The Best (And Worst) Stocks for Rising Prices

UBS views pricing as a lever to fight inflation. Those companies with strong pricing power can ably deal with rising prices. Those without might struggle.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It's understandable, even forgivable, if our current environment of rapidly rising prices has left investors at a loss.

After all, with inflation running at levels not seen in four decades, few folks have firsthand experience managing their portfolios against this kind of backdrop of rising prices.

Probably the first thing an investor needs to know about investing for rising prices is that some stocks actually benefit from inflation. Companies that have pricing power can have distinct advantages at times like this.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Conversely, companies with weak pricing power are at the mercy of rising prices. Rising prices increase their costs, which saps their margins and, by extension, their profits. A company that can't pass its rising costs onto customers by raising prices tends to be a bad bet when inflation runs hot.

Ideally, investors want to own stocks in companies with strong pricing power, and avoid those with weak pricing power. Helpfully, UBS Global Research has developed a proprietary framework to assess pricing power at the stock level.

UBS's Tactic for Tackling Inflation

Pricing is a lever to fight inflation, UBS says. Unfortunately, it's not one that every firm or industry can use.

"With inflation pressures surging, pricing power relative to cost exposures will be a key theme and source of [absolute outperformance] for global equity markets," writes the UBS Equity Strategy team.

Indeed, UBS finds that historically, whenever the two-year U.S. breakeven inflation rate has topped 2.5%, "companies with strong pricing power have outperformed their weak counterparts by nearly 14% on average over the next 12 months."

If shares in companies with strong pricing power have delivered those sorts of returns in the past, well, investors would do well to adjust their portfolios accordingly.

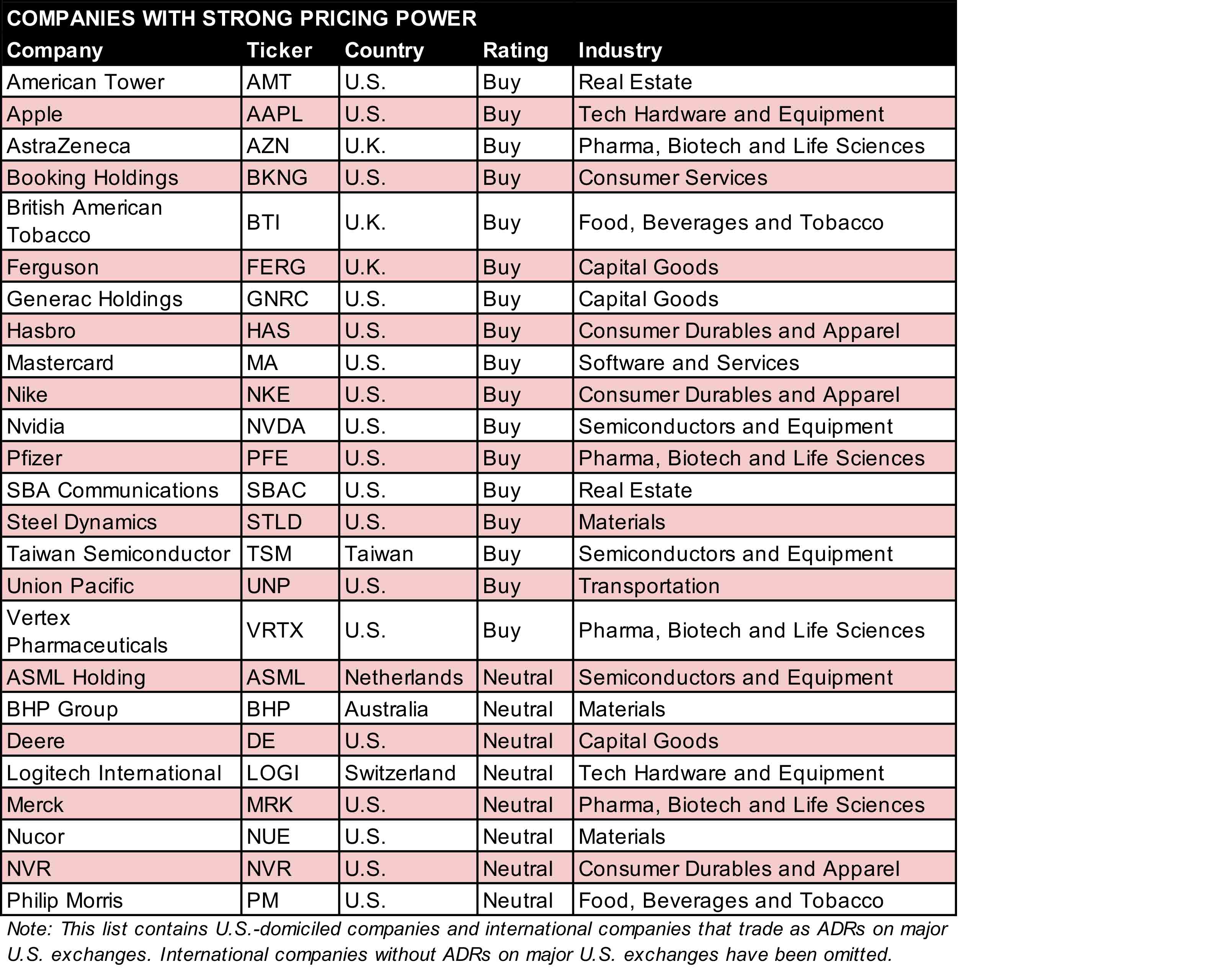

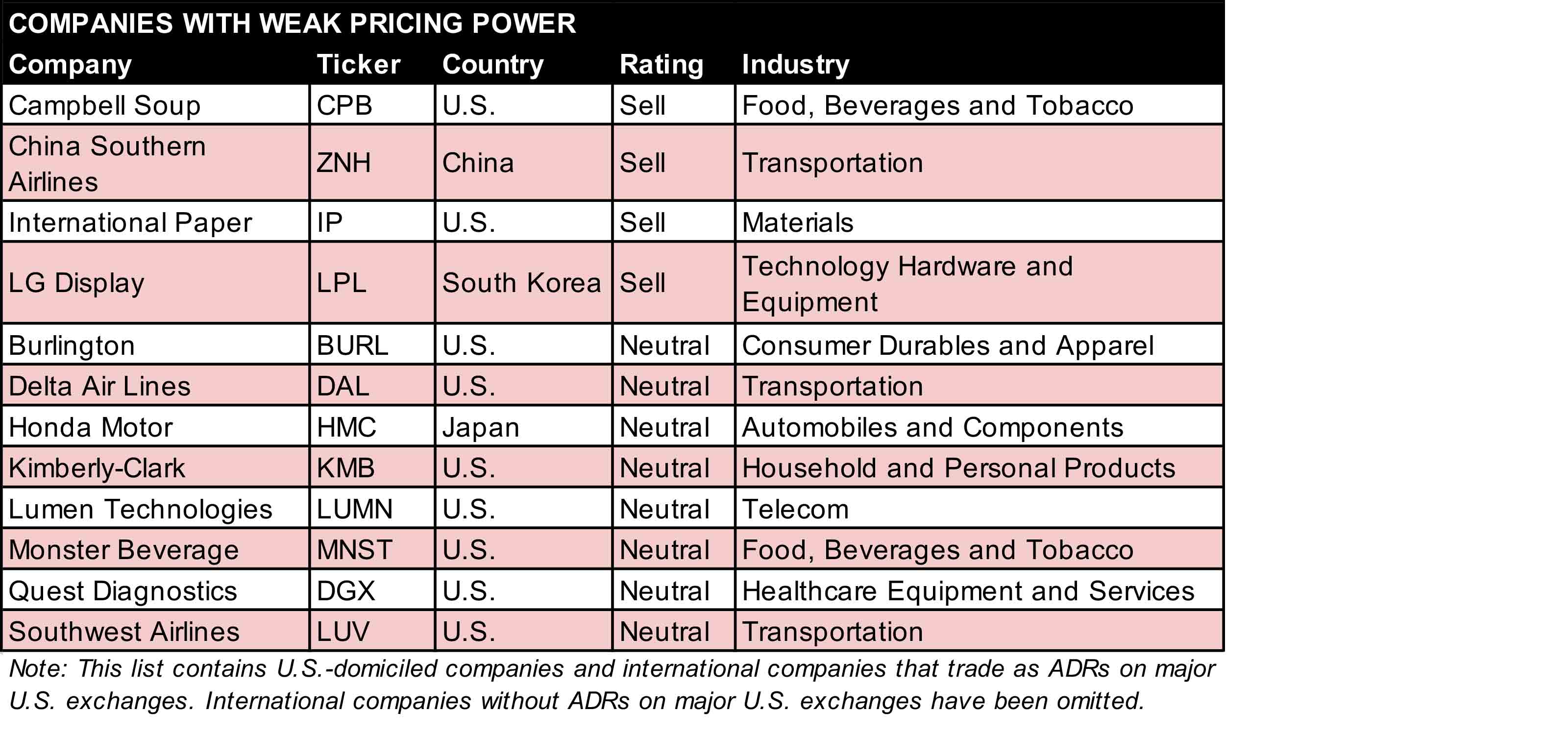

Let's explore UBS's best and worst stocks to buy for rising prices. The best stocks have pricing power and are Buy- or Neutral-rated by UBS industry analysts, while the worst stocks have weak pricing power and receive Neutral or Sell ratings.

You can see the full list of stocks below, with a few highlights of companies with the strongest (and weakest) pricing power.

The Best Stocks for Rising Prices Include…

- Apple (AAPL, $170.40) gets a Buy rating from UBS analyst David Vogt, who cites its ability to maintain and raise prices. "End-market demand has been improving year-over-year leading to elevated 'wait times' despite increased product procurement/production," the analyst says.

- Hasbro (HAS, $83.80) enjoys "pricing power because demand has held up well, while supply has been constrained given port congestion and difficulty to get product into the U.S.," notes UBS analyst Arpine Kocharyan (Buy).

- Nvidia (NVDA, $222.03) "is increasingly monetizing its software solutions more directly which should translate to higher margins and a greater component of revenue from recurring sources," writes UBS analyst Timothy Arcuri (Buy). "It continues to use software to open new markets for its unique hardware solutions which should provide headroom in terms of pricing."

The Worst Stocks for Rising Prices Include…

- Campbell Soup (CPB, $45.81) gets a Sell rating from UBS analyst Cody Ross. "Since 2017, packaged food companies' pricing power diminished as barriers to entry eroded," Ross writes. COVID-19 boosted demand and gave the industry a pricing-power boost, but Ross expects that to "diminish and revert to historical levels over the long-term."

- International Paper (IP, $47.05) suffers from the fact that pricing power for containerboard and paper products is mixed. "Paper products are largely commoditized and traded globally," notes UBS analyst Cleve Rueckert (Sell). "Producers rely heavily on third party logistics and freight in their domestic markets where inflationary pressures have been difficult to pass on."

- Universal Health Services (UHS, $148.96) struggled to control costs in Q4, "something we expect to continue through at least Q1," says UBS analyst Andrew Mok (Sell)." While the nursing labor market should improve throughout the year, we're normalizing to a market that's structurally weaker than it was in 2019. Even then, labor had already been a multi-year headwind for UHS."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.