7 of Warren Buffett's Biggest Misses

The Oracle of Omaha's investing wins are well known up and down Wall Street, but no one bats a thousand. Here are some of Warren Buffett's biggest misses.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Warren Buffett is many things – the world's most famous investor, the departing CEO of the trillion-dollar Berkshire Hathaway (BRK.B) holdings company, and a true Cherry Coke junkie among them.

But like the rest of us, he's certainly not perfect.

We keep a close eye on Warren Buffett, for good reason. Investors not only are curious about the stocks Buffett is buying and selling each quarter and what he keeps in the Berkshire Hathaway equity portfolio, but also the occasional pearls of wisdom he doles out in shareholder letters, annual meetings and interviews.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That said, the "Oracle of Omaha" might boast myriad successes, but he certainly hasn't batted 1.000 for his career – not even close. Indeed, the retiring CEO of Berkshire Hathaway has made numerous mistakes to the tune of many billions of dollars.

And those mistakes serve to teach us a pair of vital lessons:

1. You don't need to be perfect to be a successful investor.

2. Like Buffett, you should use each of your errors as a learning opportunity – even if the lesson is nothing more than "you're not infallible."

With that in mind, let's take a look at some of Warren Buffett's biggest misses:

ConocoPhillips

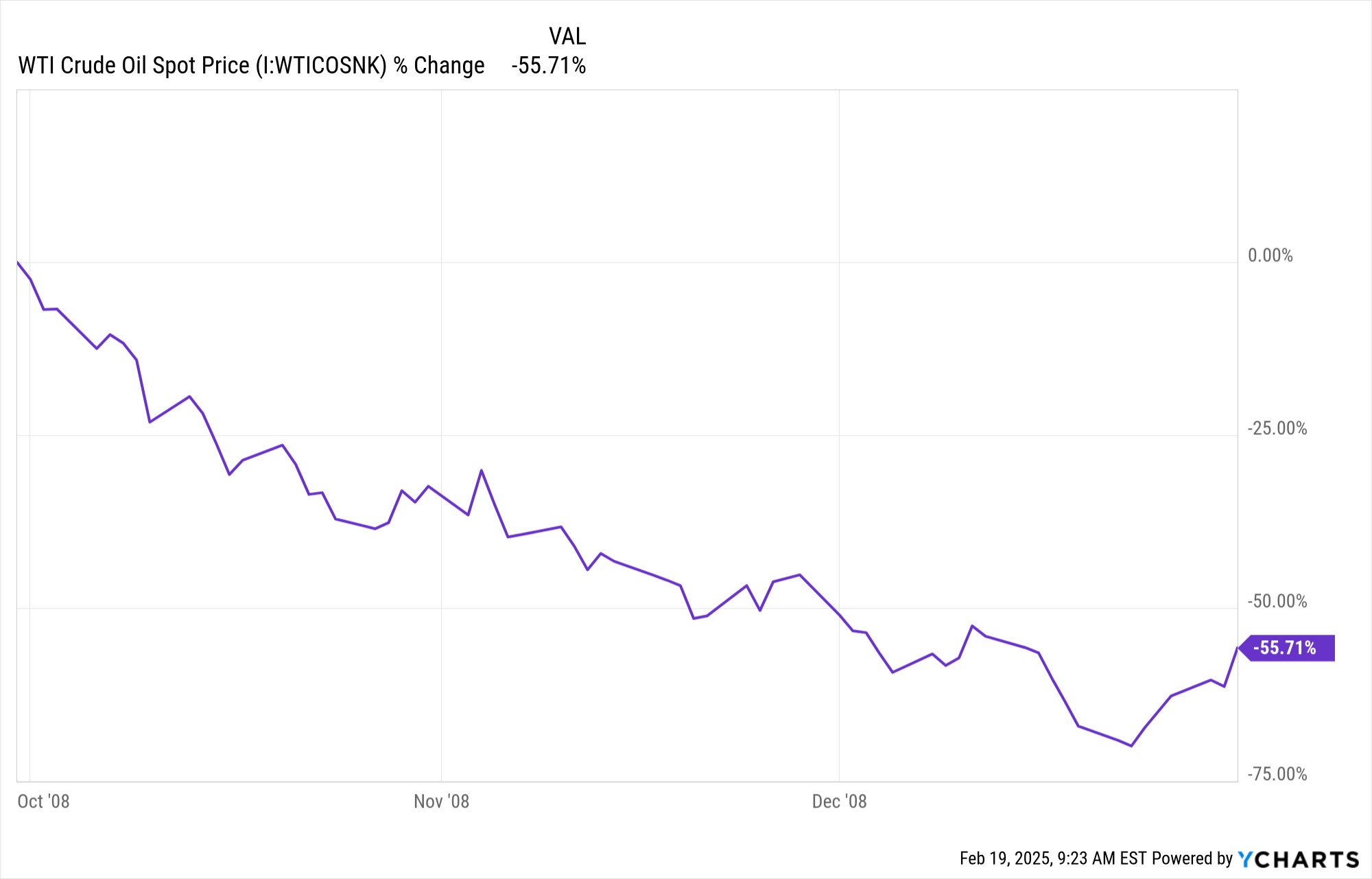

Warren Buffett first entered ConocoPhillips (COP) in 2005, but his big, disastrous splash in the energy stock didn't come until 2008, when he vastly expanded his stake from 17.5 million shares to 84 million by the end of the third quarter.

And what, pray tell, happened in the fourth quarter?

COP shares cratered with the rest of the energy sector, losing roughly half of their value by the middle of Q1. Buffett's Berkshire Hathaway ended up absorbing a $1.5 billion loss during the quarter, predominantly fueled by a $1.9 billion write-down of its ConocoPhillips stock. Buffett began unloading shares that same quarter.

Buffett was characteristically open about the failure in February 2009, when he issued his annual letter to Berkshire shareholders:

"I told you in an earlier part of this report that last year I made a major mistake of commission (and maybe more; this one sticks out). Without urging from Charlie or anyone else, I bought a large amount of ConocoPhillips stock when oil and gas prices were near their peak. I in no way anticipated the dramatic fall in energy prices that occurred in the last half of the year. I still believe the odds are good that oil sells far higher in the future than the current $40-$50 price. But so far I have been dead wrong. Even if prices should rise, moreover, the terrible timing of my purchase has cost Berkshire several billion dollars."

Berkshire's stake winnowed away until 2013, when Buffett finally exited the position outright – and shifted his focus to a new $3.7 billion in competitor Exxon Mobil (XOM).

Paramount Global

One of Buffett's biggest failures provides a quick back-story to one of the market's biggest current dramas, the battle for Warner Bros. Discover (WBD) between Paramount Skydance (PSKY) and Netflix (NFLX).

Berkshire started building a stake in PSKY's predecessor Paramount Global's Class B shares during Q1 2022. That stake reached 93.6 million shares (~$1.6 billion). And it was an unmitigated disaster.

Paramount – the company behind CBS, Showtime, MTV, Comedy Central, Nickelodeon, BET and more – has suffered alongside other traditional media companies from the decline of cable and lousy ad rates.

The past three years have seen Paramount slide from robust profits to deep losses, thanks in large part to a $6 billion write-down of its cable businesses announced in August 2024.

Buffett wasn't around for the write-down – he had sold off roughly 30 million shares in 2023, then announced in early May 2024 that Berkshire had fully bailed on the position. That was the same day Paramount announced a 79% cut to its dividend and a wide earnings miss.

"I was 100% responsible for the Paramount decision," Buffett said at Berkshire's annual shareholder meeting. "It was 100% my decision, and we've sold it all and we lost quite a bit of money."

He's not exaggerating. PARA shares lost more than two-thirds of their value between the end of Q1 2022, when Berkshire reported it had opened the position and its May 2024 exit.

Energy Future Holdings

While virtually all of the attention paid to Warren Buffett's investments involves his equity decisions, one of his biggest failures came in the bond market.

In late 2007, Berkshire announced a $2.1 billion purchase of double-digit-yielding junk bonds from Energy Future Holdings Corporation, an electric producer that was primarily reliant on coal.

Buffett was making effectively the same bet that KKR, TPG Capital and Goldman Sachs Capital Partners made when they purchased the company (then called TXU) a couple of months earlier: that its coal-fired plants would become more competitive as natural gas prices increased.

They did – sharply, but briefly, before turning tail and plunging for years. Energy Future Holdings eventually filed for bankruptcy in 2014, saddling Berkshire with a loss of more than $870 million.

That year, Buffett admitted to not running the decision by Berkshire Vice Chair Charlie Munger.

"Most of you have never heard of Energy Future Holdings. Consider yourselves lucky; I certainly wish I hadn't," Buffett said. "Next time I'll call Charlie."

It wouldn't be the Oracle's last time getting the short end of the stick from Energy Future Holdings. In 2017, the company turned down a bid from Berkshire to buy power transmission company Oncor for $9 billion, opting instead to sell it to Sempra Energy (SRE) for $9.45 billion.

USAir

Curiously enough, one of Buffett's self-professed mistakes was a deal that technically resulted in gains.

In 1989, Buffett directed Berkshire to buy $358 million worth of convertible preferred shares from U.S. carrier USAir. Shortly thereafter, the dividend – typically the primary source of returns for preferred stocks – was suspended.

"In the 1990 Annual Report I correctly described this deal as an 'unforced error,' meaning that I was neither pushed into the investment nor misled by anyone when making it," Buffett admitted in a 1994 shareholder letter. "Rather, this was a case of sloppy analysis, a lapse that may have been caused by the fact that we were buying a senior security or by hubris. Whatever the reason, the mistake was large."

But that wasn't the end. A new CEO helped USAir rehabilitate and actually catch up on its missed dividend payments to Berkshire. In 1998, USAir redeemed the convertible preferreds for common shares, which Buffett sold at a profit.

The Oracle refused to spike the ball.

"But we then got very lucky," Buffett explained years later, in a 2007 shareholder letter. "In one of the recurrent, but always misguided, bursts of optimism for airlines, we were actually able to sell our shares in 1998 for a hefty gain. In the decade following our sale, the company went bankrupt. Twice."

In a single gaffe, Buffett was able to teach two lessons: the importance of taking responsibility for losses, as well as the importance of recognizing when we're not responsible for gains.

Other airline stocks

If only Buffett had learned from his USAir mistake.

"Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down. The airline industry's demand for capital ever since that first flight has been insatiable. Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it."

Those comments, made in the aforementioned 2007 shareholder letter, were a reflection on his USAir losses, but they also foreshadowed the failure he would suffer roughly a decade later.

In 2016, he dove headfirst into the airline industry – but rather than making a single concentrated bet, he spread his wealth by accumulating 10% stakes in American Airlines (AAL), United Airlines (UAL), Delta Air Lines (DAL), and Southwest Airlines (LUV).

By 2019, the trade was profitable, but … well, most of us can sympathize with what happened next.

All four airline stocks cracked under the weight of the COVID-19 pandemic. Buffett completely abandoned the position in early May 2020, having suffered steep losses.

To add insult to injury, Berkshire's exit came roughly around the bottom of the airlines' descent. A year later, those positions would've been worth roughly double what Buffett sold them for.

Berkshire Hathaway Textile Business

"Monumentally stupid." "The dumbest stock I ever bought."

These words were reserved not for any of the stocks mentioned above, but for the company that gave its name to Warren Buffett's $1 trillion empire.

Before Berkshire, the Oracle did his investing out of Buffett Partnership, Ltd. (BPL), which he established in 1956. In 1962, Buffett began acquiring shares of Berkshire Hathaway, then a declining textile manufacturer. He bought shares with an expectation that, as Berkshire sold off its mills, he would be able to sell the shares back at a profit … and indeed, in 1995, he struck an oral deal with Berkshire manager Seabury Stanton. But when the written tender offer came in under what he was told, he became angry and began aggressively buying a controlling stake in the company.

In 2010, Buffett told CNBC that, had he taken the money he poured into the textile business and invested it into the insurance company he bought in 1967 instead, Berkshire would've been worth some $200 billion more.

"… Berkshire Hathaway was carrying this anchor, all these textile assets. So initially, it was all textile assets that weren't any good. And then, gradually, we built more things onto it," Buffett said. "But always, we were carrying this anchor. And for 20 years, I fought the textile business before I gave up. [If] instead of putting that money into the textile business originally, we just started out with the insurance company, Berkshire would be worth twice as much as it is now."

Alphabet/Amazon

"Sometimes your best investments are the investments you don't make." It's a clever way of saying that investment success isn't just about putting your money in the right places – but also avoiding putting your money in the wrong places.

Unfortunately, sometimes, the opposite is true – our worst mistakes can occasionally be the investments we passed on.

Buffett has, on more than one occasion, fessed up to staying his hand when he shouldn't have. And two of those missed opportunities stick out like a sore thumb:

Amazon (AMZN) and Alphabet (GOOGL) … even though Berkshire directly owns one and indirectly owns the other.

In 2019, Buffett initiated a $900 million Amazon stake that has more than doubled. But in a CNBC interview, he said he was "an idiot for not buying" AMZN even earlier.

He's nothing if not consistent – Buffett had expressed regret about not buying Amazon several times before he finally took the plunge.

In 2017, he blamed "stupidity" on his inaction while lavishing praise on Amazon founder Jeff Bezos. And in 2018, he told CNBC: "It's far surpassed anything I would have dreamt could have been done. Because if I really felt it could have been done, I should have bought it. … I had no idea that it had the potential. I blew it."

As for Alphabet? During Berkshire's 2017 annual shareholder meeting, he said he missed out on buying Google, citing the company's $10-$11 per-click advertising rates charged to Berkshire subsidiary Geico.

However, while the Berkshire Hathaway stock portfolio still doesn't include Alphabet, the company still has exposure to it – through New England Asset Management (NEAM). Berkshire acquired NEAM when it bought reinsurer General Re in 1998. It's often referred to as Buffett's "secret portfolio" even though Buffett has no direct input in its holdings – which today include nearly 5,200 shares of GOOGL.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.