7 Small-Cap Tech Stocks That Pack a Punch

Small-cap technology stocks might be a rollercoaster ride to hold, but their oversized upside potential makes them worth exploring.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

You always have to accept some risk when you buy small-cap stocks, especially when they're in the technology sector. But in some cases, the juice is worth the squeeze.

It doesn't take much to move small-cap tech stocks – typically considered to be companies between $300 million and $2 billion in market value. There's the idea that it's easier to double revenues from, say, $10 million than it is to do so from $10 billion. Of course, it's just as easy for those revenues to be cut in half. Thus, catalysts such as a new major contract can swiftly lift positions, while losing a single customer can crush shares.

Thus, it's wise to invest no more in any small company than you can easily afford to lose. But if you can stand a little risk, the rewards can be rich.

Let's go over seven small-cap tech stocks to buy. Each of these companies is positioned in a growth business with a promising trajectory. They also benefit from bullishness from the analyst set – each tech stock listed here has a consensus Buy rating from the group of Wall Street pros covering it.

Data is as of Oct. 15. Revenues are for the trailing 12 months. Analyst ratings and revenues are from S&P Global Market Intelligence.

CommVault Systems

- Market value: $2.0 billion

- Revenue: $681.7 million

- Specialty: Data backup

- Analyst ratings: 5 Strong Buy, 1 Buy, 3 Hold, 0 Sell, 0 Strong Sell

CommVault Systems (CVLT, $43.87) offers software to back up, manage, protect and recover data, via both the cloud and on-site systems. The New Jersey-based firm says its software makes it a leader in data resiliency.

The company's most recent quarterly results, for its fiscal Q1 ending in June, included revenues of $173.0 million, up 7% year-over-year. That included a 24% improvement in recurring revenue to $141.1 million. That means about 80% of revenues are on some sort of subscription basis, which is typically viewed as more stable and predictable.

In September, CommVault announced it would make several products – New Commvault Disaster Recovery, Commvault Backup & Recovery and Commvault Complete Data Protection – available to general customers. Disaster Recovery, for instance, lets customers quickly launch backups of their workloads in the event of an outage.

Twice as many analysts covering CVLT call it a Buy, putting it among Wall Street's top small-cap tech stocks at the moment. Among the former group is William Blair analyst Jason Ader (Outperform, equivalent of Buy), who likes that a higher percentage of software revenue now comes from cloud subscriptions.

"We continue to see a favorable risk/reward for the stock, and believe that the company's deep technology portfolio, installed base, and recurring revenue profile continue to be underappreciated by investors," he says.

John Freeman of CFRA, one of a few analyst outfits that use Strong Buy ratings, gives one to CommVault. He cites a laundry list of points that back up the bull case, including "solid progress for CEO (Sanjay) Mirchandani's turnaround plan," the expansion of a Microsoft (MSFT) partnership, attractive valuation and "large, conservative, loyal customers." He adds that the company had $341 million in net cash as of June.

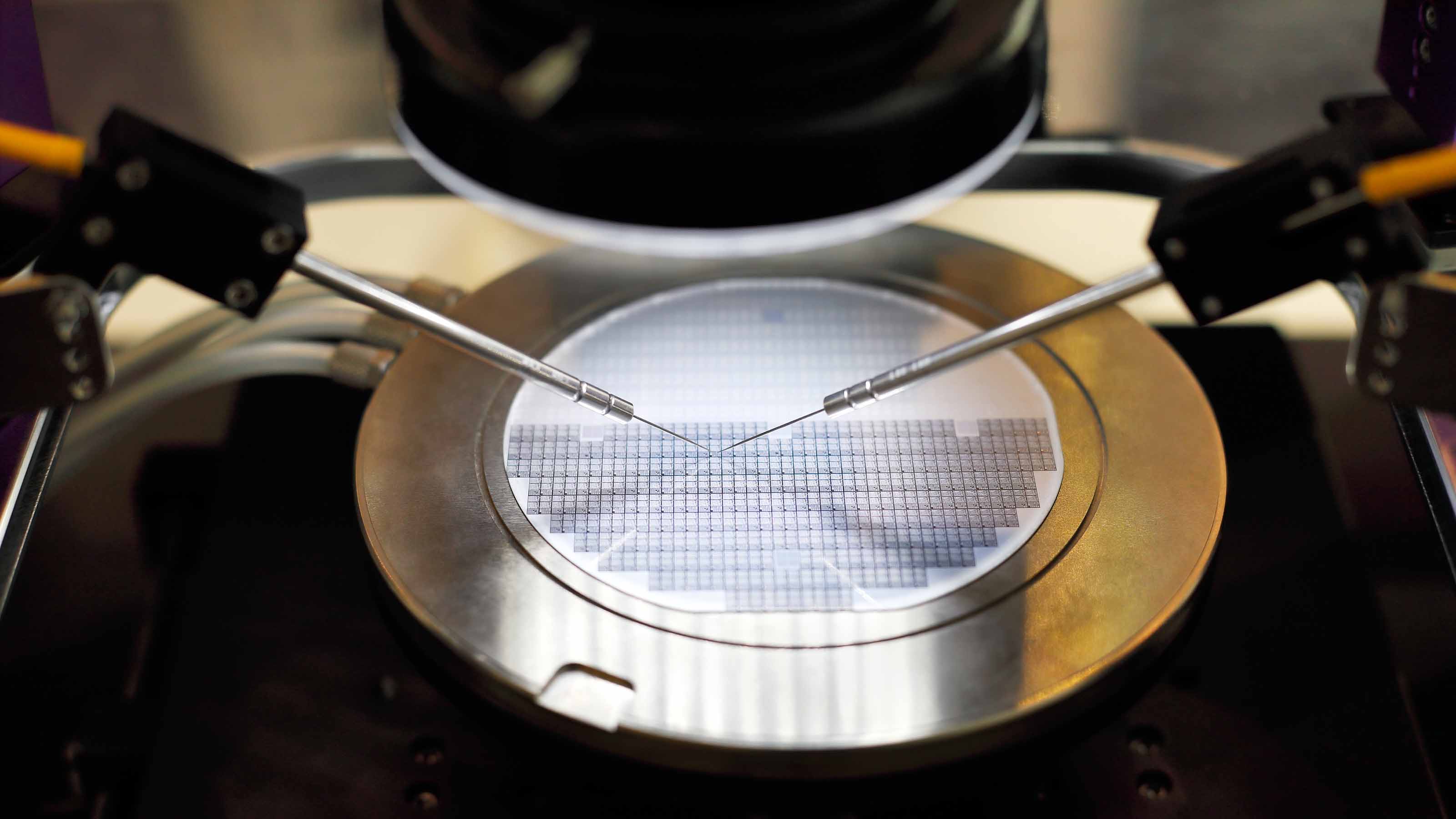

FormFactor

- Market value: $2.3 billion

- Revenue: $637.8 million

- Specialty: Semiconductor testing

- Analyst ratings: 5 Strong Buy, 1 Buy, 1 Hold, 0 Sell, 0 Strong Sell

FormFactor (FORM, $29.41) – based in Livermore, California, in what could be called Silicon Valley's exurbs – is in one of the hottest niches for small-cap tech stocks: It provides service to semiconductor manufacturers.

FormFactor makes high-performance probe cards, which can be used to test chips for defects while they're being made. These now include probes designed for use in cryogenic environments, as low as 4 degrees (kelvin) above absolute zero. These can be important in testing quantum computers, which deliver results based on the spin of individual atoms. As circuit lines approach the width of a light beam, such quantum computer techniques become a key to increasing compute speed.

For the first six months of 2020, FormFactor's revenues grew almost 18% YoY to $270.2 million, while adjusted profits jumped 66% to $51.9 million. (The company also was profitable on a generally accepted accounting principles, or GAAP, basis.)

While second-quarter numbers did miss estimates, Craig-Hallum analyst Christian Schwab nonetheless upgraded the stock from Hold to Buy with a $30 price target in September, when shares were trading closer to $23. Stifel analyst Brian Chin also reiterated his Buy rating on the stock.

"FormFactor's strong cash generation and deepening reserves also position the company to expand into new markets," Chin says, "and our analysis shows ample investor willingness to pay higher growth multiples for acquisitive peers with an ostensibly similar revenue profile (lower volatility and recurring)."

Citi also upgraded FormFactor to Buy recently, citing its exposure to 5G technology, where sales are expected to be strong during the second half of the year.

Limelight Networks

- Market value: $737.3 million

- Revenue: $227.0 million

- Specialty: Content delivery

- Analyst ratings: 8 Strong Buy, 1 Buy, 1 Hold, 0 Sell, 0 Strong Sell

Scottsdale, Arizona-based Limelight Networks (LLNW, $6.04) sells content delivery services to media and software companies, and that has been a booming business in 2020. Shares have been driven up by nearly 50% year-to-date, albeit in rocky fashion, and nine out of the 10 analysts following it say it's among the best small-cap tech stocks for new money.

Limelight operates its own private network with more than 70 terabits per second of capacity across 130 "points of presence" worldwide. It saves or caches content and serves it from the best location, with software that can scale to handle surges in demand. This includes video and gaming content, and computer security services.

Its most recent quarterly numbers (Q2) don't look that spectacular at first blush: a loss of $1.7 million (or 1 cent per share) on revenues of $58.5 million. But those revenues were up 28% year-over-year, and the loss was much narrower than 2019's $7.2 million in red ink. Across the first six months of 2020, Limelight has more than halved last year's losses, while sales have shot up by 30%.

Truist Financial analyst Greg Miller recently initiated coverage with a Buy recommendation, saying he expects LLNW to gain share in the $9 billion content delivery network market. Moreover, he thinks the company can hit its long-term revenue growth and EBITDA (earnings before interest, taxes, depreciation and amortization) goals thanks to the pandemic exacerbating secular trends in the space.

William Blair analyst Jim Breen (Outperform) has raised his earnings estimates recently. He said Q2 results exceeded expectations thanks to over-the-top offerings such as Comcast's (CMCSA) Peacock and AT&T's (T) HBO Max. Limelight expanded its capacity ahead of this new demand, he writes, and should also benefit from the rise in demand due to 5G devices.

"The company has no leverage, and we expect that it will continue to expand margins beyond 2020, as OTT video services accelerate top-line growth," he writes. "We believe that Limelight's stock is attractively valued, trading at a discount to its peers on an enterprise-value-to-sales basis and relative to the growth opportunity ahead of the company."

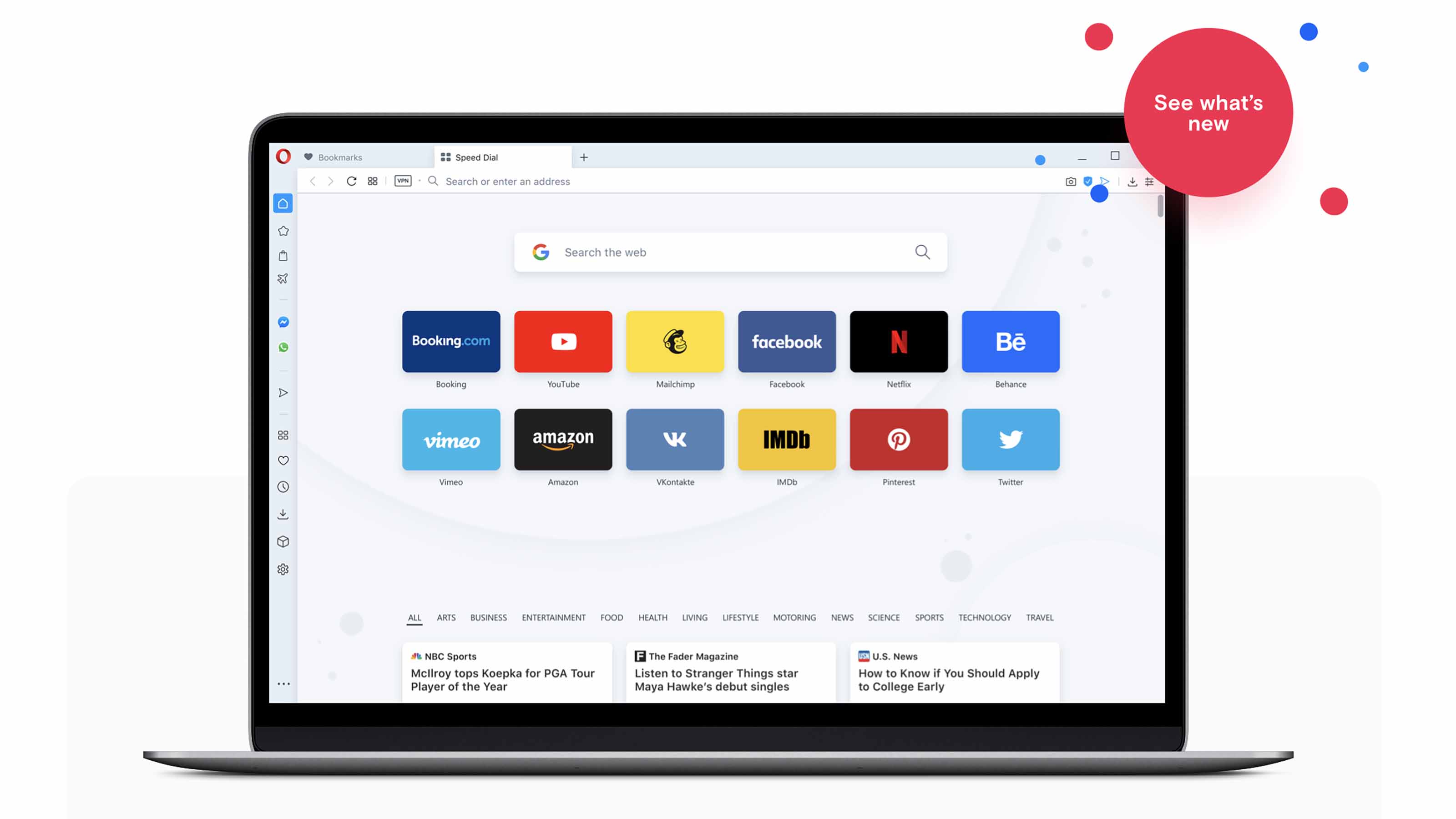

Opera.com

- Market value: $1.2 billion

- Revenue: $416.9 million

- Specialty: Internet software

- Analyst ratings: 5 Strong Buy, 0 Buy, 0 Hold, 0 Sell, 0 Strong Sell

Opera (OPRA, $9.83), based in Oslo, Norway, makes the "best browser you never heard of," according to Popular Science. It's focused on privacy, with versions for desktop, mobile and gamers. There is even a version designed for Tor, allowing access to the dark web.

Opera itself seeks out niches in the market, with different versions of its software for each niche. These include cryptocurrency, micro-lending, news aggregation, and virtual private networking. Its latest versions are based on the open-source Chromium, using the Blink rendering engine.

Despite boasting 360 million monthly active users worldwide, there's a good chance you haven't heard of Opera. And that's the challenge. It's not a large business, and it is losing money – but fortunately, it's doing so at a much slower rate. The company's revenues for the first six months of 2020 have shot up 73.6% to $194 million, and it slimmed net losses by 76% to just $3 million.

Only five analysts follow this small-cap tech stock, but all five are all-in. Citi's Alicia Yap (Buy, $12 price target) notes that Opera is popular with cryptocurrency companies. She expects its new aggregator to gain traction in 2021, but she admits it's a niche player.

Lake Street analyst Mark Argento lowered his price target from $15 per share to $11 back in August but retained a Buy rating. He says the company's plan to spin off its emerging-markets microlending business and merge it with Mobimagic "complicates the story in the near term" but will be the right move down the road.

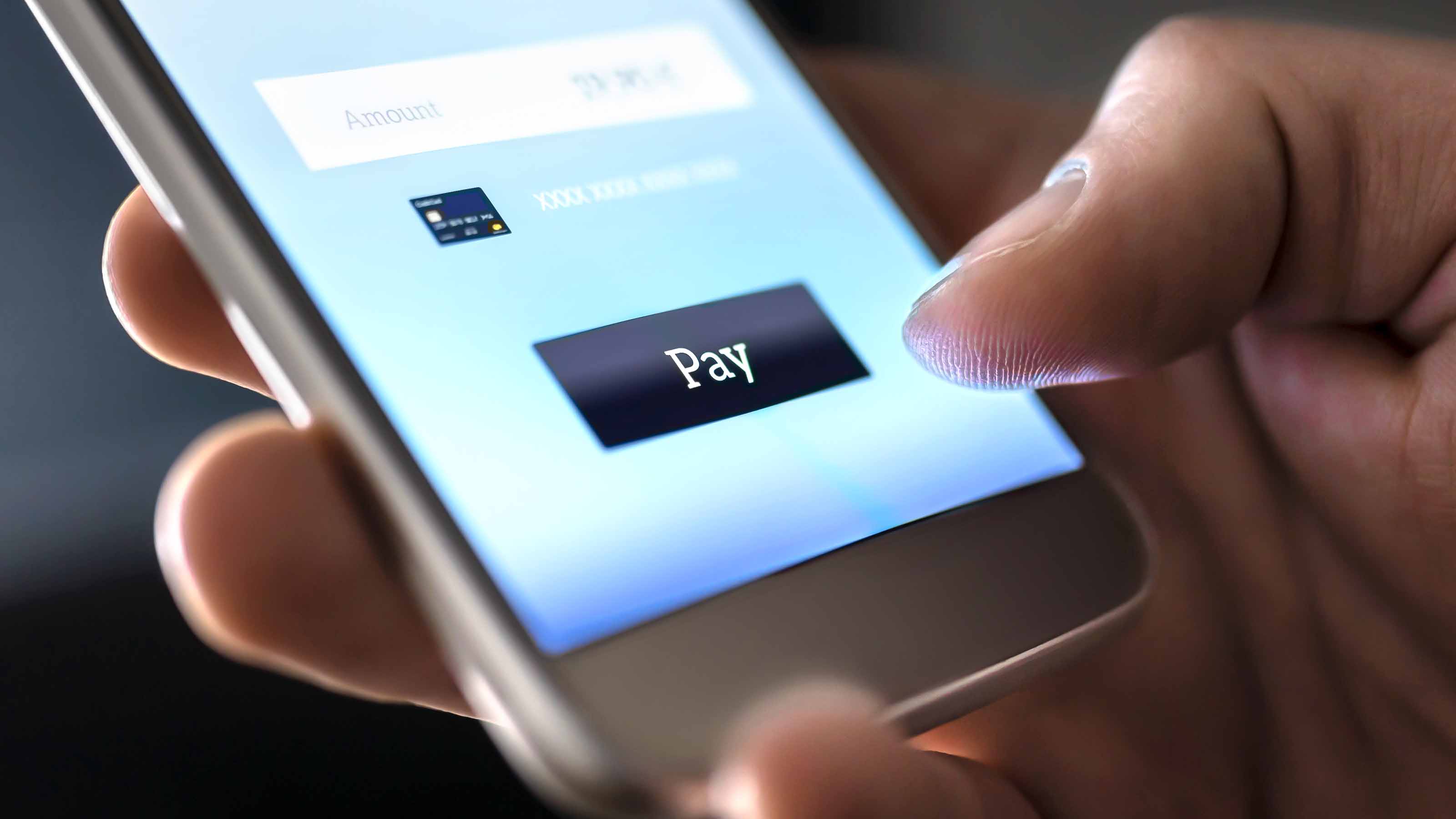

Repay Holdings

- Market value: $1.8 billion

- Revenue: $135.9 million

- Specialty: Payment processing

- Analyst ratings: 6 Strong Buy, 3 Buy, 1 Hold, 0 Sell, 0 Strong Sell

Repay Holdings (RPAY, $24.06) is at the center of another hot technology: transaction processing, and it's based in Atlanta, the employment center of that industry. Repay also is developing a niche in handling business-to-business (B2B) payments to go along with its auto payments biz.

Repay is best known for Instant Funding, which moves loan money directly to customer prepaid or debit cards. The company also offers standard Visa (V) and MasterCard (MA) transaction processing. It's at the center of a trend toward moving credit purchases into payment processing networks.

In July, Repay purchased cPayPlus – an accounts payable automation provider – for $8 million, with up to another $8 million payable in Q3 2021 depending on whether it hits certain growth targets. The company expects cPayPlua to "generate top line and gross profit growth in excess of 100% annually through 2022."

The company's stock has gained more than 64% year-to-date, despite multiple secondary share offerings to help bolster the company's coffers. It current has about $166 million of cash on hand, versus $253 million in long-term debt.

Profitability is a bit more of an issue here. While the company's revenues for 2020's first six months are up 70% year-over-year, the company flipped from a $5.6 million profit during the first half of 2019 to a $6.7 million loss so far this year.

Nonetheless, Wall Street likes RPAY more than most other small-cap tech stocks.

William Blair's Robert Napoli (Outperform) says Repay is building an "an end to end, business-to-business business," not just a consumer franchise.

Canaccord Genuity's Joseph Vafi, who recently hosted Chief Financial Officer Tim Murphy at a conference, calls RPAY a Buy with a 12-month price target of $30. He calls B2b "one of the best land grabs out there." He also points out that "over two-thirds of the deals that Repay wins are greenfield opportunities," referring to untapped markets.

Sprout Social

- Market value: $2.4 billion

- Revenue: $116.5 million

- Specialty: Social network management

- Analyst ratings: 5 Strong Buy, 4 Buy, 0 Hold, 0 Sell, 0 Strong Sell

Chicago-based Sprout Social (SPT, $47.54) is not, as the name might lead you to think, a social network. Instead, it offers a cloud-based tool used by brands to manage the social networking traffic around them. That allows brands to then quickly respond to that traffic and adjust strategies as necessary. It's a niche that's also appropriately branded "reputation management."

Sprout came public in December at $18 per share, and the stock has taken off like a rocket since then. In its most recent quarter, the company posted 27% revenue growth to $31.4 million, and its losses shrank by 23% to $8.3 million.

Sprout believes the next generation of chief marketing officers will come from people who currently are doing social media management. While social networks like Facebook (FB), Microsoft's LinkedIn and Twitter (TWTR) offer their own analysis tools, third-party systems such as Sprout's, as well as competitors HootSuite, Buffer and AgoraPlus, let managers monitor all these networks at once.

SPT is among the most popular small-cap tech stocks on the Street, with nine analysts following it, and every one of them calling it a Buy or better.

Stifel analyst Tom Roderick (Buy) wrote in August that the economy's COVID headwinds have turned into digital tailwinds. Roderick called Sprout the leading player in its niche, saying it's "best positioned to capture share in this fast-growing market."

Upland Software

- Market value: $1.3 billion

- Revenue: $260.5 million

- Specialty: Cloud-based business software

- Analyst ratings: 5 Strong Buy, 4 Buy, 0 Hold, 0 Sell, 0 Strong Sell

Upland Software (UPLD, $44.41), based in Austin, Texas, is building a suite of cloud-based applications through acquisitions; it has made more than a couple dozen so far. That's quite the haul, considering it was only founded a decade ago and came public in 2014.

Upland's products, organized around documents, projects, sales and customer experience, are sold by subscription. Total revenues for the second quarter improved by 35% to $71.3 million, which included a 39% boost in subscription and support revenues to $67.7 million. UPLD is guiding for 29% growth in recurring revenues for the full year.

Upland's strategy is to buy small companies, backed by venture capital, once they get to $5 million to $25 million in sales per year, making them affordable. At the end of June, the company had $88 million in cash to fund such acquisitions.

UPLD and SPT have the same analyst split, 5 Strong Buys and 4 Buys, making them the two top small-cap tech stocks, based on analysts' opinions.

"We appreciate Upland's healthy capital position, durable installed base and platform for driving accretive M&A in the future as the economy continues to recover," writes Credit Suisse (Outperform), which recently raised its 12-month price target from $37 per share to $46. "The company remains focused on organic initiatives, with an emphasis on its 6-8 quarter playbook for (go to market) improvements, while also looking forward to a healthy pipeline of M&A targets with potential for a 'banner year' in FY21."

William Blair's Bhavan Suri reiterated an Outperform rating after Upland's earnings call in August. "We exited the call optimistic about the company's durability during this economic cycle and believe Upland's investments in its go-to-market strategy will allow the company to come out stronger on the other end."

Canaccord Genuity's David Hynes (Buy) has a $50 price target, and says he sees more positive cash flow coming from a renewed emphasis on sales instead of deals. Some of this comes from using its own acquisitions, like Altify, bought last October for $84 million, to reorganize the sales effort.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

What Is AI? Artificial Intelligence 101

What Is AI? Artificial Intelligence 101Artificial intelligence has sparked huge excitement among investors and businesses, but what exactly does the term mean?

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

The Best Tech Stocks to Buy

The Best Tech Stocks to BuyTech stocks are the market's engine of growth. But what defines a tech stock? How do you find the best ones to buy? We take a look here.

-

All AI Regulations Are Not Created Equal: Kiplinger Economic Forecasts

All AI Regulations Are Not Created Equal: Kiplinger Economic ForecastsEconomic Forecasts As Congress regulates artificial intelligence, tech advocates urge lawmakers to define different areas of AI, as some are more dangerous than others.

-

Text-Generating AI Faces Major Legal Risks: Kiplinger Economic Forecasts

Text-Generating AI Faces Major Legal Risks: Kiplinger Economic ForecastsEconomic Forecasts Major legal risks to text-generating artificial intelligence: Kiplinger Economic Forecasts

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.