To Make the Case for Equities in the Long Term, Look to the Past

While cash yields are attractive now, if we look at the performance of equities in the past, we can expect that, going forward, they could be a better bet.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Well, the year 2023 is officially a wrap. Overall market performance was relatively strong, with equities, defined as the total return of the S&P 500, up 26.29% for the year, and bonds, defined as Bloomberg U.S. Aggregate Bond Index, up 5.53%.

The strong performance of equities in 2023 was somewhat unexpected, with many market forecasters predicting lower returns at the beginning of the year, especially with growing concerns of a recession. The stock market return for 2024 is equally uncertain, and many investors may be looking to cash, given attractive yields exceeding 5%; however, it’s important to remember that equities have dramatically outperformed cash historically, especially over longer investment periods, and are expected to do so into the future.

Therefore, the case for equities is as strong today as ever, but it’s important to ensure the risk level of your portfolio is appropriate and to stay invested for the long term!

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A look back in time

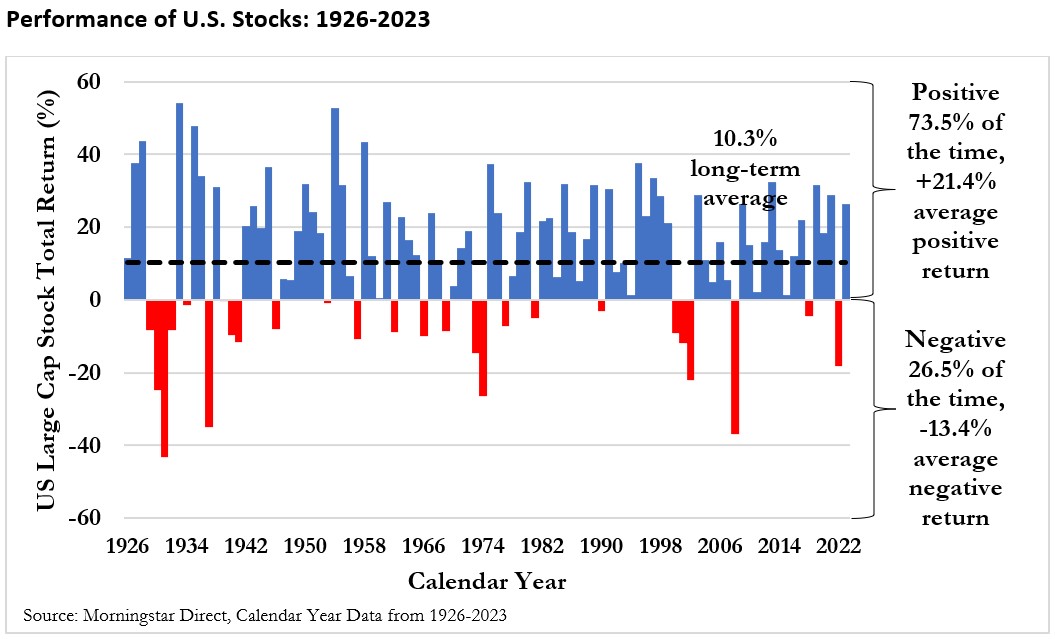

There has always been risk associated with investing in equities, especially over shorter periods, which is why it’s important to take a long-term perspective when it comes to investing. If we look at total returns for U.S. equities from 1926 to 2023, which include the performance benefit of dividends, they’ve been positive for 73.5% of calendar years with an average annual long-term geometric return of 10.35%, as demonstrated in the chart below.

It’s important to note, though, while the total return on stocks has been positive for 73.5% of calendar years, if we look at five-year periods, it’s been positive 87.2% of the time, and if we look at 10-year periods, it’s been positive 95.5% of the time. In other words, being invested for the long term has definitely benefited investors.

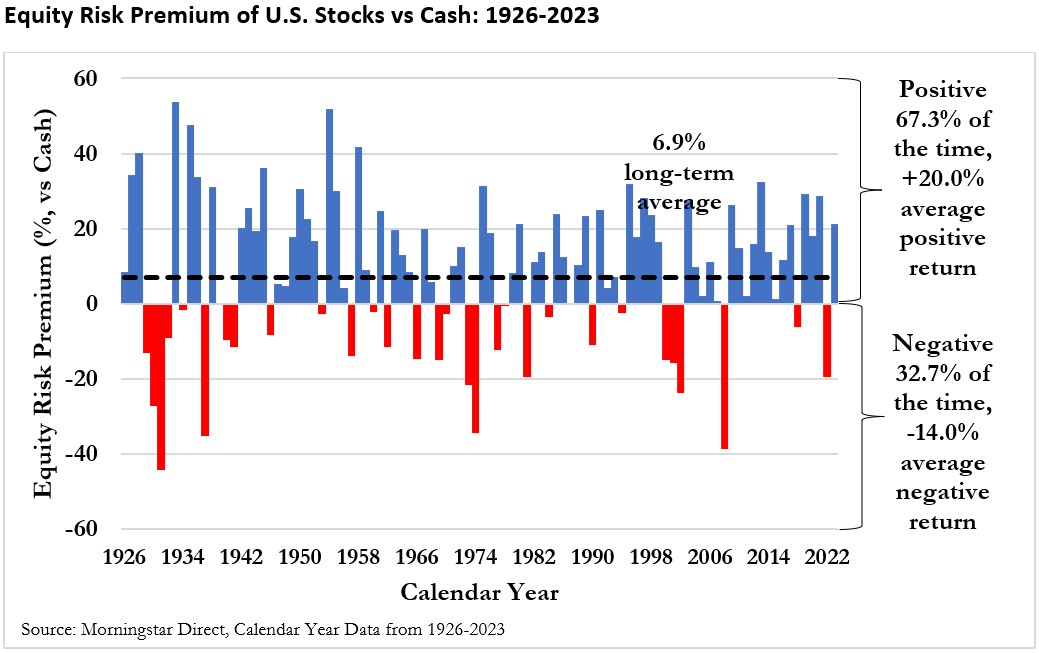

The current high returns on cash, which exceeded 5% at the beginning of the year, may have many investors rethinking their longer-term strategy allocations and possibly underweighting equities in their portfolios. While it’s true that current cash yields are significantly higher than long-term averages, equities have dramatically outperformed cash over the long term. Looking at returns from 1926 to 2023, equities have outperformed by 6.9% per year on average and had a higher return 67.4% of the time, as demonstrated in the chart below.

Clearly, there have been times when cash has outperformed equities, in particular those years when the return on equities was low or negative, but over the long term, equities have dramatically outperformed cash. For example, stocks outperformed cash 76.6% of the time over rolling five-year periods and 85.4% of the time over rolling 10-year periods. Therefore, it’s important to take a long-term perspective when it comes to investing.

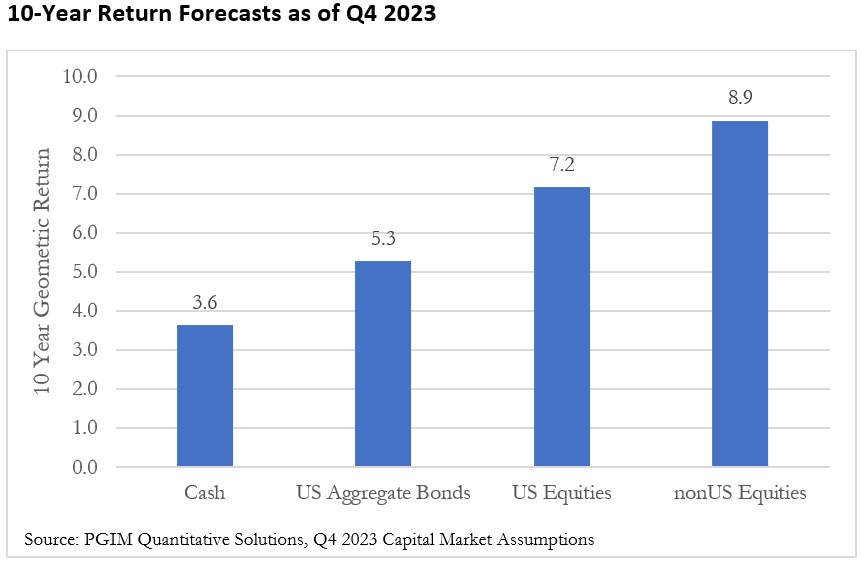

While it obviously is difficult to predict where the market is headed, one of our affiliates, PGIM Quantitative Solutions, does create forward-looking return estimates for the next 10 years. These forecasts can be used to help create expectations for investors around likely future returns. The latest return expectations available, as of Q4 2023, are included below, for a few common asset classes.

Some important things to be aware of with respect to these forecasts. First, there is still the general expectation that stocks will outperform cash and bonds into the future, but at lower levels than have been experienced in the past. Second, the forecasted return for U.S. equities over the next 10 years, at 7.2%, is notably lower than the historical long-term average, at 10.2%. This is more than 3 percentage points lower and important for investors to be aware of when running any kind of financial plan, given the pronounced potential effect.

For example, $1 invested at 7.2% for 10 years would grow to roughly $2 at the end of the period vs $2.66 if invested at 10.2%, which is roughly one-fourth lower.

Going forward

The common expression that past performance is no guarantee of future results is true today more than ever. Since it is impossible to know what’s going to happen in the financial markets, one of the most important things to try to control is investor behavior, by ensuring your portfolio is consistent with your objectives and staying invested for the long term.

Related Content

- Expecting a 12% Return on Your Portfolio? That’s Dangerous

- Your Retirement Readiness Rx: Plan Early and Get Help

- Four Historical Patterns in the Markets for Investors to Know

- Five Common Retirement Mistakes and How to Avoid Them

- What’s the Difference Between Average and Actual Rate of Return?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Blanchett, PhD, CFA, CFP®, is Managing Director and Head of Retirement Research for PGIM DC Solutions. PGIM is the global investment management business of Prudential Financial, Inc. In this role he develops research and innovative solutions to help improve retirement outcomes for investors with a focus on defined contribution plans. Prior to joining PGIM he was the Head of Retirement Research for Morningstar Investment Management. He is currently an Adjunct Professor of Wealth Management at The American College of Financial Services and Research Fellow for the Alliance for Lifetime Income. David has published over 100 papers in a variety of industry and academic journals that have received awards from the CFP Board, the Financial Analysts Journal, the Journal of Financial Planning, and the International Centre for Pension Management. In 2014 InvestmentNews included him in their inaugural 40 under 40 list as a “visionary” for the financial planning industry, and in 2021 ThinkAdvisor included him in the IA25+. When David isn’t working, he’s probably out for a jog, playing with his four kids, or rooting for the Kentucky Wildcats.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.

-

This Is How You Can Land a Job You'll Love

This Is How You Can Land a Job You'll Love"Work How You Are Wired" leads job seekers on a journey of self-discovery that could help them snag the job of their dreams.

-

65 or Older? Cut Your Tax Bill Before the Clock Runs Out

65 or Older? Cut Your Tax Bill Before the Clock Runs OutThanks to the OBBBA, you may be able to trim your tax bill by as much as $14,000. But you'll need to act soon, as not all of the provisions are permanent.

-

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need To

The Key to a Successful Transition When Selling Your Business: Start the Process Sooner Than You Think You Need ToWay before selling your business, you can align tax strategy, estate planning, family priorities and investment decisions to create flexibility.