Goldman Sachs’ GTEK: A Hand-Picked Cutting-Edge Tech Portfolio

Goldman Sachs Future Tech Leaders Equity ETF amassed $260 million in its first three months.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Since their debut in financial markets, the vast majority of exchange-traded funds (ETFs) have been passively managed, either tracking an index or tweaking an index in some way to achieve their investment goals.

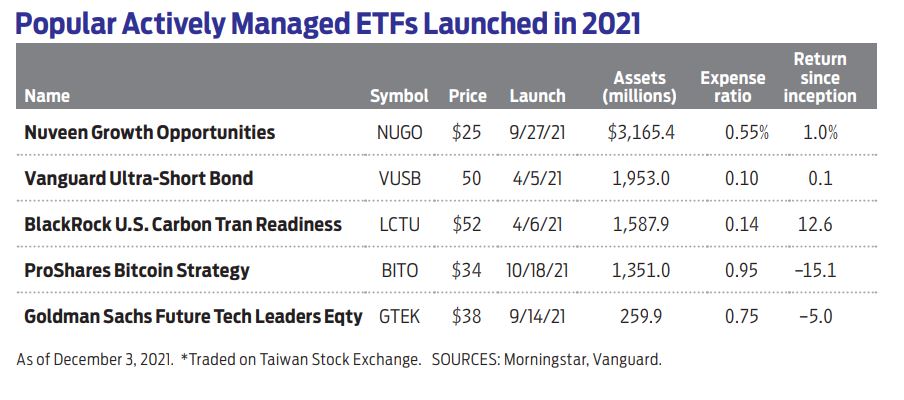

That has changed in recent years. In 2021 through the third quarter, ETF providers launched 332 products – with 197 of them, or 59%, managed by real, live humans, according to ETF.com. Seven of the top 10 ETF launches in 2021 (ranked by assets under management) are actively managed, gobbling up $10.2 billion in assets amongst them.

One of the more intriguing launches of 2021 sits not far outside the top 10: Goldman Sachs Future Tech Leaders Equity ETF (GTEK) amassed an impressive $260 million in less than three months of existence.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Goldman’s managers and a horde of more than 80 fundamental equity analysts are on a mission to identify innovative companies aligned with durable, long-term growth themes – and ones that trade for reasonable valuations to boot.

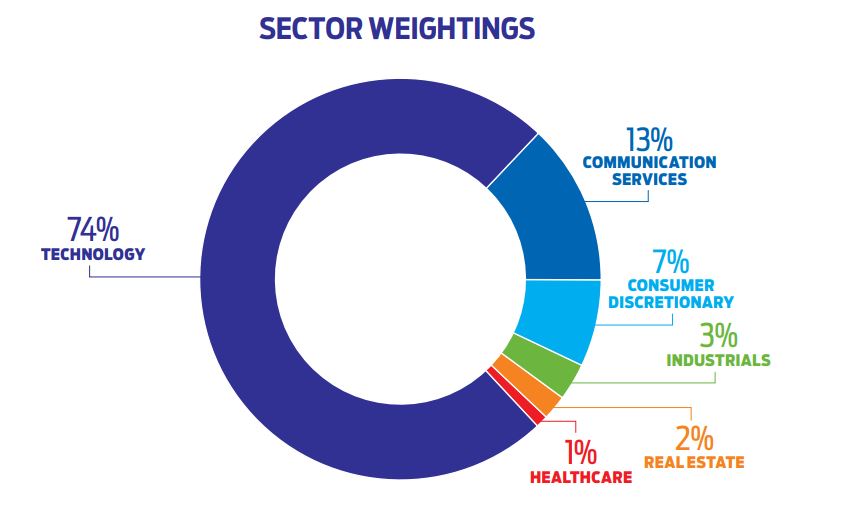

You might assume that GTEK is chock-full o’ tech – and you’d be right: Nearly 75% of assets are invested in technology firms; the tech-adjacent communication services sector claims 13%.

Some 62% of the portfolio is invested in U.S. companies, including Marvell Technology (MRVL, semiconductors) and Workday (WDAY, cloud software). But the sizable remainder of assets is spread across another dozen or so countries. Top GTEK holdings MediaTek and Silergy are a pair of Taiwanese silicon firms.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales Revival

Stock Market Today: S&P 500, Nasdaq Hit New Highs on Retail Sales RevivalStrong consumer spending and solid earnings for AI chipmaker Taiwan Semiconductor Manufacturing boosted the broad market.

-

Stock Market Today: Powell Rumors Spark Volatile Day for Stocks

Stock Market Today: Powell Rumors Spark Volatile Day for StocksStocks sold off sharply intraday after multiple reports suggested President Trump is considering firing Fed Chair Jerome Powell.

-

Is Goldman Sachs Stock Still a Buy After Earnings?

Is Goldman Sachs Stock Still a Buy After Earnings?Goldman Sachs stock is struggling for direction Tuesday even after the financial giant beat expectations for its third quarter. Here's what you need to know.

-

Ford Stock Is Rising After Getting a Big Upgrade at Goldman Sachs

Ford Stock Is Rising After Getting a Big Upgrade at Goldman SachsFord stock has struggled in recent months, but Goldman Sachs is upbeat about improving profitability. Here's what you need to know.

-

Goldman Sachs Reports Q2 Earnings Beat, Dividend Hike

Goldman Sachs Reports Q2 Earnings Beat, Dividend HikeGoldman Sachs stock finished higher Monday after the big bank beat expectations for its second quarter and raised its dividend. Here's what you need to know.

-

Bond Basics: Zero-Coupon Bonds

Bond Basics: Zero-Coupon Bondsinvesting These investments are attractive only to a select few. Find out if they're right for you.

-

Bond Basics: How to Reduce the Risks

Bond Basics: How to Reduce the Risksinvesting Bonds have risks you won't find in other types of investments. Find out how to spot risky bonds and how to avoid them.