Walt Disney's Dividend Is Back. Will DIS Stock Follow?

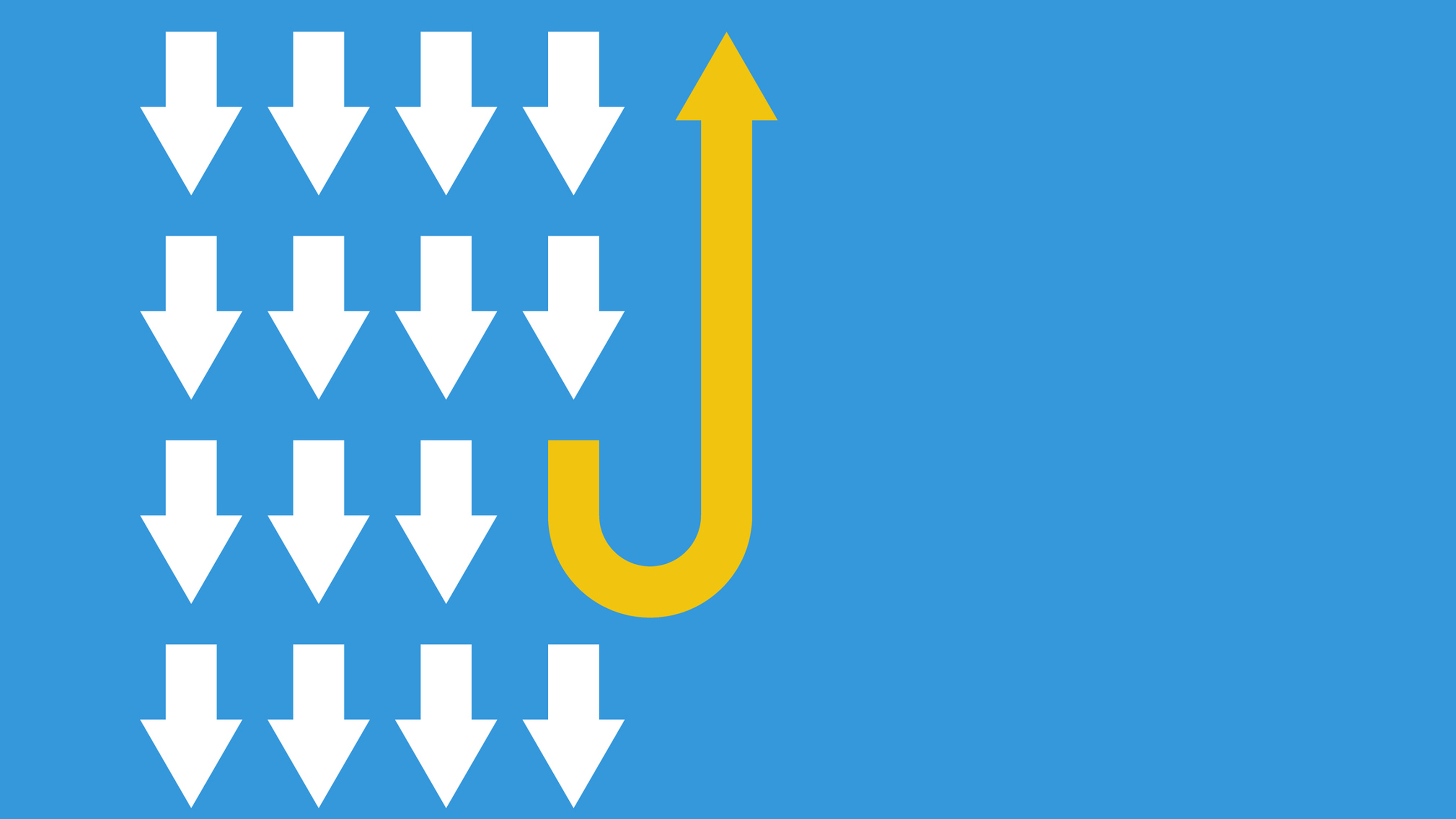

Disney reinstated its dividend after a three-year suspension as shares remain depressed.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Walt Disney (DIS) reinstated its dividend after a three-year suspension, a move that's good news for income investors and could help bolster the media and entertainment giant's beleaguered share price.

Disney's board on Thursday declared a cash dividend of 30 cents per share, payable on January 10 to shareholders of record at the close of business on December 11, 2023.

"This has been a year of important progress for The Walt Disney Company, defined by a strategic restructuring and a renewed focus on long-term growth," said Disney Chairman Mark Parker in a news release. "As Disney moves forward with its key strategic objectives, we are pleased to declare a dividend for our shareholders while we continue to invest in the company's future and prioritize meaningful value creation."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Disney suspended its dividend in the spring of 2020 in order to conserve cash amid the COVID-19 pandemic.

Also on Thursday, Disney said that Morgan Stanley (MS) CEO James Gorman and former Sky TV chief Jeremy Darroch will join its board early next year. The move comes as Disney faces a proxy fight with activist investor Nelson Peltz, who is reportedly seeking at least two board seats.

Better times ahead for DIS stock?

Disney shareholders can be forgiven if they wish the company were celebrating its 100th anniversary against a happier backdrop. Like the rest of the industry, Disney is grappling with slower advertising spending, the decline of linear TV and steep losses in its streaming business.

Shares in DIS now lag the broader market on an annualized total return basis over pretty much every standardized period you care to measure. That's a big come down for a name that was once one of the 30 best stocks of the past 30 years.

Indeed, if you'd put $1,000 into Disney stock 20 years ago, you would be very disappointed with the results today.

As painful a period as this has been for long-term DIS shareholders, Wall Street thinks better times are ahead. Disney is one of analysts' top Dow Jones stocks, for one thing. Of the 32 analysts issuing opinions on Disney stock surveyed by S&P Global Market Intelligence, 19 rate it at Strong Buy, five call it a Buy, six have it at Hold and two rate it at Strong Sell. That works out to a consensus recommendation of Buy, with high conviction.

Meanwhile, with an average target price of $103.71, the Street gives DIS stock implied price upside of about 13% over the next year or so.

"Disney remains Netflix's (NFLX) one true competitor in long-form video streaming, and is taking giant steps toward profitability in its direct-to-consumer businesses," says Argus Research analyst Joseph Bonner, who rates DIS at Buy. "With the return of Bob Iger as CEO, Disney is working to lower investment in its direct-to-consumer business and to focus on the most profitable content."

The market's so-called smart money increasingly likes Disney stock too. Although it may have fallen off the list of hedge funds' favorite blue chip stocks in the third quarter, hedge funds still increased their net ownership of Disney stock by more than 12%, or 23 million shares, during the period.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Dow Dives 797 Points as Government Opens: Stock Market Today

Dow Dives 797 Points as Government Opens: Stock Market TodayThe process of pricing and re-pricing realities old and new never stops, and next week promises to be at least as exciting as this week.

-

Stocks Rally on Apple Strength: Stock Market Today

Stocks Rally on Apple Strength: Stock Market TodayThe iPhone maker will boost its U.S. investment by $100 billion, which sent the Dow Jones stock soaring.

-

Stock Market Today: Stocks Rise Despite Stagflation Risk

Stock Market Today: Stocks Rise Despite Stagflation RiskThe business of business continues apace on continuing hope for reduced trade-related uncertainty.

-

4 Turnaround Stocks to Consider – and 2 More to Keep an Eye On

4 Turnaround Stocks to Consider – and 2 More to Keep an Eye OnA turnaround stock is a struggling company with a strong makeover plan that can pay off for intrepid investors.

-

Stock Market Today: Stocks Waver as Big Tech Slumps on Spending Concerns

Stock Market Today: Stocks Waver as Big Tech Slumps on Spending ConcernsMarkets seesawed amid worries over massive costs for artificial intelligence and mixed economic news.

-

Is Disney Stock Still a Buy After Earnings?

Is Disney Stock Still a Buy After Earnings?Walt Disney stock is down Wednesday after the entertainment and media company beat fiscal 2025 first-quarter expectations. Here's what you need to know.

-

Stock Market Today: Tech Stocks Soar Ahead of CES 2025

Stock Market Today: Tech Stocks Soar Ahead of CES 2025This week's annual technology event will give updates on AI, EVs and self-driving cars.