UBS's 43 Top Stocks for a Volatile Market

UBS gathered the top stock ideas from its North American analysts to compile a list of its highest-conviction ideas in this tumultuous environment.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

It's a well-worn cliche that investors are supposed to buy when there's blood in the streets. In an apparent effort to help clients follow that counsel, the strategists at UBS Research Management recently went looking for the top stocks to buy amid this year's market carnage.

In late May, as stocks were reeling through their longest stretch of consecutive weekly declines in decades, the strategy team at the UBS Global Research and Evidence Lab put out a call to the firm's North American industry analysts, asking for their highest-conviction ideas.

The strategists collected scores of names, and then focused on top stocks where UBS analysts have "a truly differentiated view vs. the consensus, and where we have interesting or proprietary data sources."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

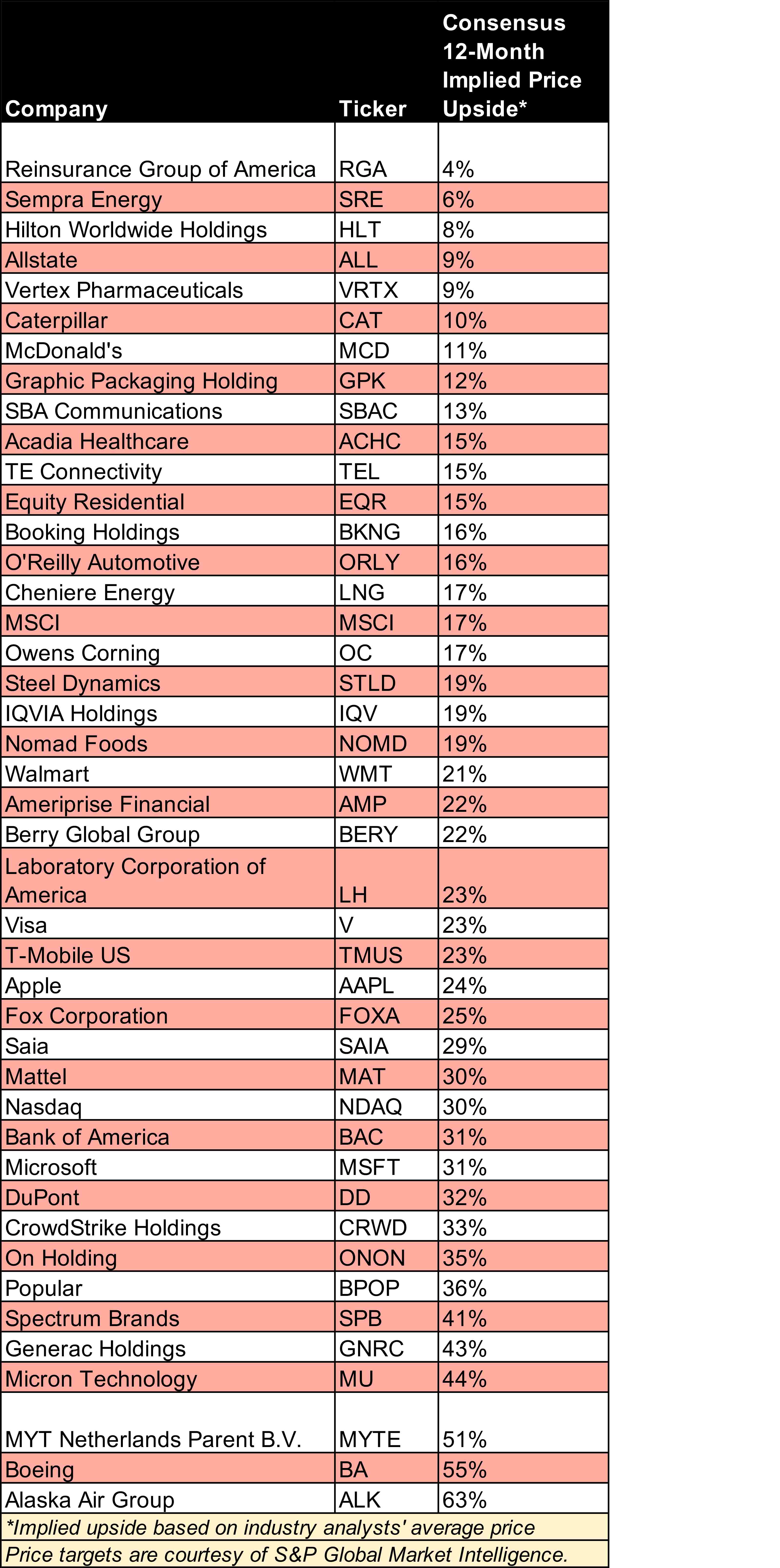

The process produced what UBS calls its "highest-conviction calls in a volatile market," which we lay out in a table below.

Note that the stocks, all of which are Buy-rated by UBS, are listed by Wall Street's consensus implied price upside, from lowest to highest. That is, we used industry analysts' average 12-month price targets rather than target prices provided solely by UBS.

The idea was to inject a little "wisdom of crowds" into the process.

Before we get to the table of UBS's top stocks to buy now, let's have a look at what their analysts have to say about some of the names that Wall Street as a whole likes the best, too:

- Alaska Air Group (ALK, $48.88): "We've maintained ALK as our top pick in U.S. airlines in 2022 given they navigated COVID-19 particularly well by avoiding shareholder dilution and shoring up their balance sheet/improving net debt," writes UBS analyst Myles Walton. "The cost side of the equation is a bit more opaque given general inflationary concerns, but ALK is better protected than most due to their hedge portfolio."

- Micron Technology (MU, $69.94): "We are structural bulls on memory and on MU in particular as DRAM demand remains levered to markets such as cloud computing, 5G and autos, all of which have a long runway of growth," writes UBS analyst Timothy Arcuri. "We believe that as fundamentals and cycles prove to be more durable, there is a significant re-rating potential."

- Generac Holdings (GNRC, $268.88): "GNRC provides a relatively uniquely diversified opportunity to which investors can gain exposure to the rapidly growing solar and storage market with underlying earnings stability from GNRC's core business of recession-resilient home standby power," writes UBS analyst Jon Windham. "Dominant market share and strong demand for home stand-by power have insulated already high residential product margins from inflationary cost pressures."

Here's a look at the rest of UBS's top stocks for a volatile market:

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.