Walmart's Transformative Ways Spark a 100,000% Stock Return

Walmart's strategic store expansion and relentless cost-cutting have catapulted its share price over the years.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Editor's note: This is part 12 of a 13-part series about companies whose shares have amassed 100,000% returns for investors and the path taken to generate such impressive gains over the long term. See below for links to the other stocks in this series.

From its humble beginnings as a small discount store in Rogers, Arkansas, Walmart (WMT) has grown into a global retail powerhouse, transforming the way the world shops.

How did a single store become the largest retailer in the world, with over $600 billion in annual revenue? The answer lies in Walmart's unique approach to expansion and its relentless focus on cost control.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

By strategically opening thousands of stores and mastering supply chain management, Walmart has consistently outperformed its competitors and reshaped the retail landscape.

To truly understand Walmart's success, we must examine these key areas: its aggressive store expansion and improvements in gross margins through cost-effective procurement. Together, these factors reveal the secrets behind Walmart's sustained growth and its ability to dominate the global market.

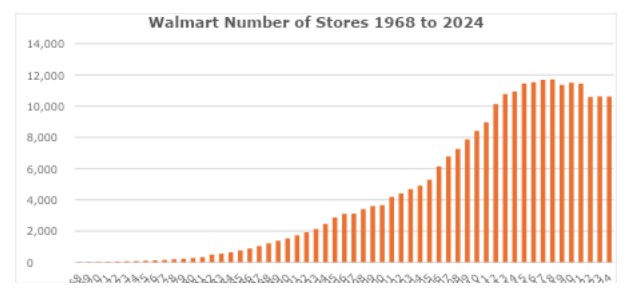

A major driver of Walmart's growth has been its aggressive expansion strategy. In 2000, Walmart operated 3,662 stores worldwide including Supercenters, discount stores, and Sam's Clubs.

By 2023, the number of stores had grown to 10,130. This rapid expansion allowed Walmart to capture a broad customer base across both urban and rural areas.

Looking at sales per store over time provides insights into Walmart's growth strategy.

In 2000, Walmart reported a revenue of approximately $167 billion. Dividing this by its 3,662 stores results in an average sales per store of around $45.6 million.

By 2023, Walmart's revenue had surged to nearly $611 billion. With over 10,623 stores, the average sales per store had risen to approximately $57.5 million. Over time, Walmart's methods allowed it to increase the productivity of each store by 26%.

Improving and maintaining gross margins has also been crucial to Walmart's ability to offer low prices and sustain profitability.

Walmart's massive scale allows it to negotiate better prices with suppliers, driving down the cost of goods sold and enhancing/maintaining gross margins. For a decade, Walmart has been able to keep its gross margin in the range of 24% to 26%.

You could almost say that Walmart is impervious to inflation, and that's one reason shoppers come back to Walmart again and again.

Amazingly, during the peak inflation of 2022, when the rate in the U.S. peaked at 9.1%, Walmart was able to maintain its gross margin at 24.1% that year, only 4% lower than the previous year's gross margin of 25.1%.

And when inflation abated in 2023, Walmart's gross margin was able to bounce back to 26.2%.

The company has leveraged its buying power to source goods at lower prices and invested in technology to enhance inventory management. These efforts have allowed Walmart to reduce the cost of goods sold and maintain its "Everyday Low Price" strategy, attracting price-sensitive customers and driving sales volume.

Despite economic fluctuations and changing market conditions, Walmart's ability to adapt and leverage its massive scale has enabled it to thrive.

As the largest retailer in the world, Walmart continues to shape the retail industry, demonstrating that a well-executed growth strategy and a relentless focus on cost control works.

The formula is still valid, and Walmart likely has more growth to deliver to shareholders.

Note: This content first appeared in Louis Navellier's latest book, The Sacred Truths of Investing: Finding Growth Stocks that Will Make You Rich, which was published by John Wiley & Sons, Inc.

Other 100,000% return stocks

- McDonald's Stock: How Small Changes Have Led to 100,000% Returns

- How Amazon Stock Became a Member of the 100,000% Return Club

- M&A Is Why UnitedHealth Group Stock Is a Member of the 100,000% Return Club

- Sherwin-Williams Is a Sleeper of the 100,000% Return Club

- Dealmaking Drives HEICO Stock's 100,000% Return

- Adobe Stock's Path to a 100,000% Return Is Impressive

- Apple's 100,000% Return Is a Result of Innovation, Brand Loyalty and Buybacks

- Home Depot's Winning Ways Fueled Its 100,000% Return

- It's No Surprise That Berkshire Hathaway's in the 100,000% Return Club

- Nvidia Stock's Been Growing for Years. Just Look At Its 100,000% Return

- Relentless Leadership Drives Oracle Stock's 100,000% Return

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.