10 Stocks to Buy When They're Down

When the market drops sharply, it creates an opportunity to buy quality stocks at a bargain.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When you buy shares of stock, you become a partner in a business. Perhaps I'm stating the obvious, but I doubt all investors see their purchases that way. Many see stocks as horses to bet on or as scorecards that tell them how their 401(k) is doing. Because stocks represent pieces of companies, the first consideration is whether that company is worthy of your partnership.

As I told readers two years ago, I keep a wish list of about a dozen companies. I want to become a partner, but I am waiting for the market to offer me a better price – an event that may never come. Some of these shares have been on my list for decades, and in my reluctance, I have missed spectacular successes.

Johnson & Johnson (JNJ) is a good example. I have lusted after the stock for 20 years, as it has gone from $54 to $176, with a dividend that has increased from 84 cents to $4.52 a share. If you bought J&J in mid-2002, your original investment would be yielding 8.4% annually in dividends alone. (Stocks I like are in bold. Prices and other data are as of June 3.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

When the market drops sharply, I don't despair. Instead, I pull out my list to see if any of the stocks I like have moved into buying range. In other words, could I become an owner? This is a subjective decision. I'm not looking for a particular price-earnings ratio but a general sense that now is the time to pounce on the value stocks.

Such an occasion presented itself in early 2020, when the market tanked on the realization that the COVID pandemic was serious. In the five-week period ending March 15, the S&P 500 stock index dropped 30%, and I told readers that it was time to "get great companies at a reasonable price."

I cited five stocks whose shares I had picked up after they'd been hammered. All have subsequently risen. Oneok (OKE), an energy pipeline company, was the big winner, going from $27 to $67. Hermès International Société (HESAY), the French luxury-goods retailer, went from $72 to $121, and Bank of America (BAC) from $20 to $36. Salesforce (CRM), the business software firm, and Starbucks (SBUX) notched smaller gains.

All but Oneok have suffered significant declines as the S&P 500 has posted double-digit losses since the end of 2021. Hermès, for instance, peaked in November at $188. I still own Hermès and the others. I am not a market timer. No one can pick the tops and bottoms with anything close to consistency. I can't possibly tell you whether the 2022 market decline will continue or worsen or reverse, and I am severely skeptical of anyone who tries.

More than a decade ago, I asked Mark Hulbert, whose Hulbert Financial Digest tracks the performance of market-timing newsletters, to examine the returns of the 97 newsletters that had been around for at least 10 years. He found that just seven of them had beaten the broad Wilshire 5000 Index over the decade.

As the late John Bogle, founder of Vanguard, put it, "After nearly 50 years in this business, I do not know of anybody who has done it successfully and consistently. I don't even know of anybody who knows anybody who has done it successfully and consistently."

By recommending that you keep a wish list and, when the time is ripe, act on it, all I'm saying is that at various points in their history good companies will become irresistibly inexpensive. Sure, they could fall some more, but take the opportunity to become an owner.

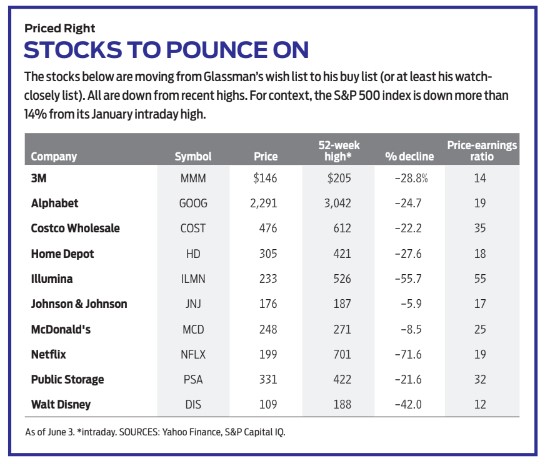

Below are five stocks that I’m moving from the wish list to the buy list.

Costco Wholesale (COST) stock dropped from over $600 to $416 in a month and a half this spring. It has bounced back but remains very attractive. Costco sells everything from groceries to garden supplies to tires in its 800 membership warehouses, about three-fourths of them in the U.S. Earnings keep rising impressively, year after year. High interest rates, supply-chain disruptions and the prospect of a recession are certainly concerns, but in the long run, don’t you want to be a partner with the best big-box retailer in the world?

Home Depot (HD), which operates 2,300 home-improvement stores, is a stock I have always wanted to own. Sales and earnings are expected to rise only a few percentage points in 2022 compared with last year, but the comparison is distorted because in 2021 sales exploded 29.9% with the issuance of COVID stimulus checks. Shares are down by one-fourth this year, and the P/E has dropped to just 18. The stock could go lower, but I am not going to pass up the chance to finally become an owner—especially with a dividend yield of 2.5%. (Home Depot is a member of the Kiplinger Dividend 15, the list of Kiplinger’s favorite dividend stocks.)

Illumina (ILMN) is the leader in the field of genomic sequencing, or determining the composition of DNA. For example, Illumina provides the tools to detect mutations in the COVID-19 virus and to determine where cancer has spread in the body and how to treat it. The stock has lost half its value in less than a year. Why? "Biotech investors are hard to impress," said an article in Barron's after sales rose 40% last year. Perhaps, but Illumina is on the cutting edge of health technology.

Netflix (NFLX) is the one that got away. I first bought the stock in 2003, when it was trading at less than $2 a share (adjusted for splits). After the stock quadrupled, I sold it and watched it soar. Disheartened, I never bought it back – even though it has gone through several periods of steep decline followed by strong advances. Netflix shares have dropped from about $700 in November to about $200 today, mainly on worries about competition cutting into subscriptions. What an overreaction! The stock, which carries a P/E of just 18.5 based on analysts' projected earnings for the 12 months ahead, is cheaper today than it was in 2018, even though sales have doubled and net income has quadrupled.

Public Storage (PSA) dominates the self-storage business. With a captive customer base that doesn't want to keep moving stuff around, the company faces little resistance in raising its monthly fees. Rental income at same-store facilities for the most recent quarter rose an incredible 15.7% compared with the same period last year. Public Storage is a real estate investment trust (REIT) that passes its tax liability on to shareholders, so it's best kept in a tax-deferred retirement account. Its most closely watched metric is funds from operations, the rough equivalent of earnings per share. For the three months ending March 31, FFO jumped 24.4% over the same period a year ago. As Public Storage sat on my wish list for three years, the stock doubled, but then this spring it fell more than 100 points in a few weeks.

I have other companies that are still on my wish list. You and I may differ on whether they have declined enough to be worth buying now, but at least keep a close eye on them. I have mentioned J&J already, but others are 3M (MMM), Alphabet (GOOGL), McDonald's (MCD) and Walt Disney (DIS). Better yet, make your own wish list. Carry it around on your mobile phone or on a scrap of paper in your pocket. The time will come to convert some of the names into partners.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence. Of the stocks mentioned here he owns Hermès, Oneok, Starbucks, Bank of America and Salesforce. Reach him at James_Glassman@kiplinger.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.