Wedbush: Tesla Stock Has Double-Digit Upside, But Don't Buy TSLA

Analyst Dan Ives just put a Street-high $950 price target on TSLA stock, but he maintained his Neutral stance. Here's why.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Tesla (TSLA, $845.00) stock has the potential to reach $950 per share, says Wedbush analyst Daniel Ives.

But he still doesn’t think you should buy it.

Tesla shares jumped at Friday’s opening but soon cooled off, perhaps influenced by Ives slapping a Street-high price target on TSLA stock without raising his recommendation.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Ives hiked his 12-month target price, from $715 per share to $950, to better reflect the electric vehicle (EV) maker's surging deliveries in China. At the same time, however, Ives stood pat on his Neutral rating, which is essentially the same as a Hold call.

The lack of an upgrade despite a PT implying double-digit upside might have caused some confusion for TSLA investors, so let's unpack it.

The Bull Case for Tesla Stock

First, have a look at the key thinking behind Ives' new price target.

"The hearts and lungs of the Tesla bull thesis is centered around China as we have seen consumer demand skyrocket into 2021," Ives wrote in his report to clients. "We believe that the China growth story is worth at least $100 per share in a bull case to Tesla as this EV penetration is set to ramp significantly over the next 12 to 18 months, along with major battery innovations coming out of Giga 3."

(Giga 3 refers to Tesla Giga Shanghai in China. Also known as Gigafactory 3, this is where finally assembly of the Tesla Model 3 takes place.)

The bottom line is Ives' raised his target on Tesla stock "to reflect a stronger EV demand forecast going forward." The analyst also lifted his "bull case" price target to $1,250 from $1,000, which is what to expect in a sort of best-case scenario.

So Why Is TSLA Stock Not a Buy?

Here's why it's not weird that Ives didn't raise his call from Neutral to Outperform: A target price of $950 gives TSLA upside of about 13%, which isn't a big deal after considering what that actually means.

Different equity researchers mean different things when they say Hold or Neutral or Market Perform, what have you. At many shops, recommendations are benchmarked against the S&P 500. A Buy call means the analyst expects the stock to outperform the benchmark index over some period of time, usually around 12 months. A Hold call reflects the expectation that the stock will perform in line with the S&P 500, while a Sell call projects the stock will lag the index.

You get the idea.

Wedbush's recommendations are a bit different. Rather than benchmark to the S&P 500, it employs the other stocks in the analysts' research universe as the benchmark.

"Expect the total return of the stock to perform in-line with the median total return of the analyst's (or the analyst's team) coverage universe over the next 6-12 months," says Wedbush. Ives covers more than 30 companies, including Apple (AAPL), Microsoft (MSFT) and Salesforce.com (CRM).

Furthermore, Wedbush's Neutral recommendation is also firmly in the mainstream when considering what the rest of the Street thinks. Of the 37 analysts covering TSLA stock tracked by S&P Global Market Intelligence, seven rate it at Strong Buy, four say Buy, 14 rank it at Hold, five call it a Sell and three say Strong Sell. The remaining four analysts have no recommendation on the stock.

Put it all together, and Tesla shares earn a consensus recommendation of Hold, according to S&P Global Market Intelligence.

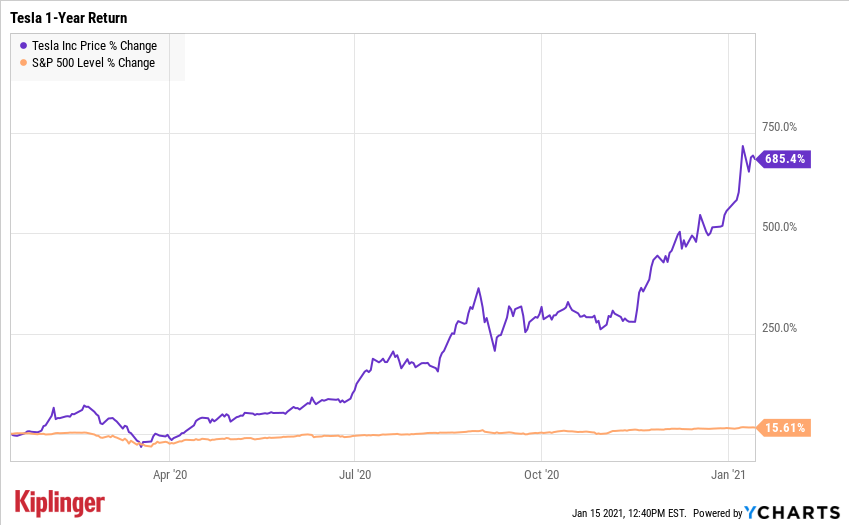

Lastly, TSLA is up about 685% over the past 52 weeks. You can't fault anyone for being cautious about chasing a stock after a run of that magnitude.

You can be bullish on a name and still not love it at current levels. All stocks rise and fall regularly and randomly, and Tesla stock itself happens to be exceptionally volatile. Waiting for a better entry point is a perfectly reasonable argument to make.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.