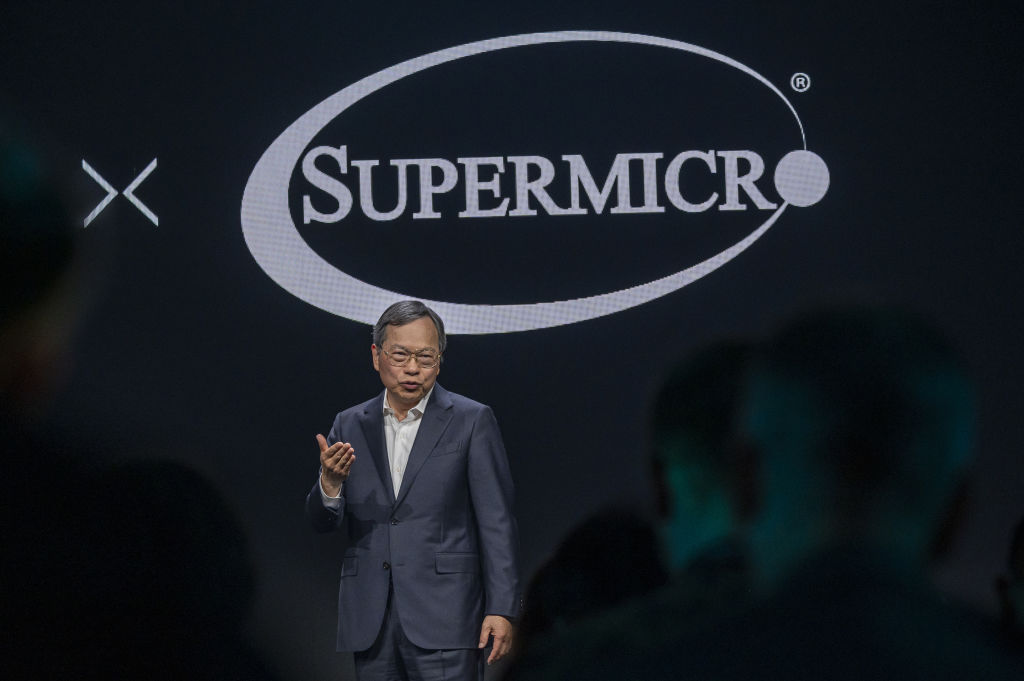

Super Micro Stock Plunges As Delisting Fears Rise: What to Know

Super Micro stock continues to slide after the AI company delayed the filing of its quarterly results, which could cause a delisting from the Nasdaq. Here's why.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Super Micro Computer (SMCI) is the worst S&P 500 stock Thursday, extending Wednesday's decline, after the AI server, software and infrastructure firm announced it would delay the filing of its quarterly earnings.

In a filing with the Securities and Exchange Commission (SEC) issued November 12, SMCI said it is unable to file its financial results for its most recent quarter ended September 30 "without unreasonable effort or expense."

The company had previously notified the SEC that it was unable to file its annual report for its year ended June 30, adding to the problems facing SMCI.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Super Micro said it is "diligently working to select an independent registered public accounting firm" following the resignation of its previous accounting firm, Ernst & Young, on October 24.

In its resignation letter, Ernst & Young said it was "unwilling to be associated with the financial statements prepared by management," according to CNBC.

Will Super Micro get delisted?

The SEC requires publicly traded companies to file annual reports to maintain their listings on U.S. stock exchanges, which SMCI has yet to do for its year ended June 30, 2024.

SMCI has until November 16 to file or submit a plan to the Nasdaq Stock Exchange to regain compliance with its listing rules, according to Barron's. With that deadline just two days away and the company having yet to name an accounting firm, there is rising concern that SMCI will not regain compliance.

So, what will happen to the stock? "You still hold shares, the shares are still traded. They’re traded on the pink sheets [over-the-counter markets]," Wedbush analyst Matthew Bryson told Barron’s.

Here's what Wall Street's saying about Super Micro Computer

Given Super Micro Computer's struggles on and off the price charts – shares are down 77% in the past six months – Wall Street is on the sidelines when it comes to the tech stock.

Of the 12 analysts following the AI stock tracked by S&P Global Market Intelligence, one says it's a Strong Buy, two have it at Buy, seven call it a Hold, and two rate it Sell or Strong Sell. This works out to a consensus recommendation of Hold.

And amid SMCI's troubles, some analysts have washed their hands completely of the stock.

"Given the reputational and financial restatement risks raised by Ernst & Young's resignation as the company's certified public accountant, we have suspended our rating on shares of Super Micro," said Needham analyst Quinn Bolton in a November 6 note.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joey Solitro is a freelance financial journalist at Kiplinger with more than a decade of experience. A longtime equity analyst, Joey has covered a range of industries for media outlets including The Motley Fool, Seeking Alpha, Market Realist, and TipRanks. Joey holds a bachelor's degree in business administration.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.