% over the past 12 months, or about half again as much as the benchmark S&P 500 Index. But even so, the stock's P/E is only 14 – very modest for a company whose earnings for the most recent quarter were up 33% over the same period in 2020. NVR, whose brands include Ryan and Heartland, builds in the Carolinas, Tennessee and Florida, as well as in the mid-Atlantic states.

In the summer of 2020, I encouraged readers to buy homebuilders in the early stages of the pandemic. That turned out to be a good call.

One of my choices was Meritage Homes (MTH), a Sun Belt builder based in Phoenix that focuses on entry-level buyers, with an average sales price of about $400,000. The stock has risen by more than 30% in the past year, but, like NVR, it appears to be a bargain, with a P/E of just 5, despite a 15% boost in home closings and an 85% increase in earnings for the third quarter of 2021 compared with the same period the year before. Meritage has a strong balance sheet, and the company has accelerated its acquisition of lots for future building.

6 Other Stocks to Cash In on COVID

If you decide to buy a home in the suburbs or beyond, and you want to spend time outdoors with family, you may want more than a grill. What about a pool? The stock for taking advantage of increased aquatic demand is Pool Corp. (POOL), a Covington, Louisiana-based company that sells pool supplies including cleaners, filters and pumps throughout the U.S. as well as in Europe and Australia. The business model is wonderful. It provides recurring income from relatively well-off consumers who can tolerate price increases, and anyone who owns a pool knows that it is a beast that has to be fed constantly.

Even before the pandemic, Pool Corp.'s revenues were rising briskly – an average of 8% annually between the start of 2015 and the end of 2019. The stock was rising too, by an annual average of 29% over the same period. Pool Corp. stock is not cheap, but neither, I believe, is it overvalued.

Similarly, Cavco Industries (CVCO), maker of modular homes and recreational vehicles under such brands as Fleetwood and Palm Harbor, has already benefited from the pandemic. RVs help families chase the sun and stay outdoors. Cavco stock has risen sharply in the past year, but it's still a good long-term investment.

I would put Home Depot (HD) in the same category as a company that will profit as COVID becomes endemic and Americans want to invest in more-comfortable homes. Yes, investors have already figured out that Home Depot is a winner, but they have not, in my opinion, bid its price up to heights that should deter you. (Home Depot is also one of the Kiplinger Dividend 15, the list of Kiplinger’s favorite dividend stocks. The stock currently yields 1.6%.)

A third company in this same category is Williams-Sonoma (WSM), which satisfies America's increased enthusiasm for cooking at home and knows how to sell its high-end products successfully online. Williams-Sonoma shares have increased about 65% in value in the past year but still trade at a P/E in the mid teens.

Finally, no list of COVID stocks is complete without Netflix (NFLX) and Amazon.com (AMZN). Netflix shares doubled from the start of the pandemic through the fall, then took a dive. This is the dominant stay-at-home company in the world, and, although it has 214 million video subscribers, there are hundreds of millions more out there.

Amazon stock has been treading water since August 2020, but its business keeps growing. Revenues for 2021 will be close to half a trillion dollars, or twice the level of 2018. Staying at home and shopping have become America's favorite pastimes.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence. Of the stocks mentioned in this column, he owns NVR and Amazon.com. Reach him at james_glassman@kiplinger.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

The U.S. Economy Will Gain Steam This Year

The U.S. Economy Will Gain Steam This YearThe Kiplinger Letter The Letter editors review the projected pace of the economy for 2026. Bigger tax refunds and resilient consumers will keep the economy humming in 2026.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.