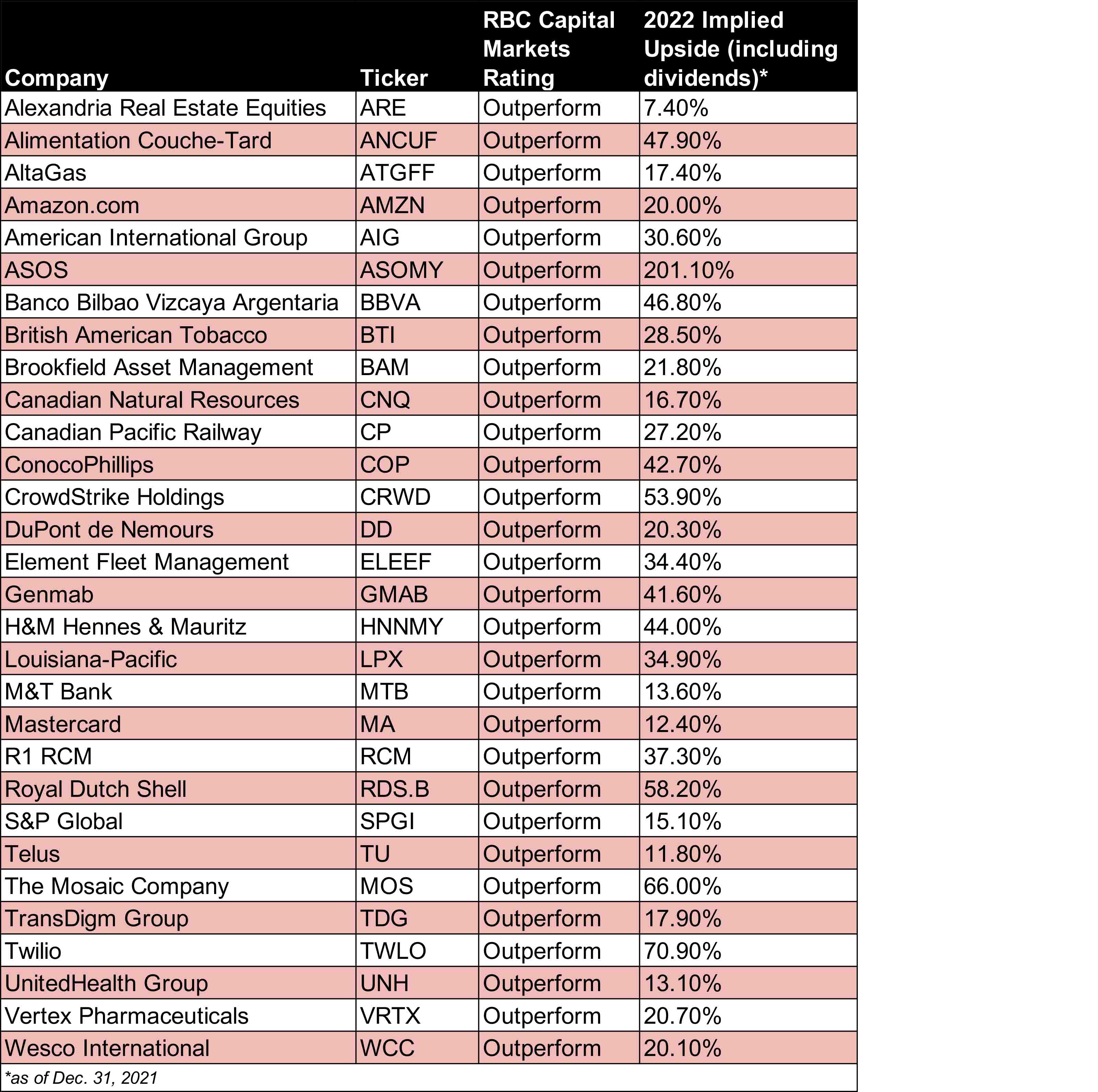

RBC's Top 30 Global Stock Investments for 2022

Inflation. Supply-chain issues. COVID. Investors face numerous hurdles in 2022, but RBC is confident in these 30 stocks' ability to weather the storm.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It will be tough to top the S&P 500's whopper of a performance in 2021. But investors can still look forward to "solid" if more "moderate" returns in the year ahead, says RBC Capital Markets – and perhaps even better with the right stock investments.

"The overall outlook for the next six to 12 months remains optimistic due to strong assessments for fundamentals, valuations, cash deployment and margins, balanced by more cautious views regarding fiscal policy," writes the U.S. Equity Strategy team at RBC.

True, COVID-19, inflation, labor, supply chain, pricing power and regulation remain key concerns, the strategists note. However, RBC industry analysts remain "generally confident in their companies' ability to manage through challenges, including omicron."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

With those factors in mind, RBC Capital Markets has put together a list of their top 30 global stock investments for the year ahead. The equity strategy team's picks span the market's 11 major sectors, and in many cases overlap with Kiplinger's own 22 best stocks to buy for 2022.

Some highlights include:

- S&P Global (SPGI, $435.39). The provider of financial information, analytics and credit ratings products ranks as one of Wall Street's 12 best financial stocks. RBC is on board as well, thanks to the firm's strategic acquisition of IHS Markit (INFO). The deal, which is expected to close in the first quarter, "should accelerate [SPGI's] revenue growth profile and deliver double-digit earnings growth driven by upside to revenue and cost synergies," RBC says. (Share prices as of Jan. 10. Analysts' consensus recommendations and other data courtesy of S&P Global Market Intelligence, unless otherwise noted.)

- ConocoPhillips (COP, $81.03). The independent oil and gas exploration & production company "offers a returns-focused value proposition, a strong balance sheet, and peer-leading distributions," RBC says. The broader analyst community definitely agrees, giving COP a consensus recommendation of Buy, with high conviction, according to S&P Global Market Intelligence. Indeed, the Street is so bullish on the name that SPGI makes the list of 9 best energy stocks to buy for 2022.

- UnitedHeath Group (UNH, $465.00). The nation's largest health insurer by market value and revenue routinely ranks among analysts' top-rated Dow Jones Industrial Average stocks, and makes the list of Wall Street's 12 best healthcare stocks to buy for 2022, as well. "Despite its scale, we believe the company offers investors a strong growth profile and excellent visibility, with earnings per share increasing at a targeted 13% to 16% clip annually," notes RBC.

See the table below for RBC Capital Market's full list of 30 best global stock investments for 2022. And be sure to check out Wall Street's top stocks to buy across individual market sectors, including analysts' 12 best industrial stocks to buy for 2022, their 12 best real estate investment trusts (REITs) and their top 12 communications services stocks for the new year.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

How to Add a Pet Trust to Your Estate Plan

How to Add a Pet Trust to Your Estate PlanAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.