Zoom Video (ZM): The Bull Case Is Cracked, Not Broken

Zoom Video's latest quarter produced a few uninspiring surprises, but analysts (and a popular fund manager) remain largely bullish on ZM stock.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

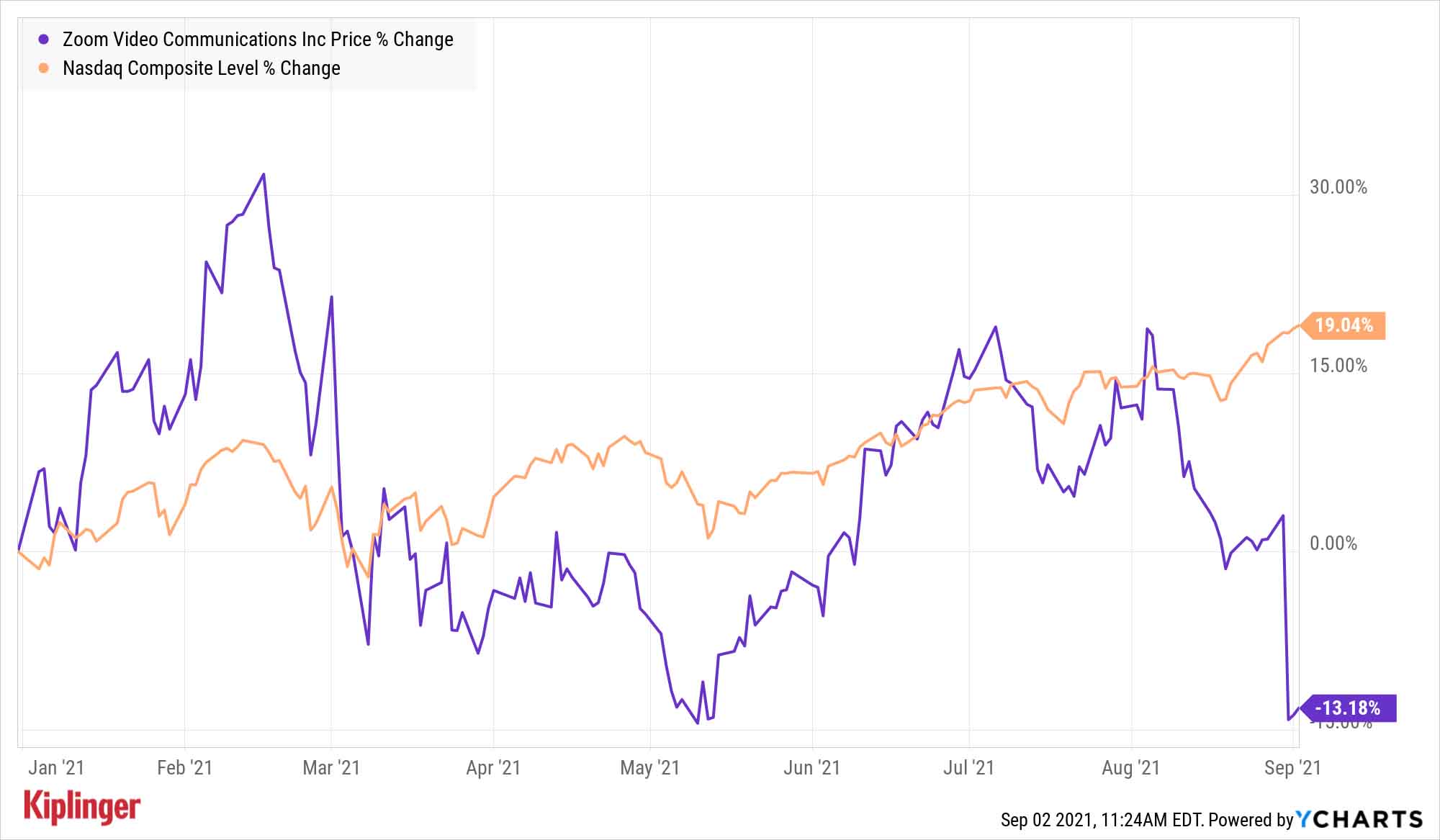

Zoom Video Communications (ZM, $290.86) is the latest work-from-home stock to come up against difficult comparisons versus last year's torrid pandemic-fueled growth. But most Wall Street analysts – and at least one noted bull – continue to bang the drum for ZM stock.

Argus Research, for one, maintained its Buy rating on shares following the company's steep post-quarterly-results selloff. And no less a market luminary than ARK Invest CEO Cathie Wood – manager of some of 2020's best exchange-traded funds (ETFs) – deployed $57 million to buy the Zoom dip.

ZM stock is still off about 15% since spooking the market with high churn in its segment serving small- and medium-sized businesses. Management and analysts alike expect that revenue headwind to persist for several quarters -- an outlook that could weigh on the stock for some time.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Analysts' Take on ZM Stock

Stifel analyst Tom Roderick sums up the Hold case on Zoom: "Year-over-year compares remain as tricky as ever, and the 'Online' business – best represented by customers with fewer than 10 employees – seems to have temporarily peaked."

Over at Needham, analyst Ryan Koontz chimes in with much the same sentiment.

"We maintain our Hold rating on increasing churn and slowing growth, as we seek greater confidence in post-pandemic and new product trends," Koontz writes in a note to clients.

But Argus Research's Joseph Bonner says Zoom's reversion to a more normalized growth rate is hardly a surprise and doesn't change the long-term bull case on ZM stock.

"Zoom made significant gains in its installed base over the last year that should provide a long term benefit whether or not some smaller customers churn in 'coming quarters,'" says Bonner, who rates shares at Buy. "Zoom also demonstrated strong growth in its enterprise business, which the market seems to have overlooked."

The central question for Zoom is whether the pandemic created a secular change in which employees continue to work from home at least part-time -- or whether they are forced to return to their offices en masse, the analyst says.

True, ZM can't influence secular demand for its communication services, but it can tilt things in its favor, Bonner notes. To that end, it's rolling out product extensions, such as Zoom Phone Appliance. Additionally, it aims to become a more broad-based communications platform by enabling third-party developers to create a new applications ecosystem.

"Although the company is competing against some large industry incumbents, it may have just the right mix of innovative technology and strong customer service to take share from these larger competitors," Bonner adds.

Cathie Wood Buys the Dip in Zoom

As much as Zoom bulls might take comfort in Argus Research's take, nothing walks the walk like capital.

That's where ARK Invest's Wood comes in.

The CEO responded to Zoom stock's initial 17% plunge by purchasing roughly 200,000 shares for ARK's flagship ETFs. The ARK Innovation ETF (ARKK) picked up 157,233 shares worth roughly $45.5 million, while ARK Next Generation Internet ETF (ARKW) purchased 36,847 shares for about $11 million.

Back on Wall Street, analysts skew more toward Wood's view of Zoom – albeit with a considerable amount of dissent.

Of the 25 analysts covering ZM tracked by S&P Global Market Intelligence, 11 rate it at Strong Buy, three say Buy, 10 have it at Hold and one calls it a Strong Sell. That works out to a consensus recommendation of Buy, but with middling-to-low conviction.

Analysts project Zoom to generate average annual earnings per share growth of 13.8% over the next three to five years. But overall, they see plenty of run left in ZM stock; their average 12-month price target of $372.05 gives shares implied upside of about 28% from current levels.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.